Assess users’ income from multiple sources and select applicants that match your credit conditions thanks to the new income metrics and filters. Improve and speed-up underwriting processes and increase your approval rates.

For lending businesses, profitability can be improved by increasing approval rates or reducing default rates. In Latin America, high default rates (reaching 30% in Brazil in 2022) and a lack of traditional credit history make this challenging (60% of the Mexican population has an informal job). But a more accurate income evaluation can help achieve this.

Lenders can overcome these challenges by accessing other sources of financial data to integrate into their models to better understand their applicants’ income beyond traditional sources such as credit bureaus data. The latest version of our income verification product offers enhanced features for lenders to improve their income verification capabilities.

What’s new

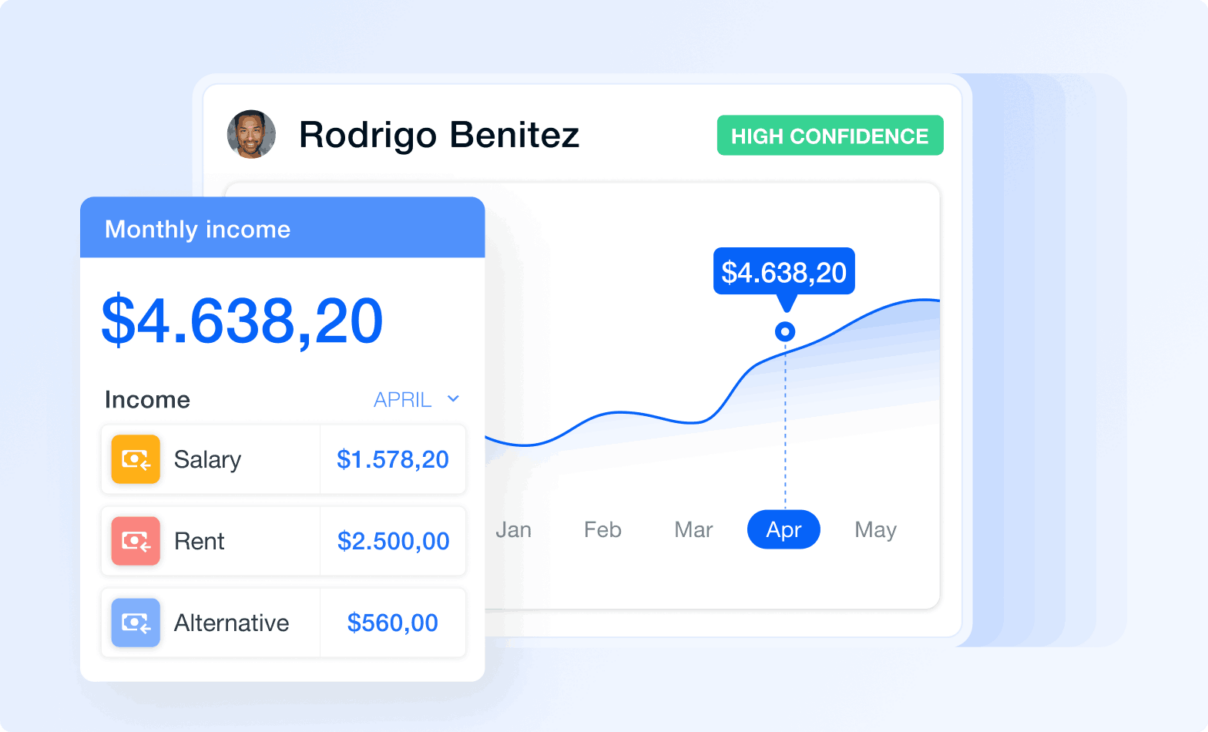

Our product is now more accurate and allows you to assess income from multiple sources (e.g. salary, rent, interests or pension). We also increased the number of income metrics we provide to give you a 360° understanding of the different income streams and overall financial health of your credit applicants.

1. More granular income categories: We’ve expanded our income categories to provide even greater accuracy in assessing your customers’ type of income. Our product now offers 10 income categories – ensuring that underwriting decisions are based on the most comprehensive information possible – and covering types of income that go beyond salary.

2. Concise and clear insights: It now goes beyond basic income metrics to offer even more in-depth and insightful data. This includes things such as regularity, stability, trend and confidence scores, which provide a more complete picture of the nature of users’ earnings as well as their evolution over time.

3. Lending tailored income verification filters: We understand that every business has unique income verification needs, which is why we now offer a range of customizable filters. They allow transactions to be grouped and filtered by category or accuracy to extract only the income streams that are relevant to your lending business.

4. Enrich your own data: Finally, our updated product accepts transaction and income data from any source, allowing users to enrich existing income data from their users and gain deeper insights into their customers’ financial situation.

With these new features, we’re better equipped than ever to help businesses make smarter lending decisions based on the most complete and accurate income data available.

How does it work?

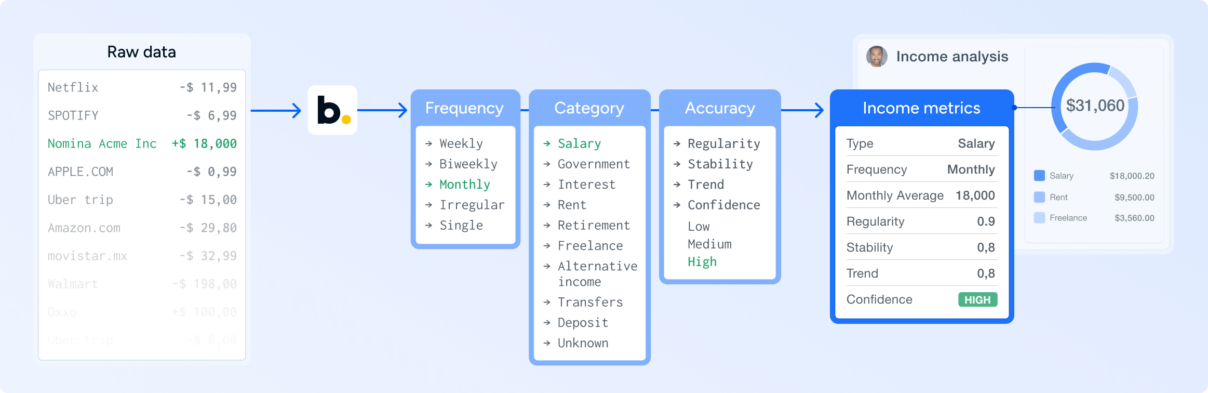

Let’s look step by step into how the new income verification process provides multiple rich insights based on a sample of a salary transaction.

First, thanks to machine learning algorithms, we can efficiently group incoming transactions based on patterns such as recurrence, description, amount, and account type, allowing us to accurately identify and extract the transactions that represent income streams. This not only saves time and effort but also improves the overall accuracy of our financial analysis.

From the example above, these are the metrics you can get:

- Description: “Nomina”

- Type: Salary

- Amount: 18,000

- Recurrence: Monthly

- Account type: Checking account

Next, each income stream is classified into one of 10 categories, such as salary, government, interest, deposit, or other. Then, we conduct accuracy calculations taking into account variables such as regularity, stability, trend and confidence scores. These assessments allow for better evaluations of creditworthiness and repayment capacity:

- Stability and regularity: to reflect the consistency of your users’ income history.

- Trend: to identify the income trend during a period of time.

- Confidence score: to forecast the likelihood of your user receiving its future income.

Finally, some of these variables also act as filters, meaning that lenders can easily filter their applicants according to specific criteria to speed up approval processes. For instance, they can automatically filter their applicants based on the type of income and its regularity for a specific campaign, allowing them to get more accurate results.

As a result of the process, lenders can obtain increased approval rates, speed up their application processing times, provide quicker access to funds, and reduce their risk of fraud and incomplete applications.

You can already try the new version of our income verification product!