This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Open Finance Payments Colombia

Accept PSE payments faster with open finance

Increase conversion and boost sales by accepting payments via Pagos Seguros en Línea (PSE) through open finance. Improve the user experience and optimize recurring payments.

Trusted by the leading financial innovators

Offer your customers a frictionless and secure payment flow

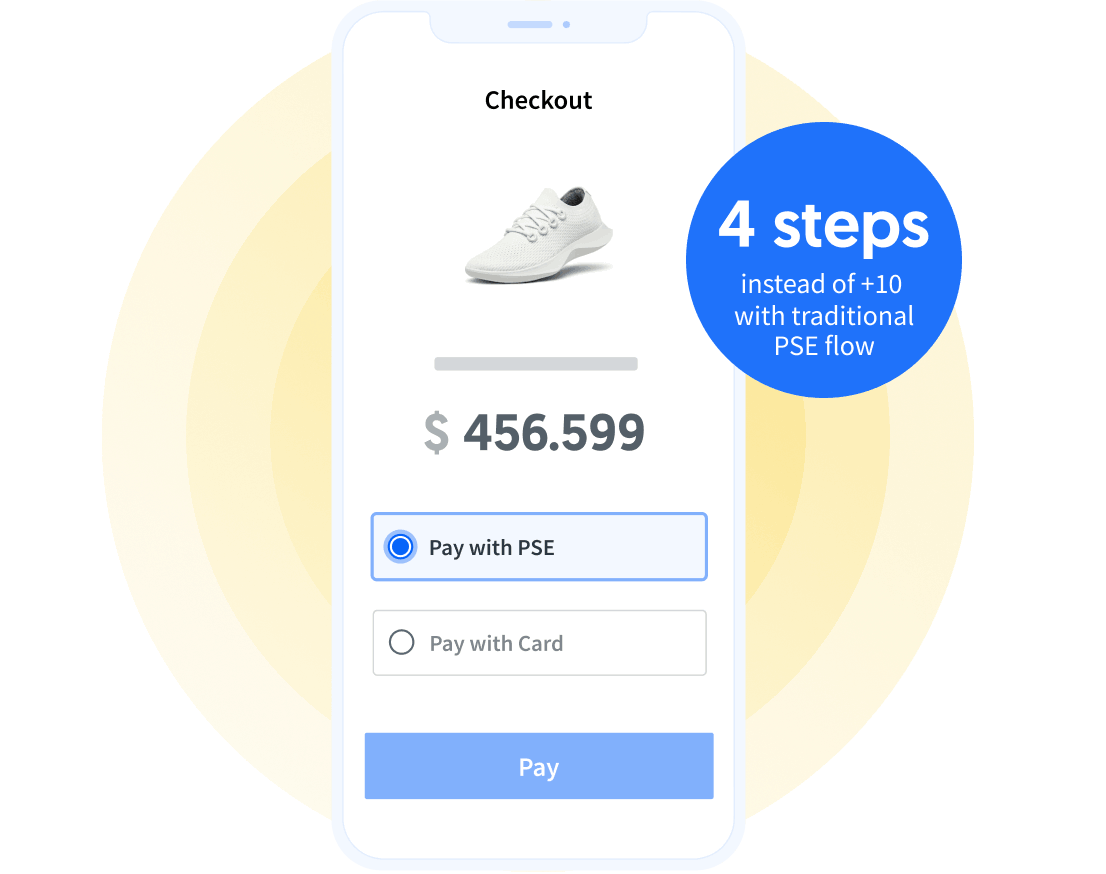

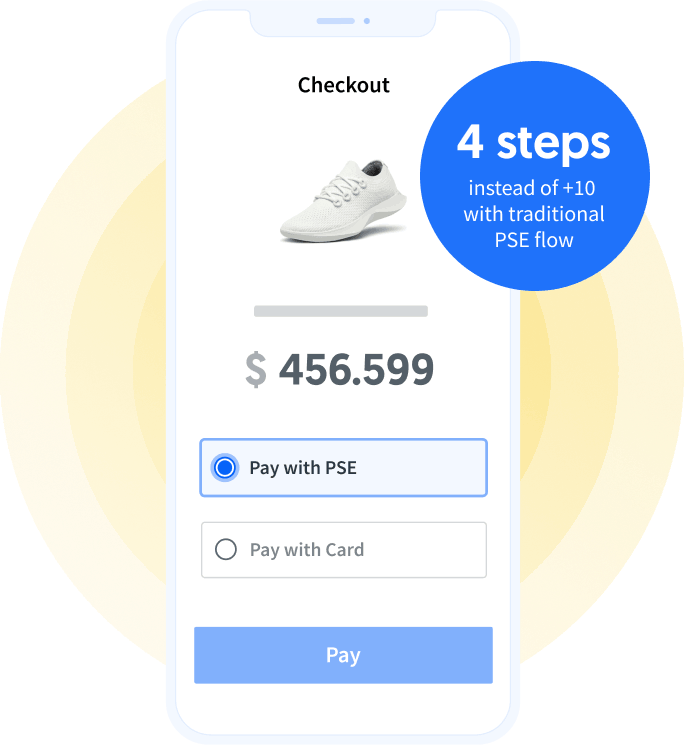

Boost checkout conversion rates

Allow your users to complete PSE payments 3x faster and without leaving your app.

Receive instant payments through a link

Easily embed and share payment links with your customers, without writing a line of code, through your preferred marketing channel.

Optimize user experience for recurring payments

Retain customers by reusing previously linked bank accounts to facilitate faster recurring payments.

A highly-secure payment experience

Rely on bank-grade security and a payments infrastructure certified with ISO 27001 standards.

Receive funds instantly through an optimized PSE user journey

Provide a better checkout experience

Reduce the number of steps needed to complete PSE payments to significantly increase conversion rates at the checkout for e-commerce websites and apps. Increase revenue by making the checkout process more efficient and user-friendly.

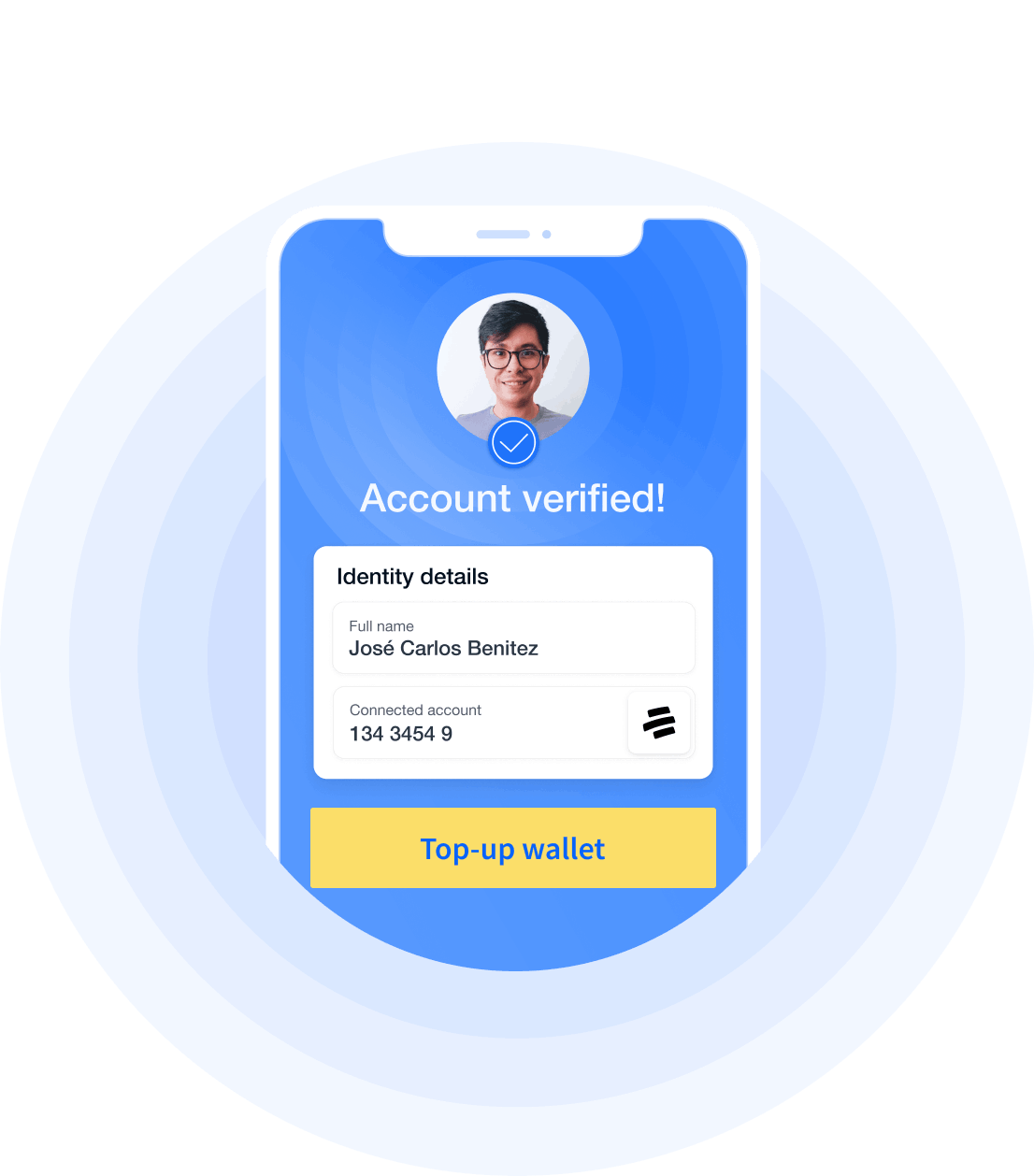

Validate users’ identities and reduce fraud

Verify that the national identifier from the user matches the one of the account being used before processing the payment. Avoid fraud accounts by adding an additional fraud prevention tool to your payment process. Quickly detect anomalies and reject payments before they occur.

Easier recurring payments for credit and loans

Improve the customer experience for loan collections and increase repayment rates by allowing your users to re-use their safely stored banking information in your app or website. Eliminate complicated and lengthy forms and boost your revenue.

Let users top-up their wallets in easy steps

Make it easier for users to top up your wallet without leaving the app. Improve user experience and increase usage and average account balance without additional fees.

Shopify integration available

Our solution is available for any Shopify-based online store as a new payment method. Seamlessly accept open finance payments without building several custom integrations.

Expand your payment options to cater a broader customer base with an improved user experience and highly secure payment method.

Related guides & Docs

Open Finance and payments in Latinamerica

Discover how Colombia and Mexico are tackling new challenges for digital payments with open finance.

Start moving money with our API

Check our technical documentation to quickly implement an optimized PSE flow as a new payment method on your website.

The Latin American road to open finance

Read about how the regional cooperation between Latin American nations will be the key to unlock the full potential of Open Finance.

We can’t wait to hear what you’re going to build

Belvo does not grant loans or ask for deposits