Enrichment products can provide out-of-the-box insights based on customers’ transactional data to improve decision-making and better understand customers. But how do these products work and what can you build with them?

Our daily financial transactions say a lot about how we behave as consumers: what days of the month you pay for your rent, what type of recurrent financial commitments you have, and what are your most common spending patterns.

Financial APIs already help financial innovators in Latin America and across the world to easily and safely access and interpret their end-users data.

But choosing what specific set of data is relevant to act upon, among the vast quantity of information that’s processed by financial companies every day is one of the biggest challenges these institutions face, according to Deloitte.

“Despite the amount of data, many organizations find that they have not been capturing the right data attributes for developing insightful analysis.”

Deloitte

Providing insights, one API call at a time

That’s where data enrichment comes in. “These solutions provide useful insights and intelligence extracted from financial data through prediction, aggregation, data science and artificial intelligence models trained with millions of transactions,” says Belvo’s Enrichment Product Manager, Óscar Castañeda.

Things like effortlessly extracting credit scores from banking data, translating raw transactions into clean feeds of information, and providing customers with more ways to understand their financial behavior, can be easier than ever before as data analytics models become more available, richer, and more accurate.

“Embedding data in every decision, interaction and process will be one of the characteristics that define what a real “data-driven” enterprise is by 2025”

Mckinsey

Examples of enrichment on top of open banking data

Being able to make decisions on top of enriched financial data will make a real difference for many types of businesses (such as accounting platforms, lenders, PFMs, or traditional financial institutions) and these capabilities will keep improving and expanding as more consumers adopt open banking-related products and services.

That’s why –alongside its aggregation services– Belvo has built a series of enrichment products that focus on solving specific problems for financial companies by providing instant access to a set of high-value insights through a single API call.

Let’s see some examples of how these products rely on advanced data analytics to help businesses build financial products with a data-driven approach:

Income verification ✔️

Consumers’ income is one of the main indicators that lenders and financial providers need to verify in order to assess eligibility for loans. Yet, the most common way to access this information is the manual collection of payslips or account statements, which entails a high consumption of resources and time, and can provide data that is unverifiable and prone to errors.

Income verification uses an artificial intelligence model that analyzes user account movements to find patterns in the frequency and quantity of transactions, as well as the combination of certain keywords that indicate if they correspond to income or not. With this information, the model is able to identify the movements that correspond to recurrent income.

This product can be used to give customers with little credit history a second option when applying for a loan by connecting their accounts from financial institutions and automatically analyzing this information to identify their income without the need to request additional paperwork.

Recurrent expenses 💸

Increasingly, customers across the world subscribe to services that are paid monthly such as Netflix or Spotify. Leveraging the information from this consumption can help companies build alternative ways to assess a customers’ financial health and stability.

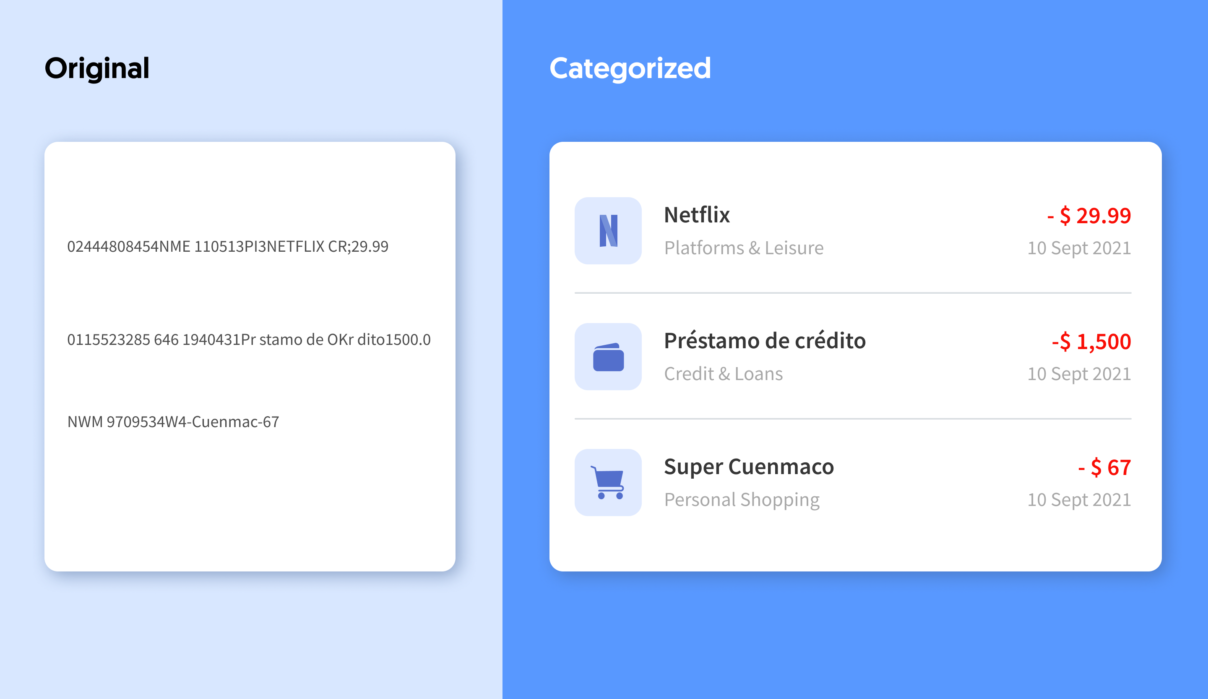

Recurrent expenses uses an advanced analytics model that automatically identifies users’ most common spending habits on subscription services (like Netflix, the gym, or Amazon Prime), frequent utility payments (like internet or electricity), as well as other cyclical payments they might make (such as loan repayments and common transfers to friends).

This product can automatically translate customers’ raw, unstructured transactional data into actionable items that are ready to be displayed and fed into an app. For example, to create an alert for users’ monthly subscriptions, help them reduce the “small expenses” that can affect their financial health, as well as help them group all their subscriptions in the same place.

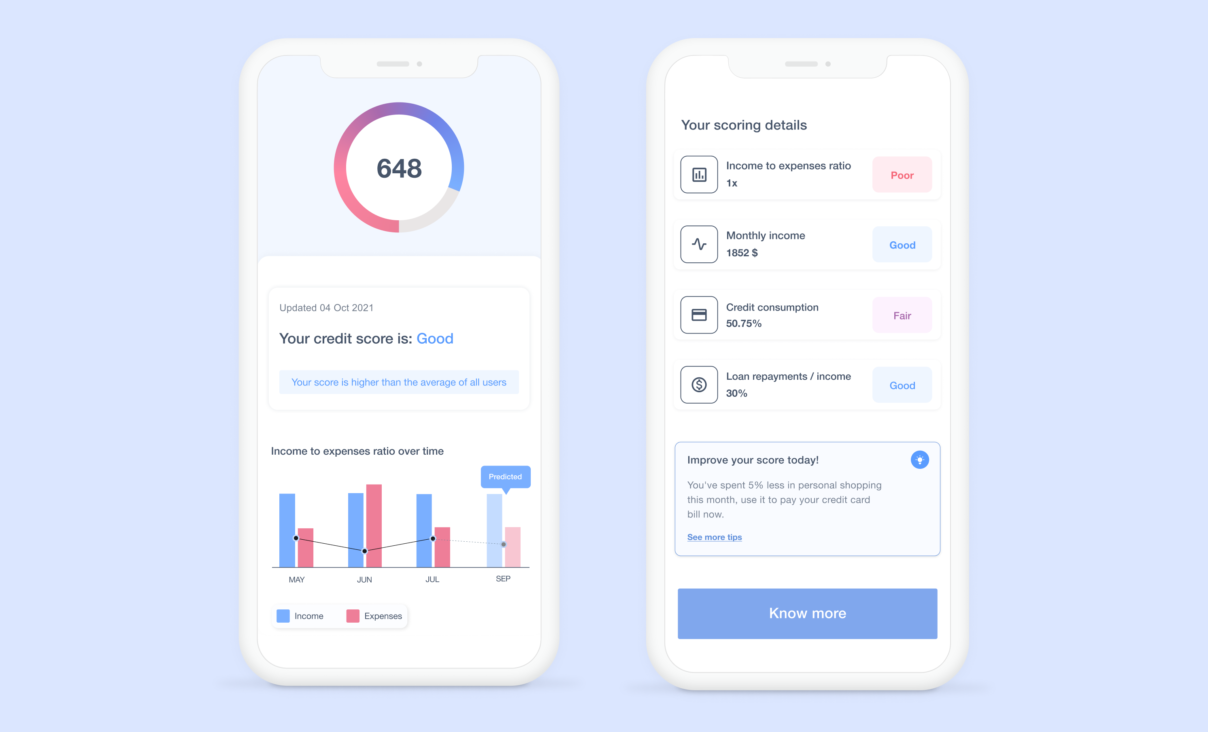

Risk insights 📊

A consumer’s payment history is key to understanding their willingness to repay. But with credit bureau data covering only a part of the population (and often with poor accuracy or dated information), it can be difficult to determine whether or not customers with an incomplete credit history are eligible for credit products.

By analyzing customers’ transactions it’s possible to identify a series of additional indicators that prove their financial stability. For example, measuring financial transactions made in a specific time period compared to the previous one, or by analyzing if a customer is reaching their credit card limit and when.

These indicators have been put together under Risk insights (BETA), which provides a set of high-quality metrics to better understand users’ risk profiles. Companies can use these insights to complement their current scoring models, get higher margins, and reach wider audiences.

Benefits of enriching open banking data

“Unlocking the power of analytics to extract value from data obtained through open banking is not only useful to improve decision-making. It’s also a way to reduce operational costs and save time when developing and launching new financial tools such as budgeting apps and alternative lending solutions”

Óscar Castañeda, Enrichment Product Manager at Belvo.

Using these tools, including our transaction categorization model, can free both fintech companies and traditional institutions from the task of manually interpreting and classifying the information provided in transaction labels themselves, which takes large amounts of time and resources.

By using enrichment products, financial innovators can access the intelligence that we’ve gathered from analyzing millions of users’ transactions from financial companies across different industries and countries.

“As more companies adopt open APIs to connect to financial data, the need for more enrichment products to empower companies to extract even more out-of-the-box value from financial data increases as well,” adds Belvo’s Enrichment Product Manager.