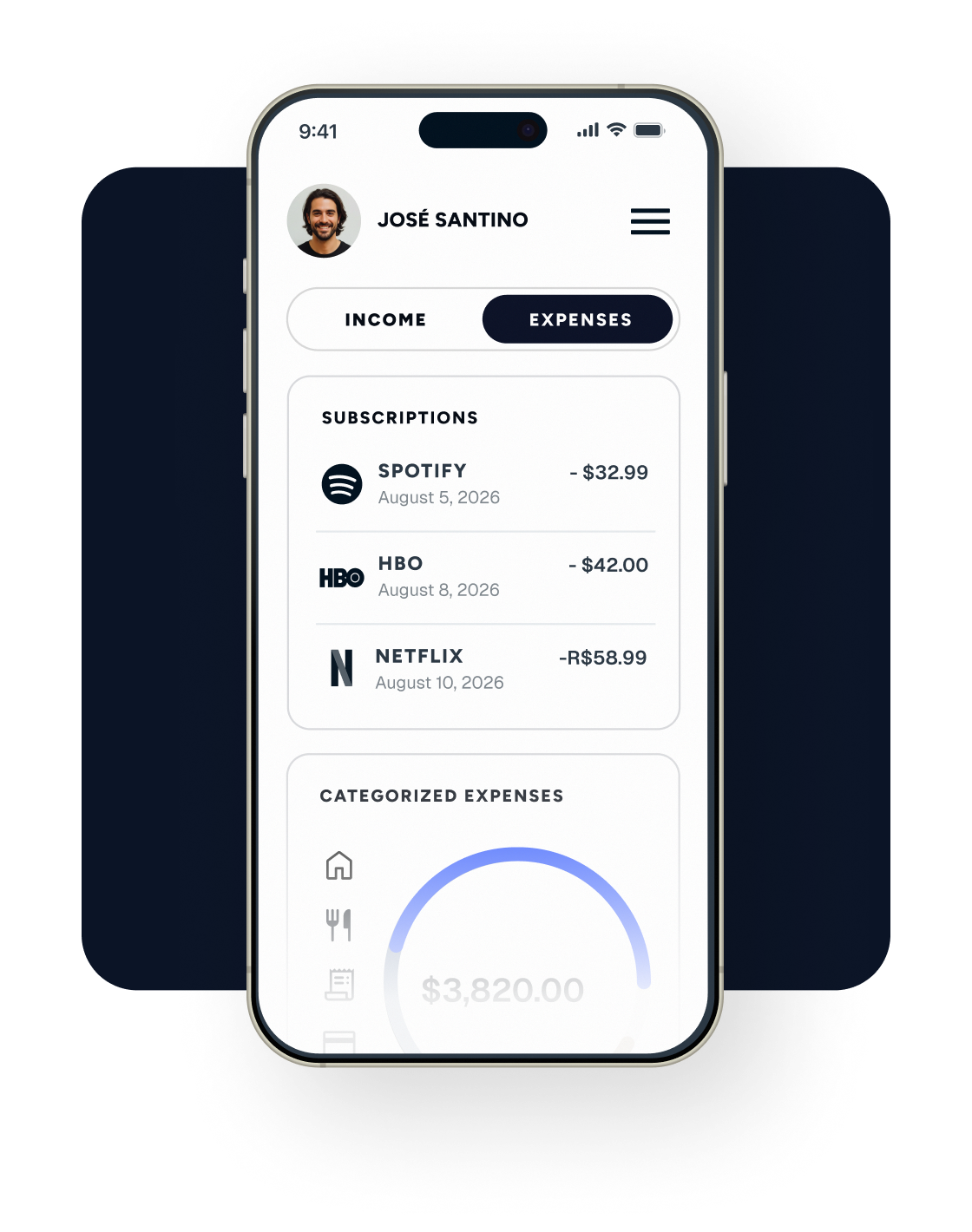

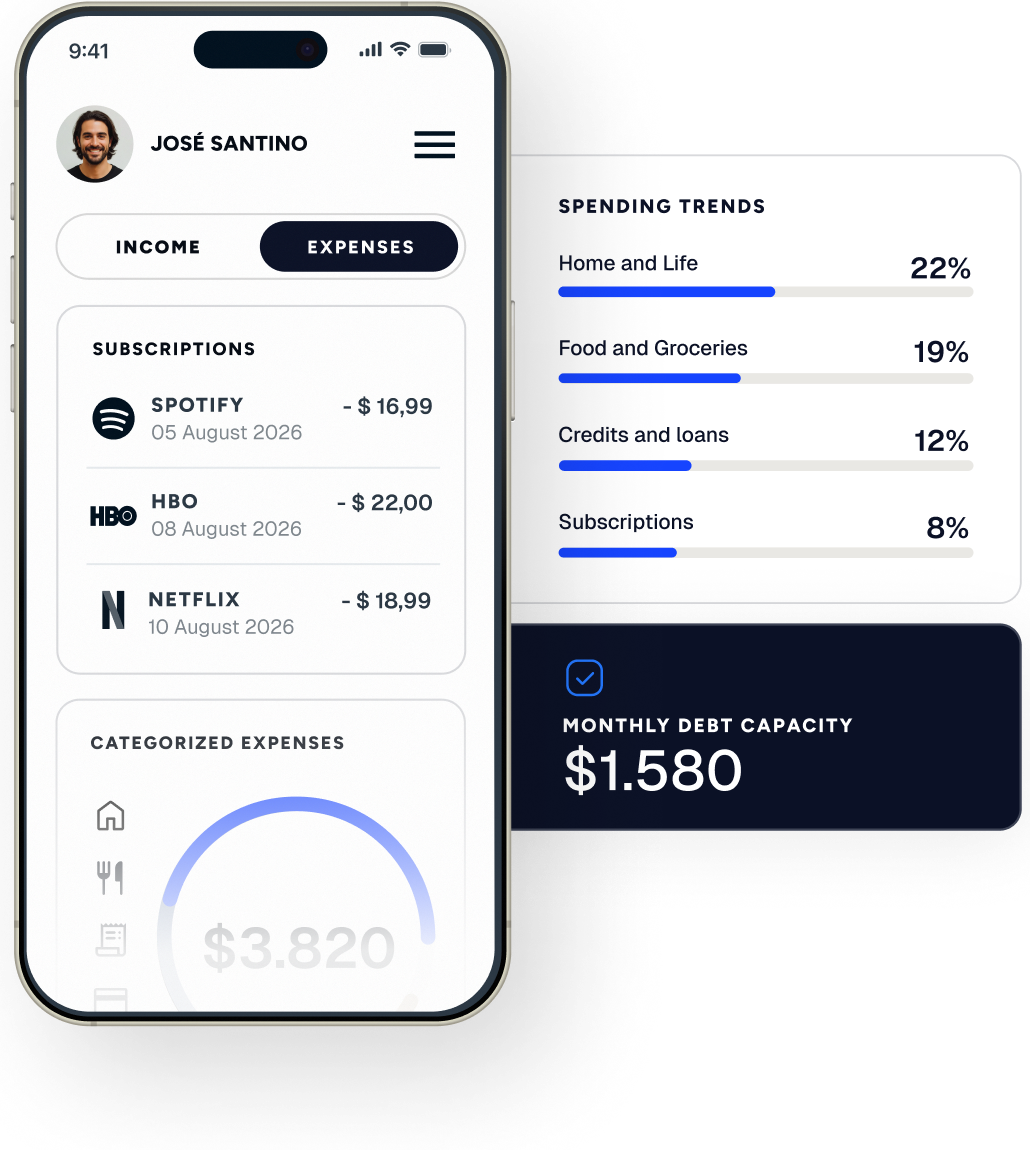

Recurring expenses

identify users’ payment habits

Get an instant overview of your users’ recurrent spending habits to assess risk and determine whether they have sufficient and stable cash flow to meet future debt services.

Trusted by the leading financial innovators

Automatically identify recurrent expenses

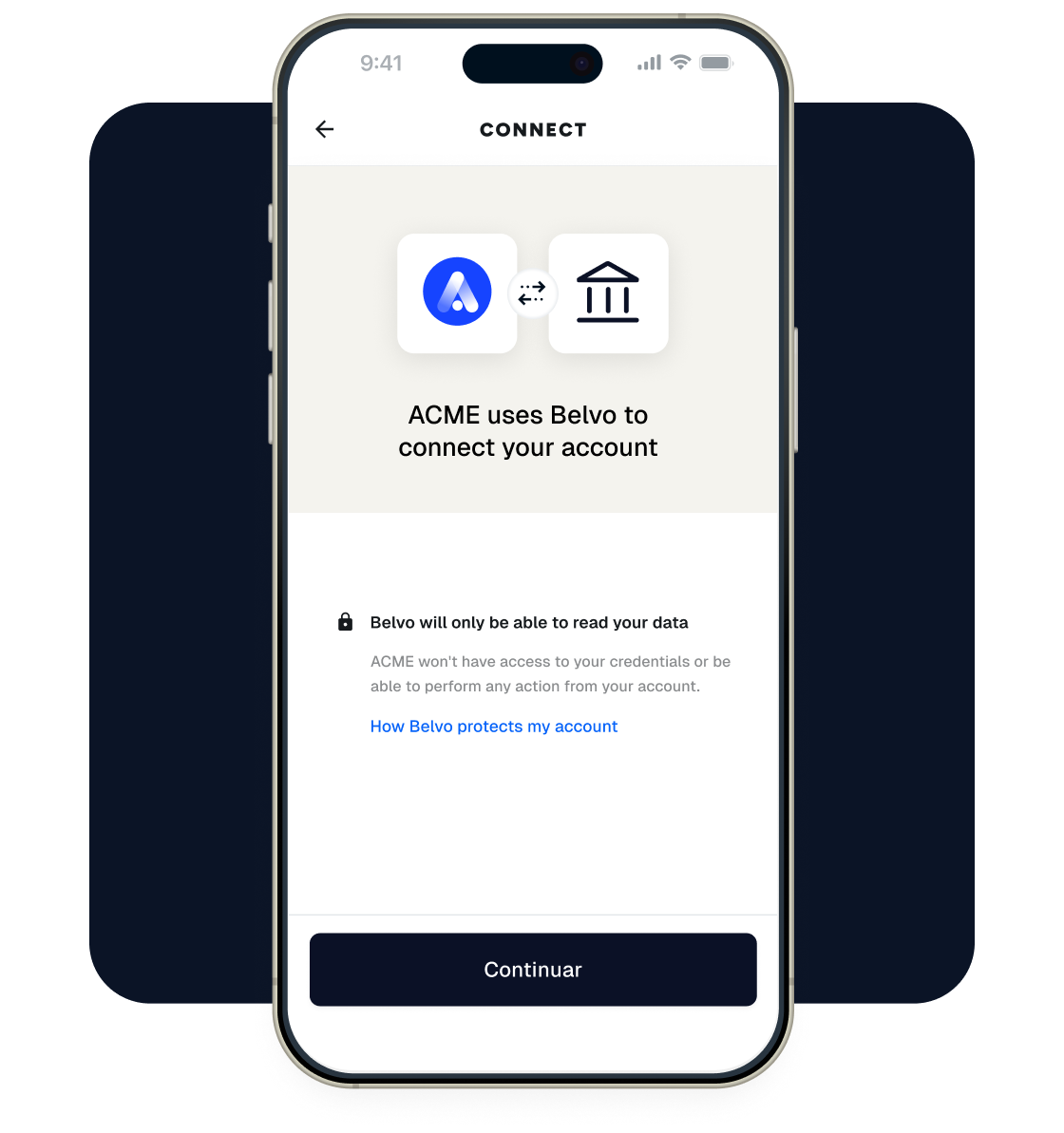

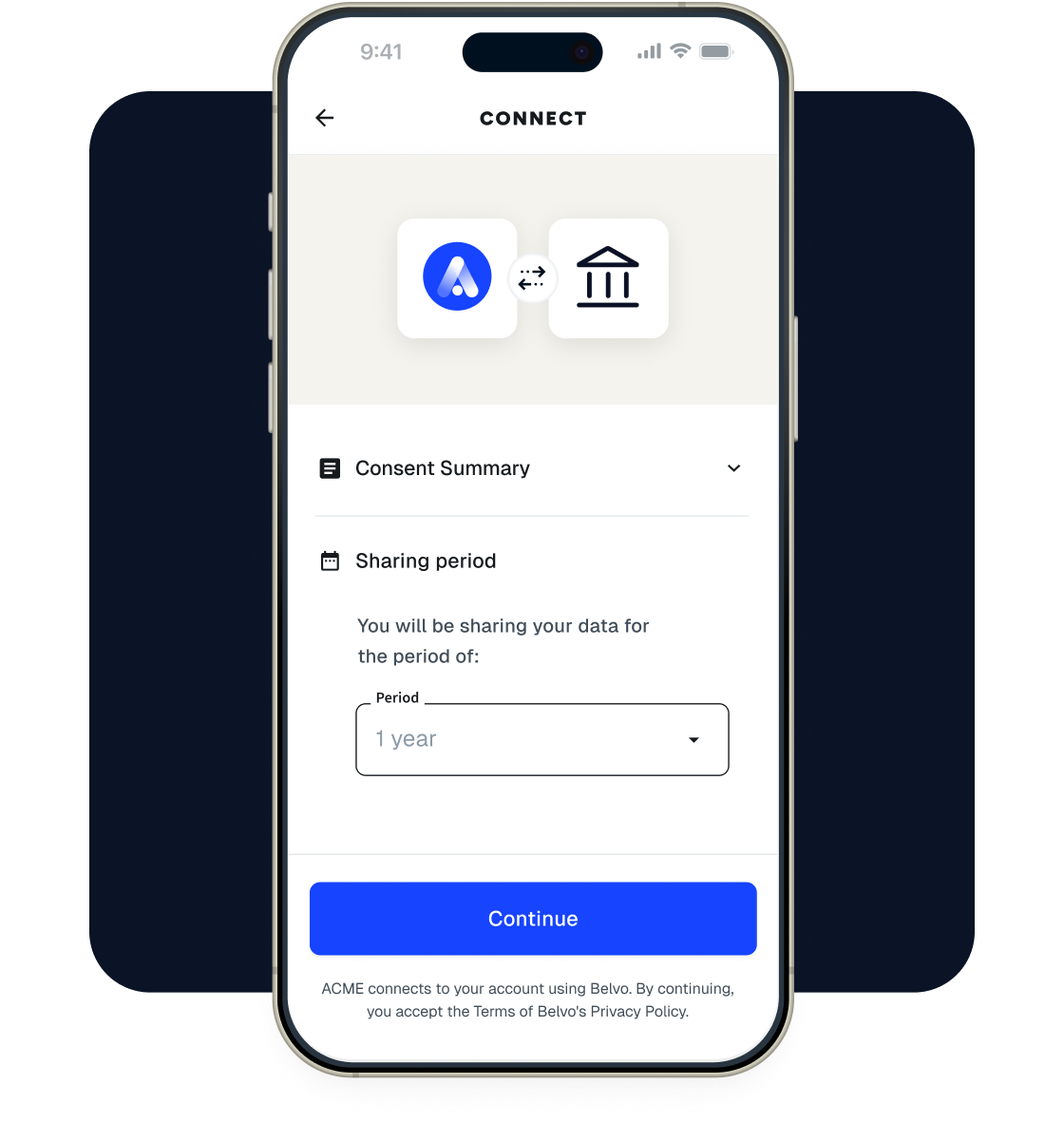

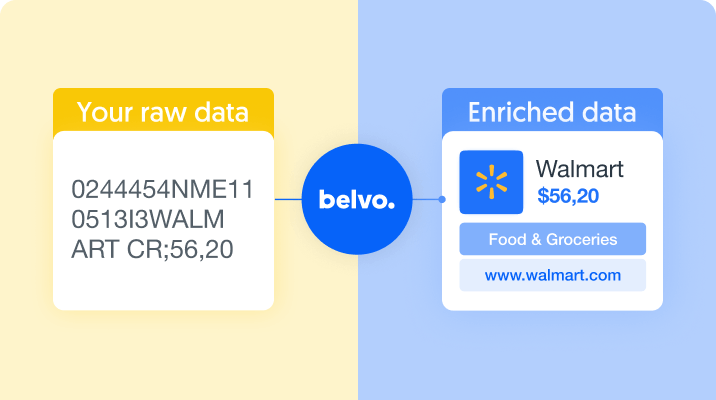

Access clean financial data

Access real-time data and identify recurring expenses to improve how your customers manage their finances.

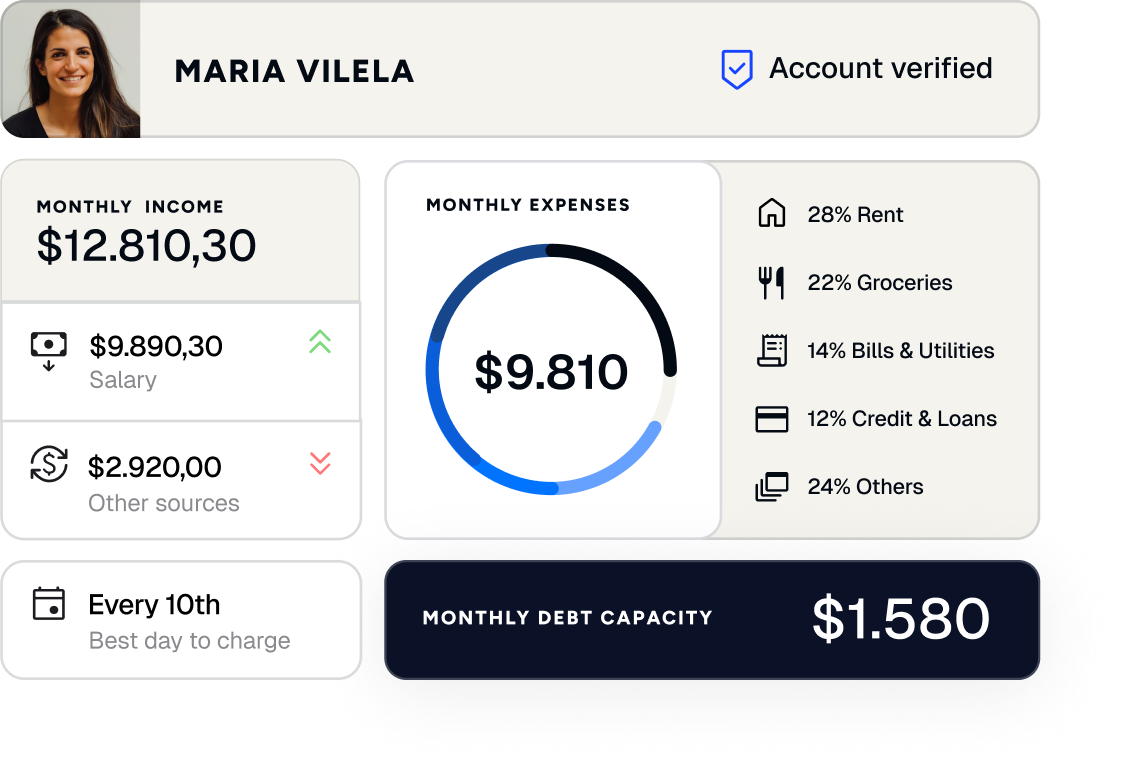

Reduce credit risk

Analyze spending patterns to foresee your customers’ ability to pay and offer tailored-made credit solutions with low risk.

MAKE SMART SUGGESTIONS

Understand the expenses that your customer is already committed to and identify how to reduce them to boost savings as well as optimize their financial health.

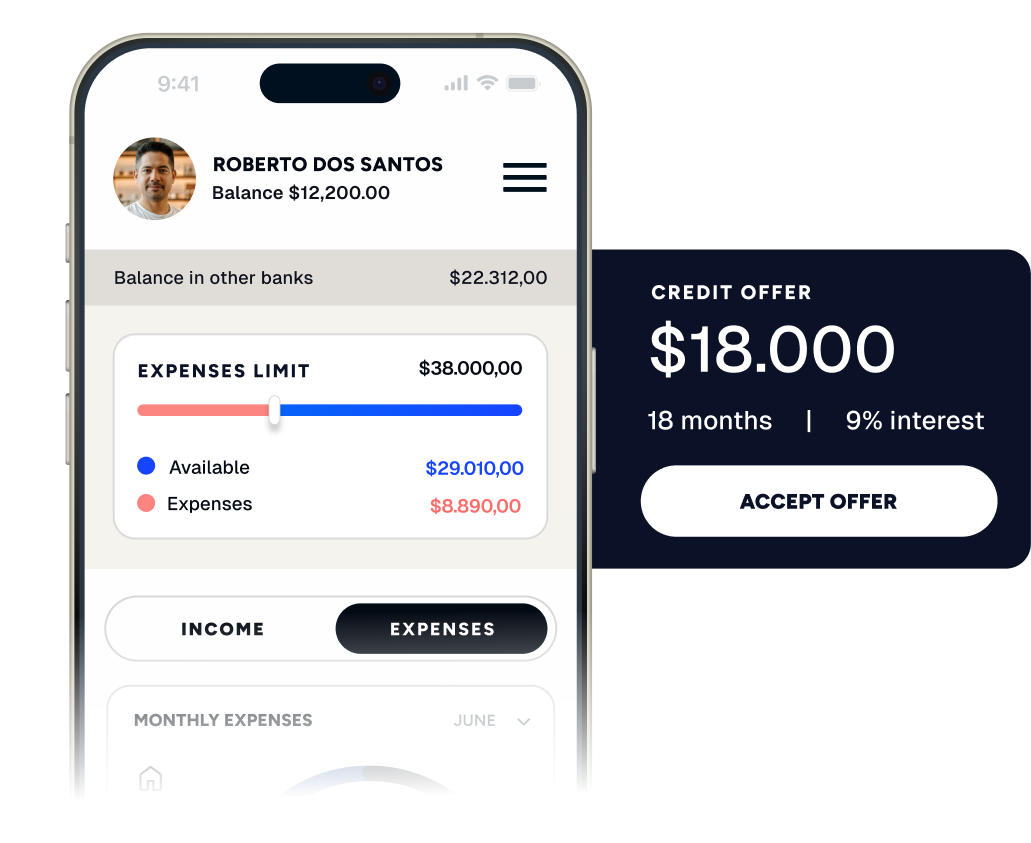

Get a clear picture of your user's FINANCIAL LIFE

prevent default and loan delinquency

Understand users’ recurring spending patterns, like digital subscriptions, utilities, rent or loans to assess the probability of payment default.

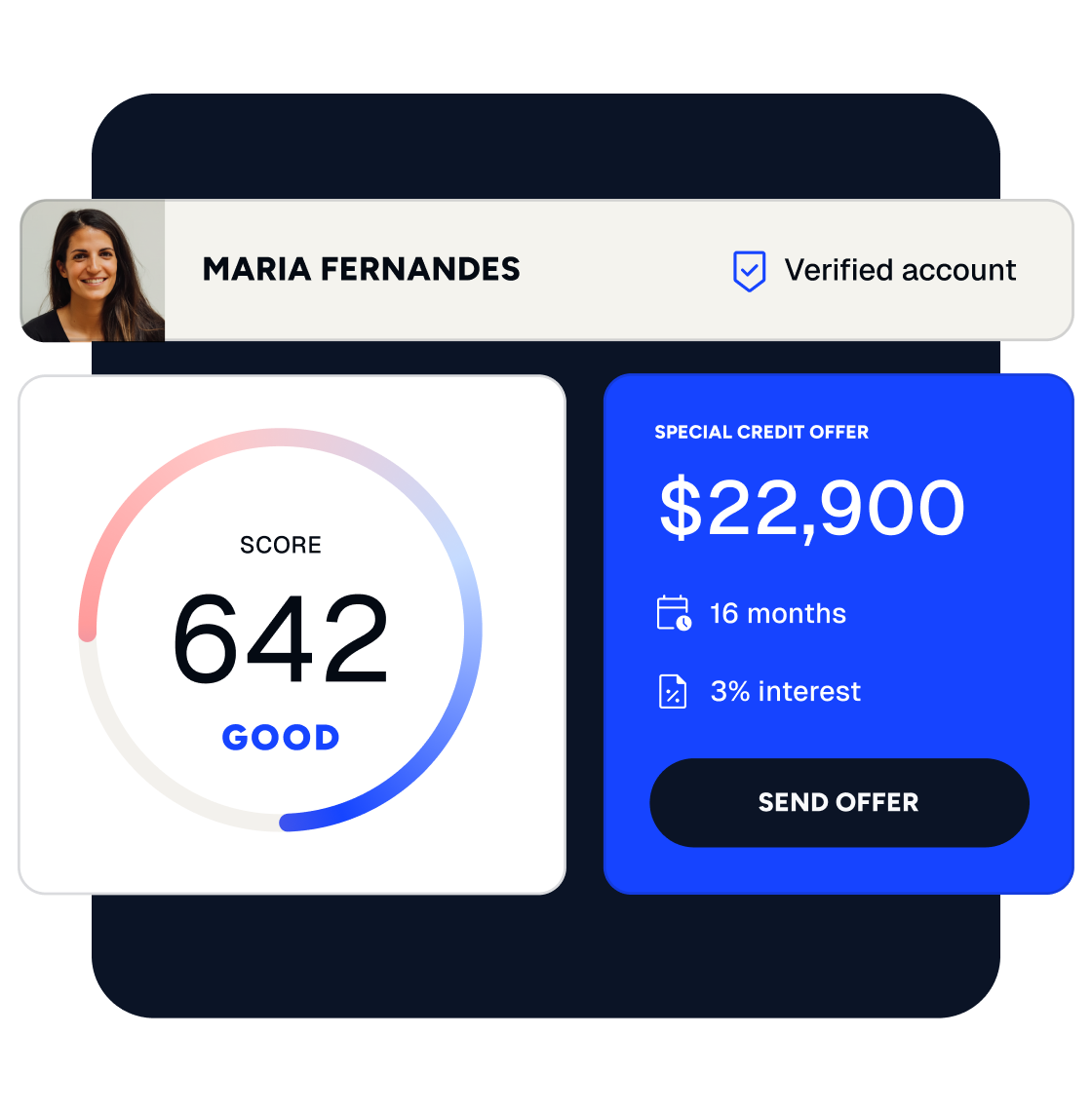

offer more credit while minimizing risk

Identify what percentage of your customers’ expenses take place on a recurring basis to offer credit offers aligned with their financial moment.