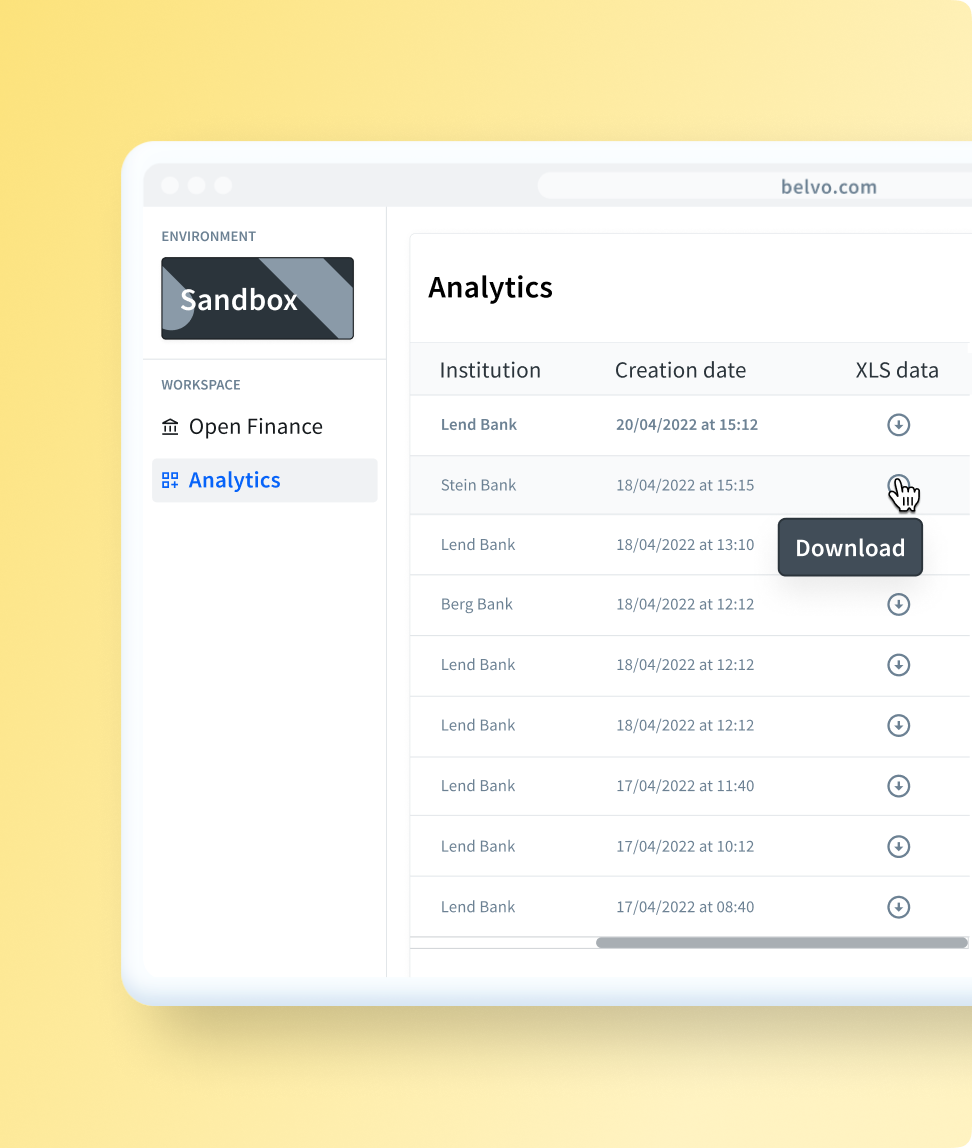

With Analytics, lenders can access enriched open finance data directly through Belvo’s dashboard without writing a single line of code.

The lending landscape is turning around pretty fast. Since the emergence of new fintech and open finance models in recent years, both the well-established lending industry and emerging players are trying alternative methods to assess users’ affordability and creditworthiness.

One of the main challenges faced by lenders is the fact that they’re limited to access to traditional credit scoring information from bureaus. They also face tedious, manual and lengthy processes to approve loans. In countries like Mexico, where only 57% of the population has access to credit, accessing more accurate and complete information to complement these processes is key to improving the efficiency of credit operations.

New lending models are relying on new data sets, such as open finance data, to speed up loan approval processes and better determine creditworthiness for people with few credit history or out of their traditional scope.

These new data sources include things like transaction history in savings and checking accounts as well as spending patterns that help predict income and identify positive signs of creditworthiness. For instance, beyond negative credit scores: are customers paying their bills in a timely manner? Have they recently repaid a credit card? Do their day-to-day operations indicate healthy financial habits?

Thanks to this new way of looking at creditworthiness assessment, lenders gain a more detailed picture of their potential customers, strengthen their risk assessment models and can reach a wider range of customers.

The solution

But, how can lenders get direct access to these new sets of information and quickly embed them into their underwriting models?

The answer is Analytics, a tool developed by Belvo that allows lenders to directly obtain key information about the financial behaviour of their customers and verify their income to assess their eligibility faster, saving time and resources.

Using Analytics has made our work process so much easier! Instead of dealing with those complicated excel spreadsheets, we now have a much simpler and user-friendly interface. With this, we can run thorough and efficient analyses, which helps us make informed and effective decisions.

Michael Gomez, Credit Analyst at Creditea

Through Belvo’s dashboard, lenders can access raw data from banks or fiscal institutions as well as enriched data such as income or categorized transactions. And while API integration usually requires some integration time and resources, Analytics has been built to save development time while keeping good conversion rates.

Without writing a single line of code, lenders can now access open finance data in only three steps:

- Customize and connect: Personalize the Connect Page with your brand elements and share it with your customers to allow them to easily and safely connect their accounts.

- Data analysis: Safely access, visualize, and analyze customers’ financial data. Download the .xlsx file to recover raw data as well as income and transactional data.

- Verify income: Verify your user’s income directly from the dashboard. We currently support 10 income categories and additional metrics to optimize credit analysts’ work.

- Dig into the data: Integrate the data and these new insights into your current credit models to reinforce credit decisions. Enrich your credit scoring with income and transaction data.

How can lenders benefit from the solution?

By accessing users’ financial data, ready to feed into credit scoring models, lenders can increase their acceptance rates while improving both the quality and speed of their decisions.

Increasing approval rate for rejected customers

We estimate that 70% of bank loan applications are rejected based on users’ negative credit scores or negative credit history. To increase the number of credits granted, lenders can set up ultra-personalized campaigns.

By using the Connect Page and Analytics, they can quickly and easily customize the landing page and share it through a marketing campaign focused on customers who lack credit bureau history. By retrieving their banking data, lenders can review the first credit proposal and provide a new offer: more affordable and tailored to their financial situation. Using this data, lenders can increase their credit acceptance rates up to 30%.

Feeding risk models with alternative data

By diversifying the data sources on which lenders build their risk models, they are leveraging tangible data about their customers’ everyday financial patterns and behavior. By integrating fiscal or employment data, they can complement incomplete data from traditional channels.

On the other hand, enriched data such as income prediction or new credit metrics based on transaction history can help lenders consolidate predictive features into their credit scoring. Feeding risk assessment models with enriched data from open finance allows lenders to better understand their customers’ economic’s situation and therefore, assess customers’ credit eligibility faster and offer more personalized repayments options.

Discover Analytics by signing into your Belvo account.