Pix Automático

Variable recurring payments with Pix

Automate recurring payments for fixed or variable amounts and get paid on the exact due date. Provide a seamless payment experience with Automatic Pix, increasing customer retention and reducing fraud risks.

Trusted by the leading financial innovators

A simple way for direct debit payments with Pix.

More efficient, less bureaucracy.

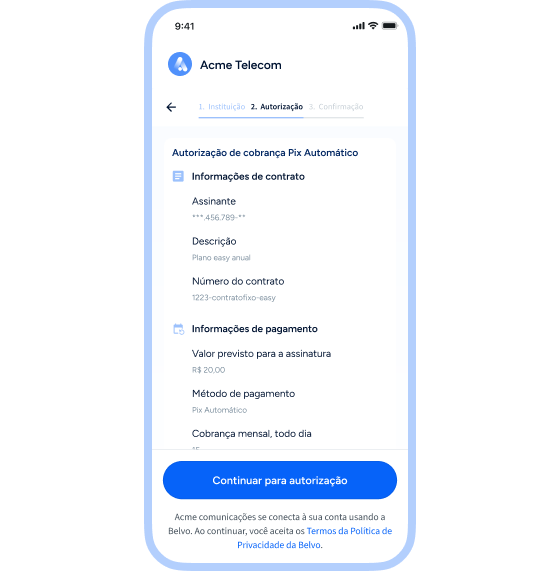

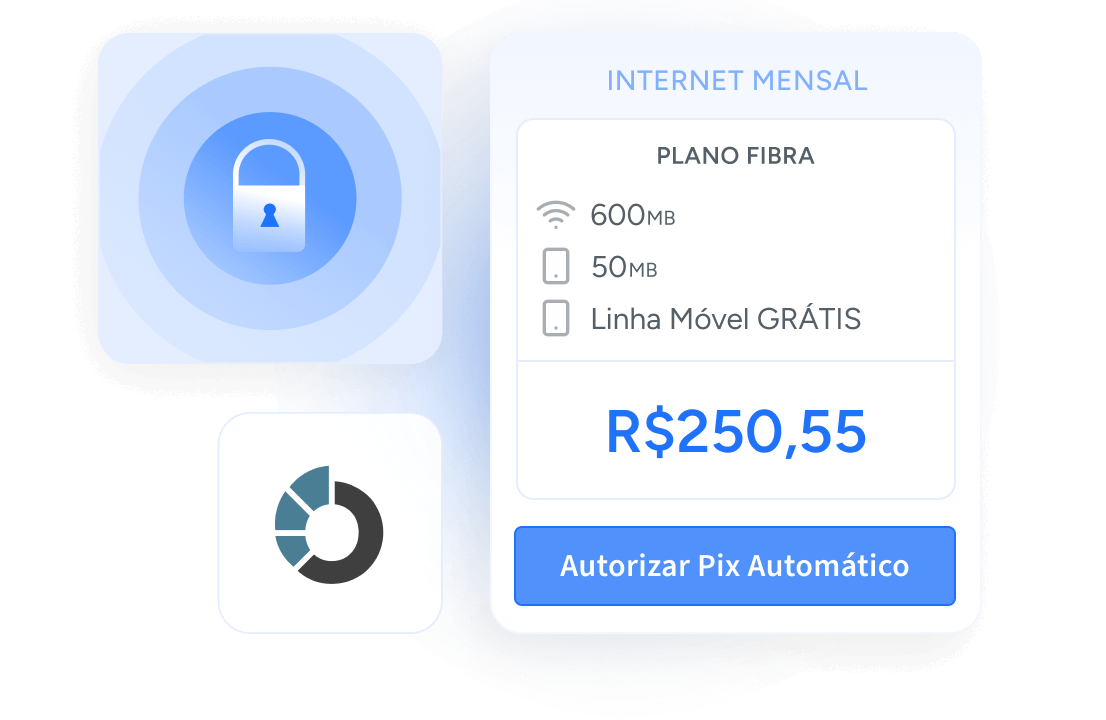

Flexibility for variable payments

Automate collections for varying amounts in each cycle, giving you the flexibility to manage subscriptions and dynamic pricing services.

Better conversion rates

Reduce payment failures with a payment method that doesn’t expire and ensures collection even if there are insufficient funds.

*Subject to overdraft availability.

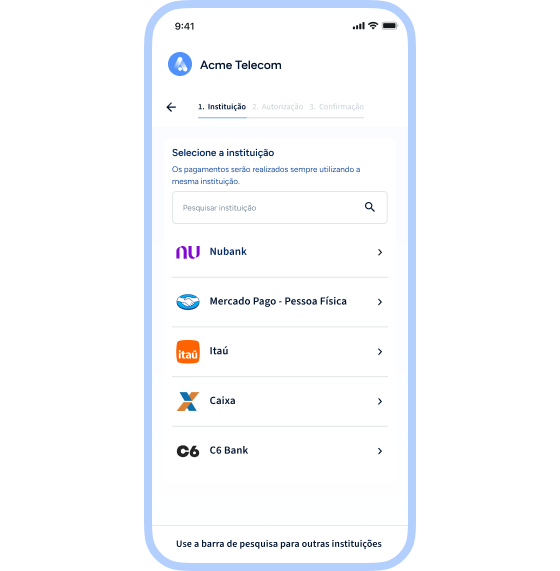

All banks, no agreements needed

With Pix Automático, any business can directly debit fixed or variable amounts from accounts in any Brazilian financial institution—no need for complex agreements.

Lower processing cost

Provide the convenience of traditional direct debit with minimal costs, while ensuring a flawless customer experience.

The easiest and safest way to receive recurring payments

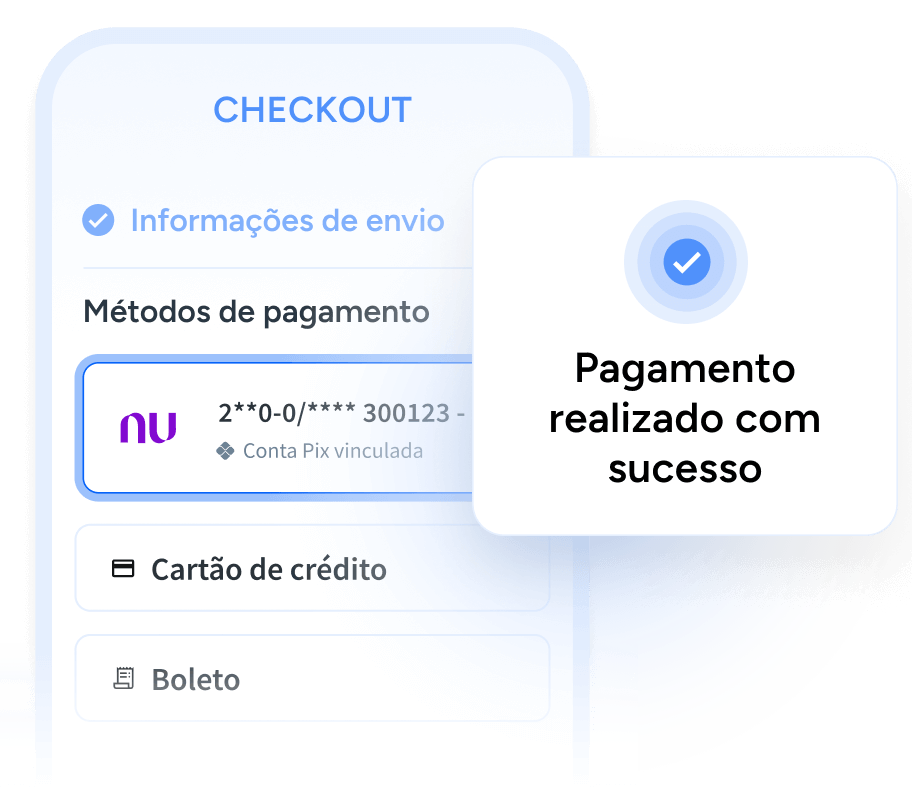

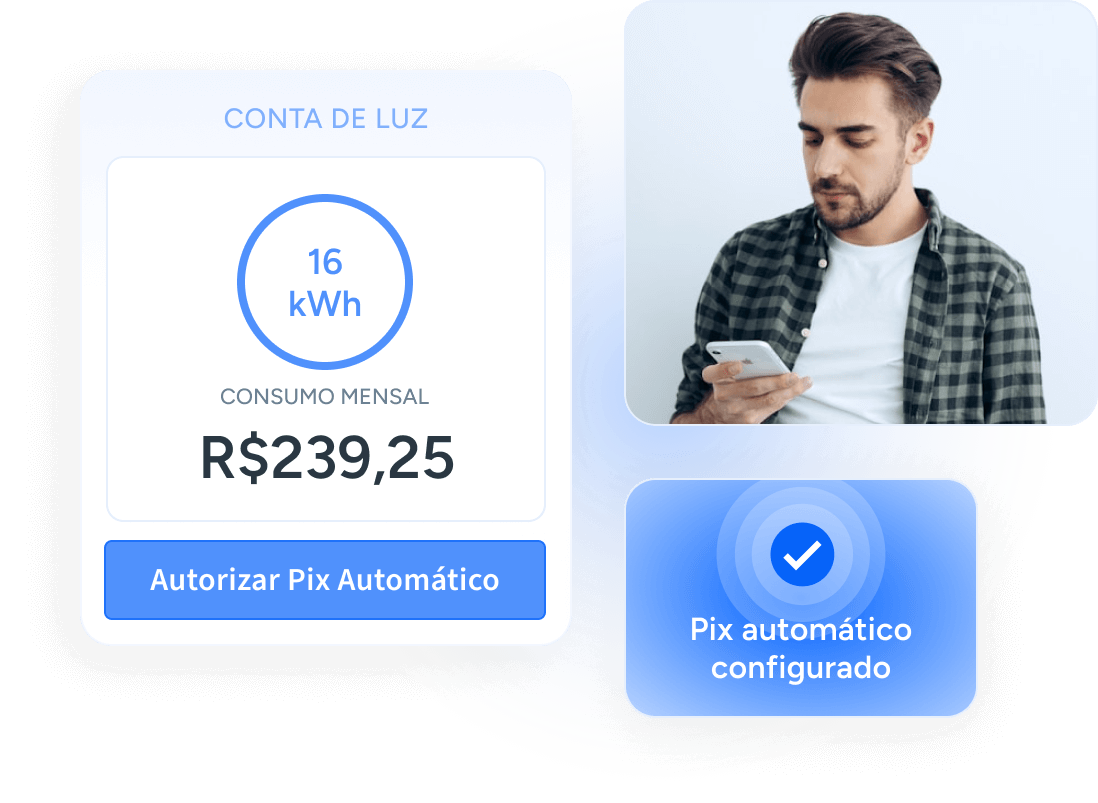

Frictionless experience

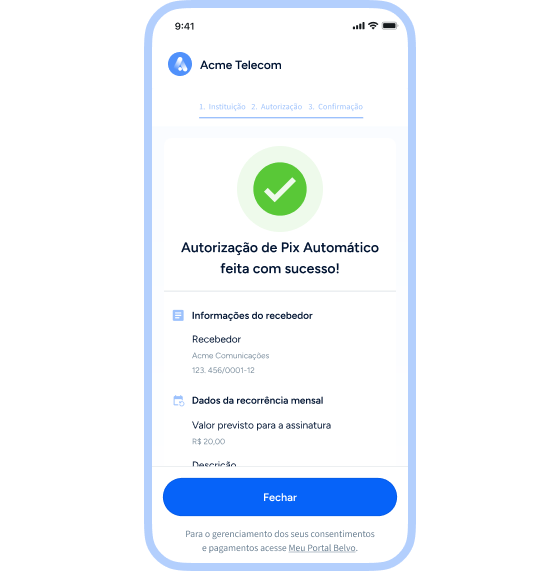

Belvo leverages the Open Finance framework to redirect customers directly to their bank’s page, making it easier for them to confirm the Pix Automático authorization.

The process is simple and seamless, with customers being automatically redirected to their bank’s environment to confirm the recurring payment—minimizing reliance on manual actions.

Optimized payment mechanism

With Belvo’s solution, you can obtain your customer’s consent and identify the best payment date to increase the chances of a successful charge.

Additionally, unlike traditional systems, if there are insufficient funds at the time of the charge, our system automatically retries—preventing unintended service interruptions or delinquency risks.

Reduced fraud risk

Since the authorization happens through Open Finance, payments are authenticated directly with the bank, ensuring that the person making the payment is indeed your customer.

This not only increases security and reduces transaction fraud, but also gives your company full control—safeguarding sensitive data and strengthening customer trust.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits.