Discover how open banking and open finance helps to enhance and improve current credit scoring models to offer more loans at a lower cost.

As we have discussed previously, the credit placement process in Latin America continues to be inefficient. There are major technological shortcomings and there are no homologated standards for evaluating people who are applying for credit. Until now, the status quo of credit systems has made it impossible for more people to have access to credit.

Table of Contents

- Open banking as a complement to risk models

- Analyze consumption patterns to provide better credit

- Practical Fraud Avoidance

- Provide offers to your rejects

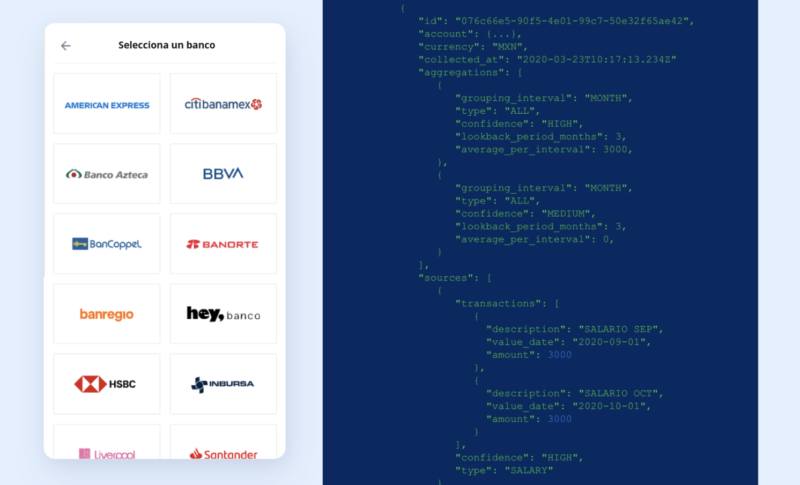

Thanks to open banking and open finance technology solutions, which provide automated and secure access to financial data through APIs, companies can now directly verify the income of their potential customers. In this way, they can get an instant picture of their real financial stability and ability to pay, generating substantive financial inclusion. They can also rely on credit metrics based on up-to-date transactional data to obtain insights and improve their risk assessment processes or include them in their credit scores.

This brings us to the central question: should we discard traditional credit scoring models, in some places known as credit bureaus, and replace them with Open Banking solutions? The answer is no.

Open banking as a complement to risk models

The idea that Open banking is the natural proposal to replace credit bureaus is a bit misleading or confusing. Open banking solutions should not be interpreted as credit scoring, but as a tool that feeds and provides additional analysis factors for current risk models.

With access to customers’ historic financial information, the possibility of increasing loan approvals grows considerably: in cases observed by Belvo, we were able to map a 16% increase in the number of customers who, after being refused in the traditional lending funnel, obtained a new offer after they shared their open Finance data. In the case of companies that wanted to increase credit lines for existing customers, there was an increase of 33% in offer acceptances after sharing open finance information.

This is based on new variables and with the help of secure and transparent technology such as Belvo’s risk insights product. It provides a series of easy-to-integrate metrics to quickly assess a consumer’s risk profile. And even if this set of features can be used by lenders and financial innovators in their credit scoring models, it doesn’t replace a risk model solution.

Analyze consumption patterns to provide better credit

One of the great possibilities offered by open banking, and solutions such as Belvo’s, is the ability to identify those small transactions that will help you better understand the health and financial behavior of a potential customer.

Some of these solutions, such as income verification, are based on machine learning models that analyze the movements of users’ accounts to find patterns in the frequency and amount of transactions, as well as the combination of certain keywords that indicate whether they correspond to income or not, all of this being updated information that is probably not provided by the credit bureau.

In addition to income verification, open banking allows us to analyze other risk factors present in transactions such as identifying if there are any other payments that limit an applicant’s ability to pay, whether they are other credits or if the current expense is too high to acquire a new financial responsibility.

Additionally, payment initiation models powered by open finance can help lenders streamline the collection process for their customers.

Practical Fraud Avoidance

One of the biggest problems faced by credit companies is fraud. According to El Economista, in Latin America, Mexico is the country with the second highest incidence of digital fraud in terms of volume, after Brazil. Financial services companies in Mexico lose 3.8 times the amount of the value of each fraudulent transaction since the cost related to the transaction is added to the expenses derived from the investigation of the illicit, as well as the interest generated and others.

An open banking solution will help you prevent fraud from the beginning, since it has the capacity to validate that the deposit made by the credit company is made to a bank account that matches the data of the person who is requesting it, reducing the probability that the applicant is lying or is impersonating others.

Provide offers to your rejects

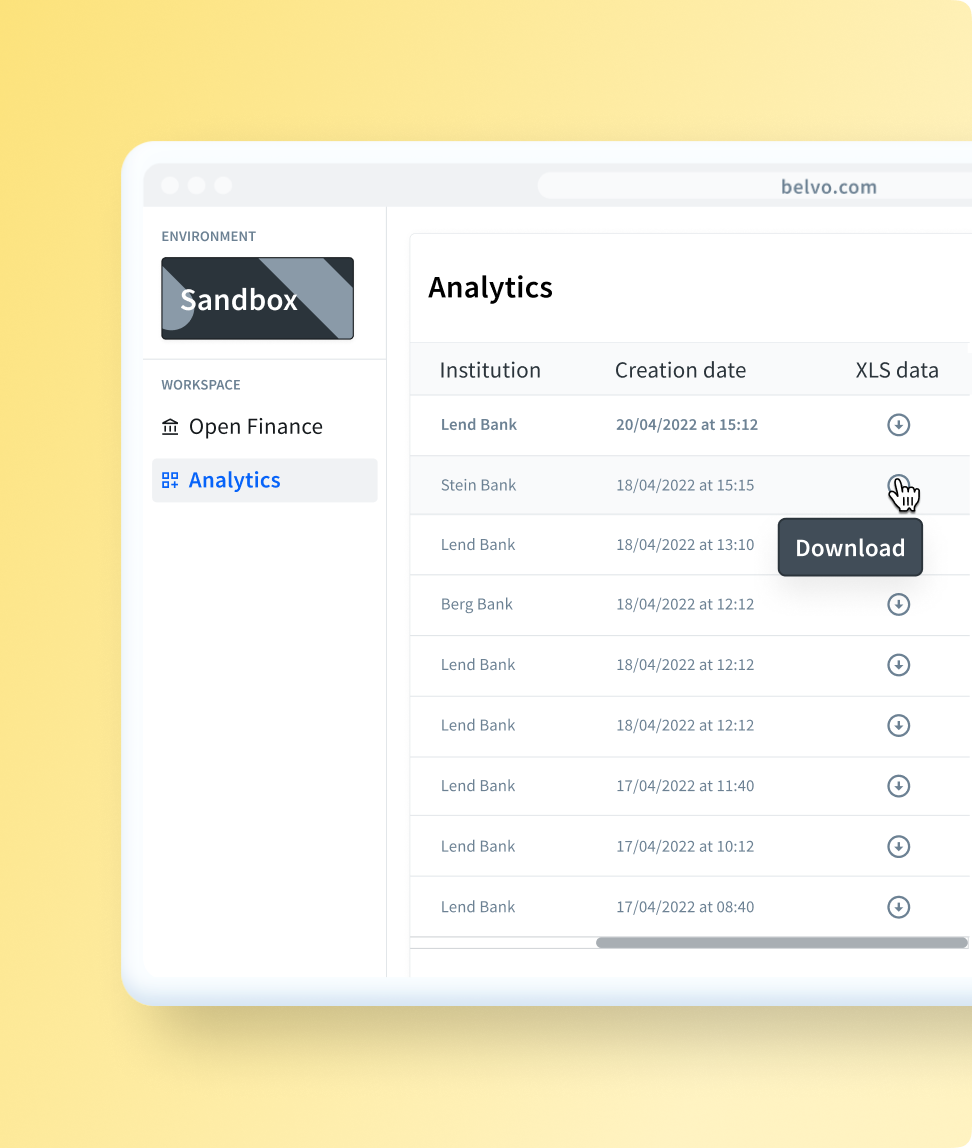

Another of the great benefits that you can find in an open banking solution as a complement to traditional credit scoring, is to take advantage of all the traffic rejected by the traditional model.

There are two trends in this. The first one is the companies that modify their current process to include an open banking solution and thus begin to provide a greater amount of credits since they have more information. Transaction history or income verification can be considered positive information as lenders can use them to help customers improve their credit scoring and increase loan eligibility. The second is lenders setting up a second credit decisioning system to accept some customers they initially rejected.

This second aspect is quite simple: after the traditional model discards a user as eligible, you have the possibility to run their application through a bank aggregation solution such as Belvo’s, where you get a complete view of an account balance, consumption, and payment patterns and, in general, the user’s financial capacity.

You can use Belvo’s ROI Calculator to estimate the return of implementing open finance to reassess the credit of users declined by the current funnel.

“Open Finance brings forward new information that can complement credit risk models, allowing lenders to make better decisions and even lower their rates for the final customer. A person who had been rejected in a previous request gets a new chance of approval with Open Finance, because the institution will be able to know this customer better, learn what they do, how they spend, and how likely they are to pay that specific loan”

Artiz Amanese Head of Credit Risk and Strategy at Belvo

With this, your acquisition costs will also benefit, since fewer and fewer users are rejected and you have a greater capacity to identify new factors or information that will help you place more loans. You are also feeding your risk matrices and business intelligence with new data.

This is how a lending company can create a product mix and have better tools to place more and better loans. At the end of the day, the open banking solution will help you to have a much more reliable and clear picture of the financial health of potential customers.

Want to learn more? Read about how our Income Verification solution solves the need for real information for lenders and discover how to retrieve risk insights metrics.