E-commerce & retail

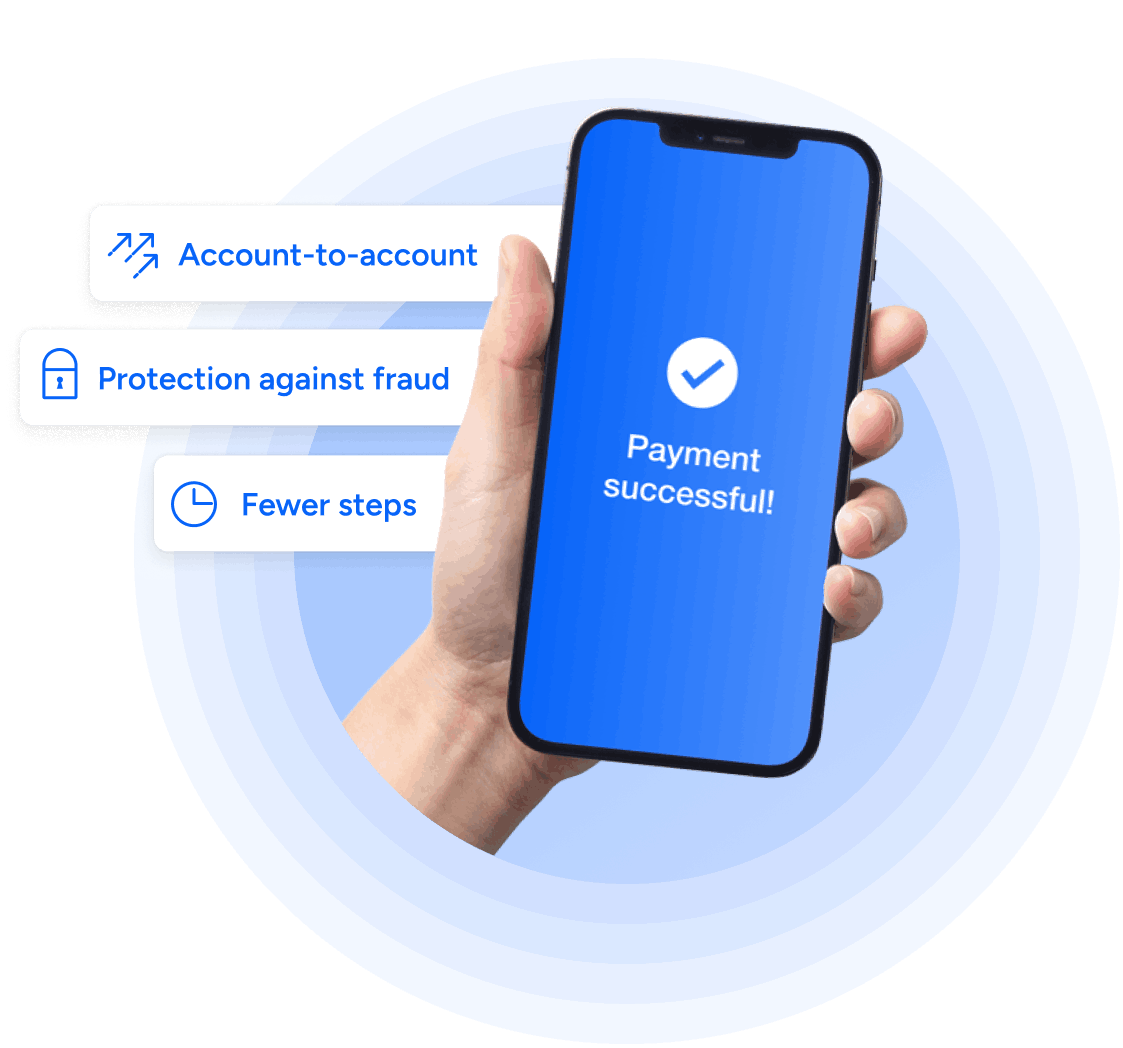

Optimize your checkout experience

Instant transactions through open finance payments can help you boost sales and conversion rates while keeping fraud down.

Trusted by the leading financial innovators

Maximize conversions and combat fraud

Boost sales with an optimized experience

Benefit from the same cost per transaction from Pix or direct debit while offering a smoother experience with increased conversion rates.

Verified and less fraud-prone payments

Reduce fraud risk thanks to real-time bank authentication ensuring that only authorized and verified payments are made.

Reduce dropout rate

Pix via open finance payments require fewer steps than Pix copy/paste. Provide an uninterrupted user flow where users are less likely to abandon the process.

Use cases

Discover all the possibilities of open

finance for e-commerce

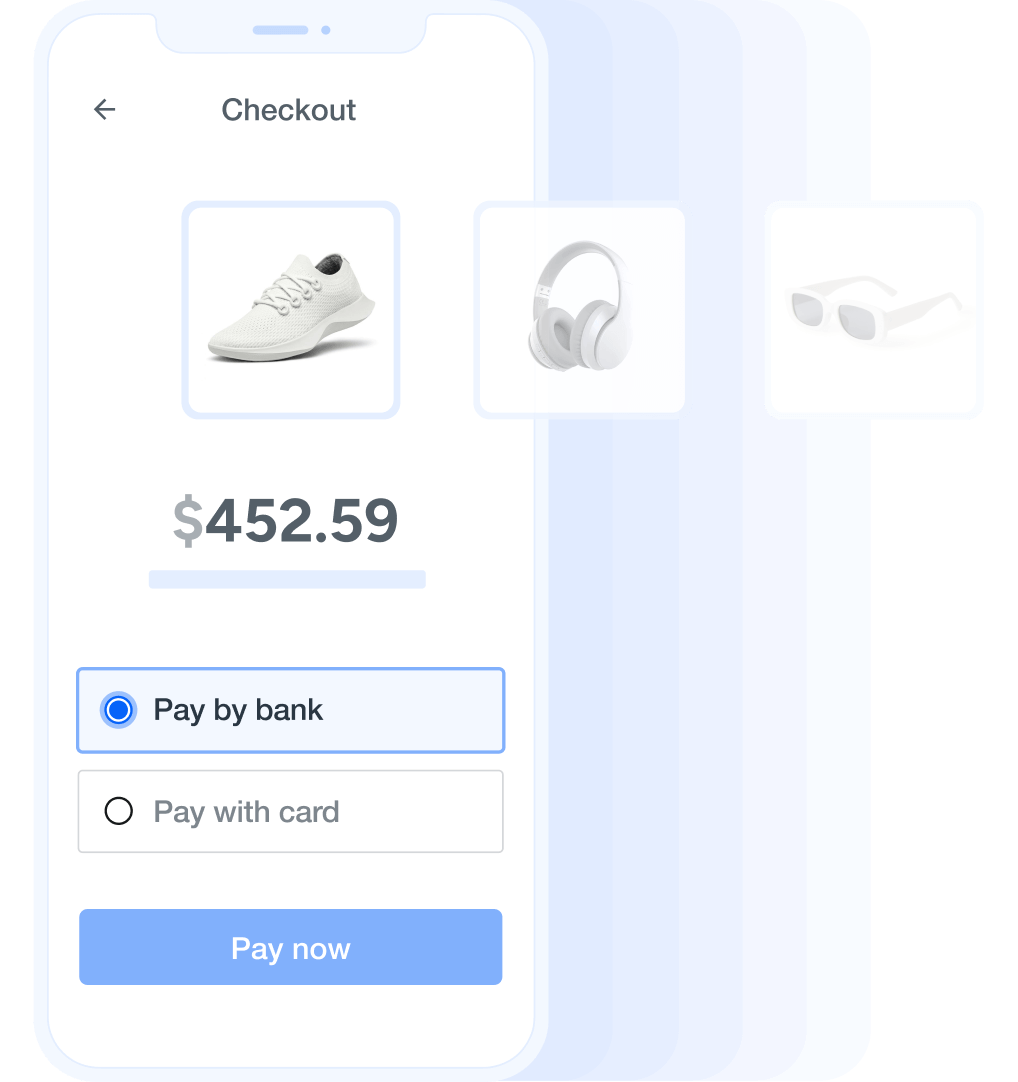

Convert more buyers with seamless payments

Account-to-account payments are the perfect fit for retail and e-commerce trying to reduce abandoned carts. Provide an uninterrupted buying experience with fewer steps and more protection against fraud while maintaining the same cost per transaction.

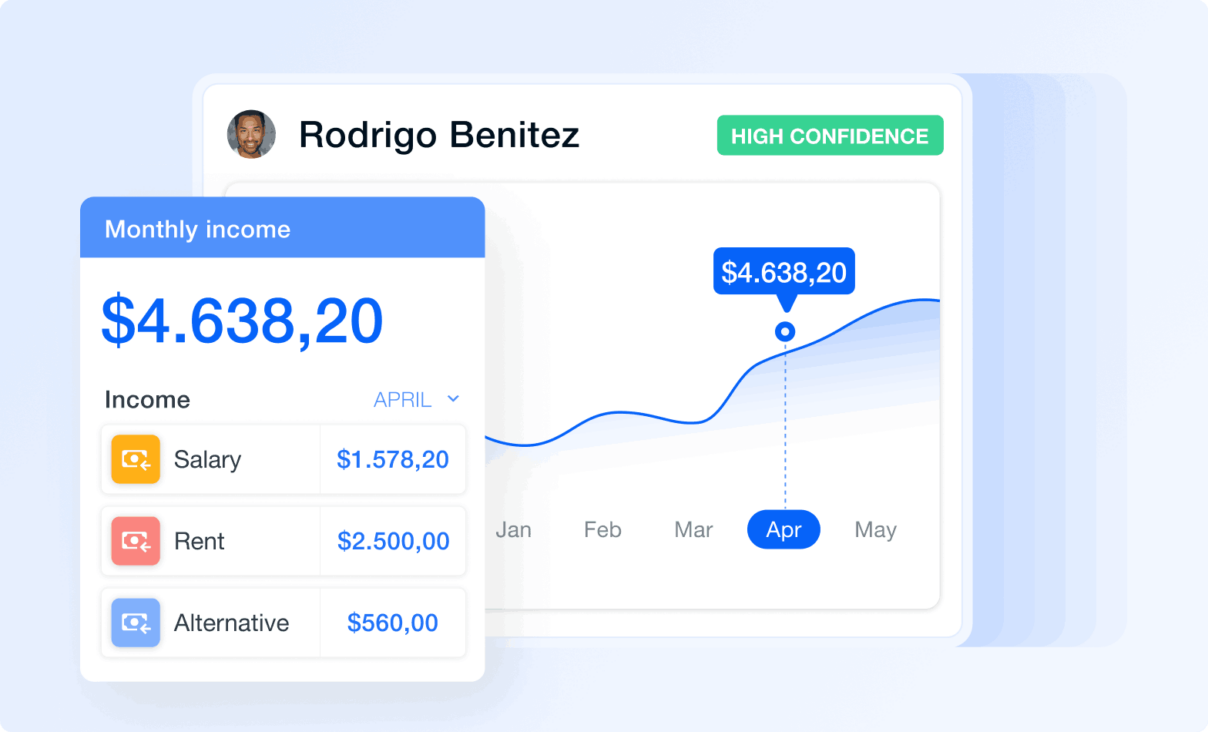

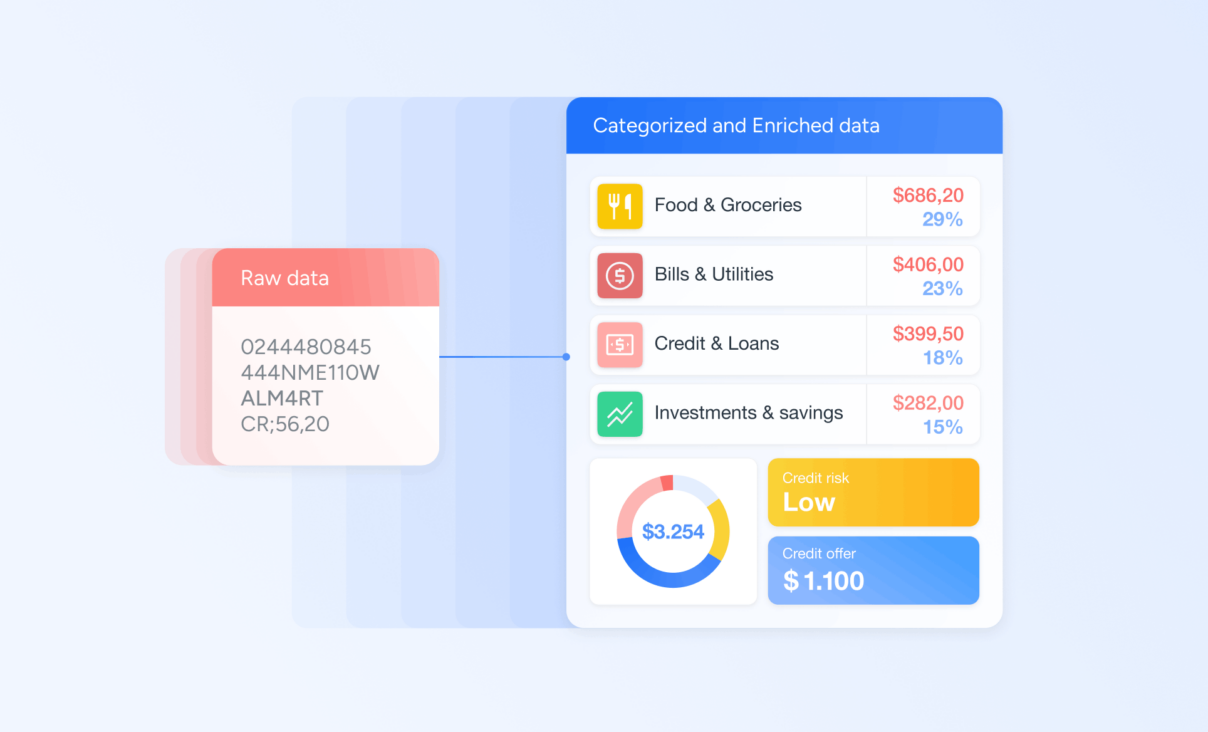

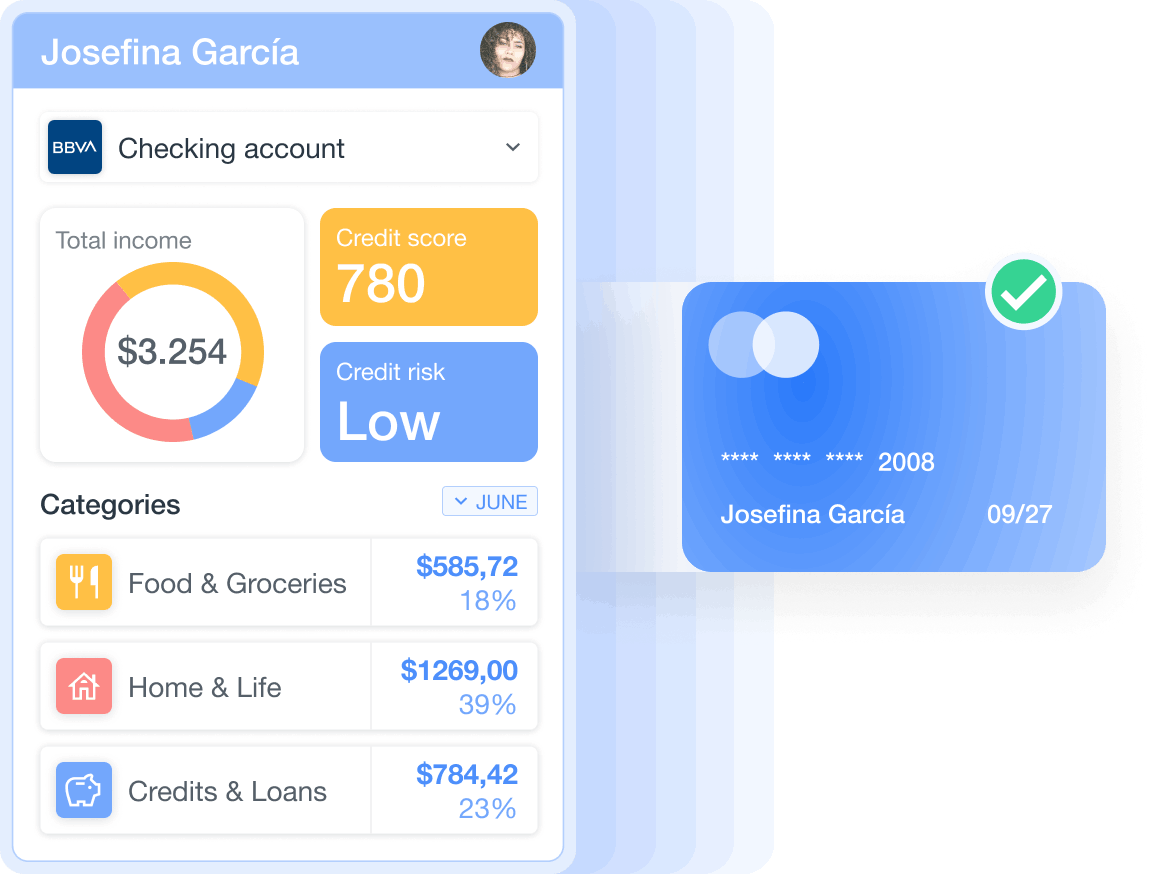

Faster credit card issuing

Create smooth built-in features to issue credit directly through your e-commerce platform thanks to direct access to customers’ bank accounts information. Quickly identify customer spending patterns, income and financial risk to better target credit offers and increase approval rates.

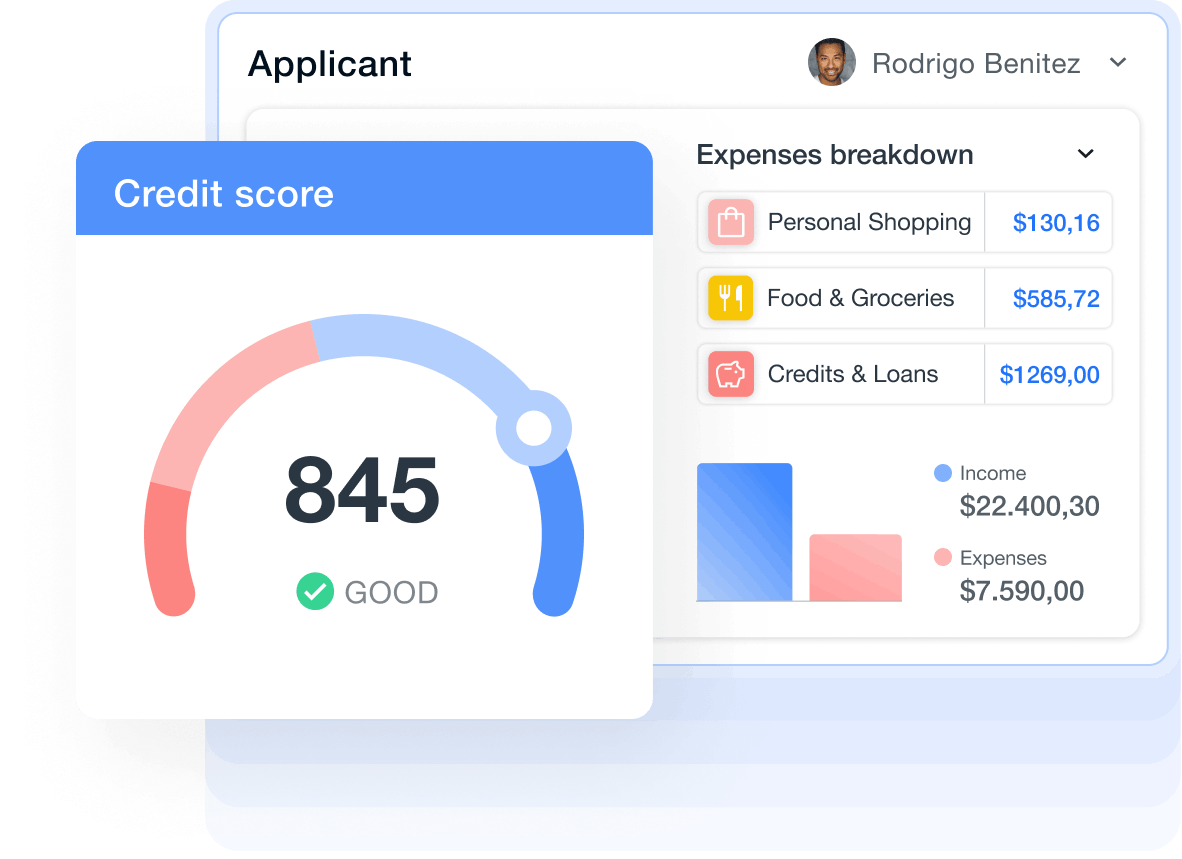

Increase the lending volume with the same risk

Easily access detailed data on customer financial behaviour to increase approval rates and lower default rates, directly through your e-commerce platform. Boost your retargeting efforts to market credit offers to both B2B and B2C customers.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits