Lending

Enhance credit decisions with open finance

Access up-to-date and enriched financial data to improve your credit scoring and underwriting models. Automate your loan collections through direct debit or Pix Agendado while reducing manual workload.

Trusted by the leading financial innovators

Accelerate and optimize credit decisions

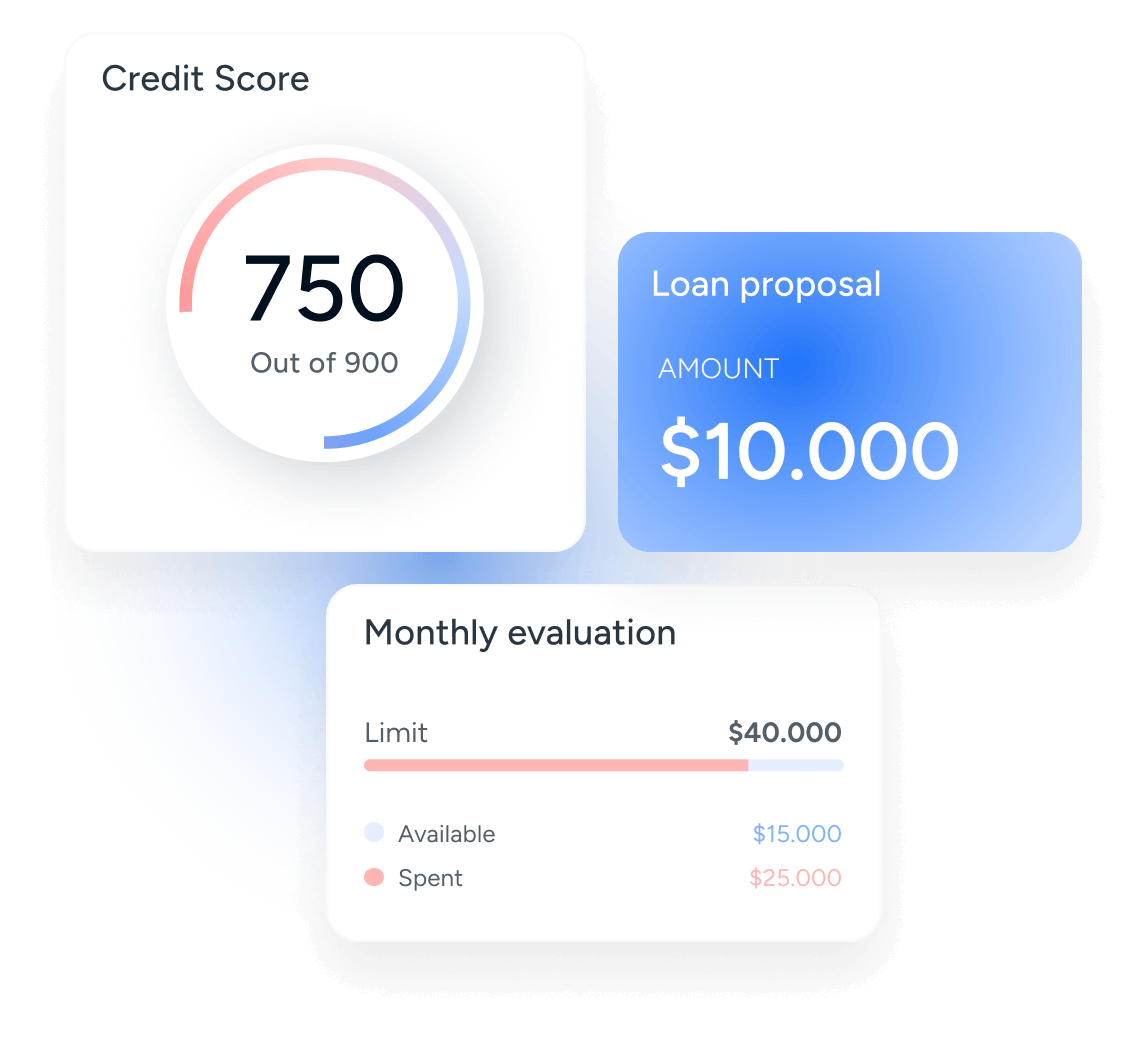

Reduce credit default risk by 50%

By combining automated data collection and tapping into new data sources, lenders can determine customers’ payment history more accurately.

Identify and reduce frauds

Speed up users’ onboarding by instantly verifying their identity, income and financial health with real-time data from their bank accounts.

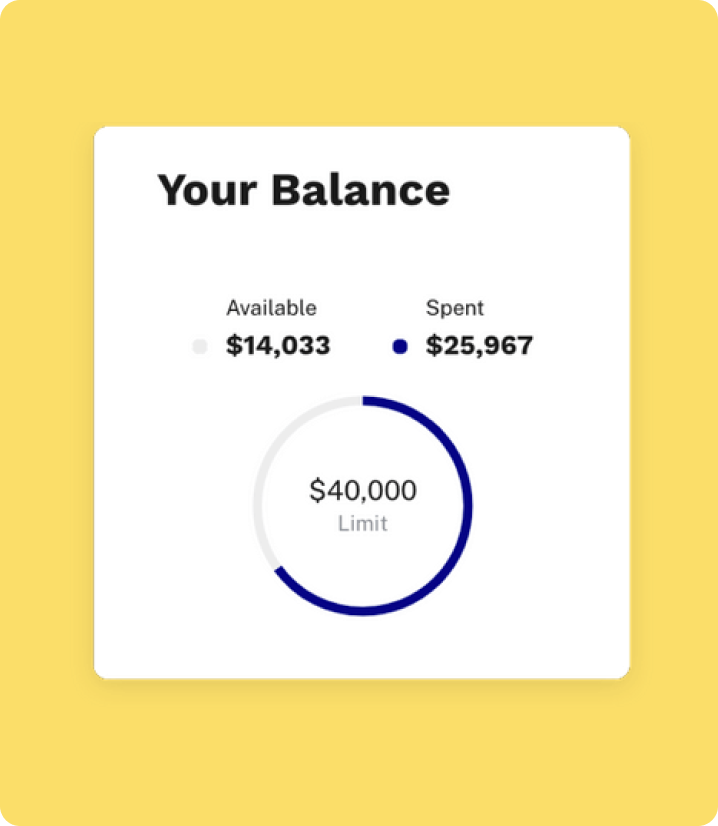

Increase your credit funnel

Access alternative sources of financial data and reach a wider range of customers, expand your loan applicant pool while increasing your loan acceptance rate.

Automate credit recollection

Implement direct debit payments to collect your loans and settle credit card debts automatically. Reduce the risk of default and enhance your daily credit operations.

Make your credit decisions more efficient and inclusive with open finance

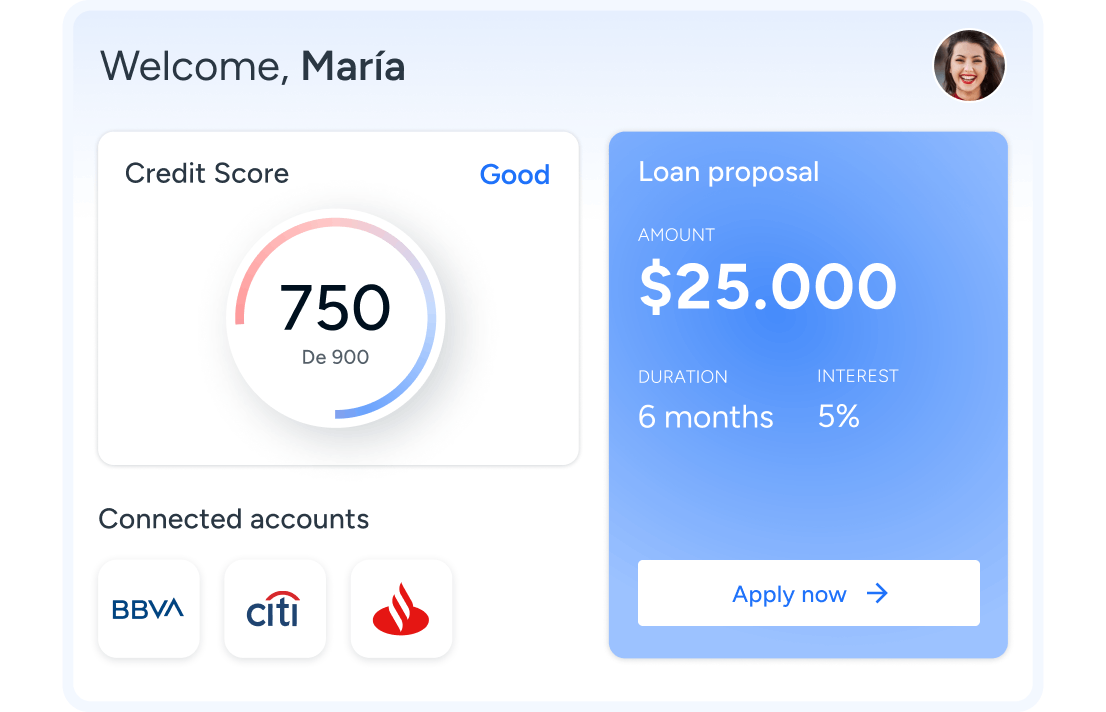

Offer tailored products based on users’ financial transactions

Access customers’ transactional data as well as different financial products contracted in other institutions to determine their consumption patterns. Through open finance data, decrease payment default risks by 50% providing tailored offers with more suitable repayment conditions and increase credit approval rates up to 30%.

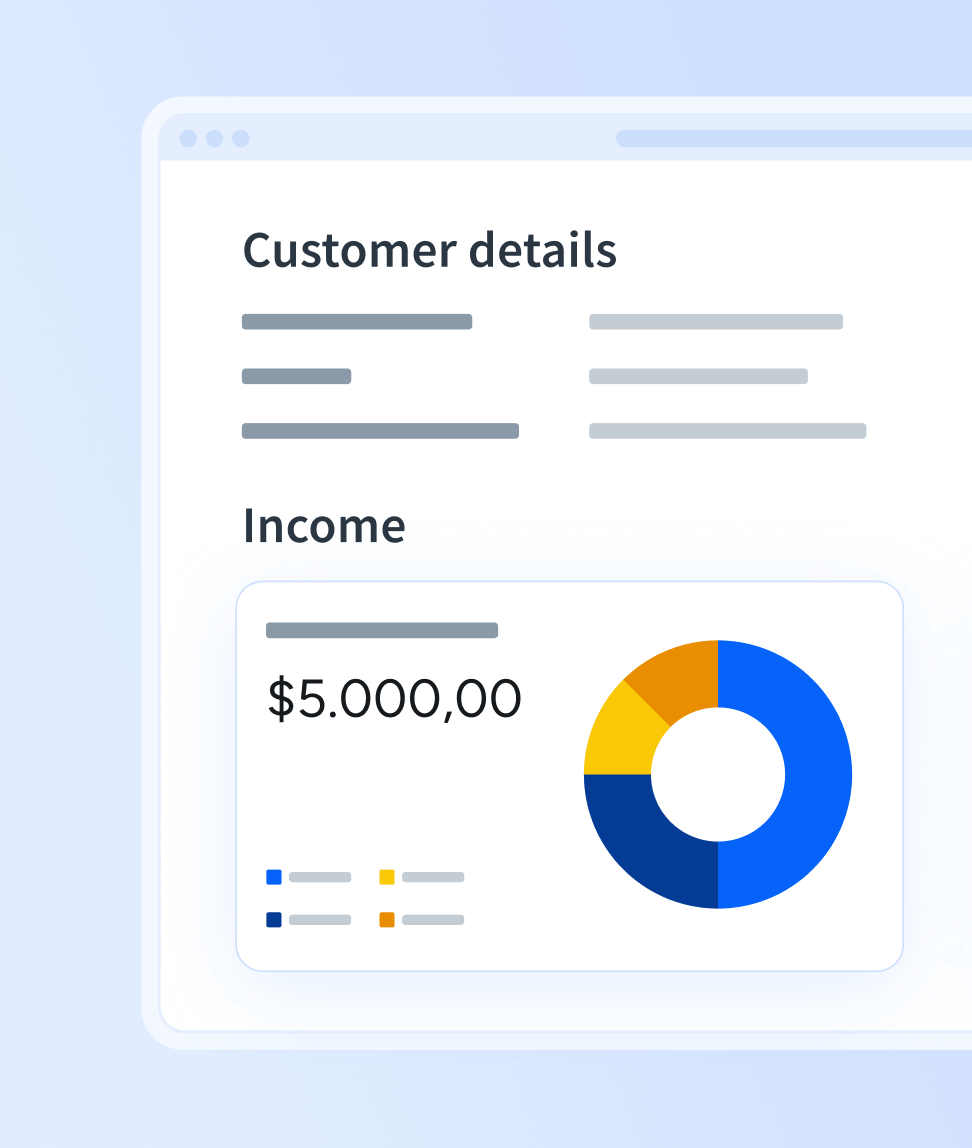

Streamline loan application processes

Remove hassle from the traditional KYC lending process by offering customers a seamless onboarding experience to set up their financial profile. Access KYC details, account information and clean transactions while eliminating manual tasks. By accessing real-time financial data, lenders reduce friction and errors while streamlining the loan application process.

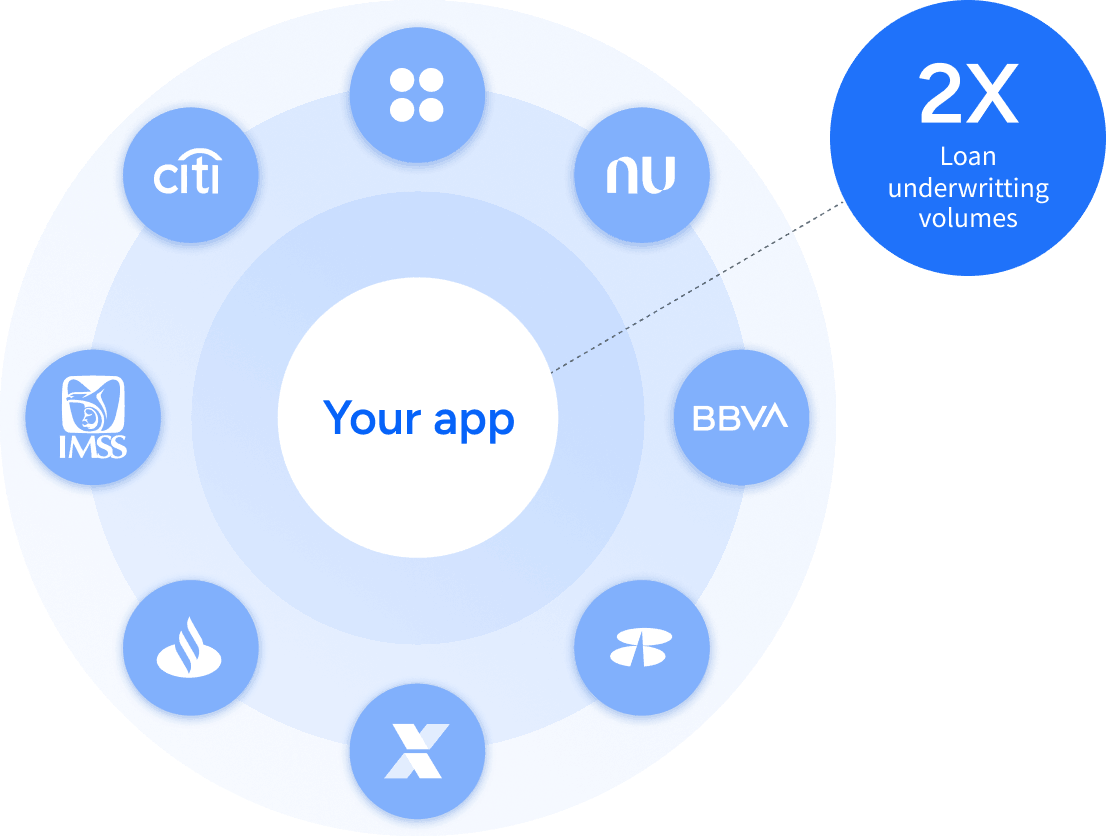

Expand your customer base with less risk

Open finance data unlocks new audiences using third-party channels and alternative sources of financial information. By leveraging positive data such as income as well as data from sources such as fiscal entities, you can feed new customers in your credit funnel and increase your loan application pool. Multiply your loan underwriting volumes by 2 while consolidating your creditworthiness.

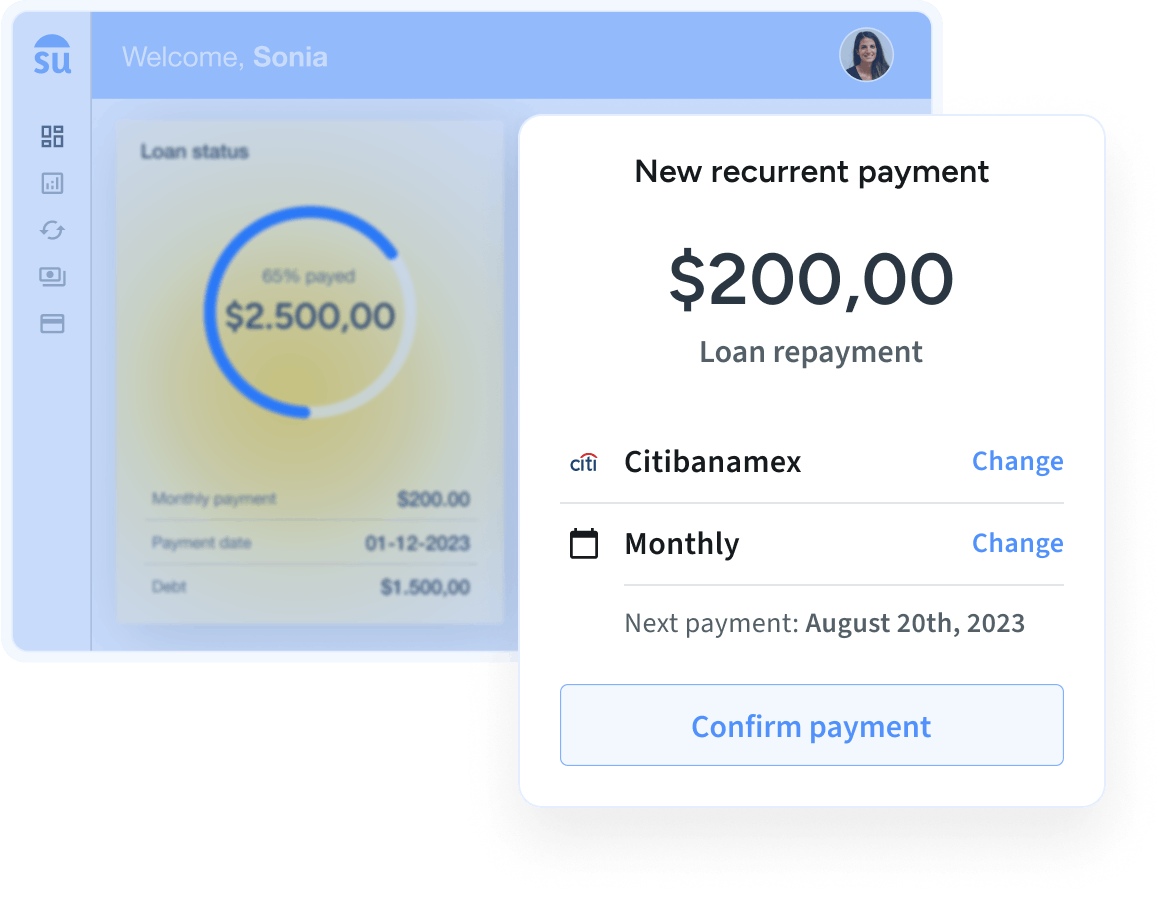

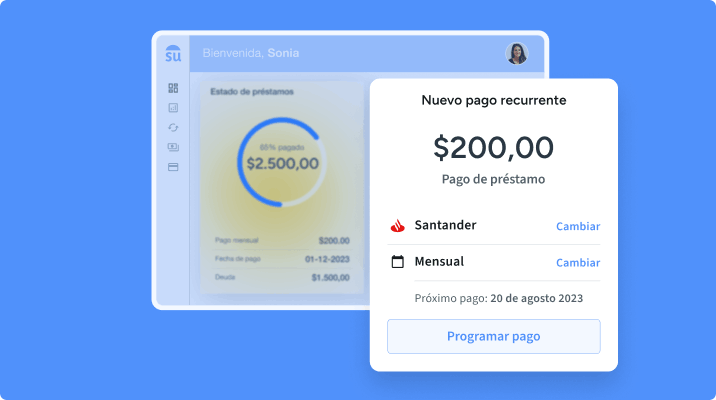

Reduce default rates with direct debit

Automate collection and settle credit payments efficiently and securely with direct debit payments. Decrease default risks and improve your recollection management by allowing users to schedule their payments directly from their bank account on the due date.

Analytics: our no-code feature for lenders

Through Belvo’s dashboard, access and visualize raw banking, fiscal or employment data as well as income or categorized transactions.

Without writing a single line of code, lenders can access open finance data ready to download in XLS format.

Related guides & Docs

What’s direct debit and how it works

Discover Pix Agendado

Pix Agendado is a feature of the Pix payment system in Brazil that allows recurring payments. (Content in Portuguese)

The state of A2A payments worlwide

From the US to Europe and Latin America, the adoption of account-to-account (A2A) payments has been driven by a combination of factors including cost-effectiveness, convenience, and technological advancements.

We can’t wait to hear what you’re going to build

Belvo does not grant loans or ask for deposits