Income Verification

High-accuracy income verification

Verify your users’ income and financial stability using our machine learning and artificial intelligence-powered models. Increase accuracy in your underwriting processes and reduce risks.

Trusted by the leading financial innovators

Get a new level of visibility on your customers’ income

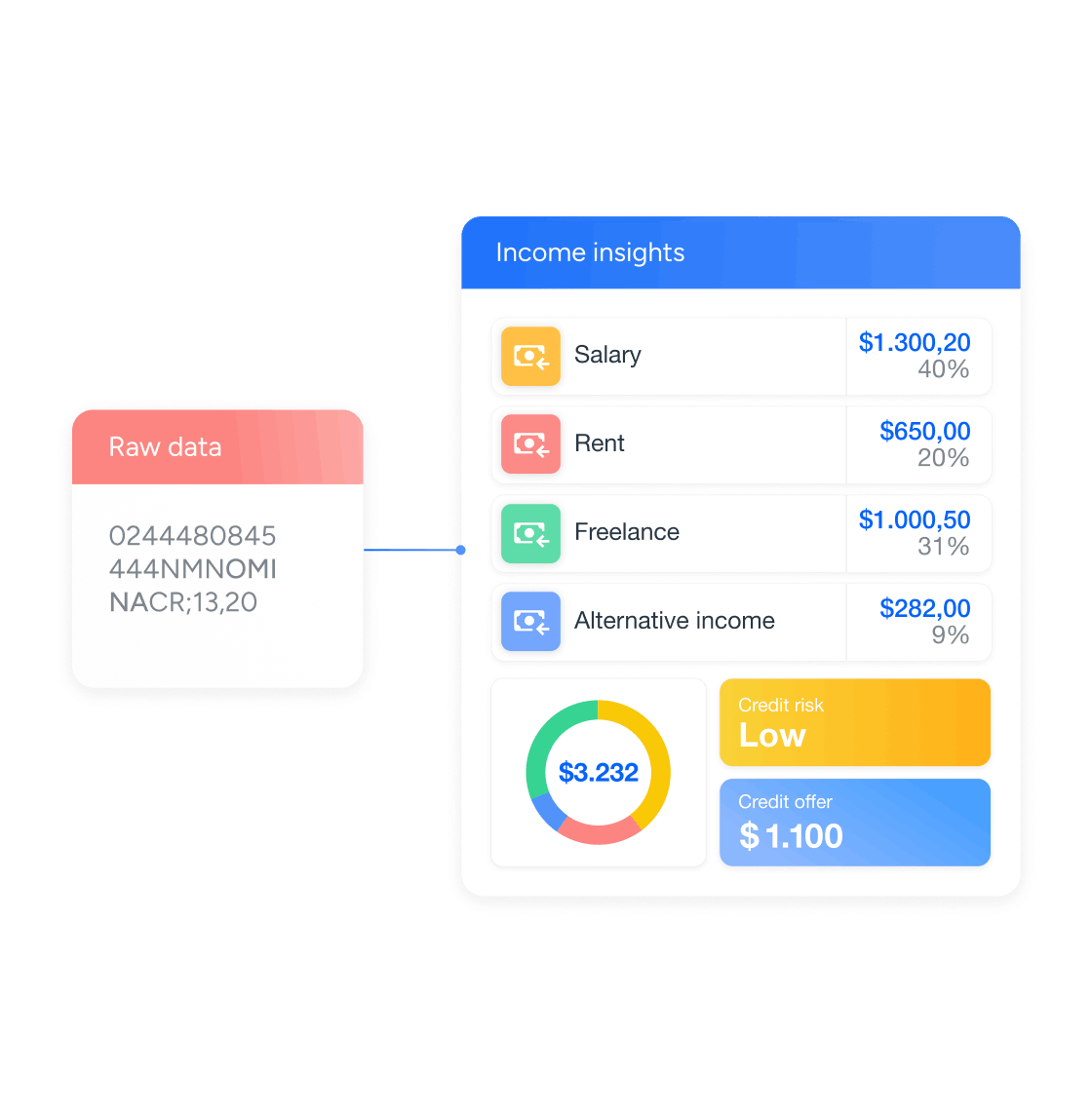

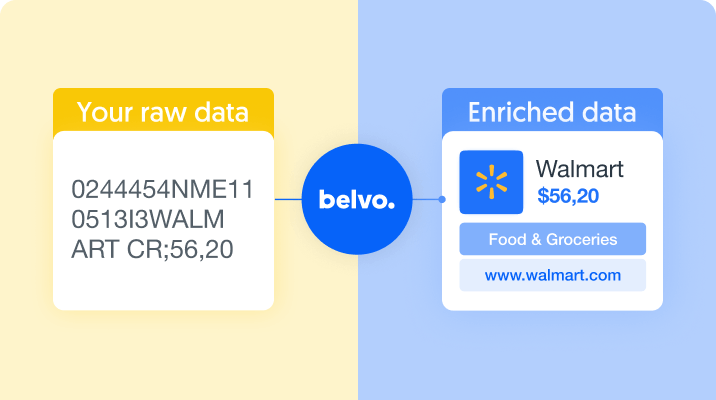

Enrich your own data

Our product is compatible with transaction and income data from any source, whether you have an existing data set or you access open finance data.

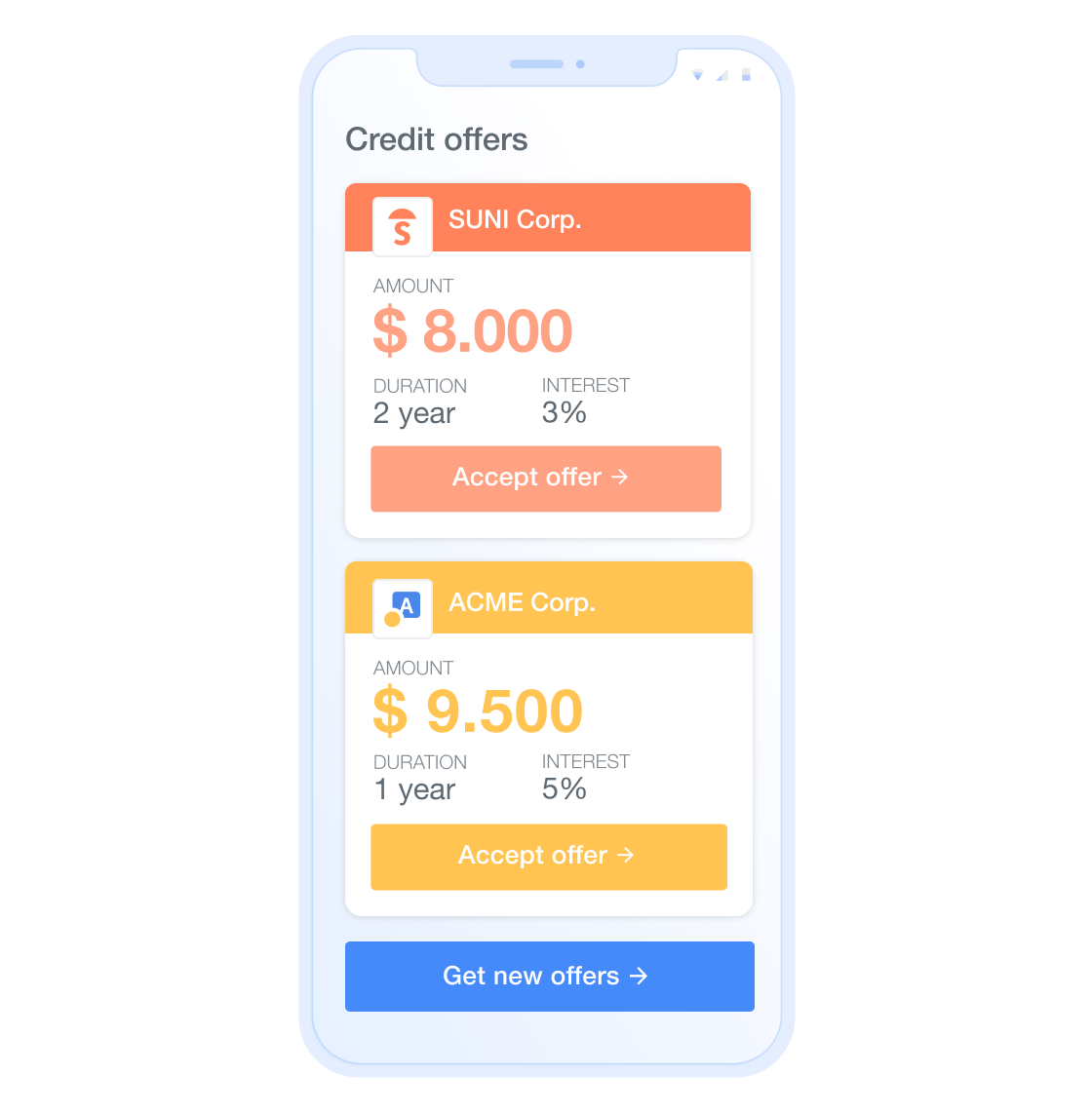

Lending tailored metrics

We offer a wide range of fine-tuned income filters tailored to lending activities. Select applicants that match your credit conditions and increase your approval rate.

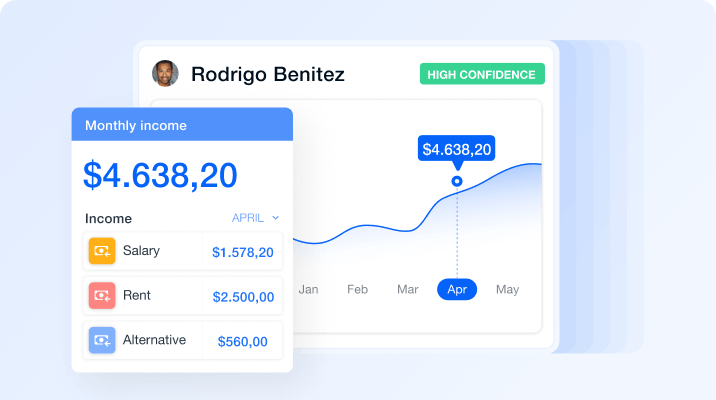

Visualize all income streams

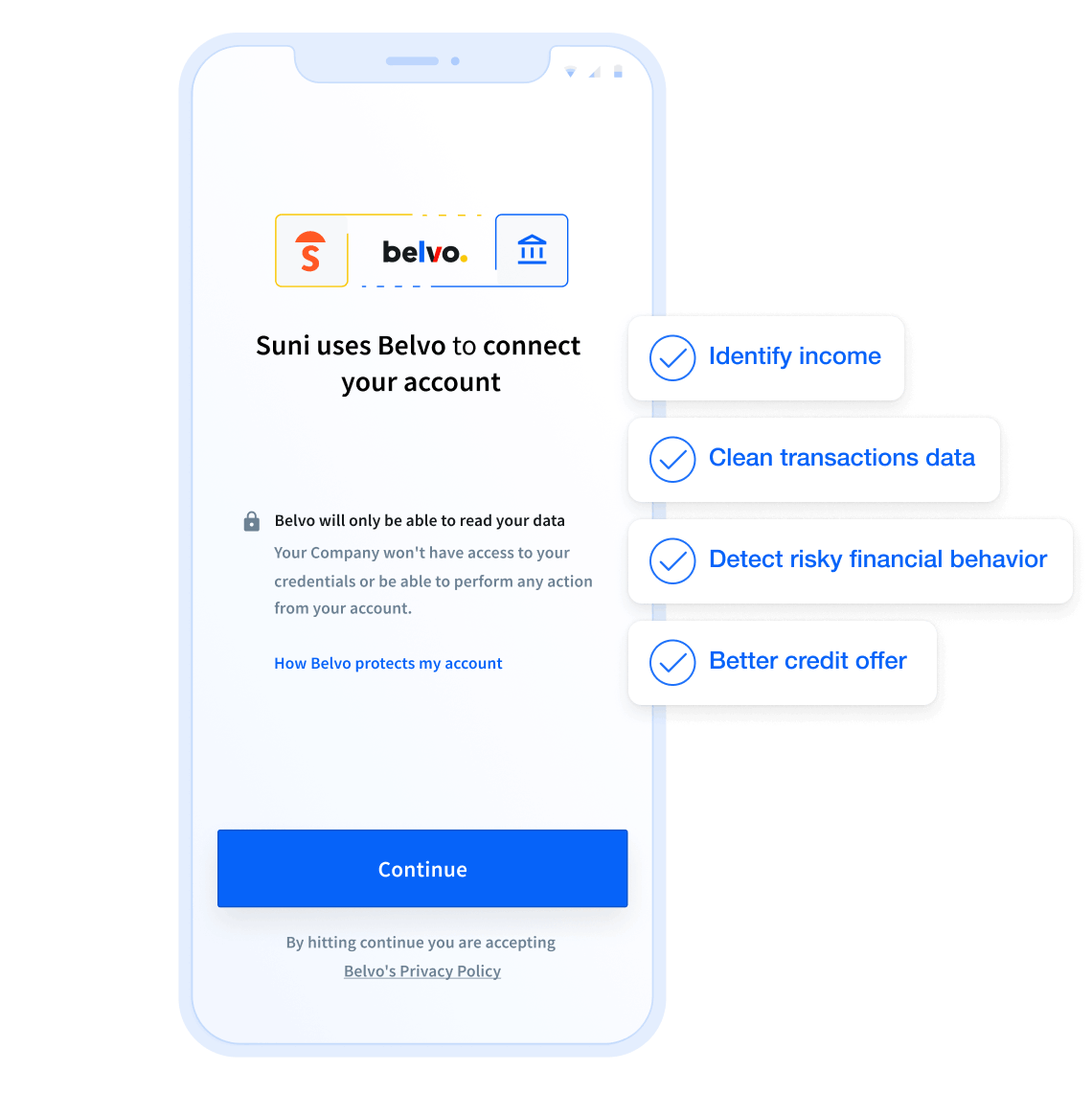

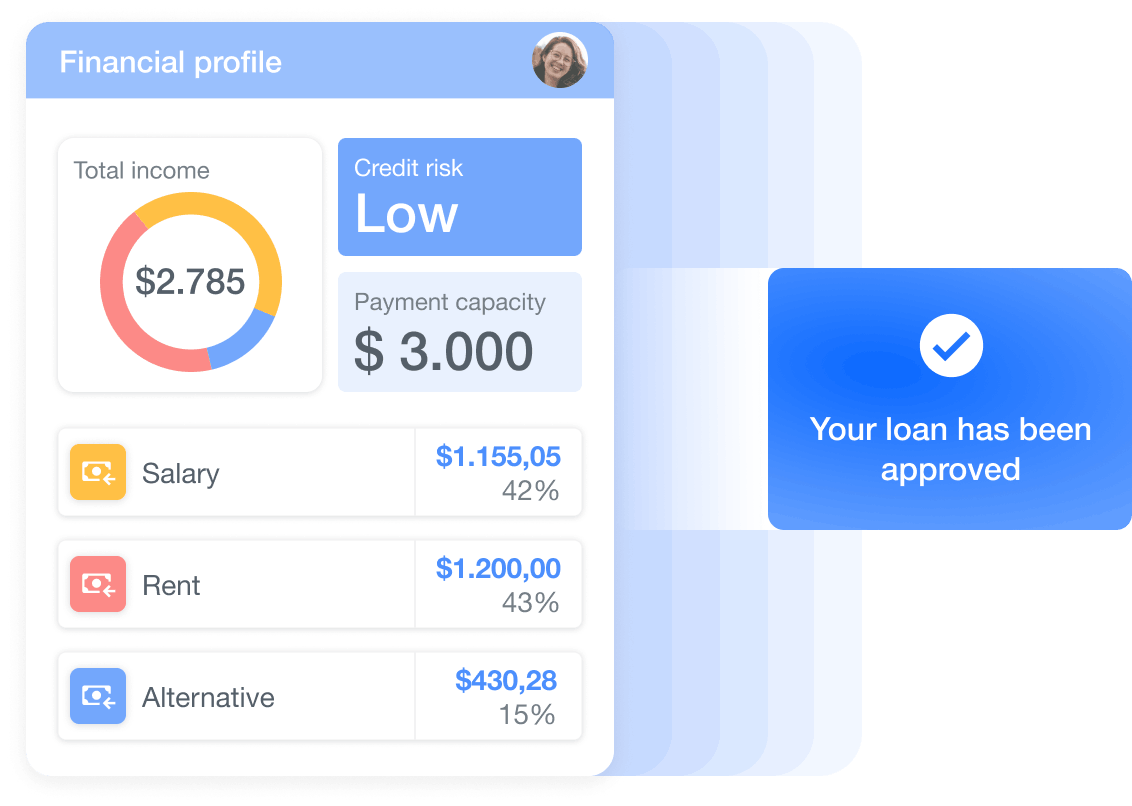

Assess your customers’ income from multiple sources (e.g. freelance, rent, salary and more) to get a thorough understanding of their financial health and affordability.

Optimize operational efficiency

Reduce time-consuming processes of manually verifying income and process credit applications much faster.

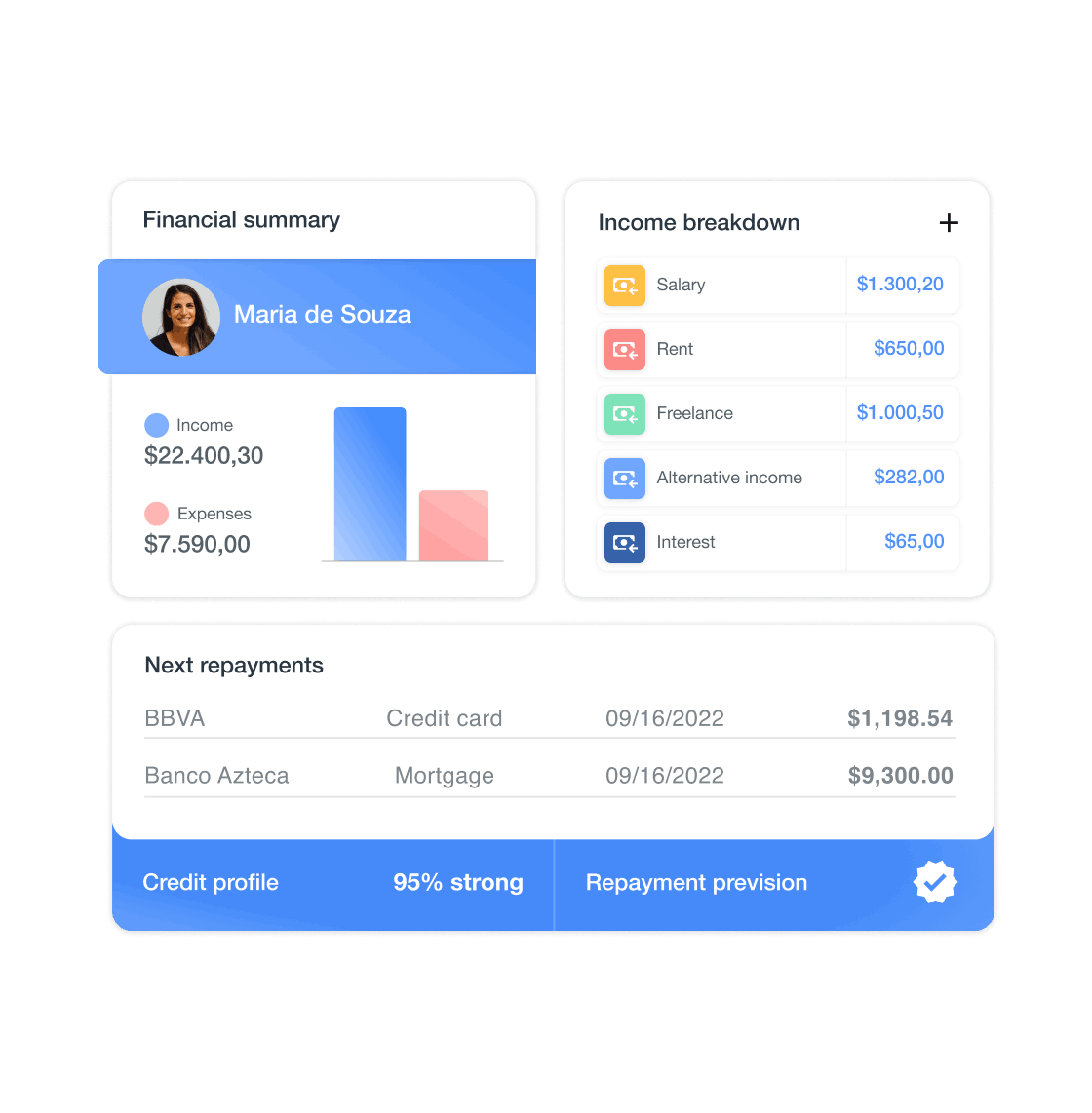

Accurately understand your users’ financial

stability and ability to pay

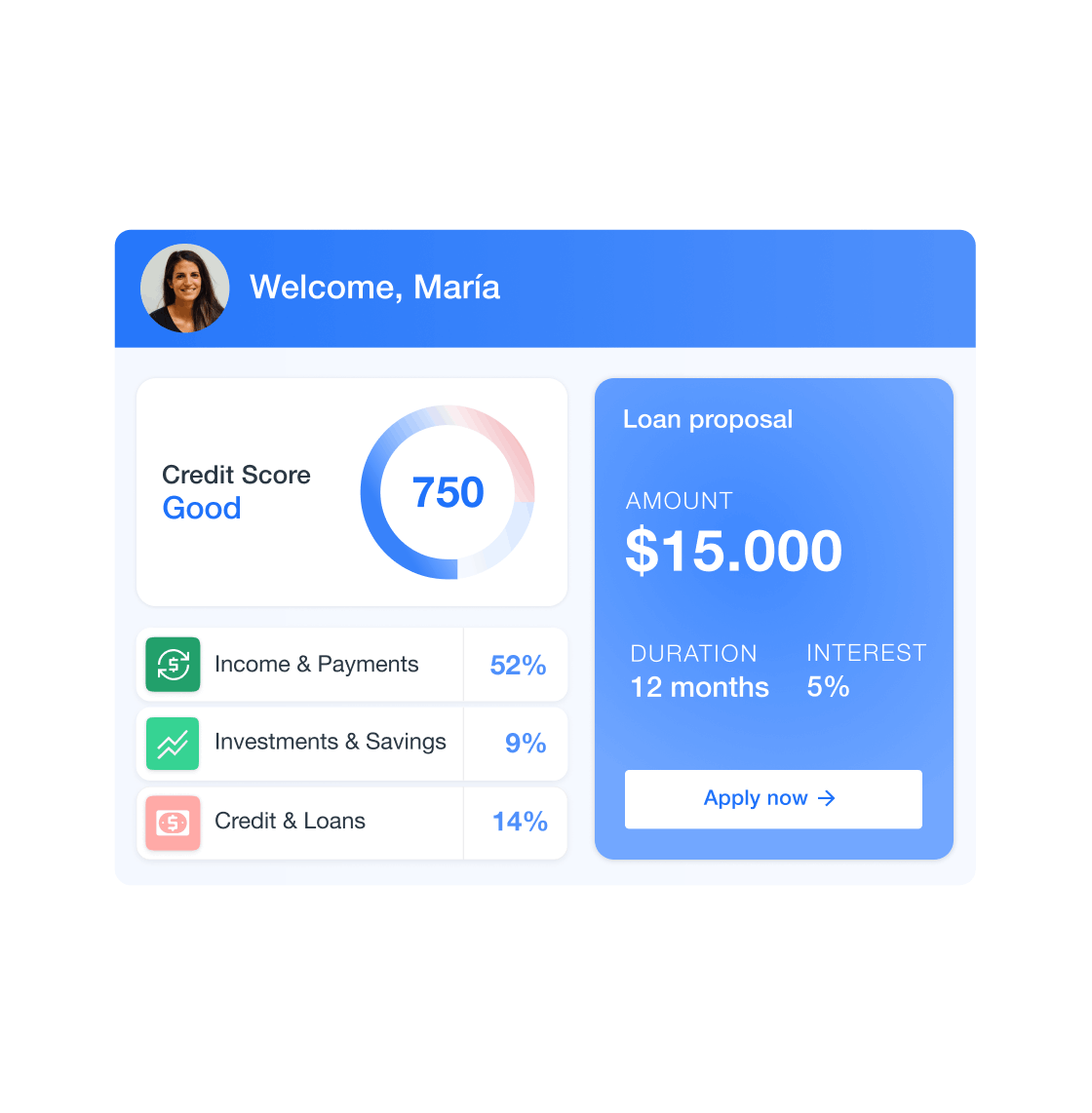

Improve credit assessment and approval rates

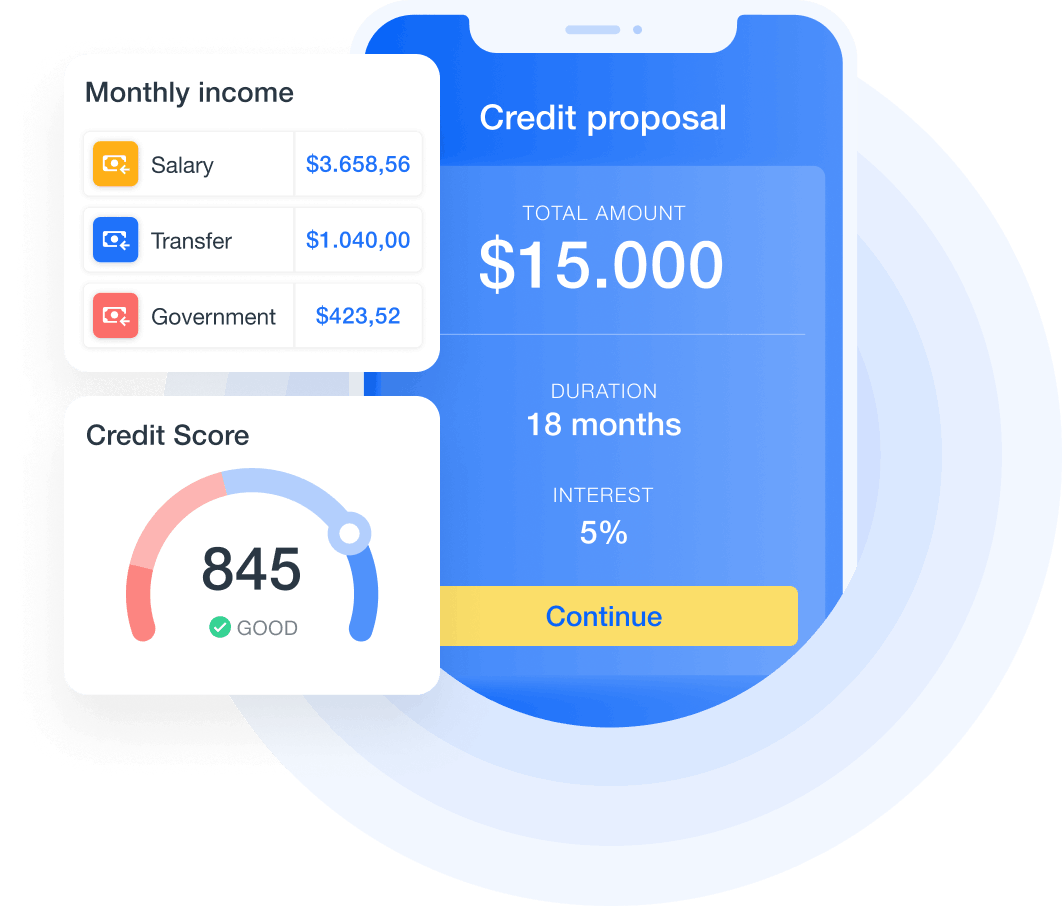

Gain insights into users’ income stability, spending habits, and overall financial health to better assess creditworthiness, including for no-hits or thin-file credit applicants.

By assessing income from multiple sources, you can provide better credit offers to more applicants with appropriate repayment rates. Increase your credit approval rates by 2% while maintaining the same default risk.

Simplify loan applications and reduce risks

Automating income verification helps lenders to reduce manual tasks and speed up loan approval processes. Easily identify risky behaviors such as unstable or irregular income related to a loan application.

You can process applications faster, based on more income data, and decrease risks and default rates.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits