Employment score

All employment data, summarized in a single score

Improve your credit models with a score that reflects a customer’s employability and income-generating capacity in Mexico, based on their employment history.

Trusted by the leading financial innovators

More than just a credit score

Built for risk experts

Your perfect ally to make better credit decisions and enrich your own models with employment data..

Predict repayment capacity

Knowing whether your users will be able to repay is key to decision-making. Add employment data to your models to better understand their ability to pay.

Boost credit applications

By improving your risk assessments, you can confidently increase the number of approved applications.

Integrate via API or no-code

Easily integrate the employment score through our API or using our no-code solution.

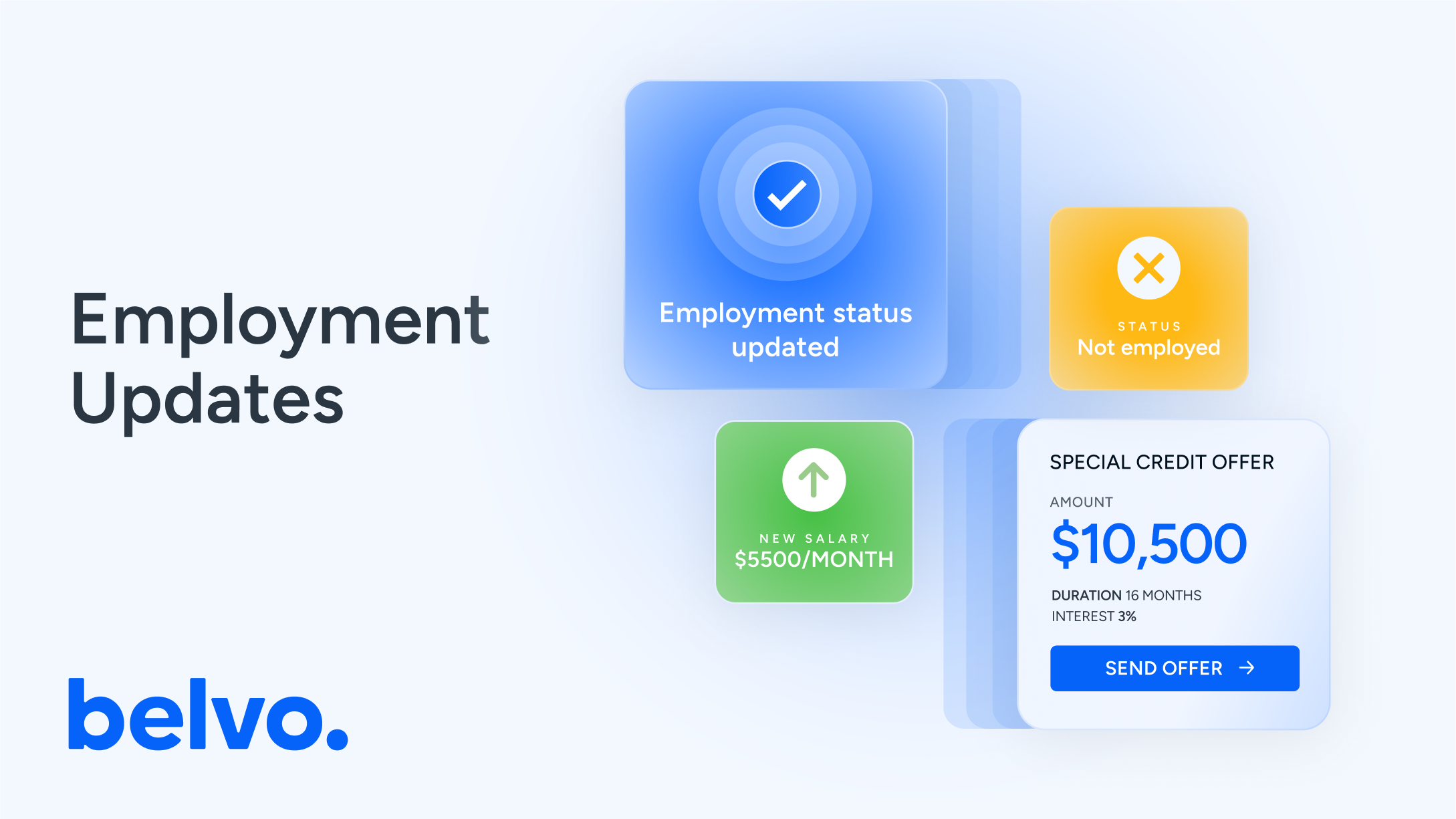

Employment updates

Predict a worker’s employment status and income

Designed for credit experts

The employment score predicts a candidate’s future employment condition and income, based on their employment history.

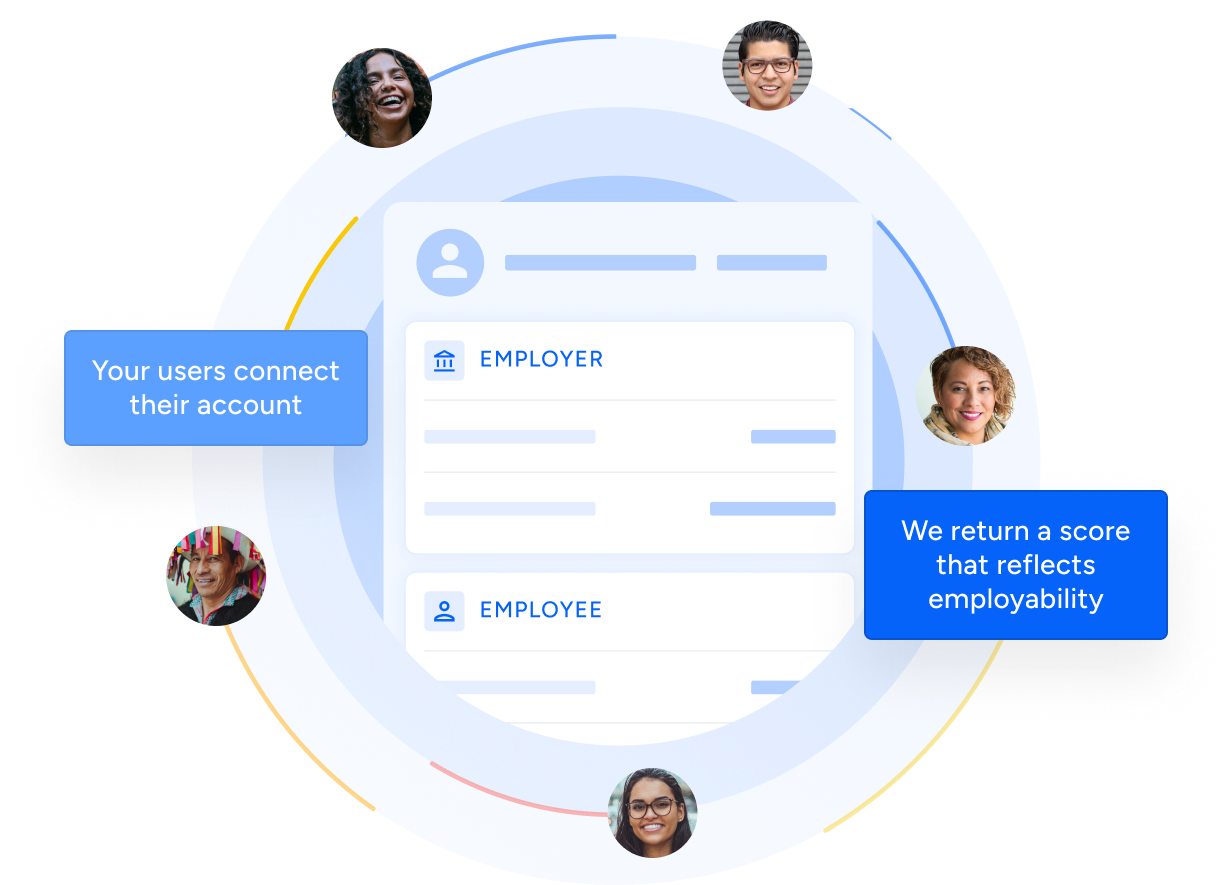

How it works

Our model returns a score between 300 and 900 for three time periods: 3, 6, and 12 months. The higher the score, the greater the person’s ability to maintain employment and generate income during the selected period.

Invite users to connect their account

Let your users know the benefits of connecting their employment data to your application.

Belvo’s model processes the data

The employment data is fed into Belvo’s model, which predicts the user’s future employment status and income.

Score output

The model returns a score—from 300 to 900—based on the user's employment history.

Smarter credit decisions

The score complements credit bureau data and internal models, helping lenders make more accurate and informed credit decisions.

Thanks to Belvo’s employment score, we can better predict the employment status and income of our applicants—and, therefore, their repayment capacity. We’ve implemented it as an additional input to our credit models, enabling us to improve originations using employment data provided through Belvo.

Viviana Gómez – Country Manager at Dineria

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits