Credit Risk

Reduce credit risk with open finance data

Improve risk assessment processes by accessing current and historical data about their financial behavior and employment status. Get a clear picture of their financial activities, better assess affordability and provide tailor-made credit products.

Trusted by the leading financial innovators

Strengthen underwriting processes while reducing risks

Increase loan underwriting volume

Add new data sources to your models, such as bank accounts and official employment and fiscal institutions, to expand credit eligibility and increase credit lines granted.

Improve credit conversion

Access enriched transactional data to offer more personalized repayment conditions to your customers while increasing your loan acceptance rates.

Better informed loan decisions

Make better-informed decisions using clean and standardized data to incorporate into your underwriting models and improve affordability assessment.

Improve credit assessment models with new data insights

Get a holistic picture of your users’ finances

With open finance, your customers can easily and safely share their banking information to facilitate their financial assessment. Analyze these sources of data to understand spending patterns and habits over time, accurately assess and predict their income, and identify loans and credit card repayments status. Get a thorough understanding of their financial behavior and improve the accuracy of your underwriting processes.

Offer personalized credit products based on employment

By gaining visibility about your users’ employment history and current status, you can better understand their credit needs and repayment capacity. With these insights, lenders have a new data source to better assess affordability and provide more personalized credit offers and repayment rates. While you reduce payment default risks, you increase your loan acceptance rate by providing credit products adjusted to users’ financial behavior patterns.

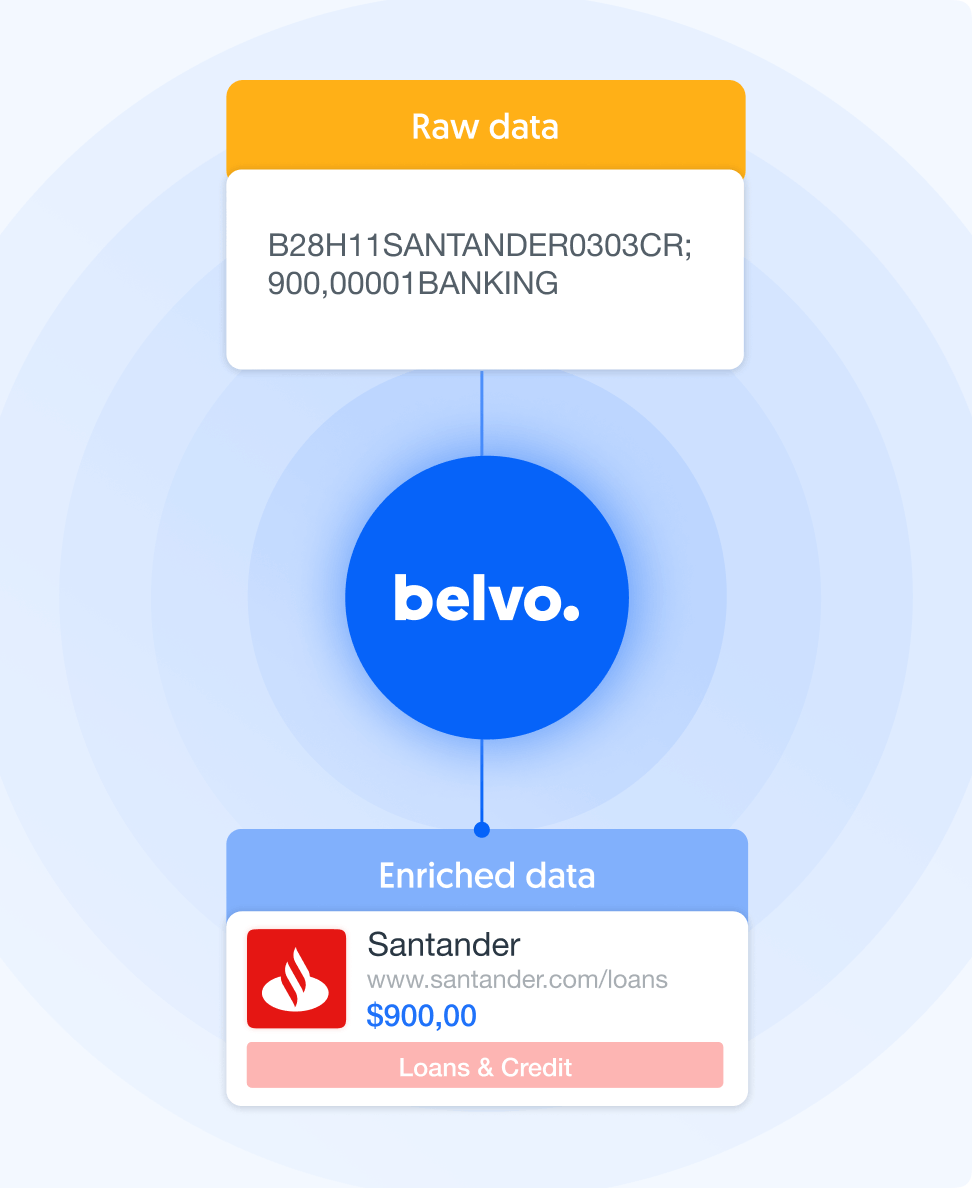

Maximize the value of raw transaction data

Our categorization engine uses machine learning to classify raw transactions into 15 categories and 94 detailed sub-categories.

We provide deep insights on income and credit and loan categories to capture the unique nuances of the lending industry, supporting lenders with the granularity they need to make data-driven decisions.

Related guides & Docs

Decreased credit risk by 50%

Facio, a Brazilian credit solution, offers payroll loans for workers while lower credit risk with Belvo.

Analytics, a solution for lenders

Access key analytics and reports from Belvo’s dashboard without writing a single line of code.

Streamlining access to credit in Mexico

Discover how they instantly access users’ personal information to provide credits in just a few minutes.

We can’t wait to hear what you’re going to build

Belvo does not grant loans or ask for deposits