If you have heard about open banking and open finance before, you may well be confused and think they are synonyms. Learn the difference between them so that you will never be confused again.

Table of Contents

- In the beginning, it was open banking

- Now, it’s open finance

- In the not-so-distant future: it will be open data

On March 24th the Brazilian Central Bank officially launched the Open Finance project, changing the name to what used to be called Open Banking. Behind what seems like just a detail, we actually have a new structural regulatory framework for data exchange.

Although Open Banking is almost new in Brazil, this is already a subject that has been around for a few years around the world. It emerged in 2016 in the UK, when the FCA (Financial Conduct Authority) decided to open the data of financial institutions once it concluded that banks did not have enough competition to offer better services.

Open finance is nothing else than the evolution of this movement. And those who believe it stopped there are wrong: we have a long journey ahead of us, and Open Finance is not the end of it. Want to understand better? Let us explain in more detail what each of these terms means:

In the beginning, it was open banking

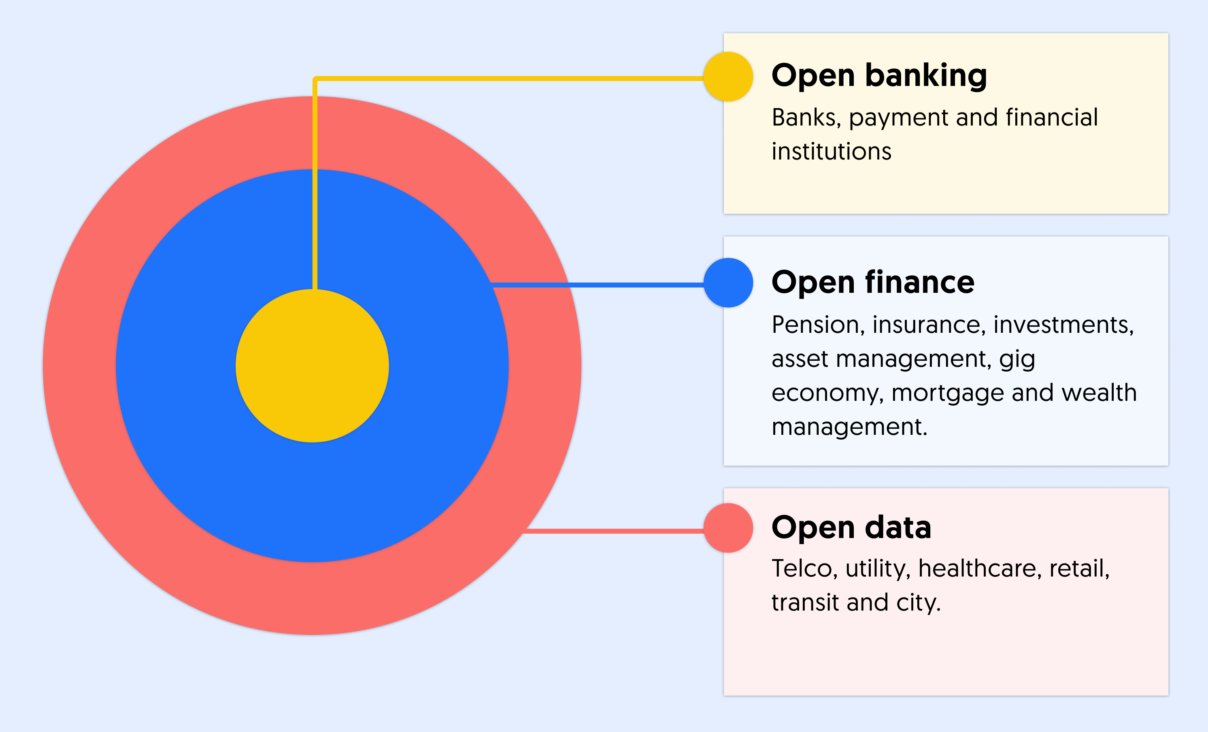

Straight to the point: Open Banking is the exchange of data and services between Financial Institutions (FIIs) and Third-Party Providers (TPPs). Still confused?

Prior to this regulation, all your financial information was trapped within a financial institution that owned them. As a result, the range of services that this entity was able to offer in relation to a third party ended up being quite limited.

With Open Banking, however, a revolution in the financial sector has taken place. The end-users are now the owners of their own financial data and they can share it freely with whomever they want, be it a financial institution or not.

This has opened up space for a whole new range of financial services and products, such as innovative credit models to support the growth of startups and SMEs, the automation of corporate financial management, or various portability solutions.

Behind all this information traffic lies the almost invisible work of APIs (Application Programming Interface), the tool that allows financial data to travel from point A to point B quickly and securely.

Now, it’s open finance

The advances coming from Open Banking in Brazil have been sensible: from the arrival of the popular PIX to an appreciable increase in the number of bank users in the country, the new regulation has already arrived showing results.

However, it was possible to go further.

In a country with historically high informality rates, it is naïve to think that the most global view of Brazilians’ financial activities is restricted only to financial institutions.

“In the case of Brazil and Latin America as a whole, the more sources of financial data you have on the platform, the better it will be for the companies that use it to create innovative financial services or applications.”

Pablo Viguera, co-CEO and co-founder of Belvo.

So Open Finance is nothing but the next step in Open Banking. The difference between the two is that now with the new Open Finance regulation, not only financial institutions must share data, but also other entities such as investment services, insurance, and pensions.

This is a great advance for the presence of more and more innovative financial services in the country, improving the lives and financial management of both people and companies in the country.

In the not-so-distant future: it will be open data

The movement does not stop there. In the near future, access to data will be increasingly mobile and democratized, and not only the institutions listed above will have to share it. After all, a lot of transactional data may be hidden in the most diverse places: be it in retail, in public services, or even in healthcare-related expenses.

Open data is not only a promise but the obvious next step in the path that the whole world is taking. With this significant amount of data coming in, we will increasingly have financial products and services tailored to each person, according to their financial habits.

Behind all this information sharing, we cannot forget the work being done to have a technological infrastructure capable of moving this data efficiently and securely. After all, there is a big difference between “let’s do it” and “how to do it”.