From the US to Europe and Latin America, the adoption of account-to-account (A2A) payments has been driven by a combination of factors including cost-effectiveness, convenience, and technological advancements.

Tabla de contenidos

- Unpacking the benefits of A2A payments

- Regional perspectives: A2A adoption and trends

- Future outlook of A2A payments

A2A payments are forecast to grow by a CAGR of 14 percent between 2023 and 2027, becoming an important alternative payment method. A2A refers to direct payments from one party to the other using banking rails vs other rails such as the credit card ones.

Different regions have adopted A2A rails for different reasons. In this exploration, we analyze the current main benefits and challenges of A2A payments across particular markets and the status of Latin America.

Unpacking the benefits of A2A payments

Why has there been a big movement in A2A payments across the globe? The response varies depending on the region, but first, let’s understand the main benefits of using banking rails vs card rails.

1. Cost efficiency

A2A payments can be a significantly cheaper alternative to traditional card rails. While card payments often incur a high percentage-based transaction fee, A2A transactions typically involve flat fees, resulting in substantial cost savings.

This can result in a huge difference in cost: to give a simple example, a $100 transaction can cost around $0.25 with A2A, while with a credit card, it would be 2% of the total amount plus a fixed fee, say $2.15 in total. That’s 8-9x more expensive.

This benefit is strongly linked to regulatory limits on interchange fees. In some regions like Europe these fees are limited, so instead of a 2% cost of the total amount we would be looking at 0.3-04% for example. The interchange fees is a crucial factor that has impacted the level of adoption of A2A payments across countries.

2. Recurrence

In some cases, A2A rails can facilitate recurring payments, allowing businesses to charge users at their convenience, with flexibility in frequency and amount. Many A2A rails do not offer recurring payments and therefore these rails cannot compete with the card network that allows the tokenization of a card to process payments on a recurring basis.

3. Fraud prevention and chargebacks

Credit card rails typically set limitations on the percentage of chargebacks they accept. This is mainly due to two reasons:

- Fraud prevention: high chargebacks are associated with risky businesses. For a processor, the risk of processing a fraudulent payment is very high: they can lose the entire payment amount and it can have legal and compliance consequences.

- Operational burden: whenever a payer complains about a processed payment, there’s a high operational cost associated with checking who’s responsible for that returned payment and to settle the dispute

Some A2A rails have an intrinsically more robust authentication mechanism, as they require direct authorization from the user’s bank account to complete the transaction. This minimizes both the risk of fraudulent transactions as well as chargebacks.

4. Settlement speed

In some cases, A2A payments can be settled instantly in the user’s account, providing businesses with quicker access to funds compared to traditional card payments, which usually take 1-2 days to process and then are disbursed on a weekly or monthly basis.

Regional perspectives: A2A adoption and trends

After understanding the potential benefits of using A2A rails, let’s analyze how these payments have been adopted in different regions and why:

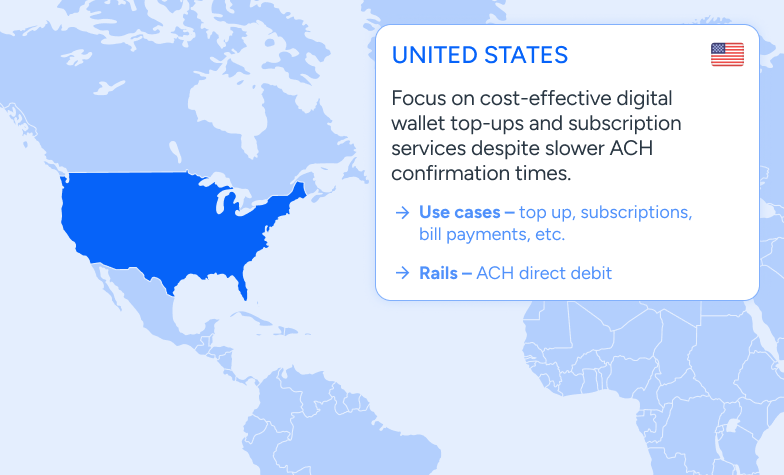

🇺🇲 United States

The interchange fees associated with card payments in the US are not limited and therefore high. This has led to significant adoption of A2A rails in the country, with cost as the main incentive.

The Automated Clearing House (ACH) network has been the primary A2A rail in the country, offering cost-effective transactions (around 0.25$ per payment) despite longer confirmation times (payments can take up to three days to be confirmed).

Several popular platforms have integrated ACH for their payment needs: Venmo (peer-to-peer payments), Robinhood (investment platform), Acorns (micro-investing service) and many others use this payment mechanism to reduce their costs and boost their margins.

To use ACH payments, customers must first validate their accounts. This can be done through:

- Penny validation: a small amount is deposited, and the user verifies the amount. This method can be slow and may lead to disengagement.

- Open Banking companies like Plaid or Trustly: these platforms can link bank accounts and verify account ownership, providing the necessary account and routing numbers quickly and efficiently, as well as a strong account authentication system.

One of the primary risks with ACH payments is the three-day delay between payment initiation and confirmation. During this period, a payment could fail if there are insufficient funds, leading to potential losses for businesses.

To mitigate this risk, businesses can use Open Banking data to assess the user’s balance and transaction history. This provides a score indicating the likelihood of a payment going through, helping businesses decide whether to proceed with the transaction. There are Open Banking companies that go one step further and can guarantee the payment at the moment of the transaction, removing the 3-day risk.

The second risk with ACH payments is the automatic chargeback process: an end user can file a chargeback during the following 60 days after a payment has been processed. However, in the US there exists an official dispute system governed by the National Automated Clearing House Association (NACHA). This process can be long (up to 60 days), and operationally costly. In general, this is a higher risk and longer dispute system compared to the card dispute system, but in comparison with other geographies, it exists and can be used.

In summary, the use of A2A in the US has been led primarily by the possibility of reducing significantly card fees while keeping the possibility of processing recurring payments using the ACH network. And while cost reduction is a huge benefit, companies need to handle very carefully new risks associated with this rail.

As we look into the future, the new rail FedNow is becoming a game changer in the country since its launch in 2023, as it can offer the benefit of low fees and instant settlement. In many use cases FedNow can replace ACH as a more secure rail thanks to the real time payment confirmation. Any step in the direction of guaranteed instant variable recurring payments is always massively adopted in the market, both in the US and in other regions.

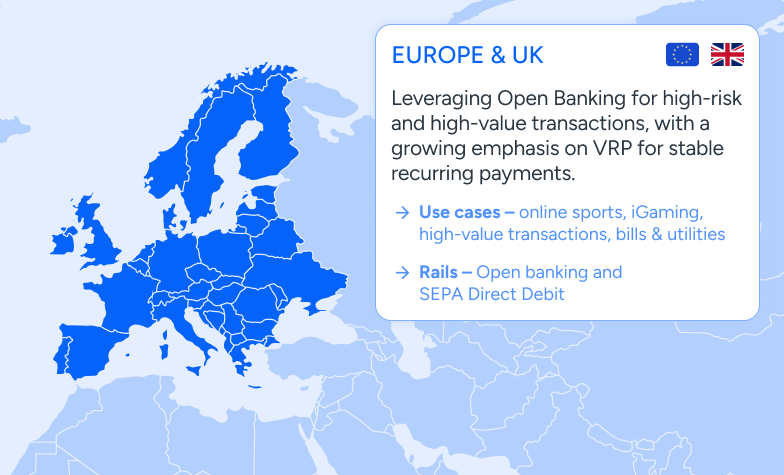

🇪🇺 Europe

In contrast to the US, the cost of processing card payments in Europe is significantly lower. This means businesses are less concerned with processing card payments due to the negligible impact on their bottom line.

As a result, A2A payments in Europe have required to focused on other use cases rather than cost reduction. We are naming here some of the most important ones:

High-risk businesses

Industries with high chargeback rates, such as eGaming or betting, already benefit from A2A payments through Open Banking. Traditional card networks struggle with these sectors due to the high fraud risk and the operational burden of managing chargebacks.

The strong authentication mechanisms that Open Banking provides guarantee the end user is present at the moment of transaction, which makes it harder to justify a chargeback

It’s relevant to note that card networks are developing solutions to tackle these high-risk areas in Europe, like implementing two-factor authentication (2FA) to reduce fraud. However, it is well known that the card network has a strong preference to avoid risky businesses, something that gives an opportunity to A2A payment providers.

High-value transactions

For large payments, even a small percentage fee can be significant. For instance, a $2,000 payment would incur a $6 fee at 0.3%, compared to $0.25 with A2A. However, businesses dealing with high-value transactions usually have a low number of payments, limiting the overall revenue potential for A2A payment processors.

Variable Recurring Payments (VRP)

Utilities and other recurring bills are other relevant use cases for A2A payments in Europe since they offer minimal friction and no expiration date compared to cards.

However, Open Banking payments are not yet recurring in Europe (this is something the industry is working towards). In this case, the most widely adopted payment method in Europe is direct debit, which provides ease of use and reliability in recurring transactions.

Like in the US, processing payments using direct debit can be riskier due to the easiness of filing a chargeback and the long time a user has to report it. On the other hand, their reduced cost and the low friction to the end user to process recurring payments have made this solution a widely adopted one. Even big companies doing high numbers of single time payments like Amazon have adopted direct debit in Europe as a payment method.

🌎 Latin America

A2A payments made up 20 percent of total e-commerce transaction value in 2023 in Latin America. Understanding the A2A payments landscape in this region requires a focus on its two largest markets: Brazil and Mexico. Both countries have distinct characteristics shaped by high card interchange fees and limited access to credit cards. Let’s look at the differences between countries

🇧🇷 Brazil: the rise of Pix

Brazil has experienced rapid development and widespread adoption of A2A payments, primarily through the Pix system. Introduced by the Central Bank of Brazil, it has revolutionized the payments ecosystem. It has multiple benefits:

- Cost-effective: Pix transactions can be as cheap as $0.15 (and free for P2P transactions), making them a cheaper alternative to traditional card payments.

- Instant settlement: transactions are settled instantly, providing not only immediate confirmation but also instant access to funds

- Strong authentication: users must authorize payments through their bank platform, ensuring that only the account holder can approve transactions.

Pix offers benefits similar to Open Banking payments in Europe, with added advantages. It combines the functionalities of Open Banking with the ease of use of P2P payment systems, allowing for instant, seamless money transfers to anyone.

This makes Pix a suitable option for all the use cases previously mentioned for Open Banking payments in Europe and the US: given its lower cost, Pix is an attractive alternative for card payments, and it provides a safer payment method for high-risk industries.

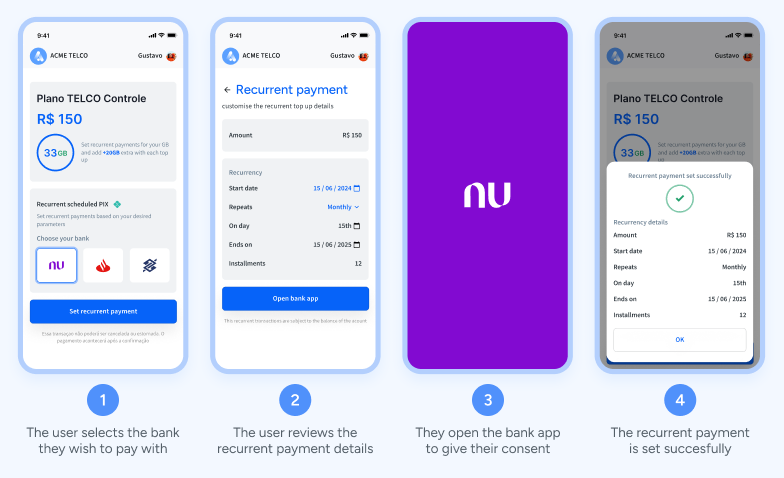

Despite its success, the primary gap lies in its inability to handle recurring payments efficiently due to the requirement for strong authentication for each transaction. The Central Bank of Brazil is addressing this through new developments such as:

- Pix Agendado or Scheduled single payments: companies can allow their customer to schedule one single payment in the future. While this is not allowing recurring payments, several use cases where the consent is given with significant time prior to the transaction can benefit from it. An example is lenders who can guarantee at least their first installment or can reduce significantly default rate for loans repaid with a single payment in the future.

- Schedule Pix or Recurring payments: this feature allows the processing of the same payment on a recurring basis. Subscription based companies that charge the same amount every month can already use recurring payments with Pix.

- Smart transfers: also known as me to me (M2M) transfers. Similarly to the UK, the first variable recurring payment feature has been made available for self transfers where users can freely move money among the accounts they own.

- Pix Automatico or Automatic payments: this is the end goal of VRP in Brazil. Unlike the previous initiatives, this one is not yet live, but will be the one that enables, at scale, all Variable Recurring use cases in Brazil.

🇲🇽 Mexico: the SPEI system and its challenges

Mexico presents a contrasting scenario. Years ago, the country developed SPEI, an efficient and instant A2A payment system. However, its utility for broader payment applications remains limited.

This system has greatly simplified bank transfers in the country, providing a cost-effective and immediate way to transfer money between bank accounts. It’s cheap, instant and non-refundable (as transactions are final, it reduces the risk of chargebacks).

Yet, there’s a major drawback: it is only a “push” payment: SPEI transactions must be initiated from the bank account, requiring users to input transaction details manually. This limits its usability for merchant payments and does not effectively compete with card networks.

To enhance SPEI, Mexico introduced CoDi, which allows merchants to request a SPEI transfer. However, CoDi’s adoption has been minimal due to mandatory pre-registration requirements and lack of promotional efforts by major players.

The potential of direct debit

Mexico also has a direct debit clearing house, CECOBAN, but its connectivity is restricted to banks, and the system is outdated. This currently limits the potential for developing robust A2A payment solutions similar to ACH in the US.

As a result of all of this, the A2A payment landscape in Mexico remains largely untapped, resembling the early stages of the US market: card networks are expensive and there are no clear, widespread alternatives in the market.

While the potential is gigantic, Mexico faces similar challenges than the US:

- Transaction confirmation time: in Mexico, direct debit transactions are confirmed on D+1 or during the same day if the transaction is intrabank. While 1 day is a lot better than 3 when comparing it to ACH, it is important to handle risk very well to make this payment method successful in the region

- Chargeback process: unlike the US, today Mexico doesn’t have an official dispute system for direct debit payments, leaving it to the banks to make the final decision. A system that protects both the payer and the payee would be very helpful to reduce the risk of this payment method

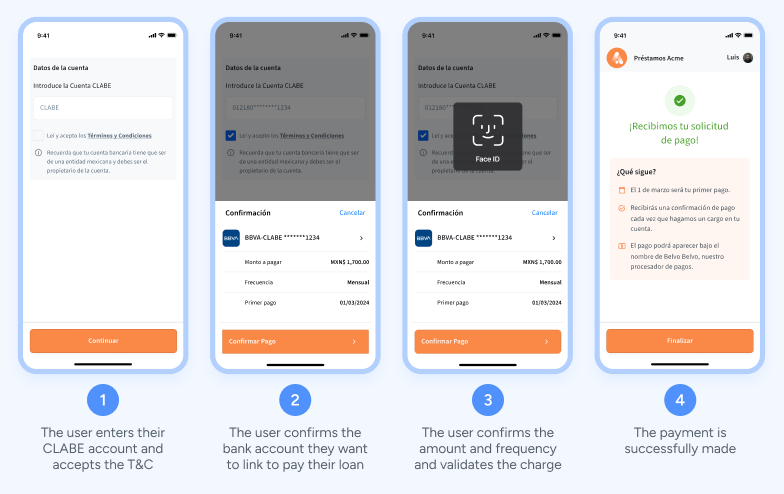

In this context, there’s a huge potential for the improvement of direct debit: the existing infrastructure can be leveraged to develop Variable Recurring Payments (VRP) platforms.

Future outlook of A2A payments

While A2A payments have made significant strides, there are still areas ripe for innovation and improvement. One such area is the development of Variable Recurring Payments (VRP) networks on top of the existing rails, which can optimize many payment processes with a huge market demand.

The missing piece to make all these new features and promises come to life will require considerable effort in building the UX and functionality around these capabilities to make VRP work in the region, to make it a smooth experience for users and provide a high level of security.

And this is precisely what we’re focused on building at Belvo: we offer a complete Variable Recurring Payments platform using A2A rails in Latin America. Stay tuned!