Unlock the power of open finance in Latin America

Reach new audiences and convert more users by easily and safely connecting to their financial data, understanding their behavior and enabling instant payments with open finance.

TRUSTED BY LEADING BANKS AND FINANCIAL INNOVATORS

Connect financial data, understand

behaviour and move money

Join the hundreds of financial innovators that already trust Belvo to make their

business more efficient and generate new revenue streams through a single open

finance platform.

Aggregation

Connect to the financial data you need

Securely access the broadest range of financial data sources – including banking, employment, and fiscal data – to gain a full picture of your customers’ financial activity and offer tailored products.

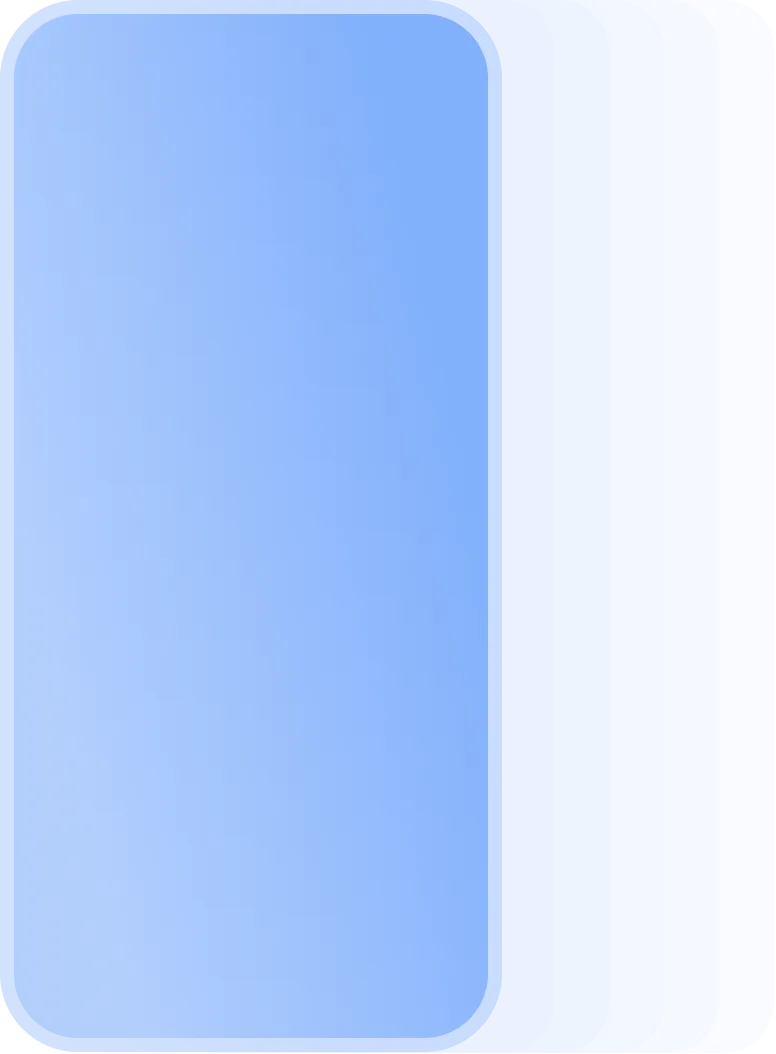

Enrichment

Turn raw data into actionable insights

Make faster decisions with AI-powered insights: access categorized transactions, income predictions, recurring expenses, and risk assessments instantly.

Payments

Power seamless account-to-account payments

Boost conversion rates with frictionless payment experiences through the region’s top Accoun-to-Account rails. Enable secure, instant payments for checkouts, subscriptions, top-ups, and more.

Powering success stories across all industries

- Optimize recurring payments

- Facilitate top-ups

- Credit risk & Lending

- Payments

- Personal Finance

Management - Accounting & ERP

- Onboarding & KYC

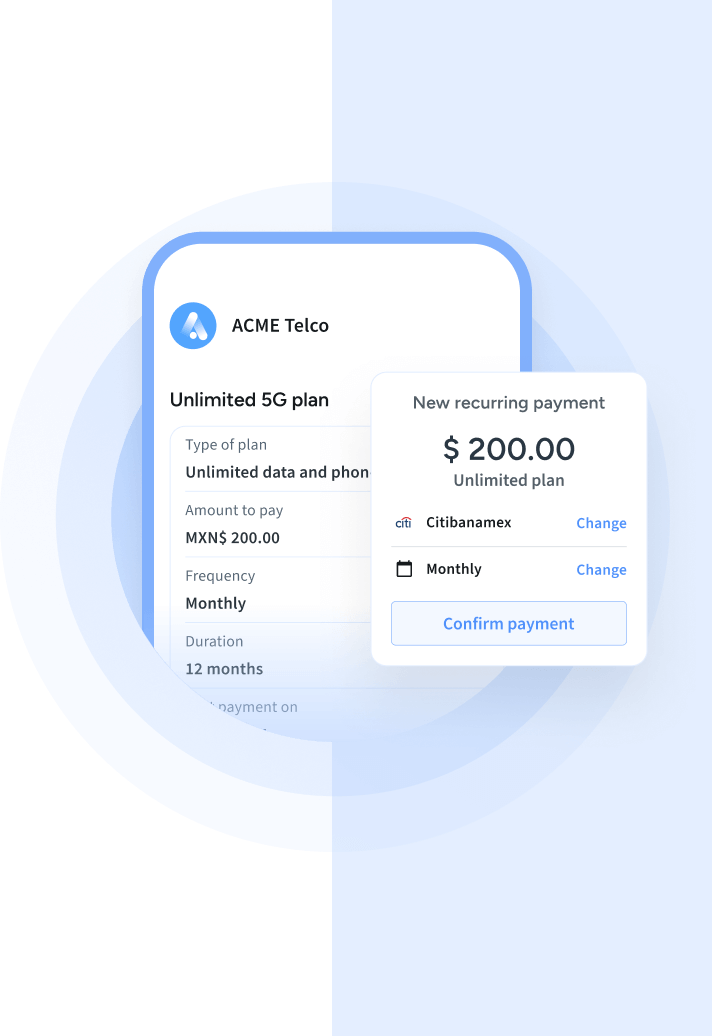

Payments

Optimize recurring payments

Allow your customers to securely and easily store their data to make and schedule payments automatically from their bank account. Optimize the collection of credits, policies, subscriptions, and other monthly payments.

Industries

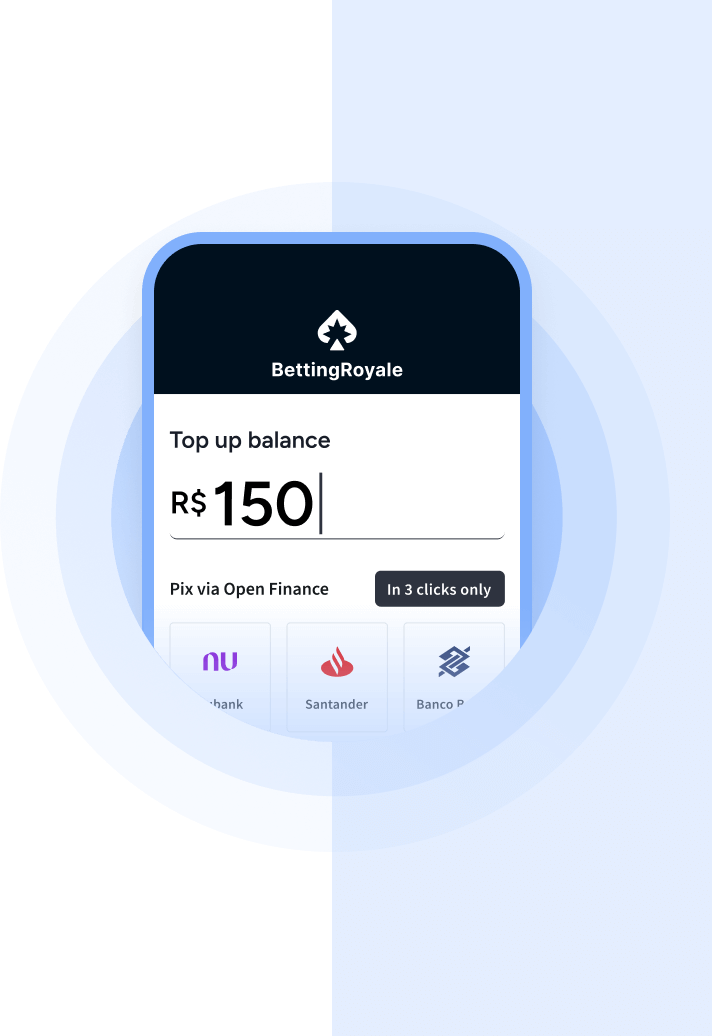

Payments

Facilitate top-ups

Increase the usage of your wallet by offering simple top-ups directly from your customers’ bank accounts, in just a few seconds, securely.

Industries

Credit risk & Lending

Improve risk assessment processes

Increase conversion rates and reduce default risks by improving your credit scoring and underwriting models with real-time and enriched financial data

Industries

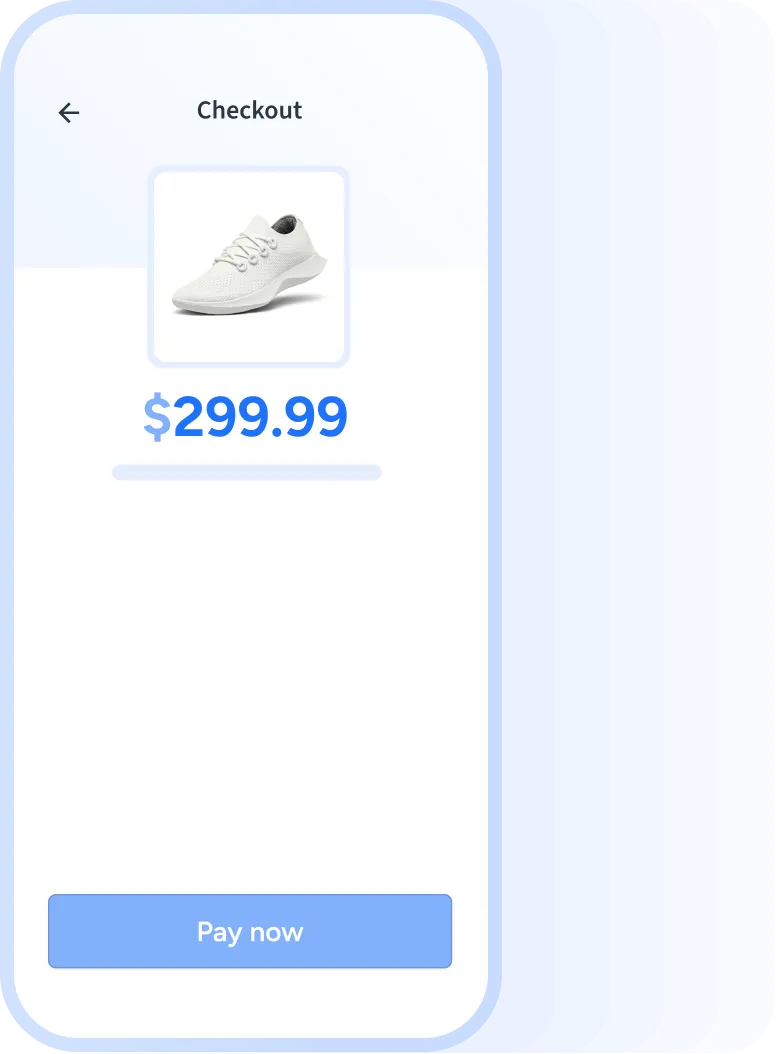

Payments

Increase conversion rates at the checkout

Boost your sales and reduce dropout rates at the checkout by allowing your users to make simple and secure payments directly from their bank accounts.

Industries

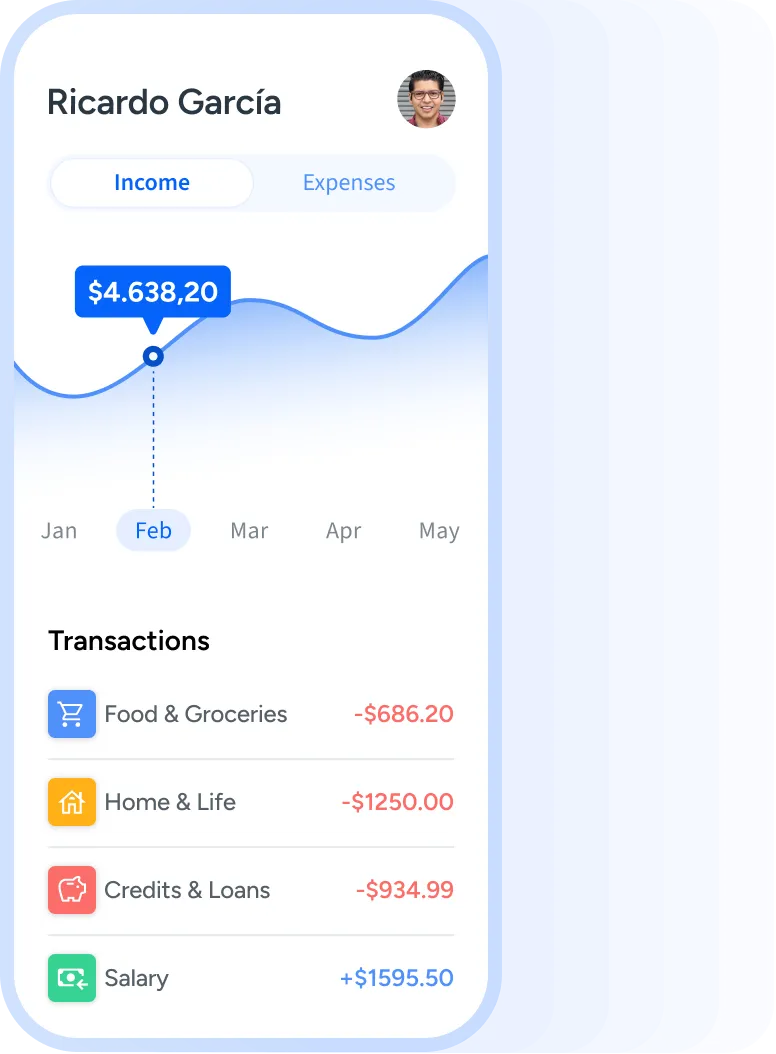

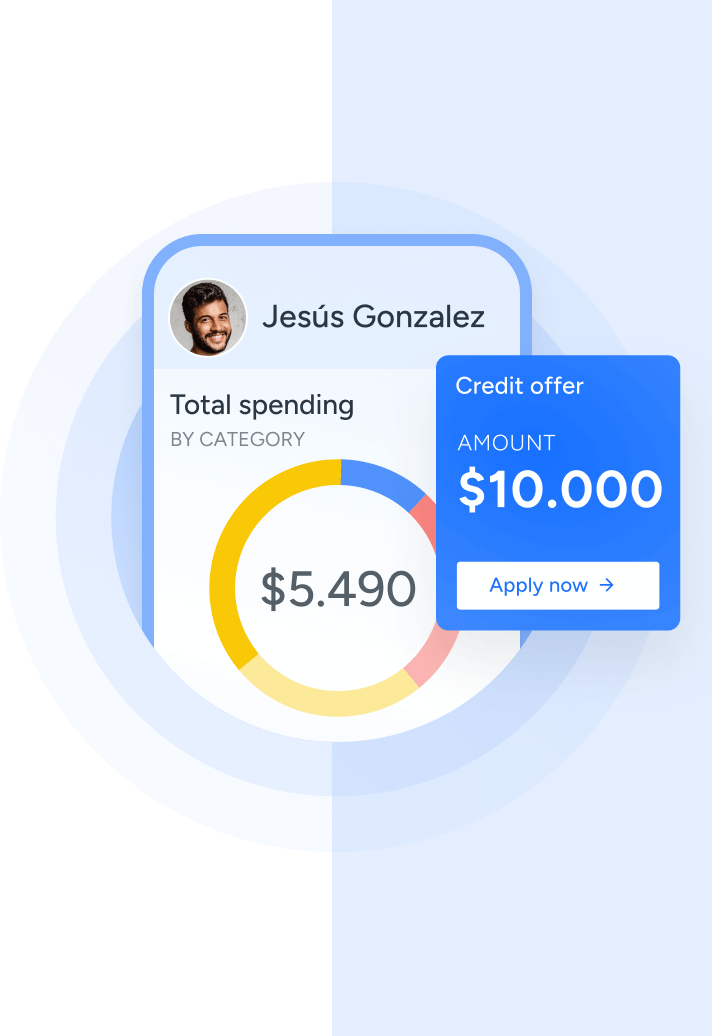

Personal Finance

Help your users make smarter financial decisions

Save time analyzing data and offer your customers unique insights to better manage their money through categorized and enriched transactional data.

Industries

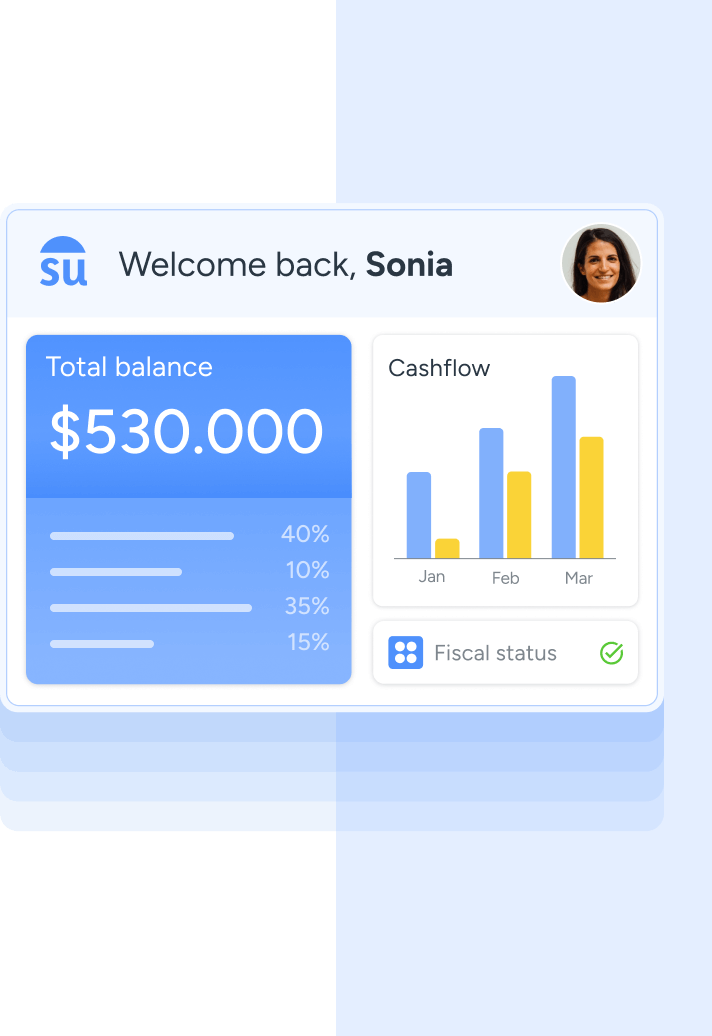

Accounting & ERP

Automate accounting processes

Reduce manual errors in accounting and simplify expense management by connecting automatically to financial sources like banking and fiscal data.

Industries

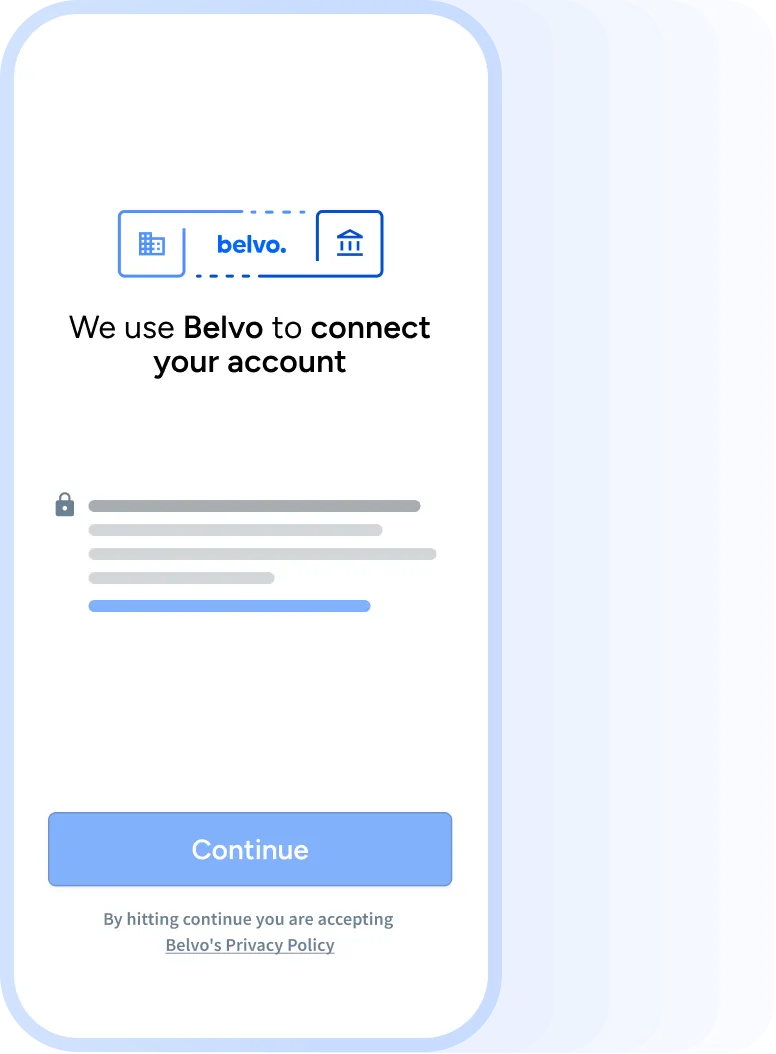

Onboarding

Increase account openings and simplify onboarding

Instantly authenticate users with data from trusted sources to simplify your onboarding process and increase account openings while reducing fraud.

Industries

The standard in open finance in Latin America

Enterprise-grade infrastructure

Rely on the most secure, reliable, and robust platform in the market that complies with standards such as ISO 27001 as well as regulatory licenses.

The best coverage in Latin America

With proprietary technology and +140 connected institutions, Belvo’s aggregation solutions are the fastest and most comprehensive in Latin America.

High-quality data enrichment

Obtain out-of-the-box financial behaviour insights based on proprietary machine learning and AI-powered models trained with billions of transactions.

Build and launch at speed

Ship new solutions easily and in no time thanks to our no-code tools and resources. Extract a clear ROI from open finance from day one.

Proven ROI to power your business

+40M

Accounts connected to Belvo-powered apps

+1Bn

Processed and enriched transactions

+140

Sources of financial data connected

+70%

Opt-in rate from customers to connect accounts

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits