Aggregation

Best-in-class aggregation from financial data sources in Latin America

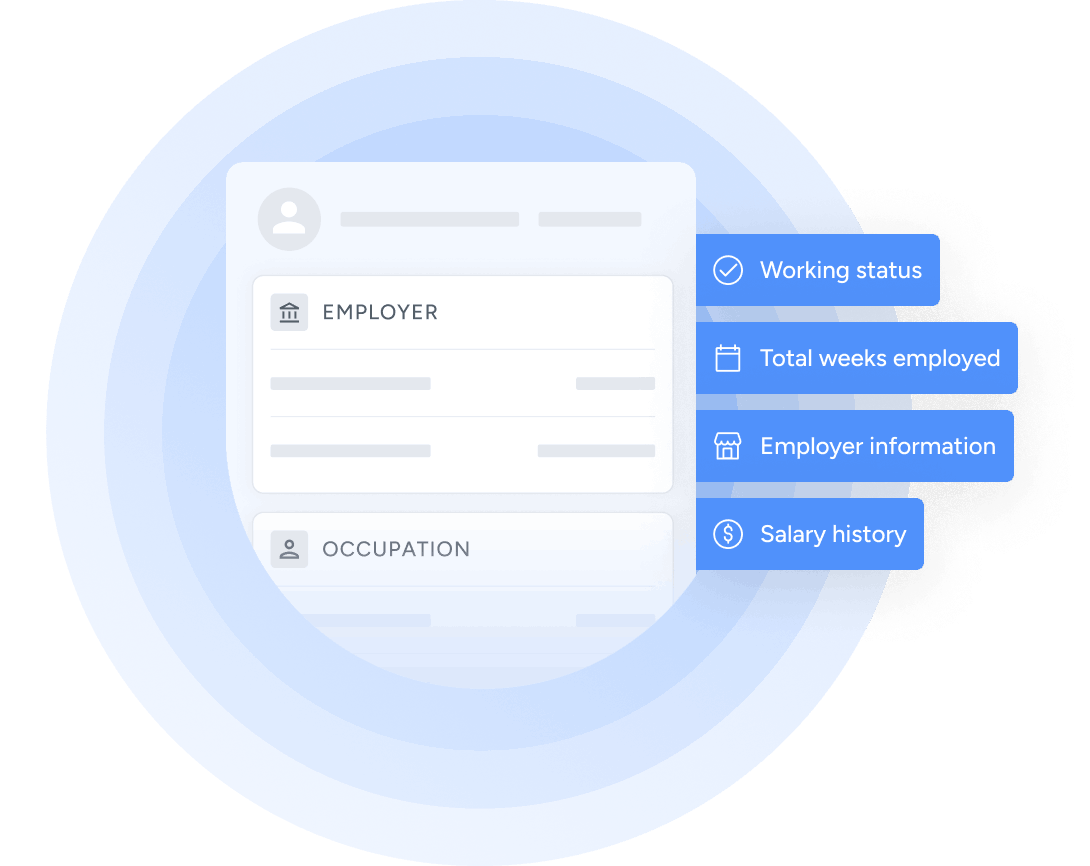

Access the widest range of financial data sources, from banking and fiscal, to receivables data, to better understand your customers and offer personalized products.

Trusted by the leading financial innovators

Why trust Belvo

The best coverage in the market

With 60+ connected institutions and 90% market coverage, Belvo’s aggregation is the most comprehensive in Latin America, covering main players across different financial verticals.

User experience designed for conversion

Our solutions follow the best UX practices to guide users to connect their accounts, driving conversion with an opt-in rate of over 70% in banking connections.

Security is our obsession

Belvo uses bank-grade security standards and complies with privacy, security, and regulatory best practices and certifications, including ISO 27001

The most complete offer of Open Finance data sources

How our clients use aggregation

How Facio decreased credit risk by 50% with Belvo

With Open Finance data, Facio offers payroll loans with lower credit risk

Improving small companies’ finances with Nibo

Financial management is made simple and efficient through Open Finance data.

Improving SMEs’ credit experience with Tribal

Tribal now has a 360º view of its customers’ financial reality.

Make the most of Open Finance data through enrichment solutions

Get to know Belvo’s enrichment toolkit that makes Open Finance data even more powerful through categorization, income verification, recurring expenses, and risk insights.

We can’t wait to hear what you’re going to build

Belvo does not grant loans or ask for deposits