Discover how to use our new version of Risk Insights to improve the predictive power of your credit models thanks to our advanced machine learning capabilities. Obtain pre-calculated metrics from transactional data to better predict creditworthiness.

When it comes to building accurate credit models, data science and risk team often face the biggest challenges in data cleansing, analysis and variable calculations.

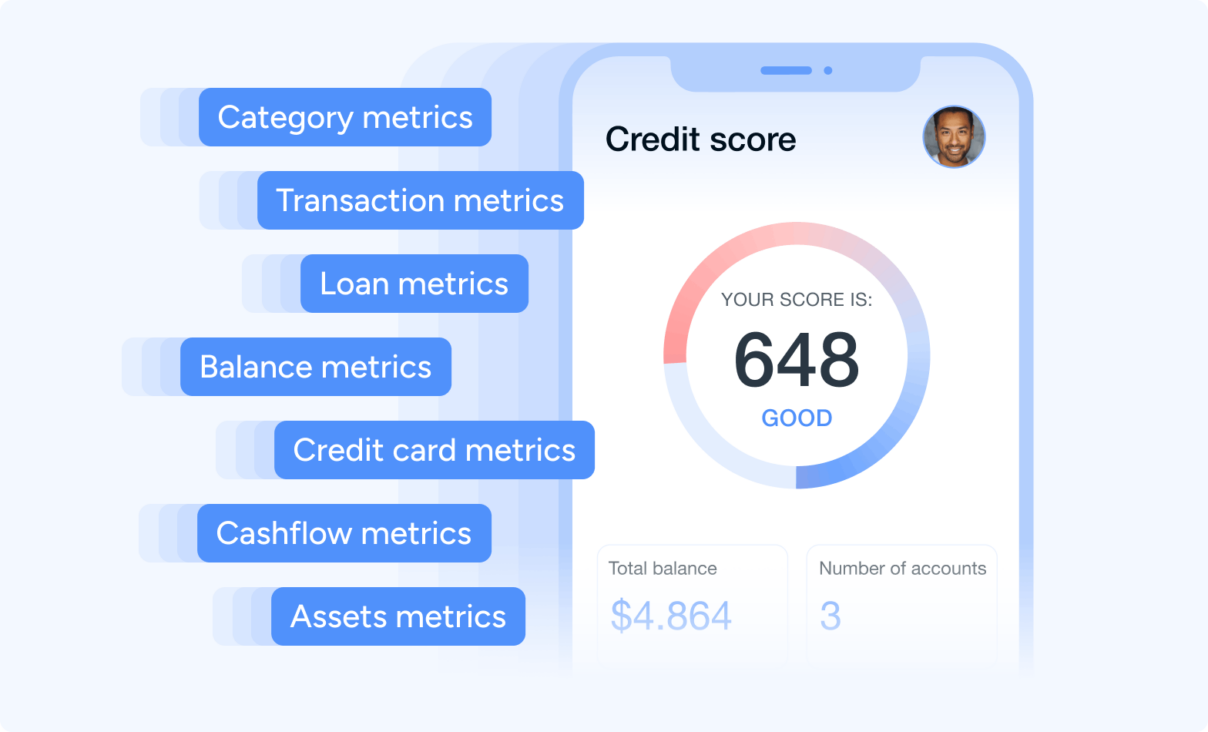

Risk Insights, one of our enrichment products, helps data scientists to effectively bridge this gap. This product offers a comprehensive list of pre-calculated and advanced metrics designed to speed up credit decisions so that teams can quickly build, iterate, and validate credit models.

By replacing outdated data with predictive indicators such as ATM behavior, low balance or overdraft usage, lenders can improve their scoring models to improve its predictive power.

What’s new

Risk insights provides a complete set of credit metrics built on top of users’ transactions and accounts data to give lenders more insights about their credit applicants’ daily financial behavior. After testing and iterating with customers, we used feature engineering to create a set of extended variables from open finance data, divided into 8 groups of metrics.

| Metric | Description | Variables examples |

| Asset | Get a snapshot of your user’s wealth and liquid assets to better assess their financial management and current financial status. | Number of accounts Accounts’ balance (…) |

| Credit card | Identify and understand your customers’ credit card usage habits to offer additional credit products or increase credit limits. | Credit limit Credit used Credit card limit used (…) |

| Loans | Understand your customers’ borrowing, repayment behavior, its ability to take on additional credits, and identify potential default risks. | Principal loan Monthly payments Overdraft limit used (…) |

| Balance | Get a picture of your customers’ overall financial health by looking at the amount of funds in their accounts over time. | Minimum balance Balance threshold Balance below 0 (…) |

| Transaction | Identify your customers’ income and spending patterns (transactionality) and get information on transaction frequency, volume, and type (incoming or outgoing). | Incoming and outgoing Total incoming amount Days since last transaction (…) |

| Cash flow | Gain insights into the actual movement of money in and out of a customer’s institution. | Positive Max negative Net cashflow (…) |

| Category | Understand customers’ main spending patterns, we return 15 primary categories and 94 detailed sub-categories. | Category Subcategory Net amount of the transactions for this category (…) |

To calculate the risk insights, we take up to 365 days of transactional data from the user’s checking, savings, investment, loan, and credit card accounts.

A breakdown of how risk insights work

Let’s look step by step into how you can make the most out of the product.

- Data gathering: With the user’s consent, we retrieve their account balance and transaction history from multiple bank accounts (checking, savings, investment, loan, and credit card accounts). Our engine can also process transactional data that you’ve already retrieved from your customers. We then calculate the balance evolution of the different accounts.

- Standardized raw transactions: To make sense of the vast amount of transactional data, we employ cutting-edge machine learning models. The raw data is meticulously cleaned, filtered, and accurately categorized, ensuring that all transactions are properly labeled. This process not only optimizes data accuracy but also enables us to extract meaningful insights from the information provided.

- Running deep analysis: With clean and categorized transactional data and account information at hand, our engine generates advanced metrics. These variables cover crucial aspects, including end users’ assets, credit cards, loans, balance evolution, cash flow, and category-specific transactional details. The resulting insights paint a complete and detailed picture of each user’s financial standing.

- Feed it into your credit models: By integrating the generated credit metrics into their credit models, lenders can significantly improve acceptance rates and risk accuracy. The enriched credit models provide a deeper understanding of each customer’s creditworthiness, leading to more personalized and fair credit offerings.

Revolutionizing credit assessment with open finance data

Better assess creditworthiness

Gone are the days of relying solely on traditional data sources, such as credit bureaus, for credit evaluations. The inclusion of predictive open finance indicators and analyzing category-specific trends, like gambling, income patterns, or luxury shopping, brings lenders valuable insights into customers’ risk profiles.

Leveraging advanced metrics that encompass end users’ assets, credit cards, loans, balance, and cash flow evolution provides a holistic view of their financial health. This multifaceted approach to credit scoring allows businesses to mitigate risks effectively and make more informed decisions.

Personalized credit products

Imagine offering credit products tailored precisely to your customers’ unique financial situations. With real-time processed data at your disposal, this becomes a reality. By accurately assessing customers’ debt burden, creditworthiness, and capacity to handle additional credit, lenders can gain a deeper understanding of their credit needs and loan repayment capacity.

Armed with this knowledge, they can craft personalized credit conditions that cater to each user’s specific requirements. As a result, approval rates are increasing without compromising on the default rate, creating a win-win situation for both customers and lenders alike.

By leveraging these metrics effectively, lenders can enhance data science teams’ efforts in improving credit models, mitigate risks and create personalized experiences for their customers.

You can already try the new version of Risk Insights!