By implementing Open Banking models, lenders can improve their underwriting decisions thanks to an automatized and secure access to banking data through APIs.

Income verification is one of the most important procedures that lenders conduct before approving a loan. The collection of this information is a crucial part of the underwriting process. It helps lenders assess if a potential customer can afford new liabilities and whether the customer fits their risk profile.

Underwriting processes are now cumbersome

However, nowadays, digital lending income verification processes are cumbersome. This makes applying for a loan a slow and inefficient process for both the applicant and the lender.

Companies still rely on time-consuming, unverifiable, and prone to error manual data recollection systems. These are hard to scale and costly.

This situation also feeds back into a vicious circle of under-banking. In the absence of convenient and accessible tools to demonstrate their income to financial institutions, citizens are forced to assume higher prices that negatively affect their financial stability.

📊 Only 18 percent of adults in Latin America use credit products from financial institutions, compared to 68 percent in the US

World Bank

Open Banking can change this

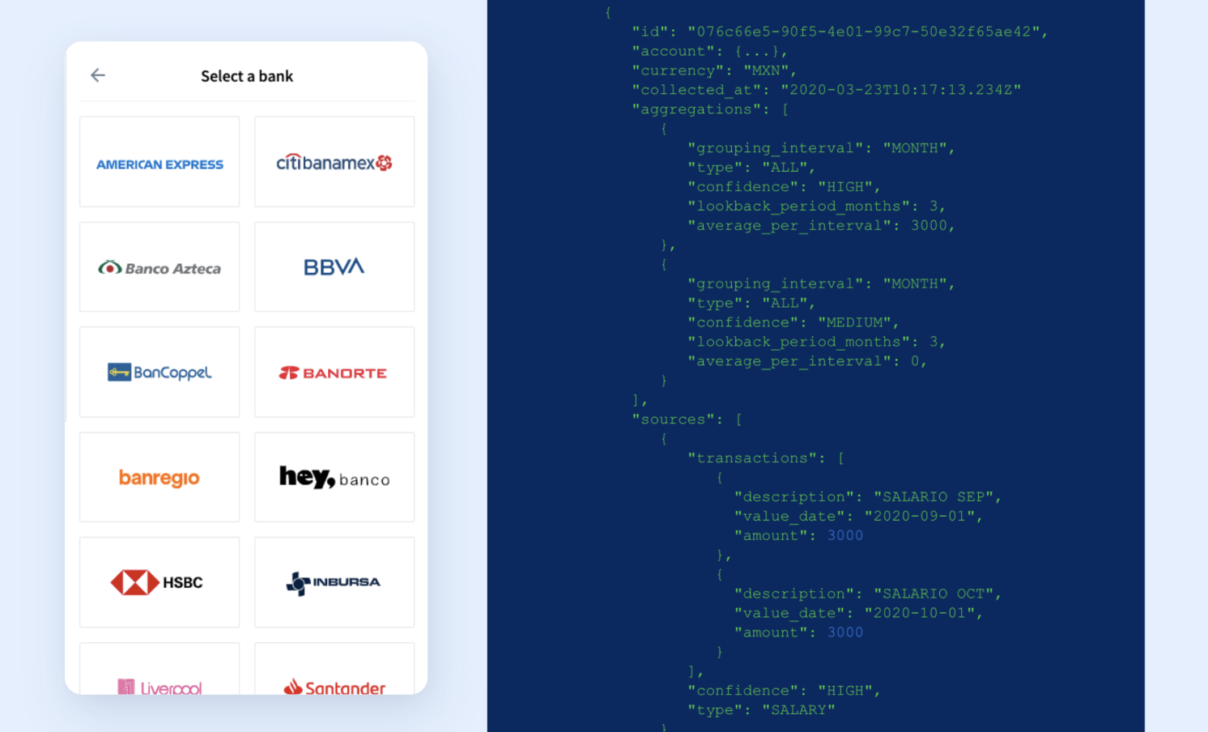

Thanks to an automatized and secure access to banking data through APIs, companies can directly verify their potential customers’ income and get an instant picture of their real financial stability and ability to pay. This reduces the time required by lenders to do risk assessments based on data-driven decisions. It also helps them reach a wider range of customers.

Following these principles, Belvo has created an Income Verification Product designed to help lenders in Latin America access income data from their customers.

The solution is based on a data-science-based model that analyzes user account movements to find patterns in the frequency and quantity of transactions, as well as the combination of certain keywords that indicate if they correspond to income or not.

📊 The model is able to identify the movements that correspond to recurrent income with a reliability of up to 90 percent

The solution developed by Belvo is 100 percent plug-and-play. All that users need to do is connect their bank account to the lender’s app. Then, Belvo will automatically retrieve the end-users income for up to 12 months.

If you want to know more about how Open Banking can help you optimize your underwriting decisions, download our quick guide: