Belvo expects to increase the adoption of Pagos Seguros en Línea (PSE) in Colombia thanks to its open finance-based solution that makes these payments easier.

Belvo, the leading open finance platform in Latin America, strengthens its offer in Colombia with a new solution aimed at merchants and fintechs to accept Pagos Seguros en Línea (PSE) with a better user experience.

This bank-to-bank payment method, already accepted by more than 20,000 merchants in Colombia, is growing rapidly in the country. According to Americas Market Intelligence (AMI) data, bank-to-bank payments have already surpassed credit cards as the preferred payment method at e-merchants in Colombia (38% and 34% respectively).

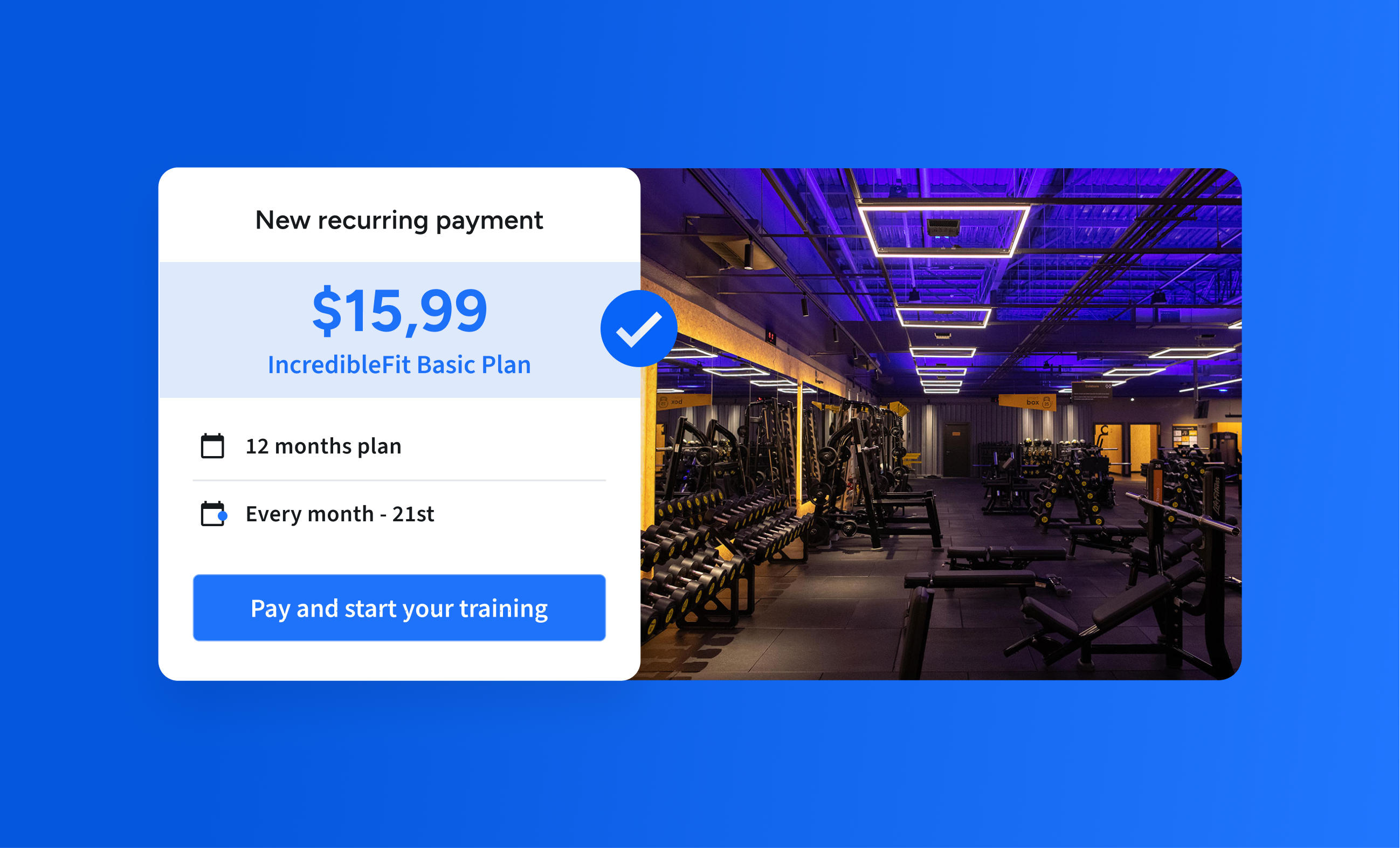

Belvo now expects to increase the adoption of this digital payment method in the country thanks to a new solution based on its open finance technology that reduces the time required to complete a payment. Specifically, if the traditional process required up to 10 steps, the new design reduces it to just four, helping more customers successfully complete the process.

“The new bank-to-bank –or account-to-account– payment methods present a great opportunity for merchants and fintechs in Colombia and across Latin America – and we want to contribute to their adoption in the market and to the advancement of digital payments in the country,” explains Belvos’ General Manager in Colombia, David Ballesteros.

We decided to use our open finance technology to offer an optimized PSE payment experience, which we believe will help more companies to adopt this system that has great benefits such as immediacy and security”

David Ballesteros, General Manager of Belvo in Colombia

This new model benefits both sides of the market. On the one hand, users can easily choose the bank from which they wish to make a payment and do it in simple steps, always with the peace of mind that the payment will be confirmed directly through their bank, which reduces the risk of fraud. And for merchants and financial service providers, it enables improved conversion rates over current methods of accepting online payments such as credit cards. In addition, the solution allows users to register their bank details just once and reuse them for future recurring transactions, which makes it even easier to adopt and use.

A clear example of this is Monet, a Colombian fintech focused on providing instant salary advances to employees in Colombia. The company has incorporated Belvo’s solution to streamline its customers’ experience when making payments on its platform.

With this latest launch, Belvo doubles down on its commitment to improve and democratize access to financial services through open finance in Colombia. Currently, the company offers a broad portfolio of products and services to access financial data from different sources, enrich such data to extract a better analysis of users, and now, accept and issue bank-to-bank payments.