In our latest conversation with Uri, co-Ceo at Belvo, we explore a topic that is rapidly shaping the future of the financial landscape: Artificial Intelligence (AI) in open finance. With the advent of open finance, AI models can now tap into a vast reservoir of financial data, offering transformative opportunities for financial institutions. In this blog post, we explore how AI is applied in financial data, the challenges it faces, and the evolving role of companies like Belvo in this dynamic environment.

Table of Contents

- The role of AI in the financial ecosystem

- Use cases of AI in finance

- Challenges in applying AI to financial data

- The role of Belvo in shaping the future

- Conclusion

The role of AI in the financial ecosystem

We can start by distinguishing between two critical aspects of AI in finance: using AI and generating AI.

- Using AI: This refers to the current applications of AI that aim to automate and enhance financial processes. For instance, many financial institutions are leveraging AI to minimize human intervention in tasks such as customer support and data analysis. This automation can significantly streamline operations, allowing firms to process complex data, images, and videos much more efficiently.

- Generating AI: This concept revolves around creating new AI models tailored for specific financial applications, like underwriting loans or segmenting users for targeted marketing. While the financial sector has long utilized AI, the real potential lies in automating the generation of these models, especially as the amount of data increases.

Uri notes that while financial data is inherently structured, the challenge lies in the increasing complexity of this data. Historically, financial institutions have relied on well-defined models that have served them well, but as the data landscape evolves, there is a growing need for more adaptable and sophisticated AI solutions.

Use cases of AI in finance

When discussing the practical applications of AI, Uri outlines several promising use cases:

- Automating client support: By reducing response times and streamlining processes, AI can enhance customer experiences. Companies like Klarna have already implemented these solutions effectively, demonstrating significant improvements in operational efficiency.

- Creating predictive models: AI can revolutionize traditional practices such as loan underwriting and marketing campaigns. The ability to quickly analyze vast amounts of data opens the door for more accurate decision-making and personalized financial products.

Uri emphasizes the importance of transitioning from unique, manually generated models to a framework where models can be built dynamically to accommodate a wide range of use cases. This shift is crucial for maximizing the potential of financial AI.

Challenges in applying AI to financial data

Despite the potential benefits, several technical challenges must be addressed:

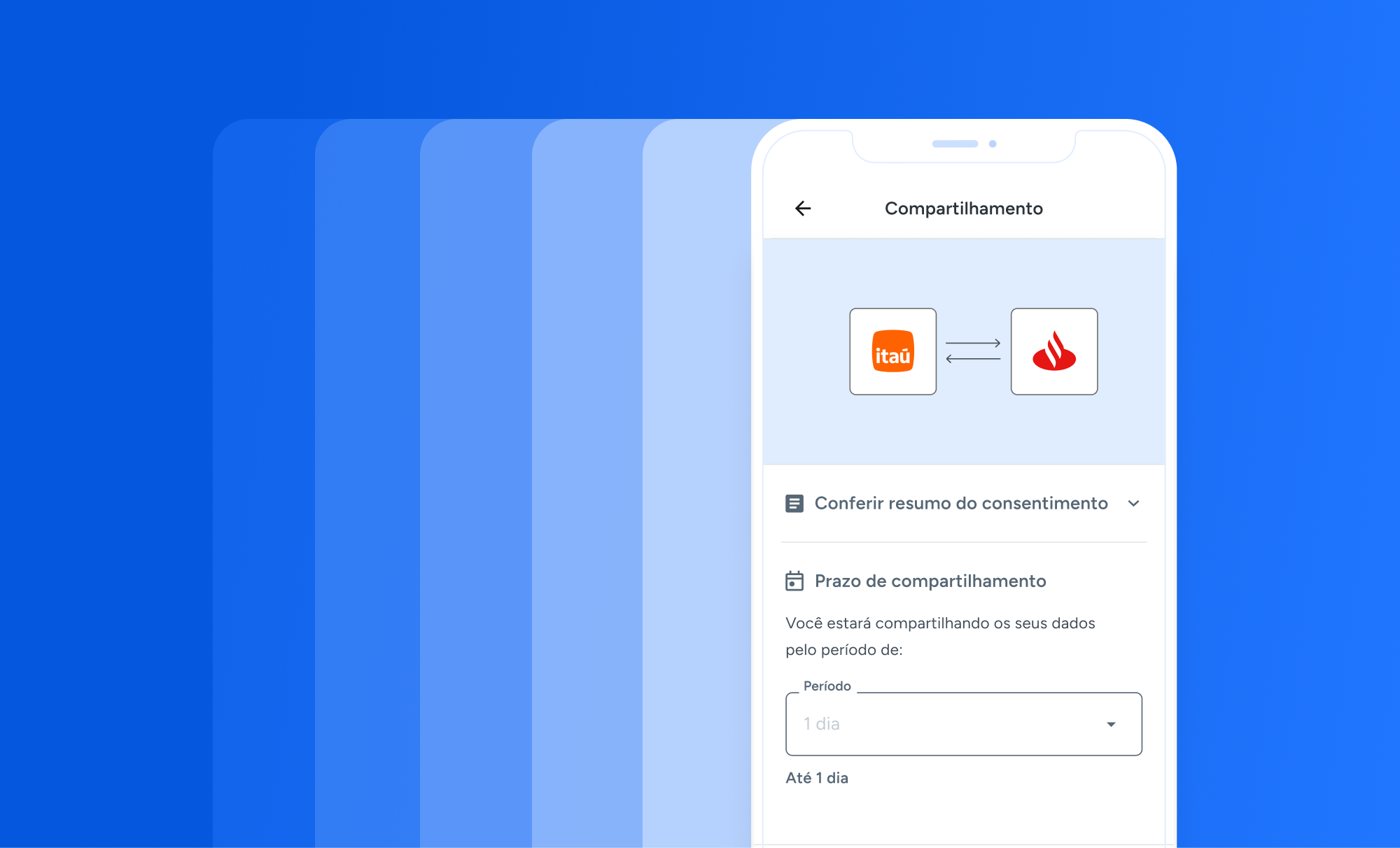

- Data access: Unlike the general internet data used to train models like ChatGPT, financial data is often proprietary and siloed within institutions. Gaining access to this data remains a significant hurdle.

- Data understanding: Financial institutions have historically structured their data in ways that are familiar to them. However, as new data sources emerge, there is a critical need to develop an understanding of these datasets to leverage their full potential.

- Model complexity: As financial models evolve to incorporate thousands of variables, traditional methods of model building become impractical. This necessitates the development of new approaches that can efficiently handle complex datasets.

- Democratizing financial AI: Uri points out that while banks are likely to create AI models for their benefit, there is a pressing need to democratize access to this technology. Companies like Belvo are positioned to bridge this gap by providing access to data and the expertise needed to leverage it effectively.

The role of Belvo in shaping the future

Uri highlights the critical role that companies like Belvo play in the emerging landscape of financial AI:

- Building Foundational Models: Companies with access to diverse financial data are uniquely positioned to create foundational models that can serve a range of financial applications. This foundational work is essential for fostering innovation across the industry.

- Market Education: Another key responsibility lies in educating stakeholders about how to understand, structure, and utilize financial data effectively. Many organizations struggle with the complexities of financial data, and having expert guidance can make a significant difference.

Conclusion

The intersection of AI and open finance presents both immense opportunities and challenges. As financial institutions increasingly adopt AI technologies, the focus must shift toward building robust models and democratizing access to data. Companies like Belvo are at the forefront of this transformation, paving the way for a more inclusive and efficient financial ecosystem. As we continue to explore these developments, it is clear that the future of finance will be shaped by our ability to harness the power of AI responsibly and effectively.