Our banking coverage now includes credit cards and loans data from most of our institutions.

Allowing companies to extract, process, and enrich financial data from any source, institution, or country in just seconds. That’s our aim!

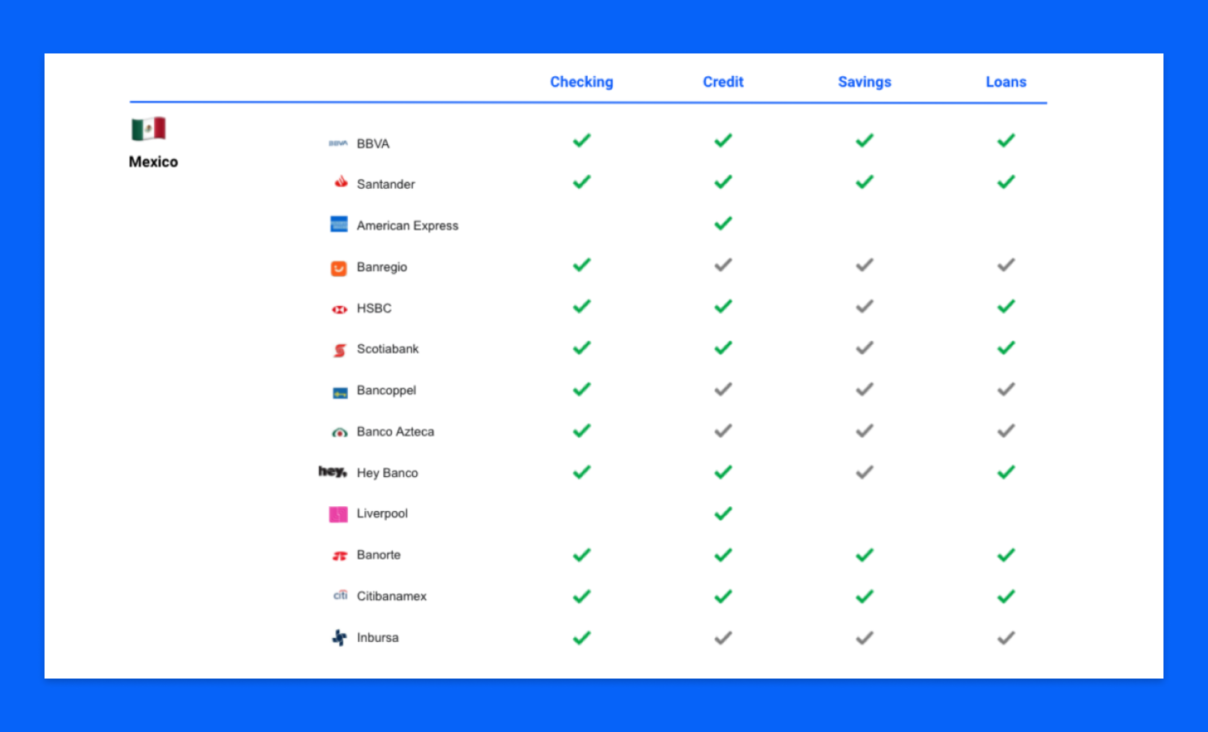

And to achieve it, we keep expanding our product coverage, not only in terms of the number of banks but also in the number of products that we include within each institution. That’s why we now also provide access to credit cards and loans data in an easy and accessible way.

Take a look at the rest of our product updates of this month:

Better product coverage 💳

We have focused on providing you access to the best product coverage within the existing bank connections. Now, on top of the traditional checking and saving accounts, you can get reliable and comprehensive data on credit cards and loans for most of our institutions.

Also, we have added a clear product coverage to our public documentation to make it extremely easy to know which product is fully supported by Belvo for each institution.

New fiscal guides 📖

We constantly work to make it as easy as possible to extract and generate value from Belvo. With that goal in mind, we created a series of dedicated guides to get started using our fiscal product and drive impact with extracted data.

Following those guides, you will learn step by step how to use fiscal data to:

- Get a 360 view of your retail customers.

- Get an in-depth view of your business customer.

Learn more about our guides and, in case you missed it, watch our recent hands-on webinar about how to extract value from fiscal data.

And if there are any other guides you’d like to find in our documentation, please let us know!