Risk insights

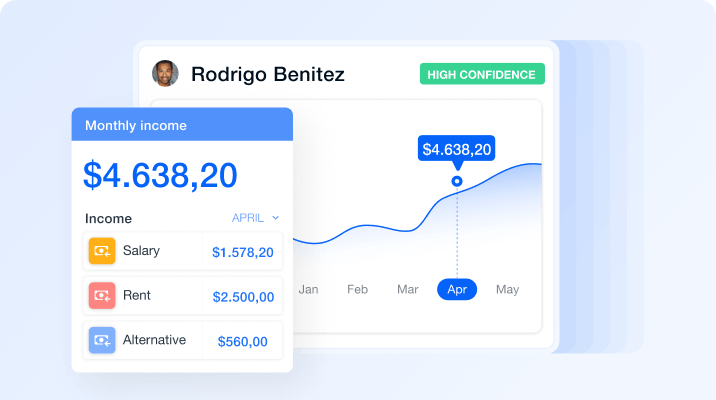

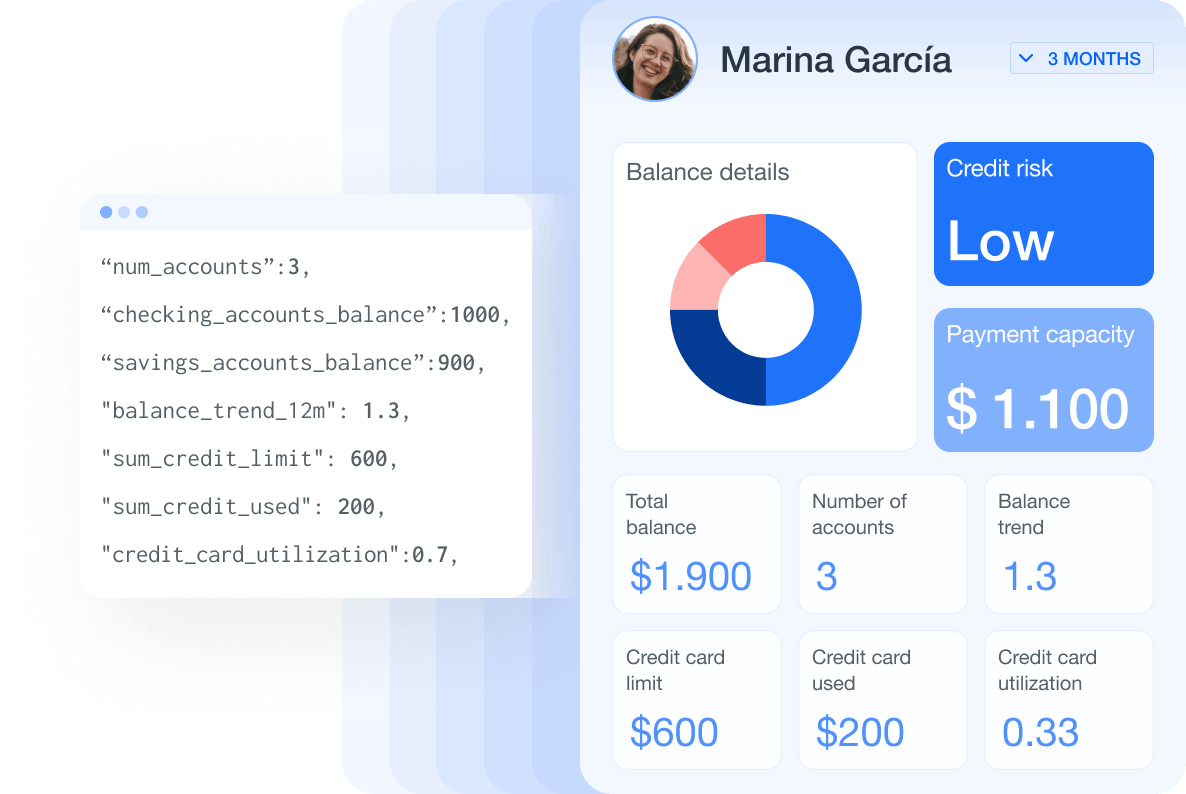

Boost the predictive power of your risk models

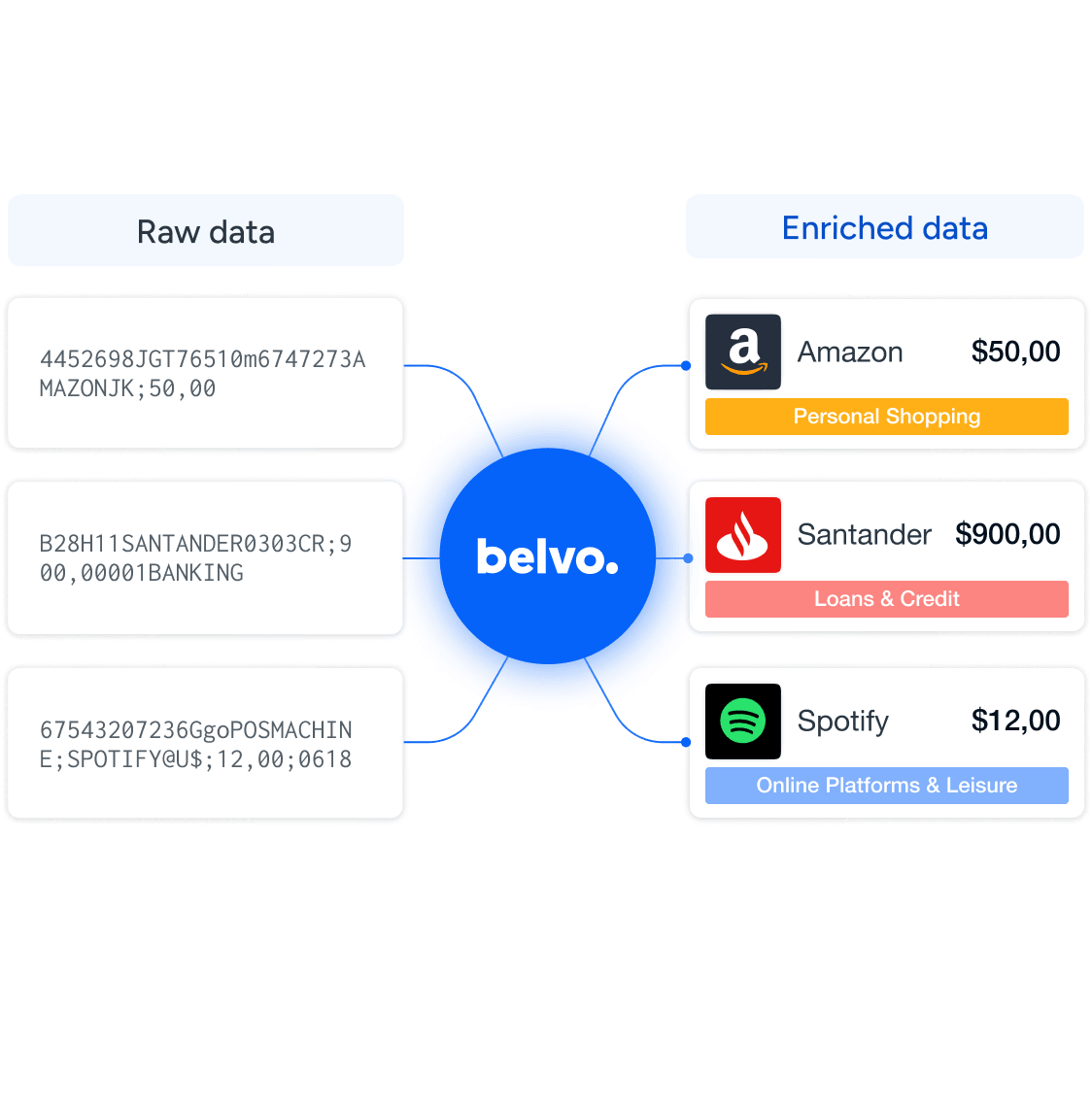

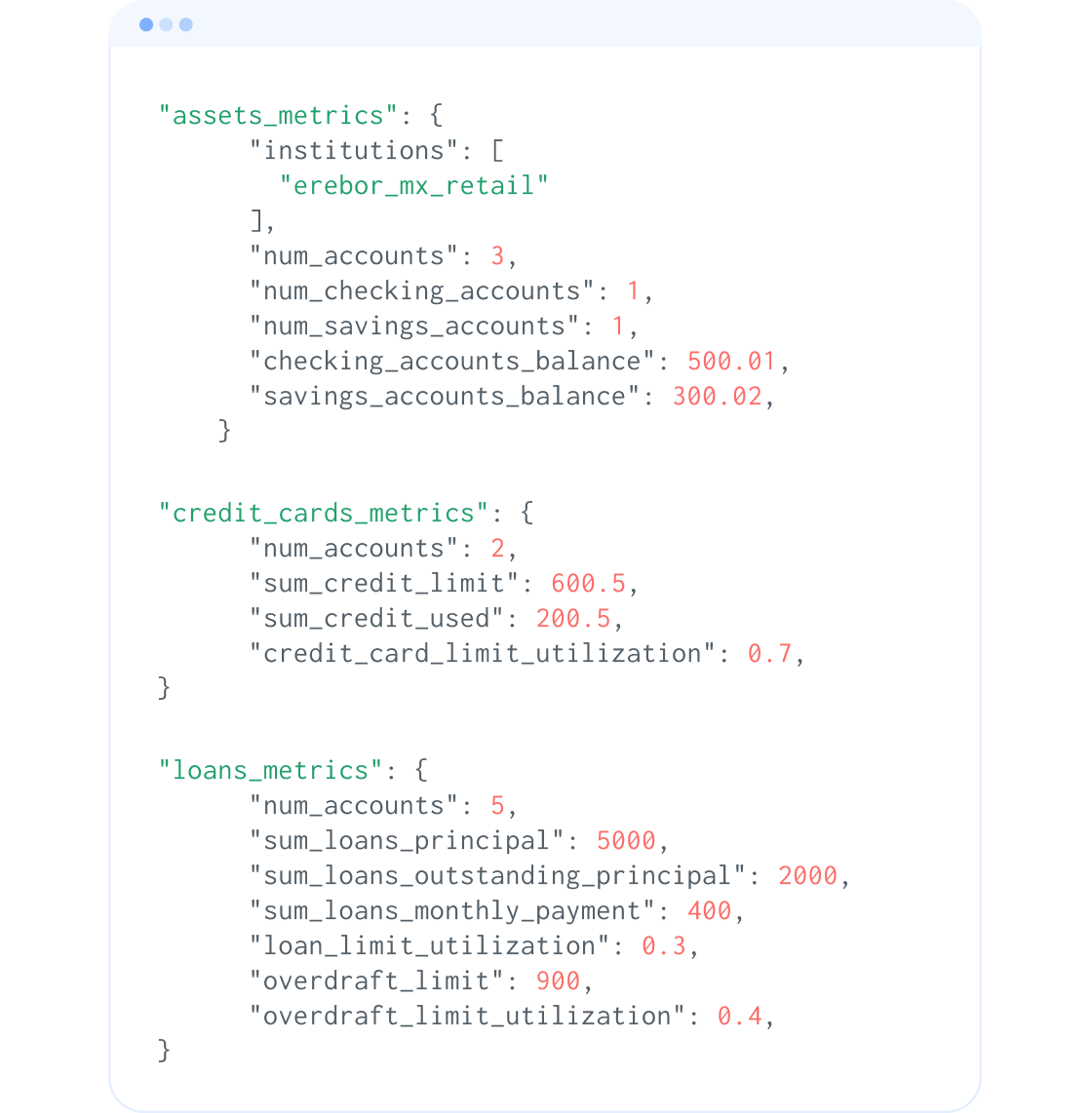

Automatically extract metrics from customer-categorized transactional data, accounts and balance evolution to predict debt capacity and tailor credit offers in real-time. Unlock powerful insights with our open finance feature engineering.

Trusted by the leading financial innovators

Built by lenders, for lenders

Leverage our expertise in financial data

We specialize in handling complex and diverse financial data. Our experience enables us to understand the nuances of different financial instruments, institutions, market dynamics, and relevant data sources.

Real-time data processing

Instead of relying on batch processes to post-processed all your open finance data, access features that can be used instantly, and significantly reduce the time it takes to approve a new product to your clients.

Continuous updates and improvements

We keep our feature engineering pipelines up to date with the latest industry best practices and improvements. Benefit from these updates without investing additional resources.

Focus on your core business, save time

Outsource feature engineering to save development costs and speed up your time-to-market. Leverage our pre-built features, ready to integrate into your models.

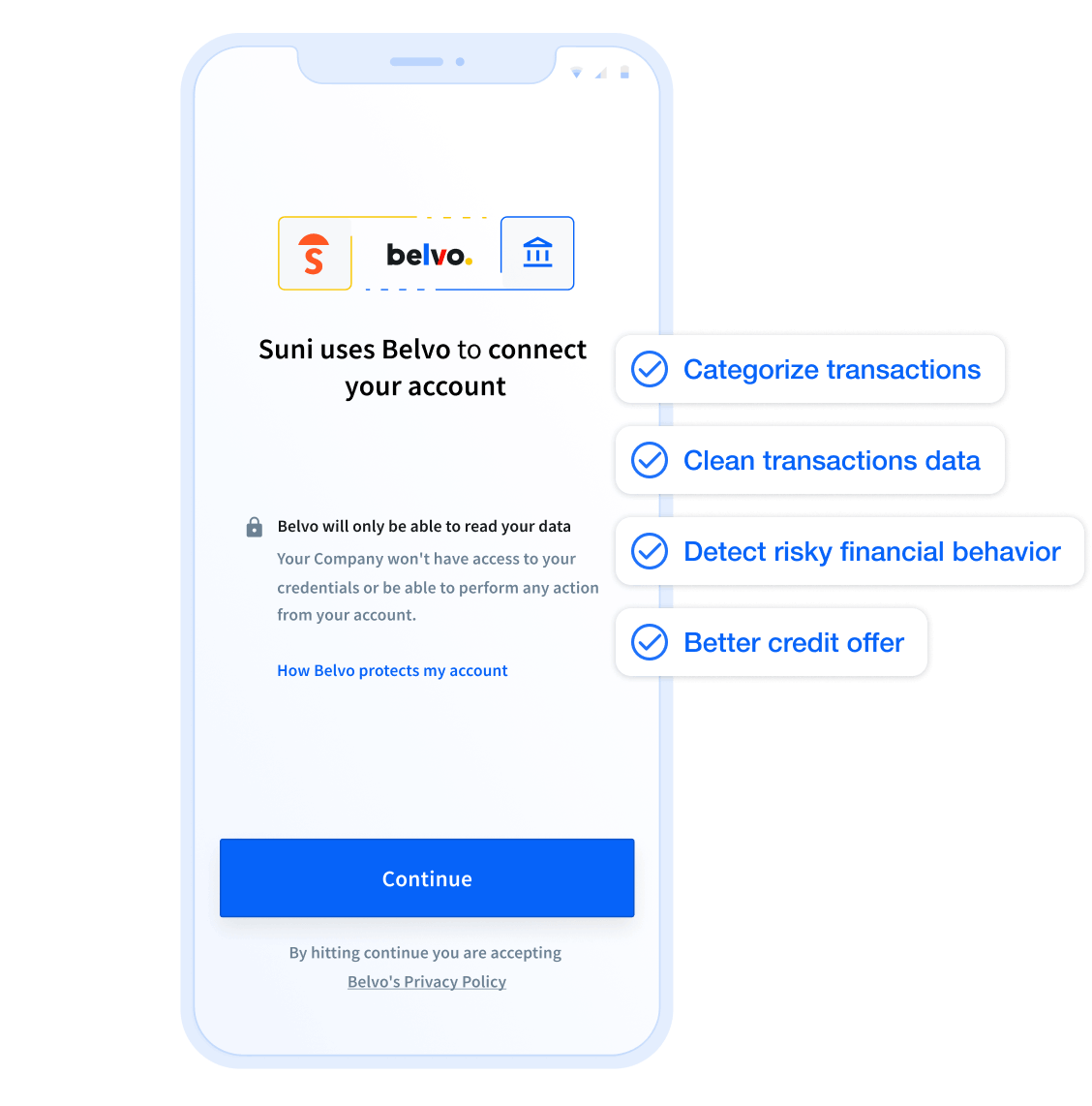

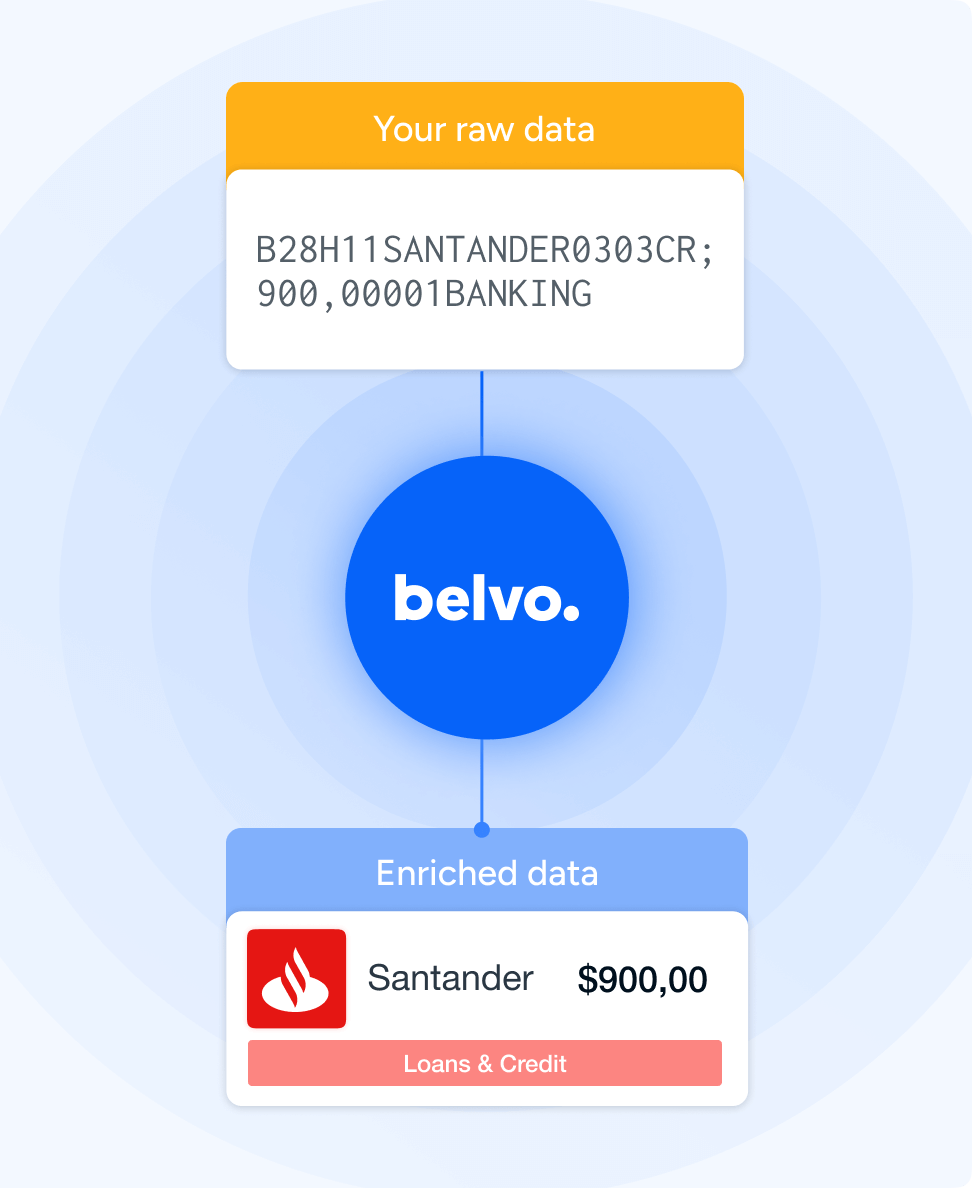

Enhance risk models with open finance data

from end users’ accounts

Better assess creditworthiness

Complement existing data sources with predictive open finance indicators (income behavior, category spending patterns like gambling or travel…) to understand your customers’ risk profile.

Leverage advanced metrics on end users’ assets, credit cards, loans, balance evolution, cash flow and category-specific transactional data into your credit scoring and reduce risks.

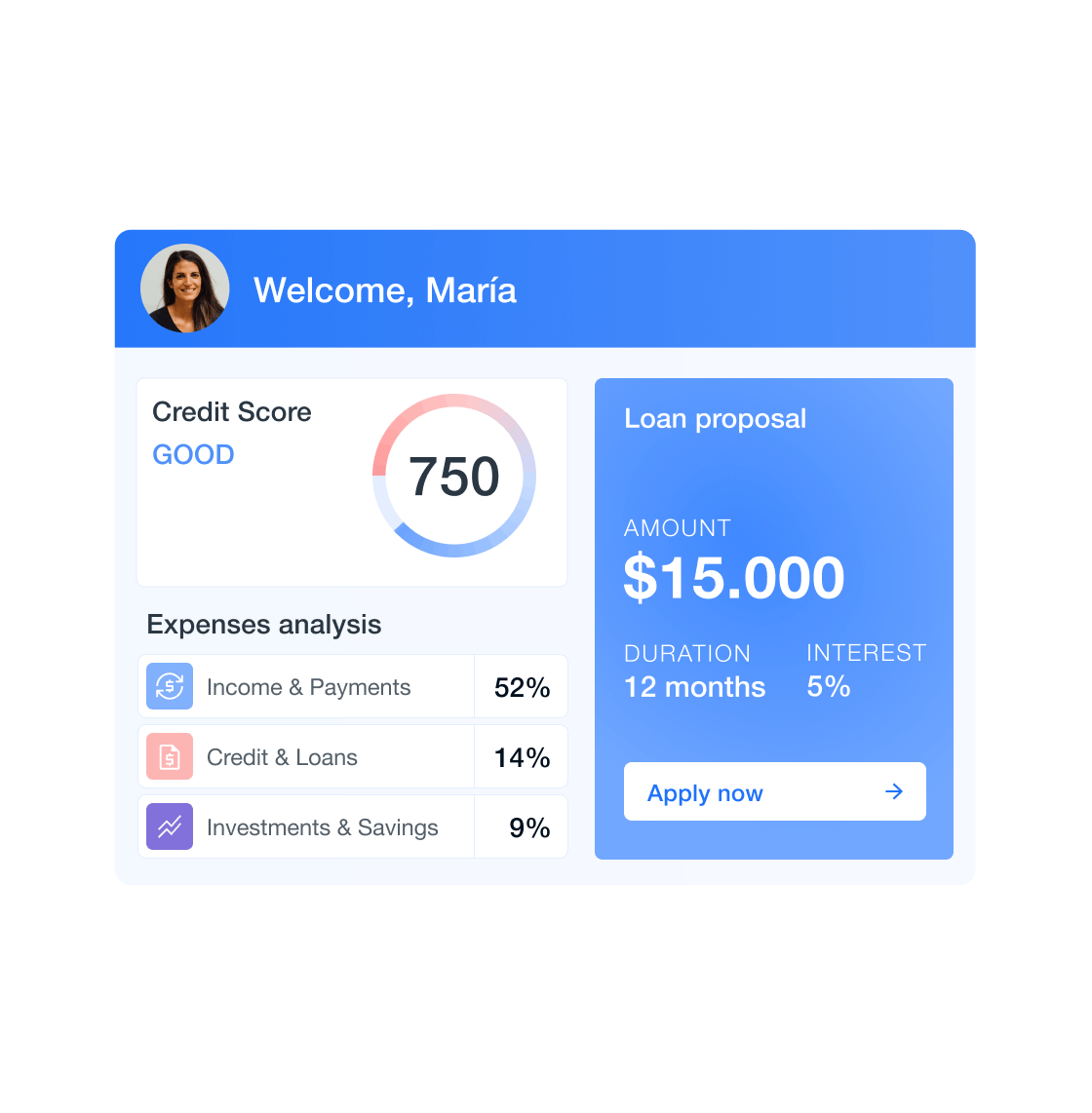

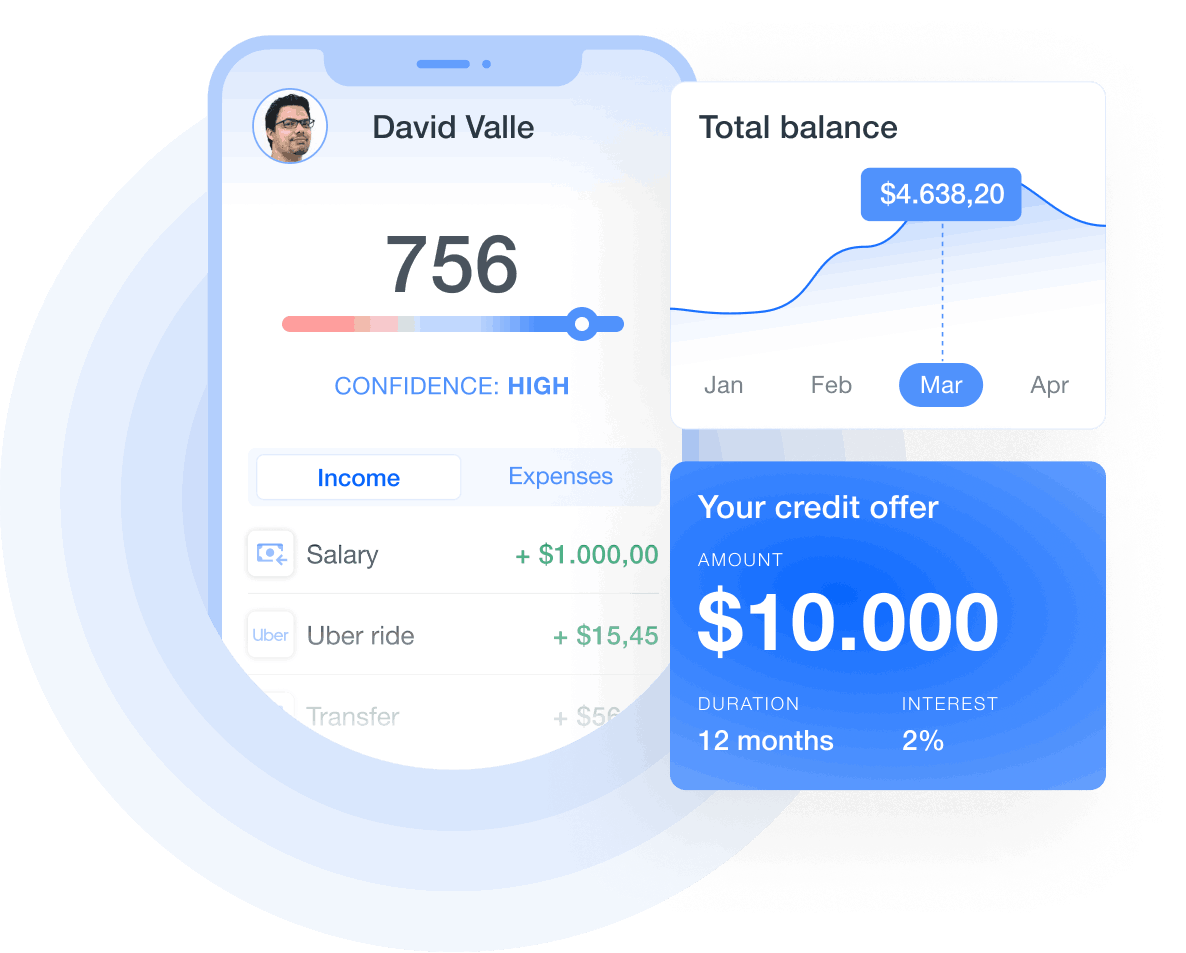

Personalized credits products

With real-time processed data, properly assess your customers’ debt burden, creditworthiness and ability to take on additional credits to better understand their credit needs and loan repayment capacity.

By offering credit conditions adapted to your users’ financial situation, you improve your approval rates without impacting the default rate.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits