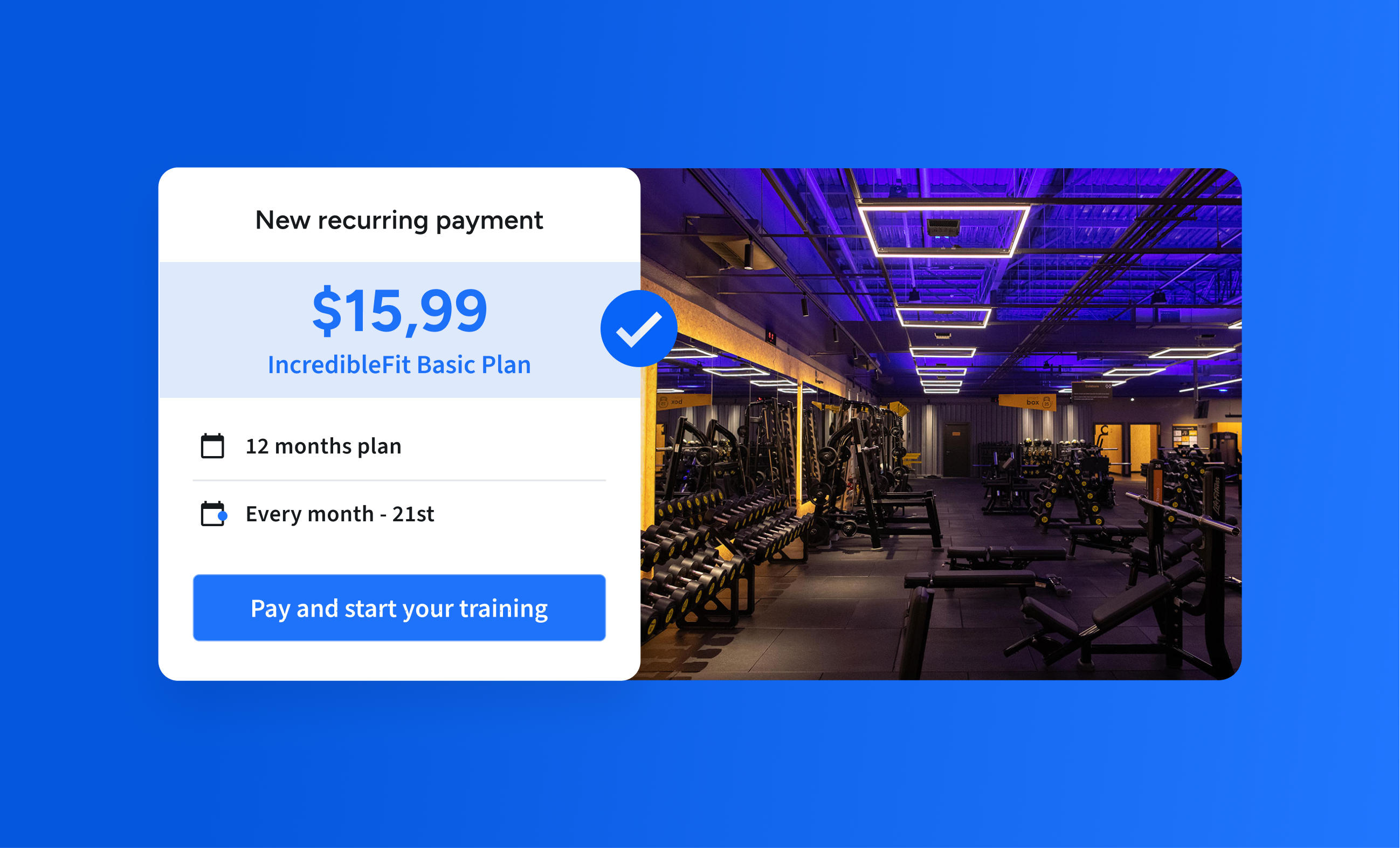

¿Cómo una de las mayores redes de gimnasios de México, con más de 400 sucursales, transformó sus cobranzas recurrentes en un proceso fluido y predecible?

Las empresas basadas en membresías prosperan gracias a la consistencia en las cobranzas. El desafío no es el primer pago, sino garantizar que cada renovación ocurra a tiempo, con la mínima fricción para los clientes y total previsibilidad para los equipos financieros y de operaciones. Esto es especialmente cierto para una gran cadena que opera más de 400 sucursales en todo México y atiende a más de 1 millón de miembros, donde el volumen de pagos recurrentes multiplica la complejidad de la gestión de cobranza.

Esta cadena de gimnasios enfrentaba obstáculos prácticos que limitaban su escalabilidad: antes de asociarse con Belvo, lidiaban con la baja priorización de su banco heredado para procesar grandes volúmenes de débitos, lo que aumentaba la complejidad de configurar y ejecutar débitos automáticos entre sus múltiples razones sociales y sucursales. Esto era especialmente crítico considerando el perfil de los clientes: personas comprometidas con un estilo de vida saludable, generalmente leales y reacias a perder su membresía. Necesitaban con urgencia un modelo que pudiera operar a escala y reducir la intervención manual, igualando la confiabilidad de su proceso de facturación con la alta fidelidad de su base de clientes.

¿La solución? Migrar a la Domiciliación Bancaria utilizando la infraestructura de Belvo para estandarizar cómo se inician, reintentan y concilian los pagos. De esta manera, los equipos de atención no tuvieron que cambiar la forma en que vendían las membresías o apoyaban a los clientes.

Flujo de caja predecible: por qué la Domiciliación Bancaria es la fuerza impulsora del modelo de suscripción de gimnasios

Para suscripciones recurrentes, la Domiciliación Bancaria es fundamental porque reduce significativamente los pagos fallidos y evita el card churn (pérdida de pagos por vencimiento o reemplazo de tarjetas). El mandato se recopila una sola vez y se aplica a los ciclos de facturación futuros, haciendo que las renovaciones sean más predecibles y garantizando cobertura continua del servicio para los clientes.

Los métodos de pago tradicionales, especialmente las tarjetas de crédito, conllevan tarifas altas y tasas de éxito más bajas debido a vencimientos, fraudes o fondos insuficientes. En contraste, la domiciliación ofrece una optimización de costos considerable; un análisis económico realizado por Belvo sugiere una reducción de hasta el 74% en los costos mensuales de procesamiento al migrar a este esquema, lo que podría traducirse en ahorros anuales de hasta MXN $23 millones, dependiendo del volumen de transacciones. Esta eficiencia es crucial para la asignación de recursos, ya que libera a los equipos de cobranza de trabajo manual repetitivo, permitiéndoles centrarse en tareas estratégicas y, en última instancia, mejorar el ROI.

Además, este sistema proporciona una experiencia superior al cliente y aumenta directamente la retención. Al eliminar la fricción del pago, la Domiciliación Bancaria ofrece una experiencia premium y de bajo esfuerzo, algo fundamental en un mercado como el mexicano, donde el 36.9% de la población adulta declara experimentar estrés financiero. Esta facilidad de pago ayuda a mantener a los clientes activos por más tiempo, reduciendo la tasa de cancelación del servicio y aumentando el Customer Lifetime Value (CLTV).

Con Belvo, el equipo de la cadena de gimnasios logró:

- Consolidar la gestión de archivos, alineando los horarios de corte.

- Implementar una estrategia simple de reintentos para recuperar pagos fallidos.

- Mantener un rastro de auditoría limpio y predecible.

Esto no es simplemente un “nuevo método de pago”, sino un modelo operativo repetible para realizar cobranzas recurrentes confiables a escala. Si tu empresa está considerando este desafío, la clave del éxito radica en establecer automatización total, ciclos de flujo de caja predecibles y supervisión financiera diaria simplificada. Estas capacidades son esenciales dentro de la solución de Domiciliación Bancaria de Belvo, que soporta naturalmente el rigor operativo necesario para un crecimiento masivo de suscripciones.

De procesos fragmentados a un modelo operativo unificado

Antes de la migración, los equipos tenían que manejar múltiples formatos y comportamientos bancarios. Esto generaba fricción innecesaria: revisiones manuales, conciliaciones tardías e incertidumbre sobre qué sucursal o razón social era responsable de cada transacción.

Con Belvo, la cadena centralizó la generación y envío de archivos de débitos y estandarizó la gestión de devoluciones y chargebacks. Esto también simplificó los reportes entre distintas entidades, permitiendo al área financiera tener una vista diaria confiable de lo que se cobró, lo que se liquidó y lo que requería atención inmediata.

Piloto y escalabilidad acelerada

El piloto confirmó la alta calidad de los pagos y la predictibilidad financiera de la infraestructura de Belvo. Durante el periodo inicial de evaluación, la plataforma procesó con éxito más de 37,500 cobranzas de más de 162,000 transacciones creadas.

De manera crucial, para la gestión de riesgo y back-office, los resultados mostraron una responsabilidad casi nula: durante un periodo de menos de tres meses, del 15 de julio al 1 de octubre de 2025, la plataforma manejó un volumen de pagos en rápida expansión mientras mantenía un perfil de responsabilidad excepcionalmente bajo: la tasa de chargeback se mantuvo en solo el 0.2%.

Esto validó de inmediato el objetivo de mantener la responsabilidad por debajo del umbral del 1%, un logro vital para escalar la salud operativa del negocio.

| Mes de operación (post-go-live) | Cobranzas mensuales exitosas (aprox.) | Aceleración mes a mes |

| Mes 4 | ~50,000 | Referencia inicial para escalar |

| Mes 5 | ~100,000 | Crecimiento de 100% (volumen duplicado) |

| Mes 6 | ~200,000 | Crecimiento de 100% (más del doble del volumen) |

| A partir del mes 7 | Más de ~325,000 | Consolidación del escalamiento |

Impacto financiero directo y predictibilidad

La consistencia operativa y la creciente adopción se reflejaron directamente en los ingresos.

En un solo mes (septiembre), la cadena recaudó aproximadamente MXN $12 millones, un aumento significativo comparado con los casi MXN $2 millones recaudados el mes anterior, demostrando la eficacia del modelo para garantizar ingresos altos y predecibles.

Este crecimiento evidencia la rápida adopción del nuevo método y la estabilidad operativa a medida que se integraban más sucursales.

La Domiciliación Bancaria es el modelo para el crecimiento

Este estudio demuestra que migrar de procesos de pago heredados a la domiciliación es una necesidad estratégica para empresas con grandes volúmenes de pagos recurrentes.

Belvo proporcionó la infraestructura necesaria para estandarizar y automatizar las cobranzas, transformando lo que antes era un punto de dolor operativo fragmentado en un modelo repetible y escalable, garantizando:

- Flujo de caja predecible

- Eficiencia para el equipo financiero

- Mejor experiencia para sus miembros

La verdadera innovación radica en hacer que las operaciones de cobranza sean tan estables como el negocio principal.