Enrichment

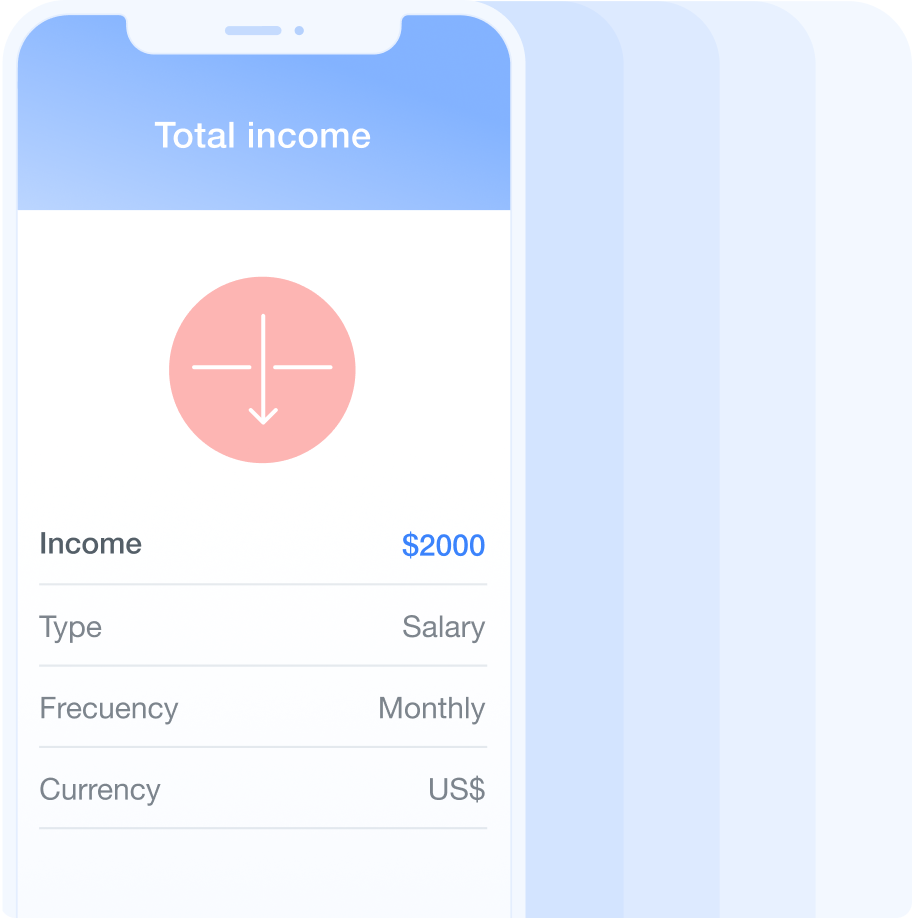

Get insights into your users’ financial behaviour

Speed up your decision-making and cut costs by using enriched financial metrics to understand your users better.

Trusted by the leading financial innovators

Why trust Belvo

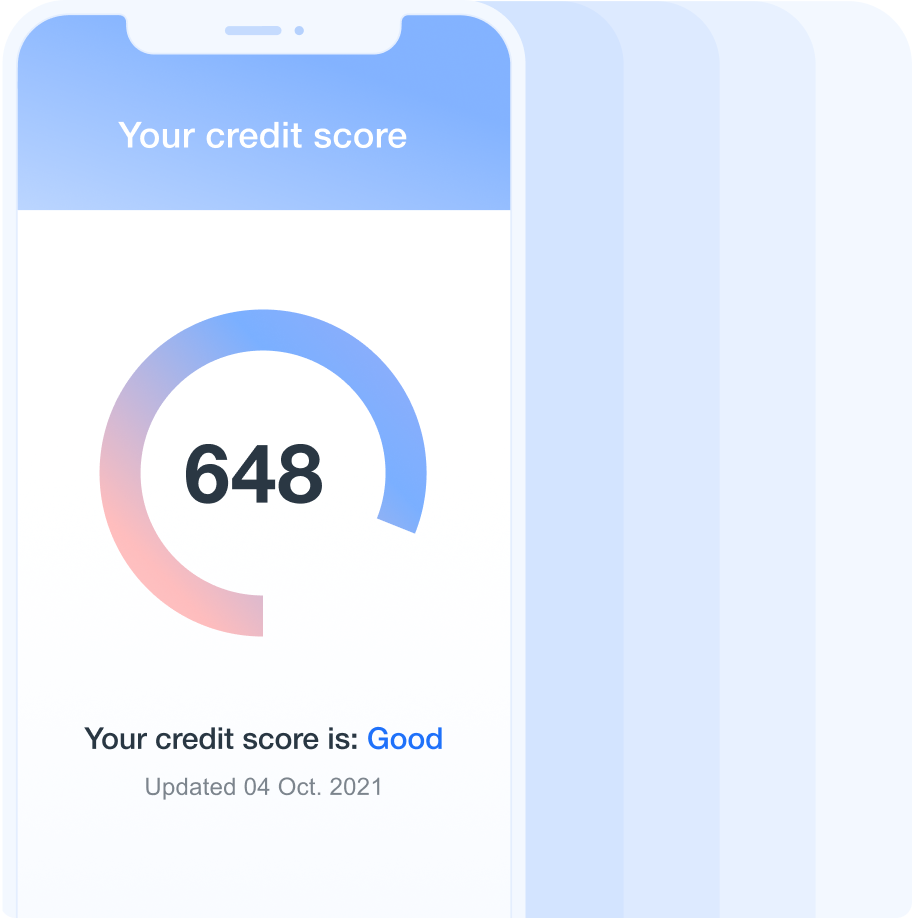

Data intelligence in our core

By connecting and analyzing transactions from millions of users through Belvo-powered apps, our machine learning models improve every day to benefit our customers.

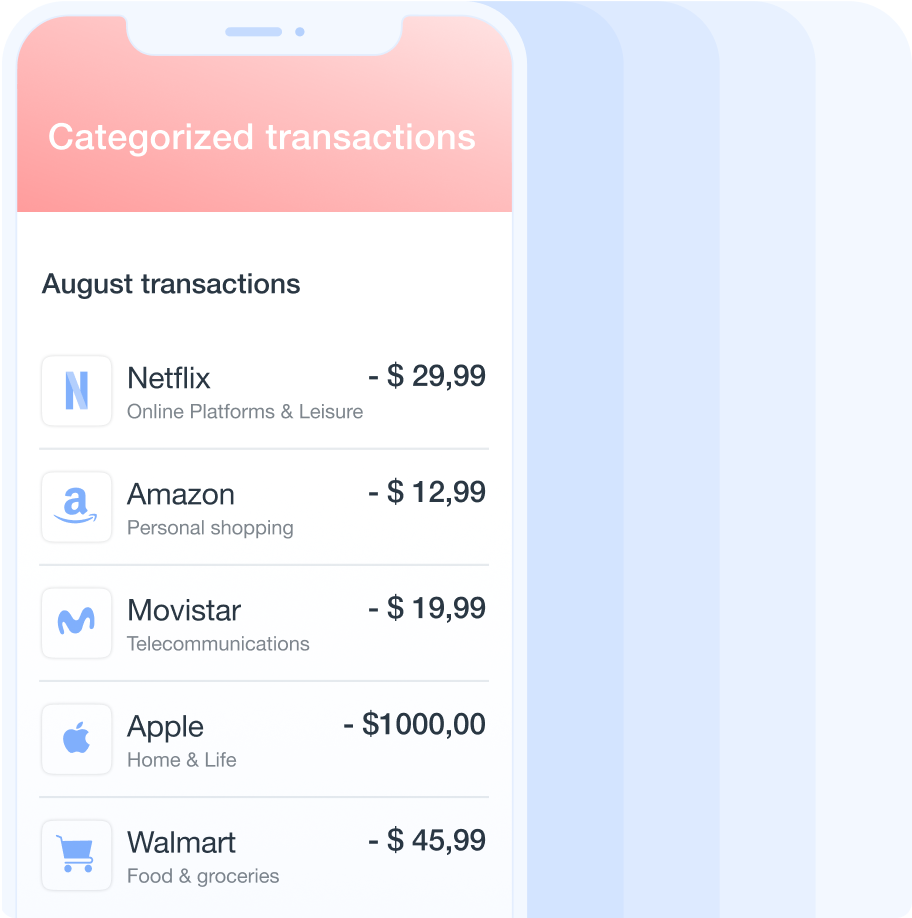

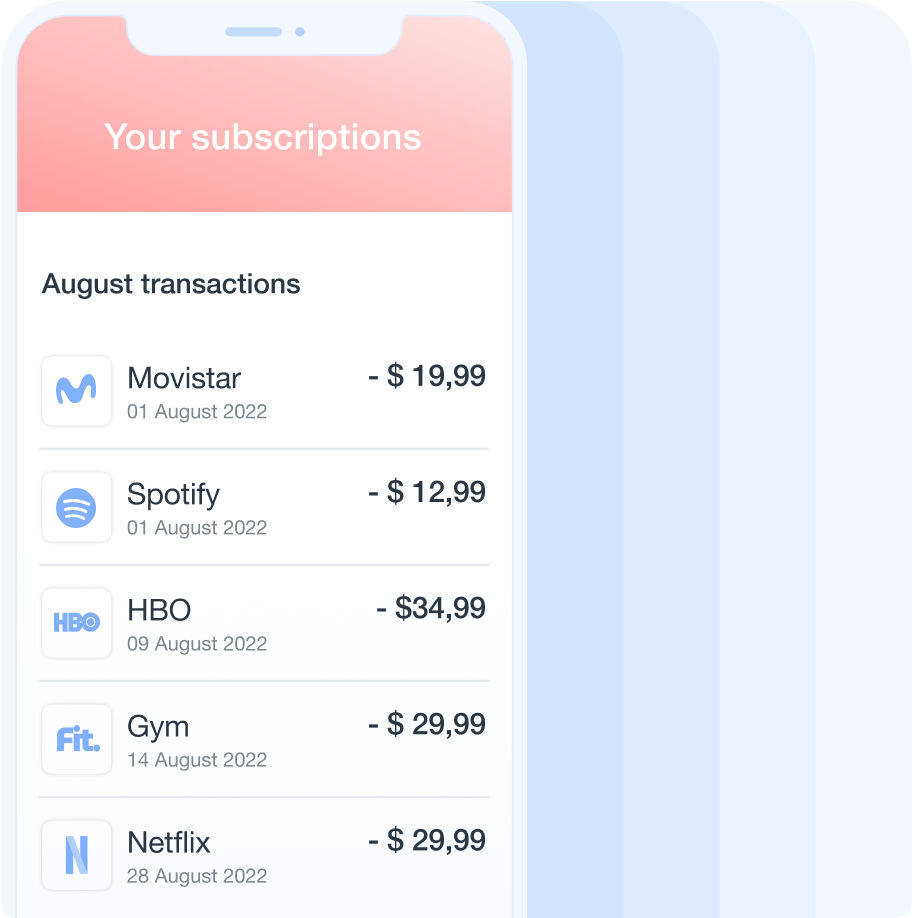

We do the heavy lifting

Our solutions translate raw data into categorized and standardized information that is ready to use, saving time and effort to focus on what matters: building great products for your users.

Security is our obsession

Belvo uses bank-grade security standards and complies with privacy, security, and regulatory best practices and certifications, including ISO 27001.

Transform raw data into actionable insights

How our clients use enrichment

Streamlining access to credit with Monet

Learn how this Colombian fintech is using open finance to offer salary advances.

Transforming the personal loan market in Brazil

EmpreX is using open finance data to offer credit services at a reduced interest rate.

How Facio decreased credit risk by 50% with Belvo

With Open Finance data, Facio offers payroll loans with lower credit risk

Retrieve data with the most complete aggregation solution in Latin America

Access a wide range of financial data sources, from banking and fiscal to gig economy apps, to better understand your customers and offer personalized products.

We can’t wait to hear what you’re going to build

Belvo does not grant loans or ask for deposits