Belvo launches new products in Mexico and Colombia, including direct debit and payouts, reshaping the landscape of recurring payments. These new solutions allow users to initiate automatic transactions directly from their bank accounts, streamlining payment processes.

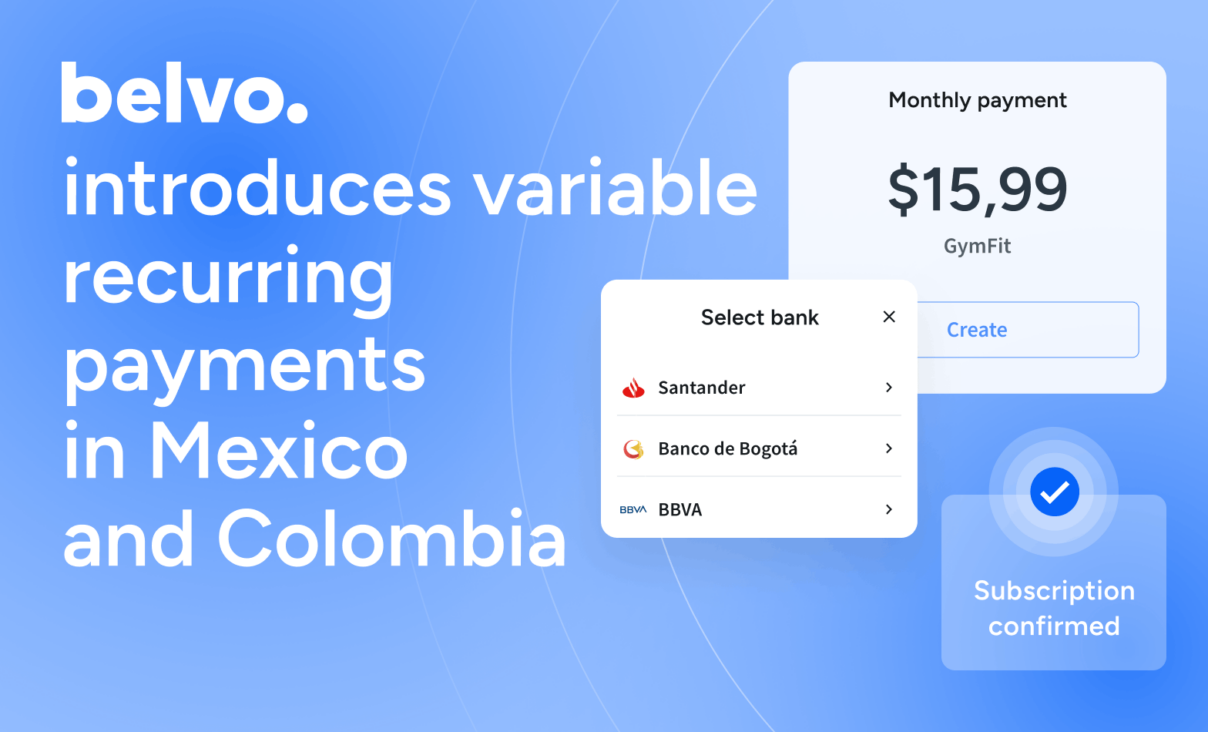

Belvo, the leading open finance platform in Latin America, has introduced innovative ‘pay by bank’ payment solutions in Mexico and Colombia to transform the way businesses handle variable recurring payments and fund transfers. In both countries, Belvo has launched new products that enable companies to conduct automatic, recurring transactions directly from bank accounts, offering a seamless and efficient payment experience for users.

In Mexico, Belvo has introduced a new Direct Debit product that allows businesses to collect payments from any bank account. Users can link their bank accounts and authorize automatic recurring transactions, facilitating quick and secure payments for products and services. This is particularly valuable for subscription payments, service bill payments, loan collections, and digital wallet funding.

Meanwhile, in Colombia, Belvo has introduced two new products that empower businesses to carry out both automatic debits and initiate payouts to destination accounts. With these, Belvo can offer the same benefits of direct debit, coupled with the possibility of automating payouts at scale.

“Chargebacks, fraud, and difficulty in setting up variable recurring payments are all common pain points our customers have shared with us. These new products not only simplify and secure money transfers between bank accounts but also leverage Belvo’s open finance data infrastructure to validate account balances and transaction histories, increasing conversion rates and reducing the risk of fraud. We’re extremely excited to see them live and already creating impact in how companies pay and get paid more easily and safely”

Uri Tintoré, Belvo’s co-founder and co-CEO

Both countries have witnessed a growing demand for efficient and cost-effective payment methods. In Colombia, where credit card networks have been the traditional choice, the integration of bank payments is expected to reduce transaction costs for businesses by over 50%. Across Latin America, the adoption of account-to-account (A2A) is taking off today and will grow regionally at a CAGR of 22% between 2022 and 2026, almost double compared to the growth rate globally, according to FIS.

Belvo’s approach promises to have a profound impact on the payment industry, as it now offers the most complete solution for variable recurring payments through account-to-account (A2A) rails across the region. In Brazil, Belvo already allows companies to accept Pix payments via Open Finance rails, reducing friction and enhancing security for customers.