Open finance (or open banking) models allow for a new type of payment that’s done directly through the users’ bank account. This is called payment initiation and its use is gaining traction quickly in Brazil. Let’s learn more about how it works.

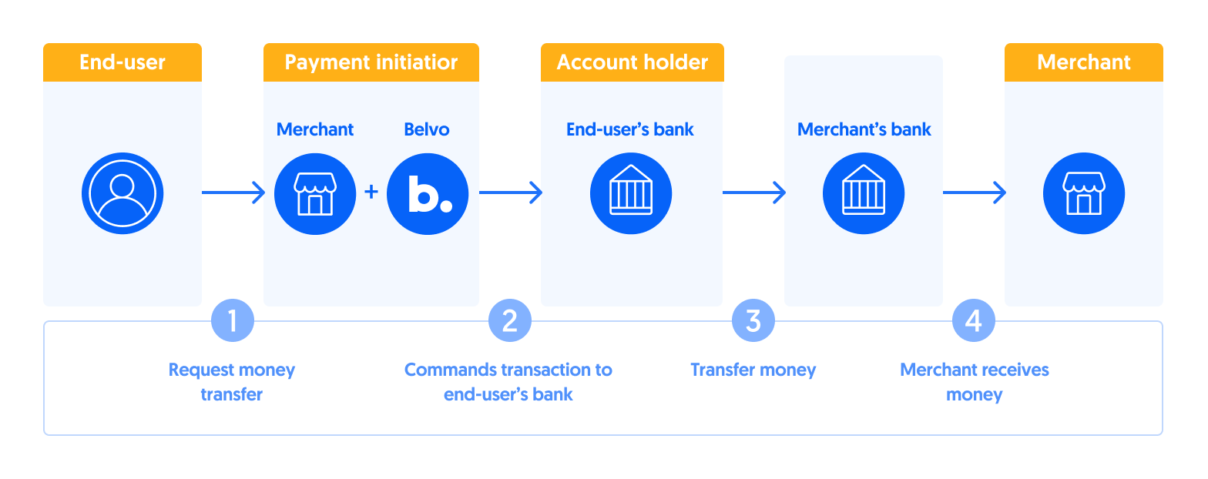

Payment initiation is a type of account-to-account (A2A) payment that’s enabled by open banking or open finance models, in which banks and other financial institutions make their customer’s financial data available to third parties through secure application programming interfaces (APIs), always with their consent.

As with any A2A payment, in these types of transactions, the funds from the payers’ bank account go directly to the recipient’s bank account, with no intermediaries.

Table of Contents

- What is payment initiation and how does it work?

- How does it work with Brazilian open finance?

- What are the benefits of payment initiation with open finance?

- Convenience

- Global trends in A2A payments

- What does it mean to be a payment initiator or ITP in Brazil?

- Why is payment initiation relevant to your business in 2023?

What is payment initiation and how does it work?

Open finance APIs allow for the initiation of payments directly from a user’s bank account to another account. This is done by providing the user’s bank account information to the API, which then initiates the payment on the user’s behalf. The payment is then processed by the user’s bank and the funds are transferred to the recipient’s account.

This typically involves the third party securely accessing the customer’s bank account and initiating the payment using the customer’s online banking credentials or other authentication methods.

Payment initiation is often used to enable customers to make payments through fintech platforms and other digital services, such as e-commerce platforms, and can help to make the payment process more convenient and efficient for both customers and merchants.

How does it work with Brazilian open finance?

In the case of Brazil, payment initiation is growing quickly thanks to the regulated environment and guidelines established by the Central Bank.

The regulated environment around open finance payments leverages the structure of Pix, allowing the same advantages of instantaneous payment with a low cost and adding the benefits of improved security, convenience, and conversion rates.

Currently, users can benefit from payment initiation through Pix keys. The way users can make payments using this method is by selecting the option to pay with ‘Open Finance’ at the checkout in digital platforms. After that, they will be automatically redirected to the financial institution where they will insert their credentials and confirm the payment.

The regulator is already working on leveraging payment initiation through Pix QR codes. Additionally, new features such as variable recurring payments, bulk payments and payments without redirect are predicted in the regulatory framework’s next steps for 2023.

What are the benefits of payment initiation with open finance?

Here are some of the key benefits of payment initiation with open finance:

Convenience

Payment initiation can make it easier and more convenient for customers to make payments through digital platforms and services. Instead of having to enter their credit card details manually, they can simply use the fintech platform or other service to initiate the payment on their behalf.

This system presents several advantages compared to other common payment methods such as credit cards, as well as Pix or boletos in Brazil.

Efficiency

Payment initiation can also help to make the payment process more efficient for both customers and merchants. For customers, it can reduce the amount of time and effort required to make a payment, and for merchants, it can enable them to receive payments more quickly and securely.

Security

Payment initiation involves the use of secure authentication methods, such as online banking credentials, to initiate the payment. This can help to protect against fraud and ensure that only authorized payments are initiated. Additionally, the customer’s sensitive financial information is not shared with the merchant, which can reduce the risk of fraud.

The same systems that are used to protect the secure access to customers’ accounts for open banking data aggregation are also in place to protect the sharing of banking credentials in payment initiation, including measures such as up to three layers of encryption. Additionally, there are complementary mechanisms put in place to protect the movement of money such as advanced anti-money laundering (AML) monitoring systems.

Conversion

Payment initiation with open banking has been widely used in Europe and the UK in recent years. The results seen in these markets show that the conversion rates with these payment methods surpass those typically achieved with other systems like credit cards. According to a report by Tink, the average conversion rate for first-time users of a payment initiation system ranges from 80% to 90% and usually goes above 90% for returning customers.

Additionally, according to data from Ebanx, alternative payment methods such as payment initiation help companies drive 4% higher-value tickets than credit cards.

Cost

Because the payment is made directly from the customer’s bank account, there are no additional fees or charges, which can be an advantage over using a credit card.

Global trends in A2A payments

During Open Views 23, the online event powered by Belvo, we had the chance to listen to representatives from some of the leading providers of account-to-account payment services globally: Tink, Truelayer, and Trusly. The A2A models, as Jesper Henriksson, VP of Corp Dev & New Markets at Tink, mentioned, have the best of many worlds to different parts of the ecosystem.

For end-users, it is a great experience that is fast, is familiar, a bank transfer that everyone knows, and reliable. For merchants, it’s low cost, low friction, low fraud, typically instant, and primarily available to every customer that has a bank account. For banks, it means the potential to track new customers and revenue streams and, for central banks and authorities, A2A payments foment financial inclusion and the move from cash to digital payments

Jesper Henriksson, Tink

One of the main examples that came up during this conversation was Brazil’s Pix, with its massive adoption in a little over 2 years of existence, and the potential of open finance to improve the customer and seller experience of this payment method and, through payment initiation services, offer 20% more payment conversion than the traditional Pix. With this in mind, we decided to offer a workshop for Brazilian innovators about A2A payments and Open Finance with Ana Luiza Castro, Belvo’s Senior Open Banking Manager.

You can also watch the workshop (in Portuguese) here.

What does it mean to be a payment initiator or ITP in Brazil?

The new payment initiation method is regulated under the Brazilian scope of Open Finance, directed by Brazil’s Central Bank (Bacen).

Under this model, institutions may offer payment services by acquiring or partnering with holders of the Payment Transaction Initiator (ITP) license from Bacen, such as Belvo. Having this license means that our Open Finance platform complies with the highest security standards and infrastructural guidelines from the regulated framework to move money in A2A payments, benefiting players such as e-commerce, ERP software, lenders and others to benefit from this solution without having to build and maintain themselves the necessary framework, all while having access to the full scope of institutions under the regulated Open Finance umbrella.

In Brazil, these players are represented by INIT, an association created by Belvo and other financial innovators to help set the framework for Open Payments and share best practices and interests among the payments market.

Why is payment initiation relevant to your business in 2023?

Statistics show that consumers are more and more inclined to use their bank accounts for digital payments. And this trend is particularly strong in Latin America: according to Americas Market Intelligence (AMI), the preference for A2A payment methods for the e-commerce sector has been growing by 86% since 2018. And by the end of 2022, they will represent a volume of almost USD 70 billion across the region.

Specifically, in the case of Brazil, 75% of adults already use Pix, the most popular A2A method nowadays. And payment initiation with open finance is expected to be the next step in this evolution as it offers an even better UX than the well-known QR method.

Want to be part of the next chapter of the digital payments transformation in Brazil? Sign up in Belvo and try our Payment initiation product in Brazil.