At Belvo, the leading Open Banking API platform in Latin America, we’ve achieved many milestones in 2020. But 2021 is even more promising and we are excited for the year to come.

This has been a long, challenging year for everyone. The sanitary crisis has had an immense impact on our lives on both a personal and professional level. And we know the great effort that many of our clients and partners have made during these past months to keep building and making their businesses grow.

It’s been an honor for us to walk side by side with them and a real privilege to watch the amazing work they’ve put together to create successful products and services across Latin America despite the circumstances. That’s why we wanted to take this opportunity to thank all of them for their trust and for accompanying us on our journey.

A trusted Open Banking API platform

We officially launched Belvo at the beginning of the year, and during the past 12 months we’ve moved from signing our first client, to working with dozens of companies across Latin America. The pandemic hit right after we started operating but we were able to quickly adapt to the context. In fact, our company and our team, were born during the crisis, and we believe that makes us more resilient and well positioned to face new challenges in the future.

Our API platform is already trusted by some of the leading financial innovators across several verticals in the region. Some of them are Minu, who’s helping companies improve the financial wellbeing of its workers in Mexico; Smart Lending, a company offering mortgage loans through a digital platform; and Nelo, a startup that’s built a digital wallet for payments, transfers and credit offering. Also Tribal, which has created a corporate card to help startup workers manage their expenses; the Colombian Sempli, a startup offering credit solutions for SMEs; and Mobills in Brazil, a leading personal finance management application with over 8 million downloads; among many others.

This means tens of thousands of users are already using Belvo to share their information and access to better financial services.

Company growth

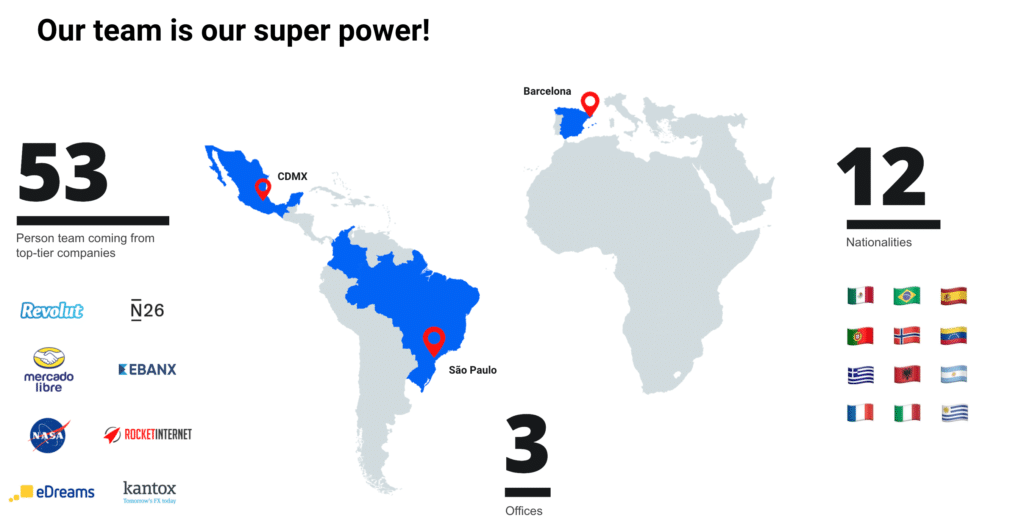

In May we announced that we raised a $10M round to continue supporting the next generation of financial innovators across Latin America and double down on our vision. And our growth has been steady throughout the year: our team has grown to over 50 people during the last year, that’s four times how many we were at the beginning of 2020!

We are already helping companies to create innovative financial products and services across Mexico, Colombia and, just recently, in Brazil, where we are growing fast and have already added coverage for our first digital bank.

Increased coverage

Our financial API platform is scaling fast and processing tens of thousands of connections every month, allowing companies to easily connect to users’ data from banking to fiscal. Just in the last quarter of 2020, we added 15 new institutions to our coverage.

This year we also started creating and sharing insights and resources with the community: we launched our first report about ‘The State of Open Banking in Latin America’, a ‘Guide for Open Banking Use Cases’, and organised our first webinars around fintech and regulation.

Big plans for 2021

And we also have big things coming in 2021! We are already working closely with our clients to deliver the type of Open Banking solutions they truly need. For starters, we plan to continue expanding our institutions coverage by adding new banks in all countries where we operate next year.

We will also continue exploring alternative data sources that can help our clients have a better vision of their users’ financial needs.

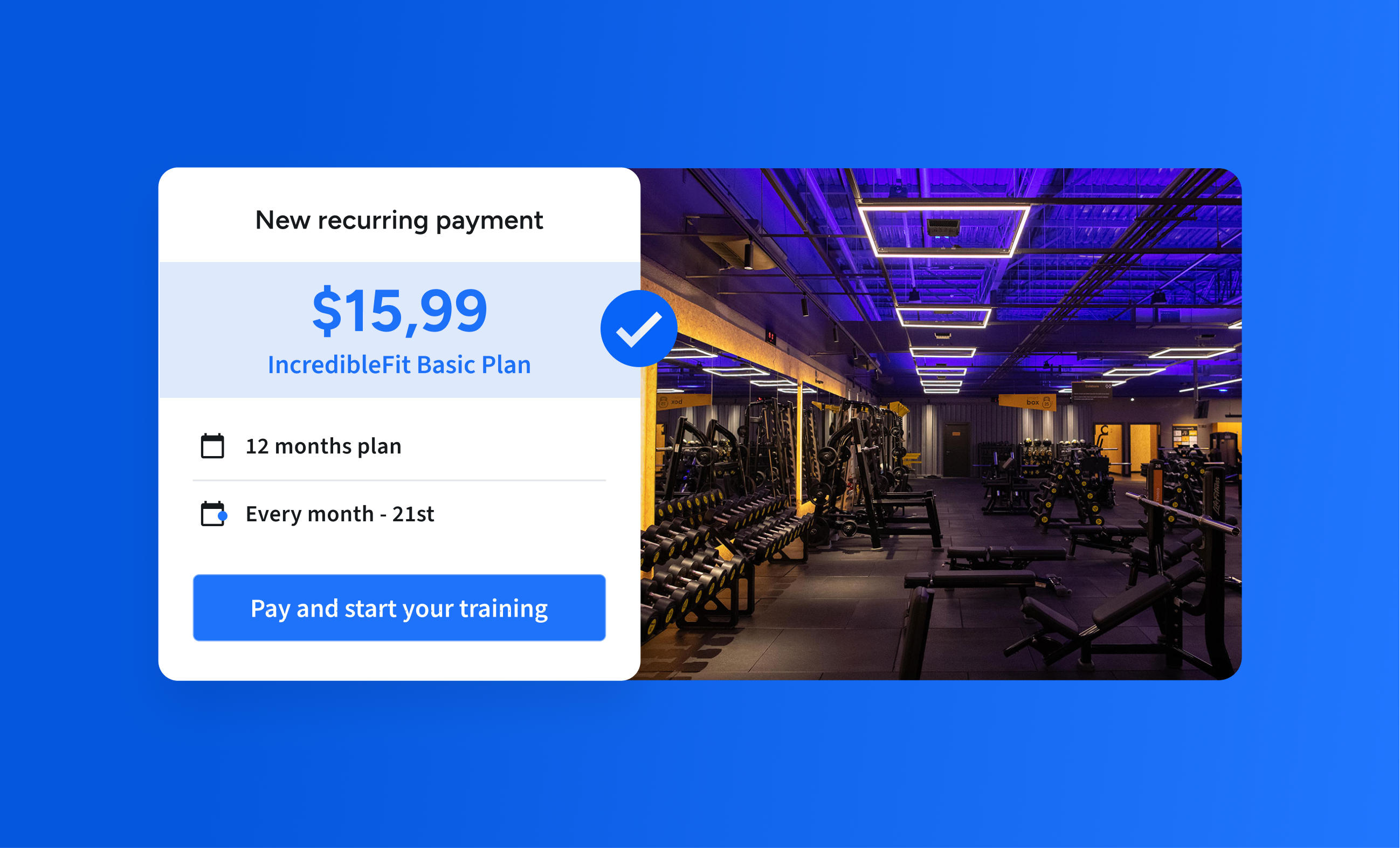

Soon, we will launch our first data enrichment solution based on Open Banking APIs, which will provide companies with an overview of useful and specific data points about their users’ financial activity like income verification, credit scoring insights and financial reports.

And our team is also already developing new solutions for bank-to-bank payments initiation through our platform. An area we have already started working on in both Mexico and Brazil and will expand during the next year.

This year we were able to successfully build our product and we validated that the technology we’ve built works really well, reaching various dozens of clients and tens of thousands of end-users. And we believe this is only the beginning. During 2021 we will continue to grow and bring our Open Banking API platform to another scale, thanks to our incredible team.

If you have any wishes for next year, don’t hesitate to get in contact with us and if you want to join our team visit our careers page. We’d love to hear from you and help you achieve your goals in 2021 and beyond.

All the best from Pablo, Uri, and the entire Belvo team.