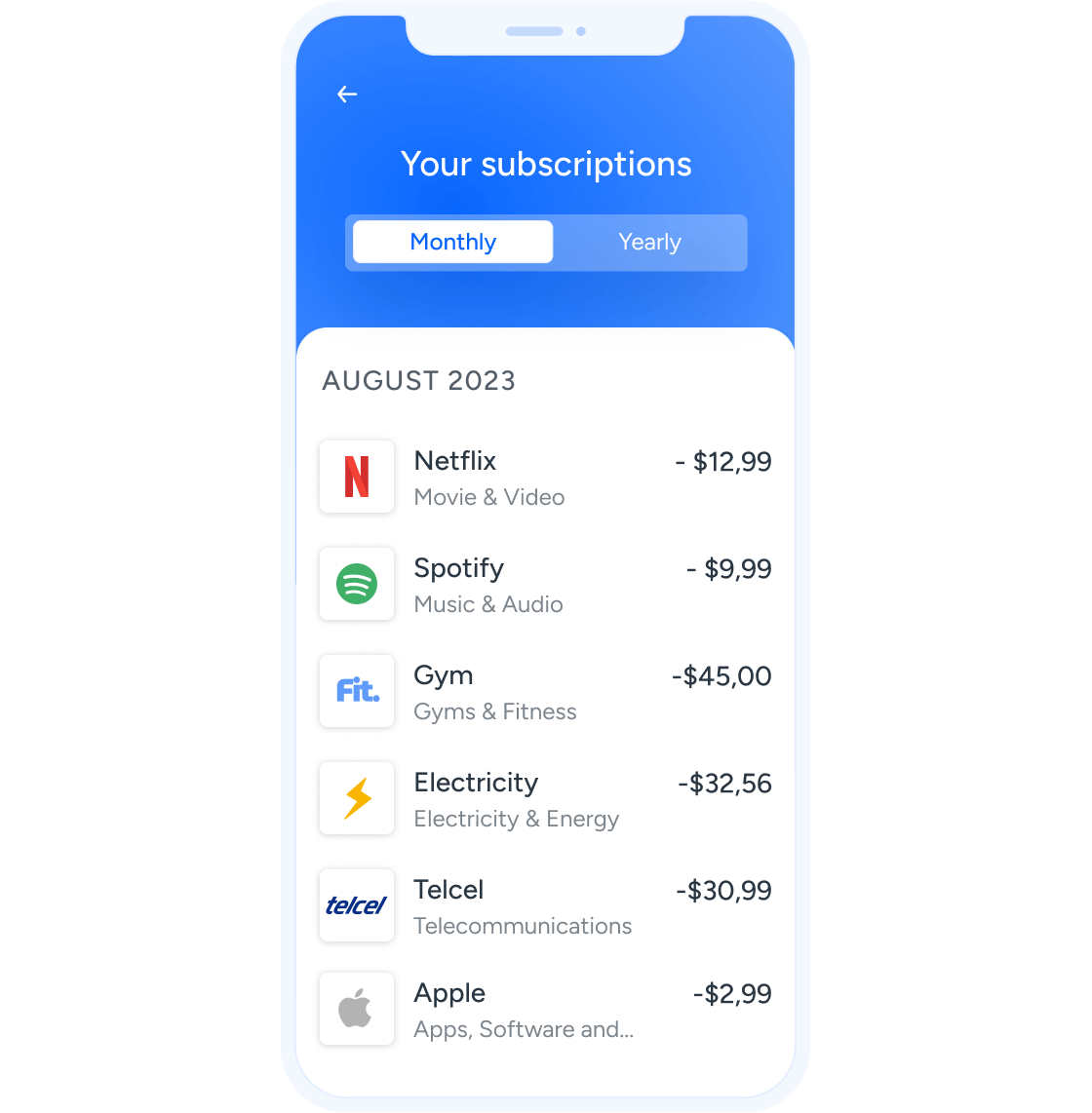

Recurring expenses

Identify users’ regular payments and spending patterns

Obtain an instant snapshot of your users’ recurrent spending behavior, encompassing subscription services such as Netflix or Spotify, as well as other periodic payments like utility bills, loans, or rent transfers. Easily understand their loan repayment risk and offer them advice on how to improve their financial health.

Trusted by the leading financial innovators

Automatically identify recurrent expenses

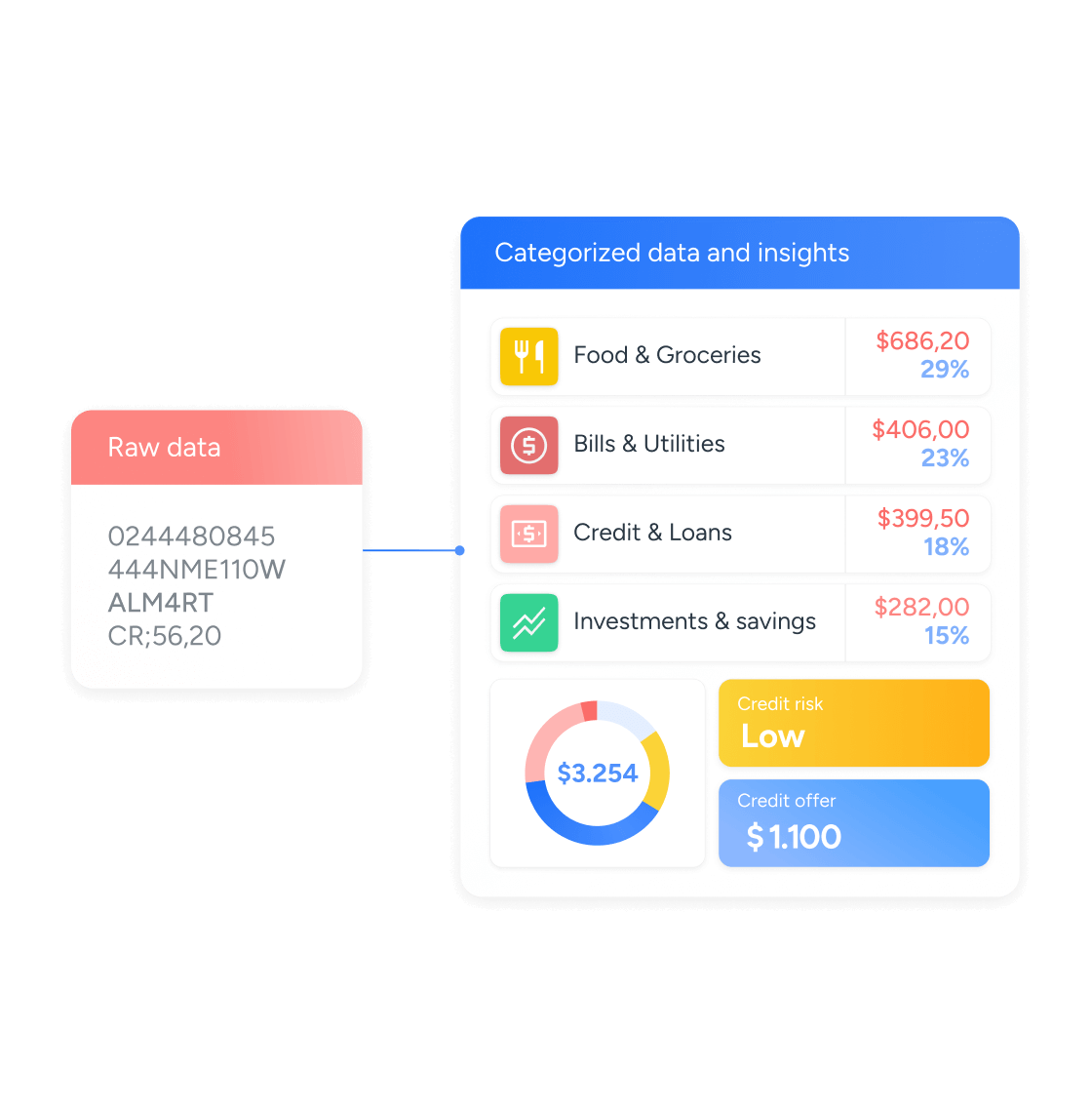

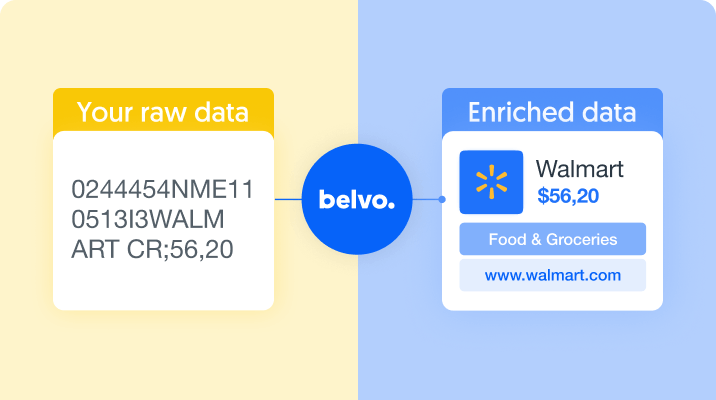

Access enriched financial data

Access real-time data and identify recurring expenses to improve how your customers manage their finances.

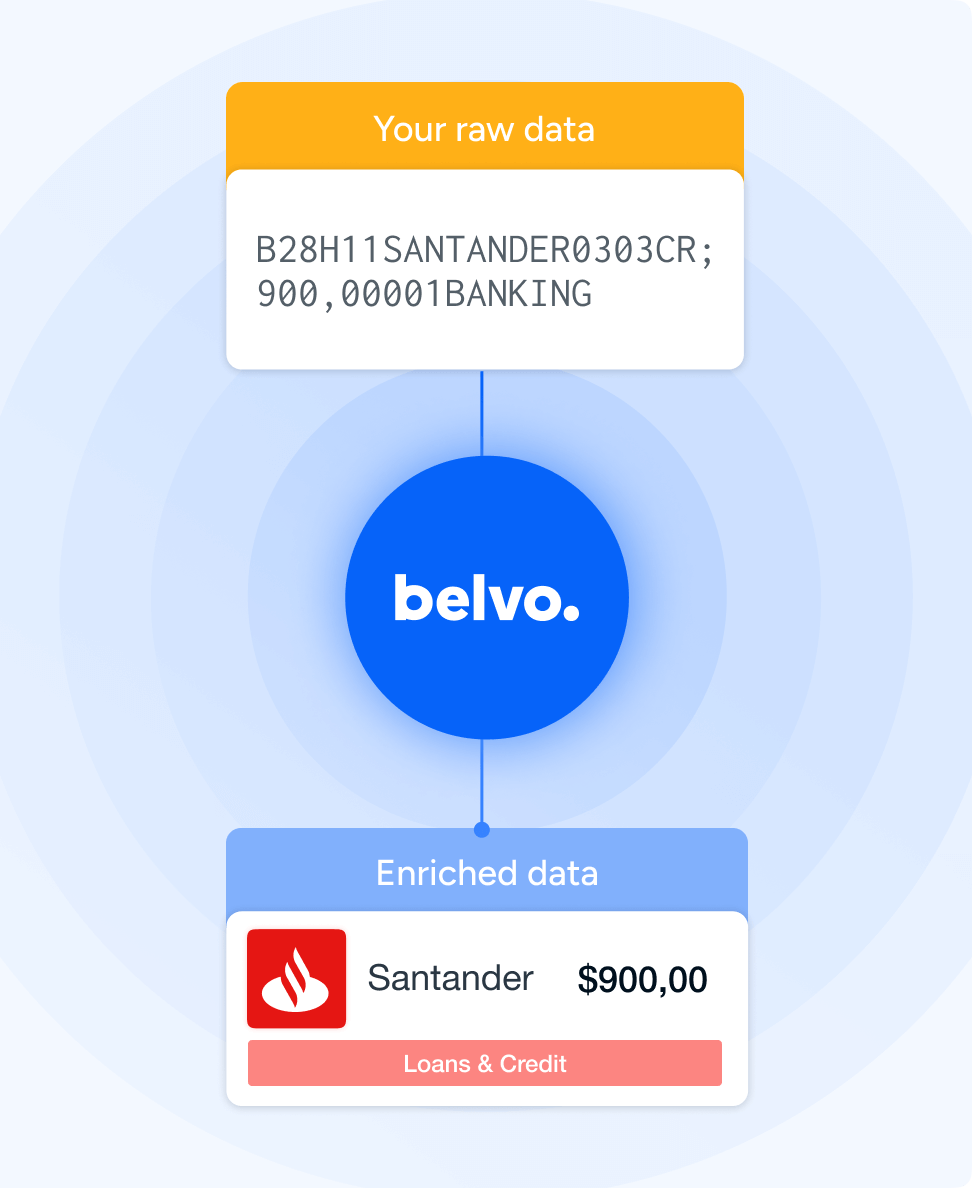

Enrich your own data

Our product is compatible with transaction data from any source. Whether you have an existing data set or you access open finance data, we properly identify recurring expenses.

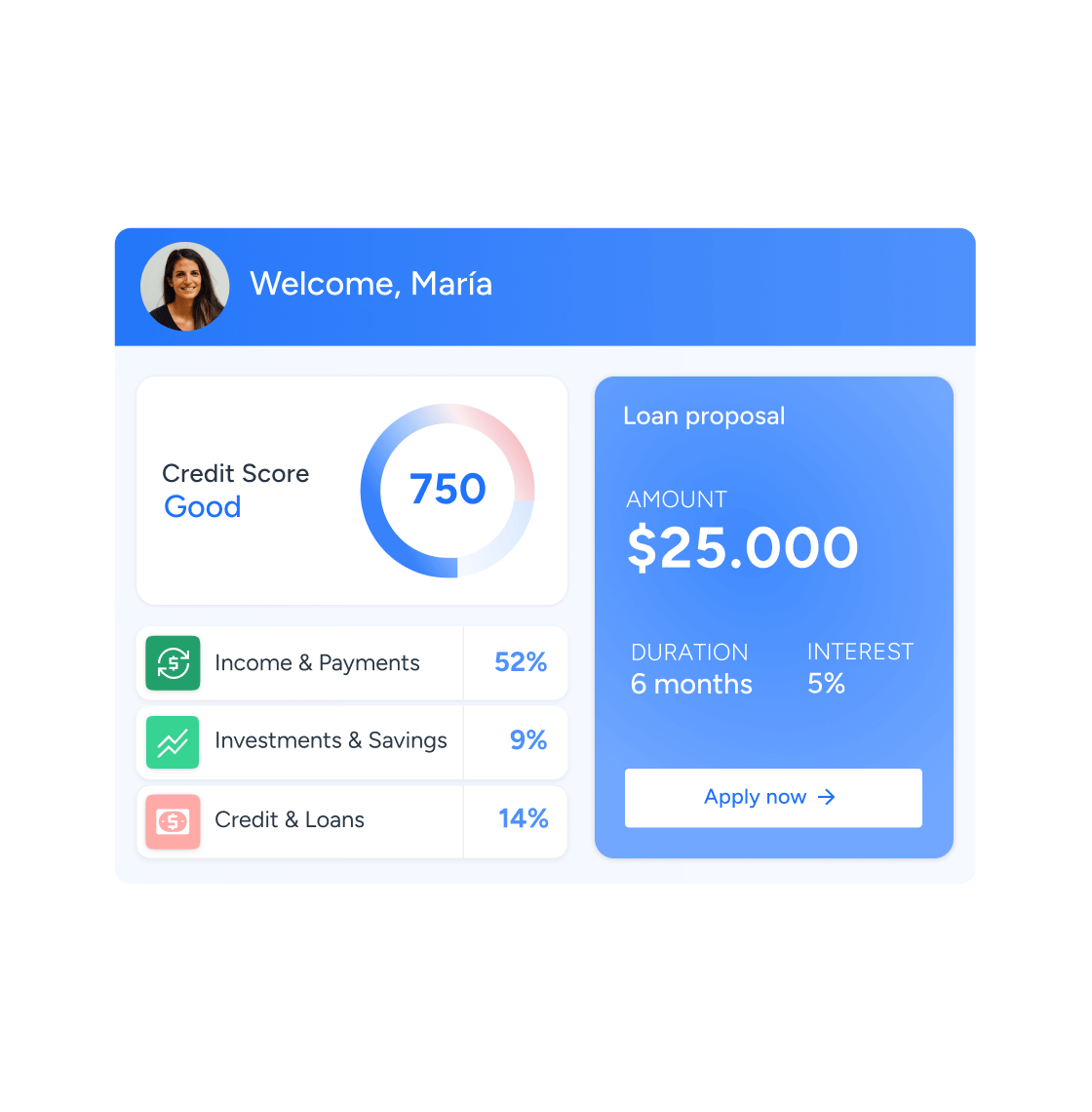

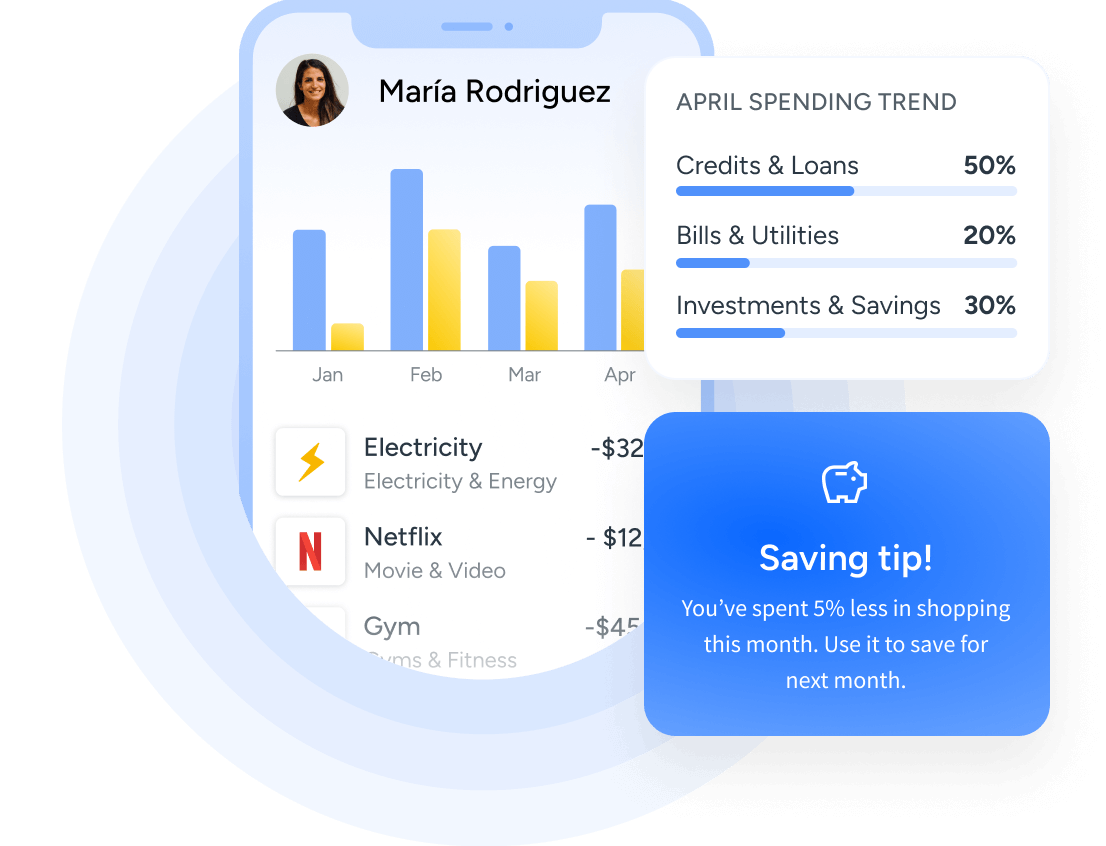

Identify savings opportunities

Understand the expenses that your customer is already committed to and identify how to reduce them to boost savings as well as optimize their financial health.

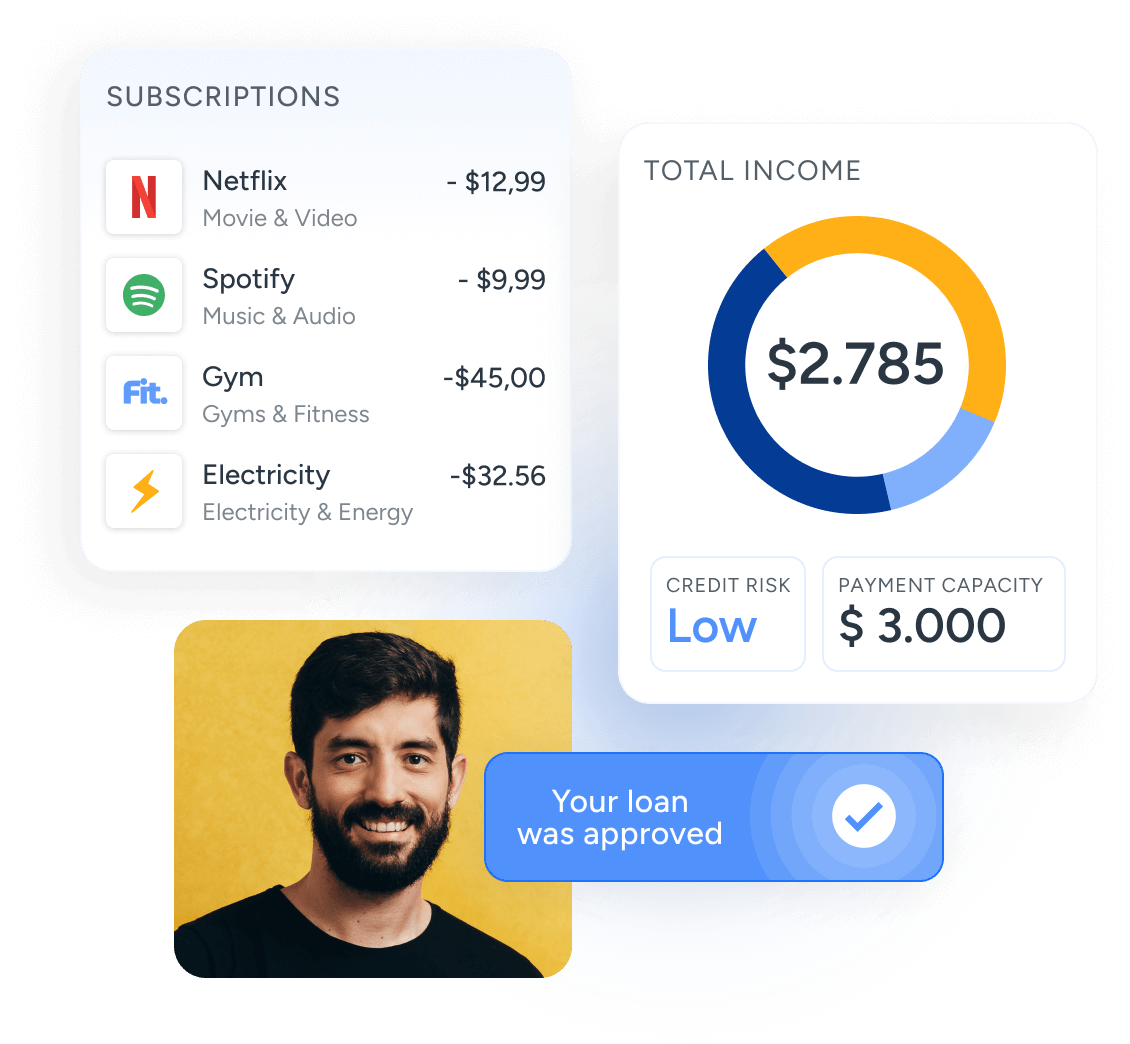

Reduce credit risk

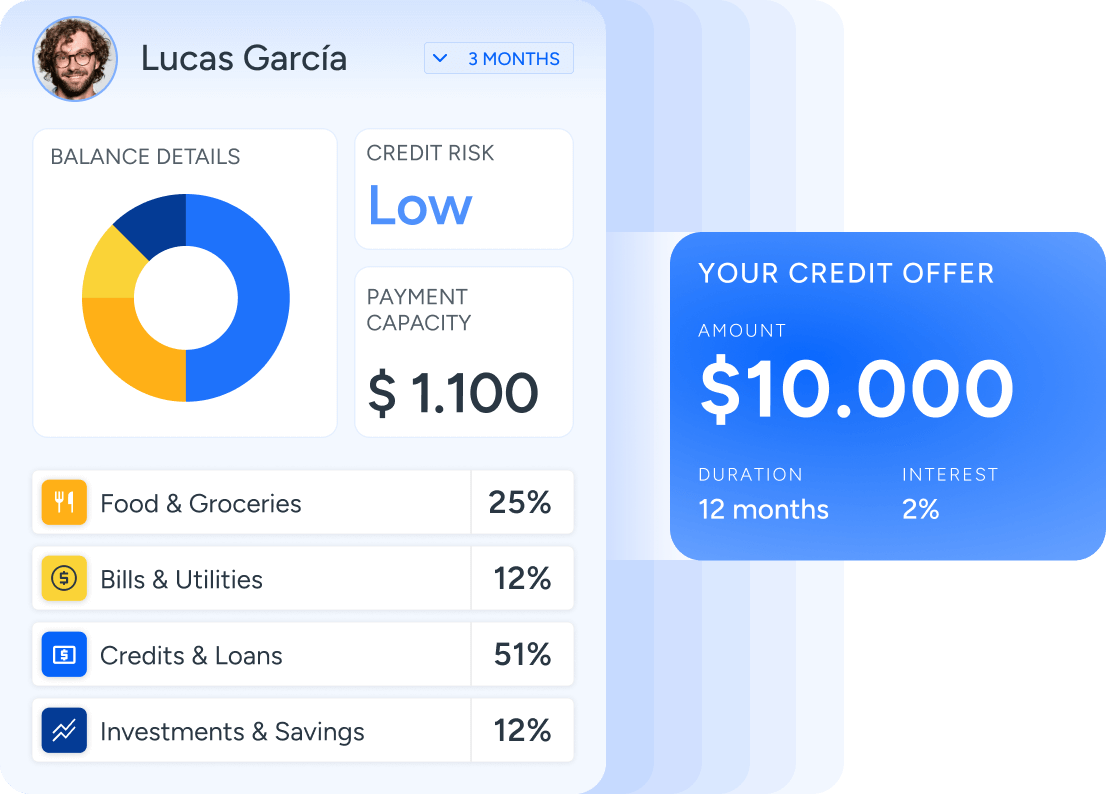

Analyze spending patterns to foresee your customers’ ability to pay and offer tailored-made credit solutions with low risk.

Get a real picture of your client’s recurring expenses

Drive more insightful credit decisions

Identify what percentage of your customers’ expenses are recurring payments to better understand their financial profile, offer them personalized credit options, and reduce risk.

Understand your users’ spending patterns

Understand your users’ recurring spending patterns on platforms, subscriptions, and utility payments. Obtain data on regular or installment payments such as rent and mortgage and provide personalized financial advice to your users.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits