A new era of ride payments in Brazil

Imagine finishing a ride and paying instantly, without the hassle of typing in card details. That’s now a reality for inDrive users in Brazil, thanks to a new partnership with Belvo. By integrating Pix via Open Finance, inDrive is enhancing the way passengers pay for their rides, making transactions faster, safer, and more seamless than ever before.

What is Pix via Open Finance, and why does it matter?

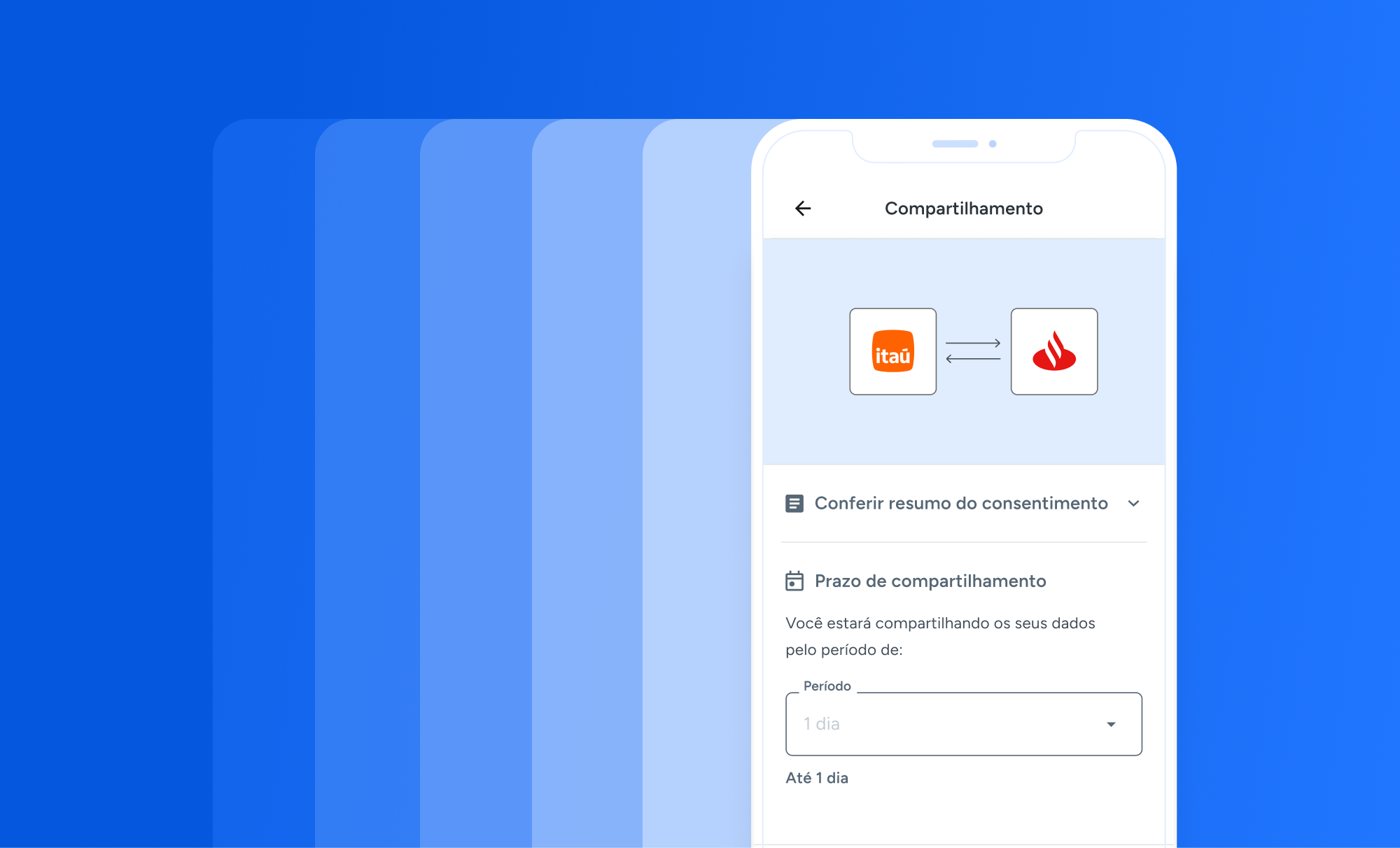

Pix via Open Finance is a payment method regulated by the Central Bank of Brazil that enables direct transfers between users’ bank accounts, without relying on traditional card networks.

This means that payments can be completed in real time, with fewer intermediaries, lower costs, and greater transparency.

For passengers, this translates into a freedom of choice and frictionless experience: no need to enter card details and worry about bank restrictions. For platforms like inDrive, it means instant payment settlement, fewer chargebacks, and reduced transaction costs.

The consumer impact: faster, more inclusive payments

The integration of Pix via Open Finance into inDrive is particularly impactful for consumers who may not have a credit card or prefer not to use one for daily transactions. With this new payment method, passengers can now complete their rides using their bank accounts directly, ensuring accessibility and financial control.

Moreover, unlike traditional credit card payments, Pix transactions occur in real-time.

Why inDrive chose Belvo

inDrive has always been about fairer, more transparent mobility solutions. Originating from a grassroots movement to challenge unfair ride fares, the company has expanded globally, offering a range of mobility services, delivery solutions, and even financial products.Partnering with Belvo, the leading Open Finance fintech in Latin America, allows inDrive to continue its commitment to innovation by leveraging state-of-the-art financial infrastructure.

As a Central Bank of Brazil-regulated Payment Initiation Service Provider (PISP), Belvo provides the secure and compliant technology that makes Pix via Open Finance possible.

A win-win for riders and businesses

This partnership not only improves the passenger experience but also benefits inDrive as a platform. By adopting Pix via Open Finance, inDrive reduces payment processing fees associated with traditional card transactions and mitigates the risk of chargebacks. Additionally, instant fund settlement improves cash flow for both the platform and its drivers.

“Our mission at Belvo is to empower companies like inDrive to harness the full potential of Open Finance and deliver faster, safer, and more efficient payment solutions to their customers. Pix via Open Finance represents a major step forward in digital payments, making transactions simpler and more accessible. “, says Leandro Piano, Belvo’s CFO.

What’s next?

With this launch, inDrive users in Brazil can now enjoy a smoother, more secure payment experience — one that aligns with the growing trend of Open Finance adoption in Latin America. And as more businesses realize the benefits of Pix via Open Finance, this technology is set to redefine digital payments across industries. Whether you’re a frequent inDrive user or simply interested in how Open Finance is revolutionizing payments, one thing is clear: the future of seamless, inclusive, and instant payments is here.