We are launching a new solution dedicated to lenders: Lenders Analytics. We also improved our dashboard capabilities to help our customers easily debug and gain more visibility about their recurrent links.

Product updates

Open Finance for regulated institutions in Brazil

It was very exciting news for us and for the Open Finance ecosystem in Brazil: we released our Open Finance product, to access standardized and enriched data from both regulated and non-regulated institutions through a single platform.

Regulated institutions in Brazil will now be able to access high-quality Open Finance data without spending time and resources on development and maintenance. Our product is totally compliant with the guidelines from Banco Central do Brasil (BACEN).

Using the Open Finance solution, regulated players will be able to receive consumer data in an already consistent and standardized format, with fewer API calls than they would have to make in a regular search of Open Finance databases. Additionally, customers can benefit from Belvo’s existing categorization and data science capabilities through its enrichment products.

Lending analytics: our new solution for lenders

We know that one of the main challenges for lenders is to extract data they can leverage efficiently when they make decisions while reducing technical and manual work.

This is why we’ve been working on a new solution, currently in BETA, dedicated to help lenders analyze the data they need without writing a single line of code: Lending Analytics. Through Belvo’s dashboard, we will deliver key analytics and reports based on the financial data we obtain from the user to enhance credit decisions.

You’ll be able to download insights and financial data directly in XLS format from your customer with only three steps:

- Connect: Share the Connect Page with your customers to let them share their financial data with your company.

- Enrich: Retrieve your users’ processed and standardized data, ready to export in XLS in your dashboard.

- Analyze: Integrate these new insights into your current credit models and make more informed decisions.

Improving dashboard capabilities

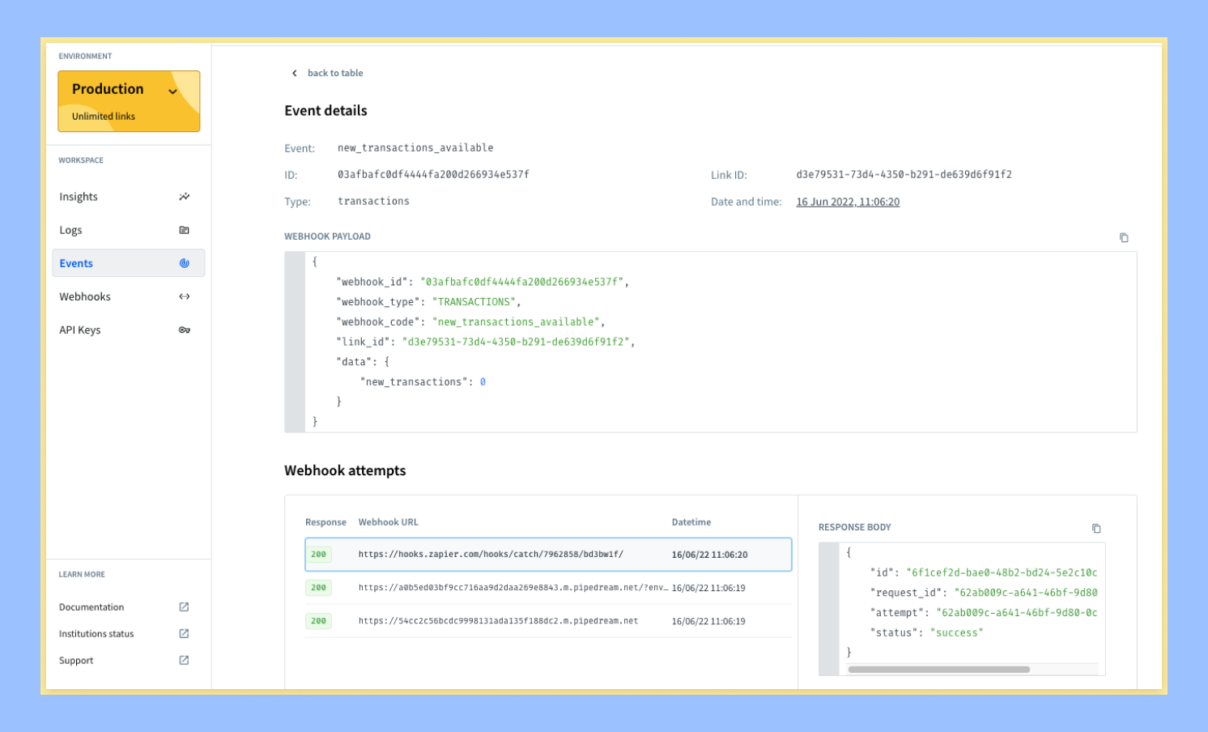

When we started Belvo our leitmotiv was: “Build for developers, by developers” because they are the ones making the “magic” happening through the integration. To make developers’ life working with our products easier, we released a new field in Belvo’s dashboard: the event section!

So, what is it exactly?

This is a place where developers can find any event generated by our recurrent links to discover all the information related to them. The idea behind it is to help our customers to easily debug all elements related to recurrent links and give them more freedom to answer questions such as: was my recurrent link updated, did Belvo send me the event, or what was the result.

We also included search capabilities to look by webhook ID, event type, or link. Additionally, now you’ll find a new module, called webhook attempts, where you can find detailed information about a specific event such as the payload sent, the full response body, and more.

We are committing to constantly providing our customers and their teams with the best tools to build on top of Belvo’s products, and improving our dashboard capabilities is a part of this commitment.

New data sources and coverage

Colombian coverage is not at rest

To consolidate our efforts in Colombia to promote open finance we are increasing our coverage and data sources there. This month we release a new banking product for Banco de Occidente: checking account!

With this new addition in da-house, we currently support nine institutions in the country including Bancolombia, Nequi, Banco de Bogotá, and BBVA. You can check the full list on our documentation.

Belvo’s related

What we learned at Open Views 22

In May we launched our first conference, Open Views 22, which brought together experts from Open Finance and fintech across the globe to discuss how new data-sharing models are reshaping the financial sector in Latin America.

After two days of learning and networking, we’ve had the chance to realize that Open Finance is truly reshaping the financial ecosystem and that there are many stories to be heard from the people building it. We went from analyzing the foundations of the fintech movement in Latin America to looking at the success stories that these models are already enabling.

If you missed it, we recorded all the sessions and they are now available on our Youtube channel 🚀

What matters in Open Finance, now in your inbox

After the launch of our first conference in May, we want to stay connected with the ecosystem and continue bringing you the most relevant news and insights bout Open Finance, so we just launched the first edition of the Open Views newsletter!

It will be sent monthly to subscribers who are interested in keeping up with the Open Finance ecosystem: regulatory changes, new companies and solutions, analysis and debates, technology news, and even job opportunities across Latin America.

Subscribe here to receive the newsletter in Spanish and here to receive it in Portuguese every month in your inbox!