Financial data APIs are completely reshaping the financial sector. These pieces of software allow the communication and exchange of data between different platforms, such as banks or fintechs, to provide new financial services and products in a completely secure way.

Table of Contents

- What is an API?

- Open banking APIs and their impact in Latin America

- Different types of financial APIs

- Use cases and examples of financial APIs in real life

- Main benefits of financial APIs

- Open banking API providers

Financial APIs are becoming an increasingly relevant source of opportunities for financial innovators, such as fintech companies in Latin America. But not only: traditional financial players and customers are also benefiting from them.

What is an API?

An API (Application Programming Interface) is a type of software that allows online applications to communicate between them. APIs are also gateways to facilitate and strengthen data exchange in a very accessible way. They have become ubiquitous because they simplify the way developers interact with new services and/or products. According to a Boston University study, it is estimated that by 2025, 30% of the world’s revenue will be generated through APIs.

There are open and private APIs. The first ones allow companies to facilitate the work of third-party developers to build external services on top of their data. A common example of this is how companies can embed Google Maps inside their apps using Google’s APIs.

When interacting with financial applications, APIs can facilitate access to users’ information, transactions, and payments. Banks have been using APIs for many years, but mainly for internal usage. With the emergence of open banking regulation and the growth of fintech companies, financial open APIs have become an essential tool for the modernization of the financial sector as a whole.

Open banking APIs and their impact in Latin America

APIs are fundamental for the development of open banking because they have been the chosen system by regulators to allow third-party service providers to access consumer data from financial institutions –always with their express consent.

In terms of regulation, countries across the world are implementing their own open banking rules and procedures. In Latin America, countries like Mexico and particularly Brazil are taking important steps to regulate this new model and make it mandatory for financial institutions to share their customer’s data using this technology. While this ecosystem takes shape, API providers are already making it possible to develop open banking products in the region.

Thanks to the transparency and agility that APIs allow, many fintechs are developing new financial services based on these platforms to meet the specific needs of the population.

A high proportion of Latin America’s population still lacks access to banking services; and in some countries above 50% of the population doesn’t have a bank account with a financial institution. The expansion of APIs is helping companies such as credit providers, personal finance management applications, or neobanks to lower their costs, be more agile, and improve the user experience.

In this context, fintechs and financial institutions can increase and improve their financial product offerings and cover a greater part of the market and population thanks to API-based solutions.

Due to the sensitive nature of the data transferred in real time, security is one of the core concepts in open banking. APIs must be robust and reliable for all the stakeholders that interact with them. Companies using them to exchange financial data typically require high standards in protocols to preserve the confidentiality, integrity, and availability of data at all times.

Different types of financial APIs

Thanks to APIs, the banking sector is becoming more open and transparent. To have an overview of the type of APIs that banks and fintechs are able to use, we can divide them into the following categories:

| Type of API | Definition |

| ℹ️ Information | Access is given to information about the profile of authenticated users (individuals or companies), speeding up registration. |

| 💡 Product | Those that give access to detailed information about the entity’s available products, such as currencies, loans, or investment products, among others. |

| 💵 Payments | Allow the institution to obtain all the information related to the payments made as well as to execute operations on behalf of the user in a secure way. |

| ⚙️ Accounts | Allow to obtain details of the account of individuals or companies such as transactions, balance, and history of movements. |

| 📊 Investments | They give access to information about users’ investments, investment portfolios, products, or financial market data. |

| 💳 Cards | They provide information about the movements made with the cards and the status of the availability as well as deferrals. |

| ⚖️ Loans | They provide information about the granting of loans and the credit analysis of customers. |

| 📈 Movements | Companies that are PISP (Payment Initiation Service Provider) authorized can ask for permission to connect to a bank account and initiate payments on behalf of the client from their bank account. |

Use cases and examples of financial APIs in real life

To meet new customer and market demands, financial institutions and fintech companies are increasingly delivering more personalized, omnichannel and instantaneous customer experiences. And APIs are the centerpiece of this model. The multiplicity of financial APIs can contribute to the creation of new services and facilitate advanced fintech services.

These are some of the most common uses cases that financial data APIs are already facilitating:

- Personal finance management: companies can increase user’s financial health through account consolidation, better spending analytics, and proactive recommendations.

- Credit: companies can increase their risk assessment, reduce fraud risk, and build innovative as well as secure experiences for borrowers (both for B2B and B2C).

- Accounting & ERP: companies can reduce manual errors and costs via automated accounting, simplified expense management, and smoother invoicing.

- Onboarding: companies can simplify onboarding and verification processes by accessing real-time and up-to-date financial information.

As we mentioned earlier, there are now APIs for a huge number of applications and businesses, and Belvo’s Open Finance API is an extension of the examples mentioned above. Thanks to our catalog of financial institutions, companies can connect to a wide range of financial data sources including: banks and fiscal institutions.

Now, let’s look at some real-life examples of how companies are using these APIs to access and interpret their end-users’ financial data and building their own services on top of it:

Buy now, pay later

When we look at Aplazo, a fintech company specialized in the business model of “Buy now, pay later”, they’re using data aggregation to gain financial information based on their customers’ transactions and accounts. They’re able to gain better insights about their payment capacity to offer better quality loans, reduce risk, and generate real financial inclusion for all the population that doesn’t have a credit card or credit history. The result? Their credit approval rate increases close to 30% for users without a banking history.

Proptech

Another good example of how to use financial APIs to increase transparency and ROI is to look at the solution developed by Nirica. They are a proptech startup based in Mexico, tackling the challenges of supporting the real estate sector to lease properties in a much faster, simpler, transparent, and secure way. Nirica is using our Income Verification solution to access enriched data for users looking to rent a property. They now have the ability to identify the income and payment capacity of prospective tenants in real-time and in a secure as well as transparent way, thanks to open banking.

Main benefits of financial APIs

This new API-based financial ecosystem is opening doors to a whole new range of financial products, providing consumers more personalized services at a lower cost. For organizations, it means better information when assessing the lending risk of a retail client, having a 360-degree view on a business, getting deeper insights before investing, and much more.

- More information, less risk: thanks to open banking’s transparency and “free access” to banking information, previously excluded consumers and businesses will gain access to some financial products and services.

- Improved services: with a more detailed view on a customer’s financial data, financial providers get a better understanding of the situation and offer more granular services, products, and advice.

- User experience optimization: thanks to open banking, the workflow and paperwork regarding bank loans, opening a new bank account, or any type of bank process, is simplified and processing time reduced.

- Fraud detection: financial institutions can now prevent fraud more efficiently by accessing information through different sources. Thanks to the appearance of more secure interfaces, the identification and authentication of customers is improved.

Open banking API providers

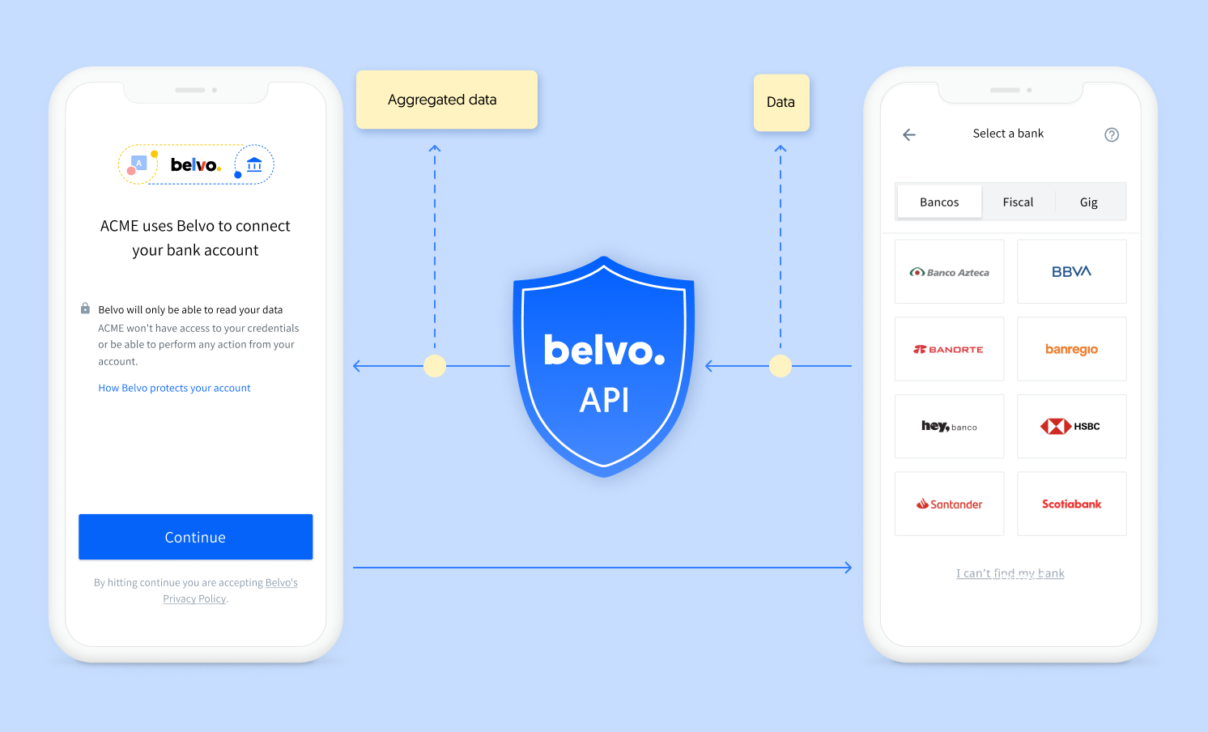

At Belvo, our mission is to unlock the power of open finance in Latin America. To do so, we built a set of APIs that allows companies to connect their apps to financial data from a wide range of financial institutions.

Connect to our API in less than five minutes and start to build your own application directly in our sandbox environment.