PIx via Open Finance

Accept Pix payments via Open Finance

Receive instant bank payments inside your app or website. Allow your customers to pay with Pix and optimize their recurring payment experience with Pix newest features. Increase conversion, cut fraud and reduce costs.

Trusted by the leading financial innovators

Simplify payments and variable recurring payments with Pix

Aligned with Brazilian Central Bank

Accept instant bank payments from all the financial institutions that are part of the Open Finance ecosystem.

Recurring payments optimized

Improve conversion and retention rates by allowing customers to automate recurring payments with Pix.

Sell through Whatsapp

Offer Pix payments in your WhatsApp messages flows without complicated integrations. Increase your sales and improve your user experience.

Reduce friction

Increase conversion and successful payment rates by allowing your users to complete a payment without leaving your app.

Instant and recurrent account-to-account open finance payments

Hassle-free payments with Recurring Pix

Facilitate recurring payments for utility bills, subscriptions, and collections allowing your users to automatically schedule payments with Pix. Optimize the payment journey and don’t wait for your customers to remember to pay you.

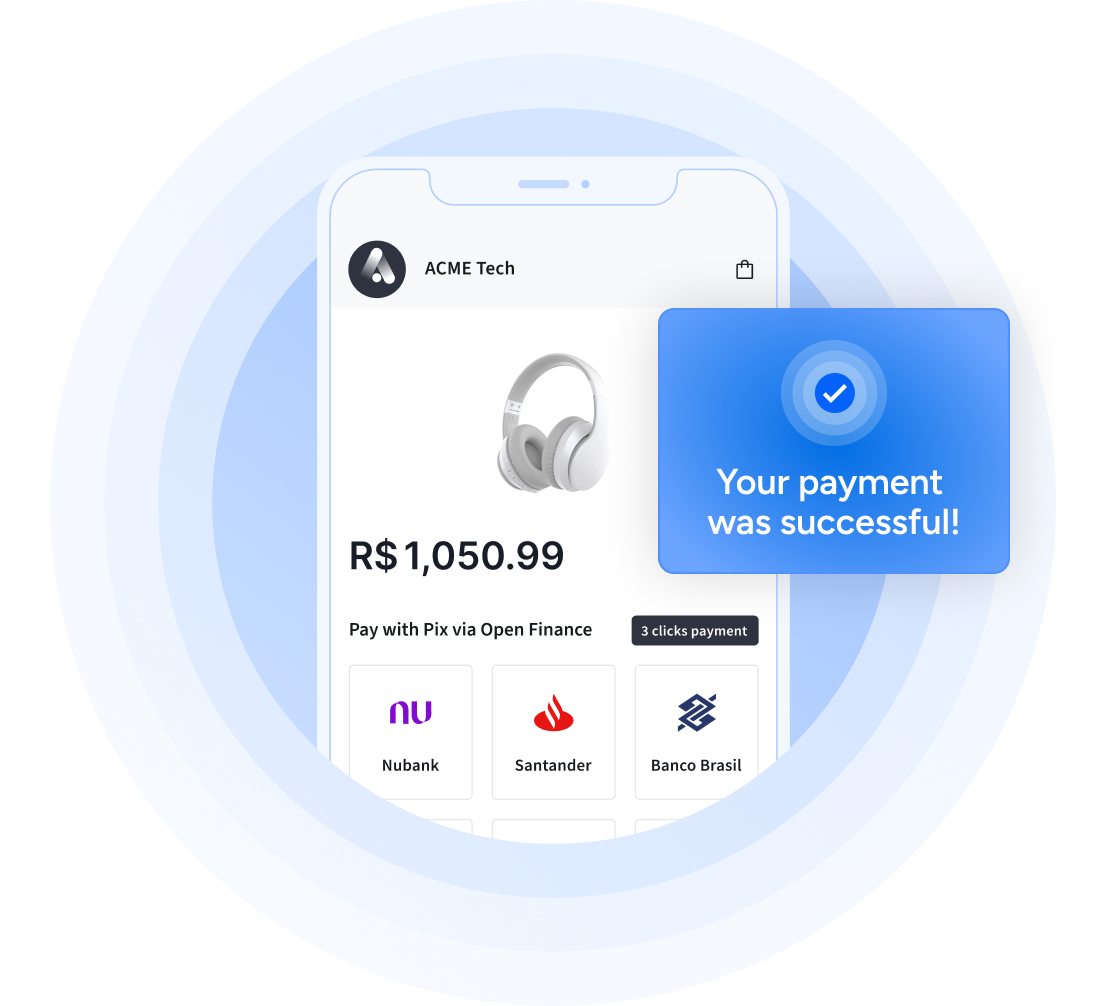

Increased checkout conversion with Pix Biometric Payments

Simplify your checkout process with a no-redirect Pix journey and enable 1-tap Pix payments. Fewer steps and more efficiency than traditional Pix or boleto to boost your sales.

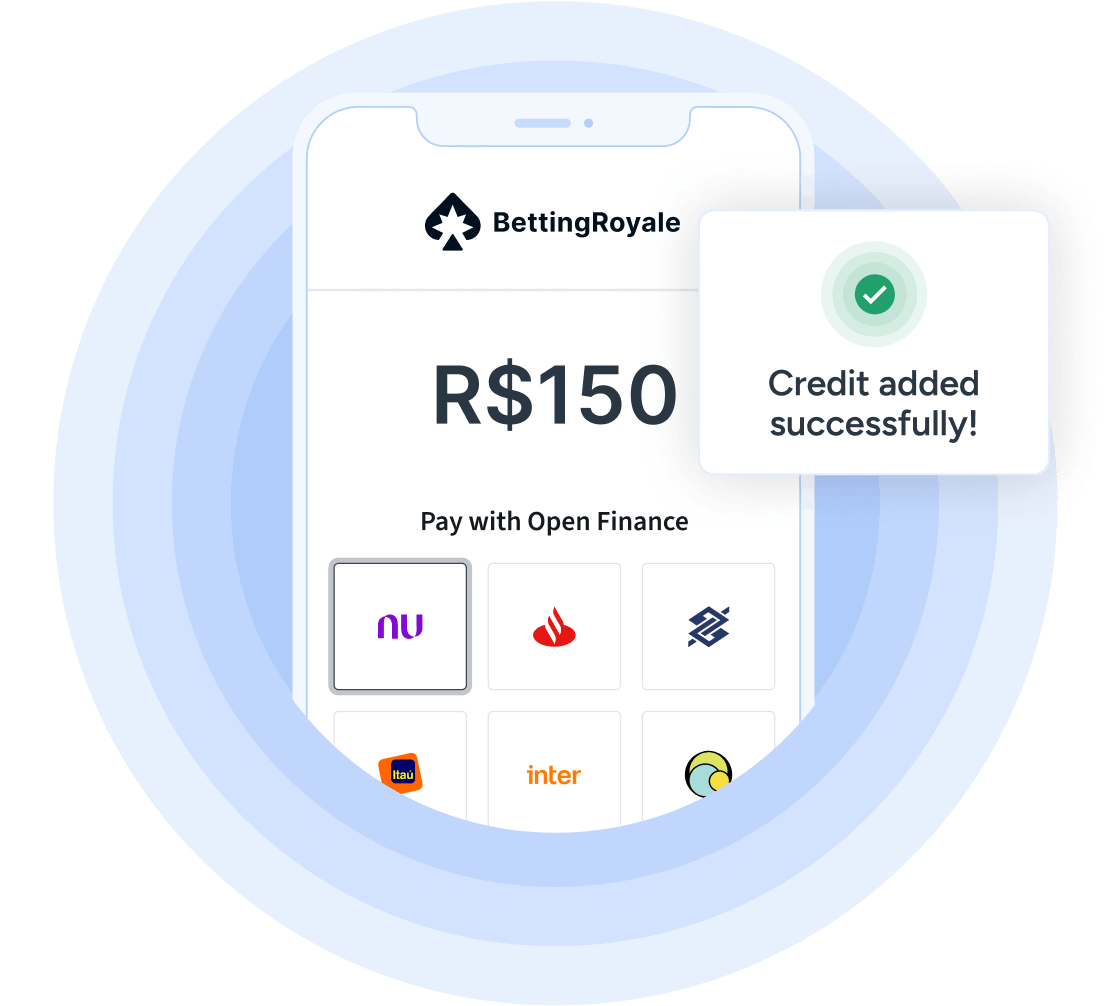

Improved top-up experience for betting apps

Increase conversion and reduce abandonment rates with a simple and fast registration and payment experience. Authentication is done directly with Face ID, reducing the risk of fraud

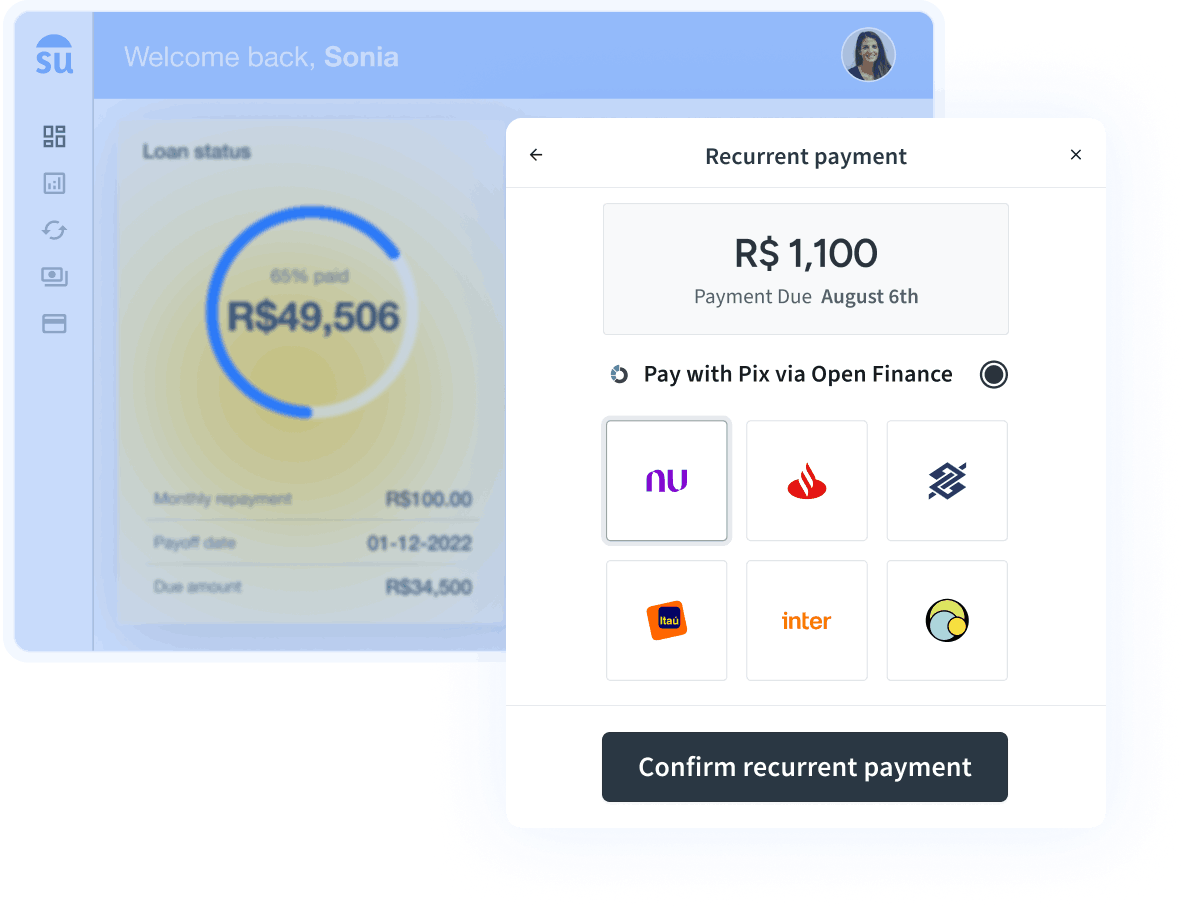

Simplified loan repayment with Recurring Pix payments

Optimize your BNPL or credit collection business with Pix recurring payments. Improve your repayment rate by reducing the risk of missed payments. Enhance the user experience by automating payment schedules, ensuring hassle-free and timely payments.

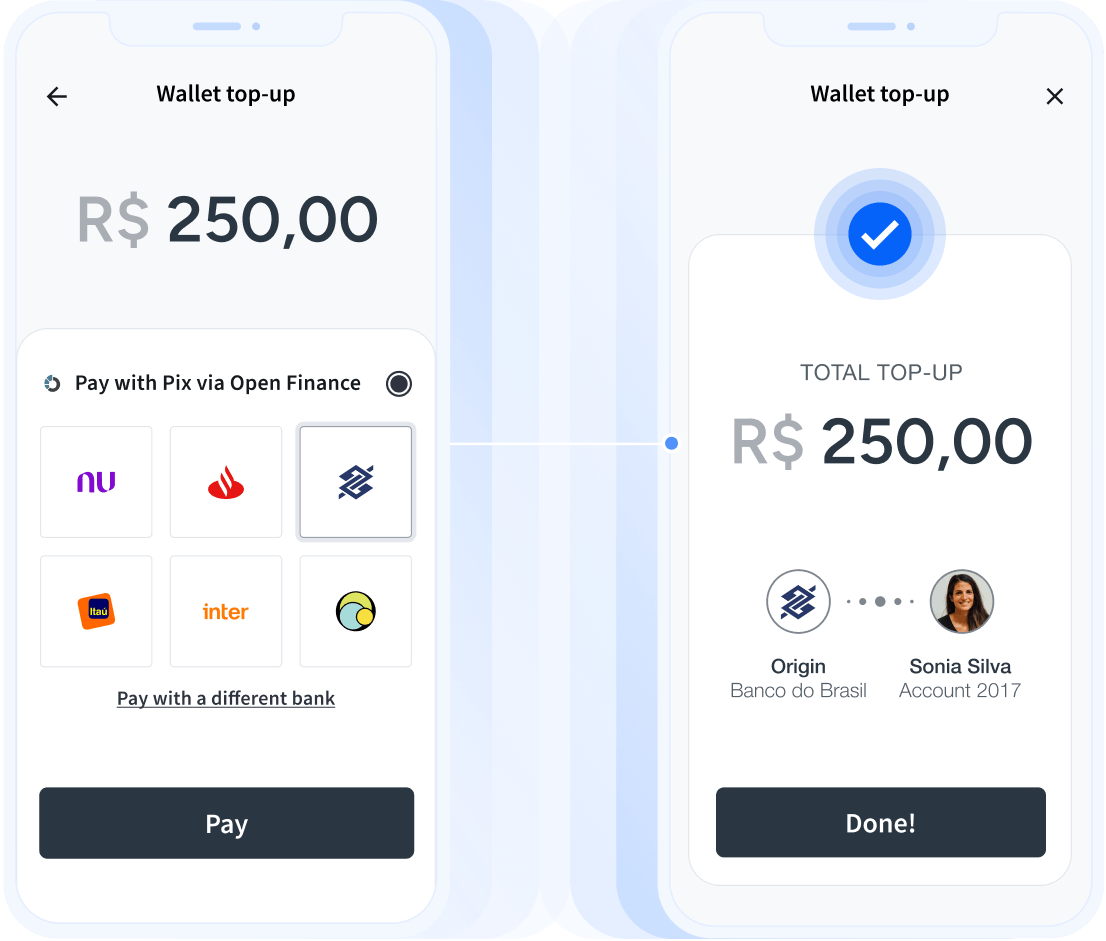

Automatic top-ups for digital wallets

Increase your wallet usage and average account balance by letting your user make instant transfers directly from their bank account without having to leave the app. Eliminate the need for multiple logins and improve your app user experience.

Pix new features

Recurring payment optimization

Recurring Pix

Customers can schedule payments of fixed amounts via Pix according to the desired periodicity.

Smart Transfers

Automatic circulation of funds between accounts held by the same person.

Automatic Pix

Any company can offer customers the option of automatic Pix payments for recurring expenses, whether fixed or variable.

Pix Biometric Payments

Allow your customers to make 1-tap Pix payments with biometric authorization.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits