Belvo’s latest product, Risk insights , provides a set of high-quality metrics based on up-to-date transactional data to better understand your users’ risk profile and help them improve their credit scores. Use these insights to optimize your risk assessments models, offer lower interest rates, get higher margins, and reach wider audiences.

Belvo has developed Risk insights, a new product that provides a series of easy-to-integrate metrics to quickly assess a consumer’s risk profile. These metrics are calculated based on up to 90 days of transactional data from the user’s checking, savings, loans, and credit card accounts. Lenders and financial innovators can easily integrate these insights into their credit scoring models and build more powerful predictive capabilities.

Improving access to financial data

For a long time, the lending industry has relied on access to poor financial information to perform risk analysis and on time-consuming and cumbersome processes to issue credit. Only 18% of adults in Latin America use credit products from financial institutions, according to data from the World Bank. This leaves an important part of the population underserved by the traditional lending ecosystem.

This situation is changing with the expansion of open banking, which provides lenders with real-time access to financial accounts data and an immediate view of their financial situation.

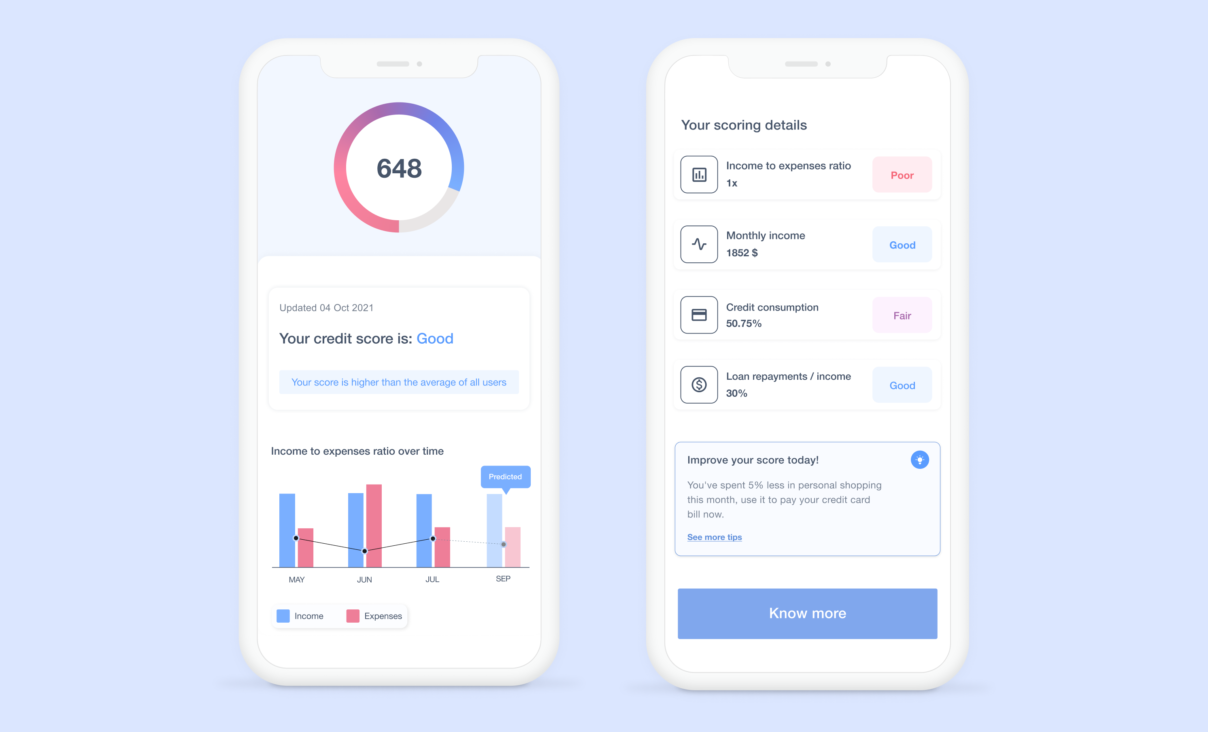

Now, with Risk insights, companies can obtain high-quality enriched information to get a more accurate view of their customers’ risk profile. This product provides a unique set of data including positive information like income and transaction history, which can be used not only to assess creditworthiness but also to help users improve their current scoring.

Thanks to this, companies can optimize risk assessment processes to increase acceptance rates and customers’ eligibility, thereby reaching more customer segments, reducing costs and processing time.

| Metrics | Description | Examples |

| ⚙️ Transactions | Aggregated metrics are calculated based on the user’s transactions from checking, savings, credit card, and loan accounts. | Get the total sum of transactions your user has made in the last week versus last month versus the last three months. |

| 💵 Cashflow | Aggregated metrics are calculated based on the user’s transactions from checking, savings, credit, and loan accounts. | Identify how much money was left in your user’s account last week. |

| ⚖️ Balance | Balance metrics are calculated based on the user’s balances from checking and savings accounts. | Get a screenshot of the balance of all the accounts of your user at a specific time. |

| 💳 Credit cards | Aggregated metrics are calculated based on the link’s credit card accounts. | Access the total sum of your user’s credit cards’ limits and the credit used. |

| 💰 Loan metrics | Aggregated metrics are calculated based on the user’s loan accounts. | Discover the total sum of the monthly payments for your user’s connected loan accounts. |

How does it work?

Building relevant features out of open banking data takes time and requires a dedicated team and hours of work to maintain them updated. Belvo’s data science team takes care of aggregating and post-processing transactional raw data to provide companies with the most relevant insights.

Once Belvo is integrated into a company’s product, they can use our Connect Widget to securely connect users’ data with their app, following the best UX and security practices.

After the connection is done between the app and the users’ financial institution, companies can automatically retrieve risk insights metrics through a single API call, obtaining a set of ready-to-use metrics with the most relevant data points they need to perform a risk assessment and integrate them directly into their business models.

Help customers improve their financial health

By using this product, lenders can make better decisions while they conduct their underwriting processes.

- Real-time access to users data: automate data recollection and analysis to speed up risk assessment, improve the precision of your models and reduce time for loans to be approved.

- Positive information: leverage useful positive information such as income and transaction history to help customers improve their credit scoring in order to increase loan eligibility and decrease interest rates.

- Reduce manual workload: benefit from a growing set of enriched metrics and hundreds of hours of data science work without having a dedicated team.

- Offer tips to improve credit score: educate your customers about how they can increase their credit score by focusing on the key metrics they should improve, for example, by showing them how they perform in comparison with the average market.

- Provide lower interest rates: increase the likelihood of loans being approved, reduce risks and lower your rates by feeding your current models with more accurate insights.

What kind of company can benefit from these features? Any lender or financial institution that’s looking for ways to provide their customers with more insights about how to improve their financial health, as well as increase their reach to new customer segments.

One example of a credit company already benefiting from our APIs is askRobin, a loan marketplace that is already using open banking and Belvo’s data analytics to access enriched information to help their customers by providing more visibility into their creditworthiness. It is one of the many examples of how open banking and a better understanding of a user’s financial health can benefit both the consumer and the lender.

Access our sandbox environment now and start retrieving the risk insights metrics that are relevant for your business. We’re really excited to hear your feedback about it!