Customer stories

Making Mobills an even more powerful PFM with Open Finance

CountryBrazil

Case of usePersonal Finance

ProductData aggregation

GoalConnect accounts

About Mobills

Mobills is a personal finance manager that allows users to make plans and be in control of their financial lives. Through the app, users can manage their accounts, create budgets, and see expenses from checking accounts and credit cards, all in a single platform. Aside from offering a categorized view of expenses, Mobills also helps users understand the short-term future of their financial situation through machine learning. With this information, users can establish financial goals and set up notifications to receive alerts to save money when the expenses limit is about to be reached. The platform exists since 2014 and has already helped over 7 million people transform their financial management into a simple and fun habit.

Challenge

Personal finance managers need at least one thing in order to fulfill their purpose: access to users’ transactions. Mobills was already able to collect this data manually, but the process was laborious and slow, especially when it came to the input of credit card expenses: payments in installments, internet purchases, and the various apps which may be connected to a card were some of the challenges in the way. To surpass this obstacle and keep users active, Mobills needed to automate the collection of transactions from credit cards, but integrating with each individual bank or provider would be a time (and money) consuming effort.

Another obstacle was the categorization of expenses. Mobills needed accurate and standardized descriptions of each transaction, ready for the user, so it could offer personalized advice according to users’ specific spending habits. However, most banks in the country still don’t offer categorized transactions, and the few that do offer this for “premium” customers still are not assertive enough. Transforming this raw data into high-value insights became a significant challenge.

So Mobills needed a quick, easy, and developer-friendly solution to connect to the largest banks in Brazil and obtain transactional data from their credit card users.

Solution

To solve this issue, the company needed an Open Finance solution that could not only connect to multiple data sources but also to categorize and enrich this information in a clear, easy-to-consume format. By connecting to Belvo, the leading Open Finance API platform in Latin America, Mobills got what they needed – and more.

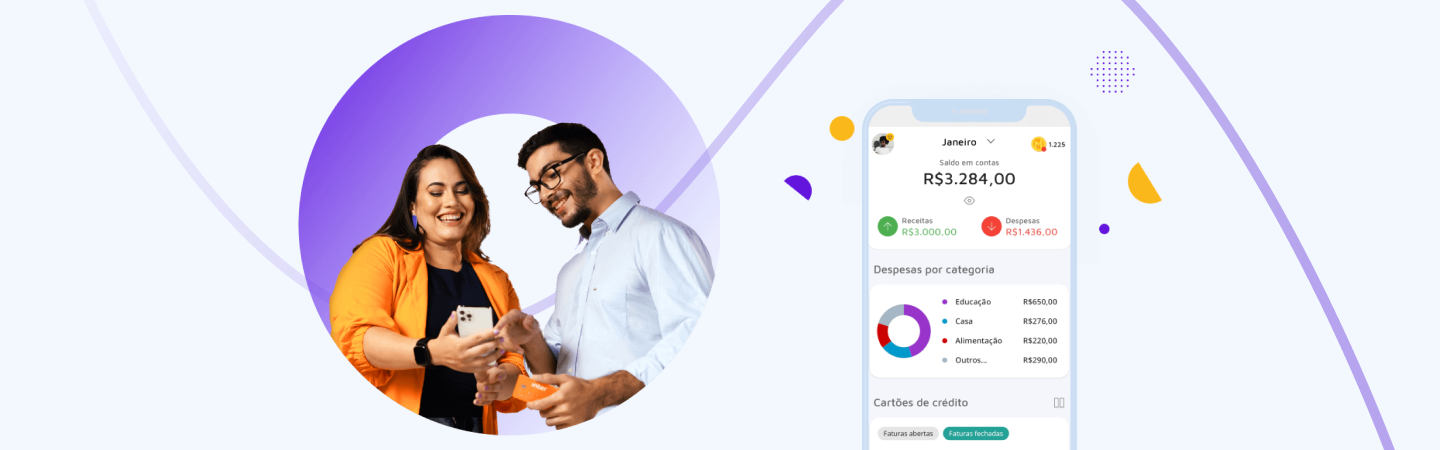

Now, Mobills users’ can synchronize their credit card information inside the app and see transactions in real-time. In addition, Belvo offers clear categorization of each transaction, allowing Mobills to speed up internal processes and focus on intelligence, leveraging this data to provide their customers with relevant insights. Through a simple interface within the Mobills platform, Belvo’s APIs allow users to share the information they want through user consent, in read-only mode and synch their accounts securely in a few seconds. All of this is done without the user having to leave the Mobills app, optimizing conversion rates. After connecting to the bank accounts, Belvo applies extra layers of intelligence to enrich this financial data, making transactions clearer and ready to be presented to users.

How does it work?

Mobills offers users the option to connect their credit card transactions automatically. The user then selects the financial institution, and that’s when Belvo’s widget gets into action.

The user fills in their credentials and Belvo establishes a secure and encrypted connection to access the information in read-only mode.

Once the connection is established, Belvo’s platform sends the data to Mobills, and the app instantaneously shows card transactions to the user.

Results

Reaching new customers

Now that it has a clearer view of users’ financial lives, Mobills is able to make more accurate predictions and offer solutions that are even more custom. This helped the company reach a different type of user: since the integration was established, the app saw a considerable rise in users who don’t have time to manually input their financial information and appreciate receiving exclusive financial information based on their habits.

What Mobills says

“Belvo helps us accelerate the data gathering process and gives us more time to pay attention to analysis, providing better insights for our customers. We are able to show categorized transactions at the very moment the platform has access to the accounts"