ANALYTICS

Visualize open finance insights to accelerate credit decisions

Through the Belvo dashboard, access key analyses and reports based on large-scale financial data extracted from your users’ accounts. Verify your users’ incomes without writing a single line of code.

Trusted by the leading financial innovators

Extract and leverage open finance insights

without writing a line of code

Focus on what matters

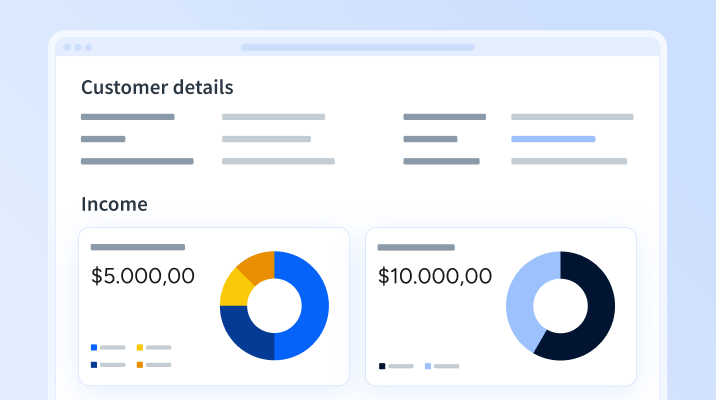

From Belvo’s dashboard, you can verify your income, visualize your users’ assets and debts, and download the data at scale, ready to integrate into your credit models.

Visualize users’ finances

Receive accurate data sourced from your user’s bank to create a smoother and frictionless user experience for your customers.

Optimize credit analysts’ work

Automatically verify your users’ income and reduce manual processes and your response time to grant a loan.

Save integration time

No development needed: integrate the Connect Page into your campaigns, start gathering data in a few days, and analyze it directly in the dashboard.

HOW IT WORKS

Access open finance data and verify income without development

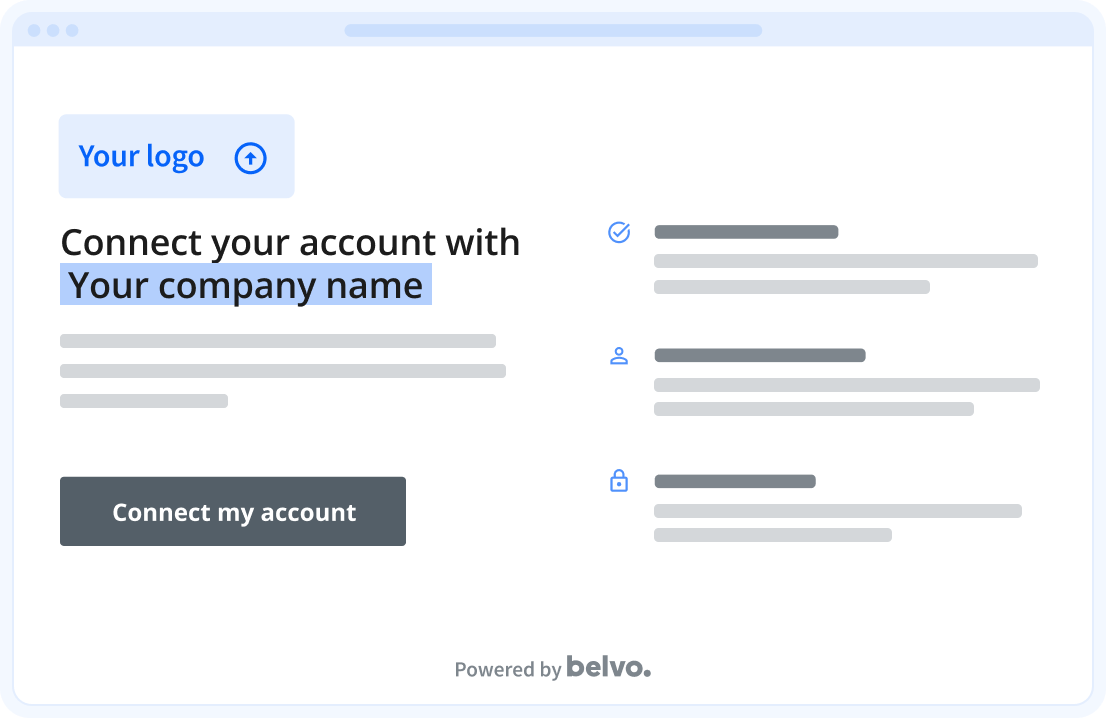

1. Customize and connect

Integrate Belvo, without development needed, by customizing the Connect Page with your brand elements. When the landing page is ready, share it directly from your CRM to your customers through targeted campaigns to allow them to easily connect their accounts.

2. Bulk download data

Access, explore, and download the data, including .csv files, in batches over specific time periods. Analyze behavioral patterns through the data sources you’re interested in.

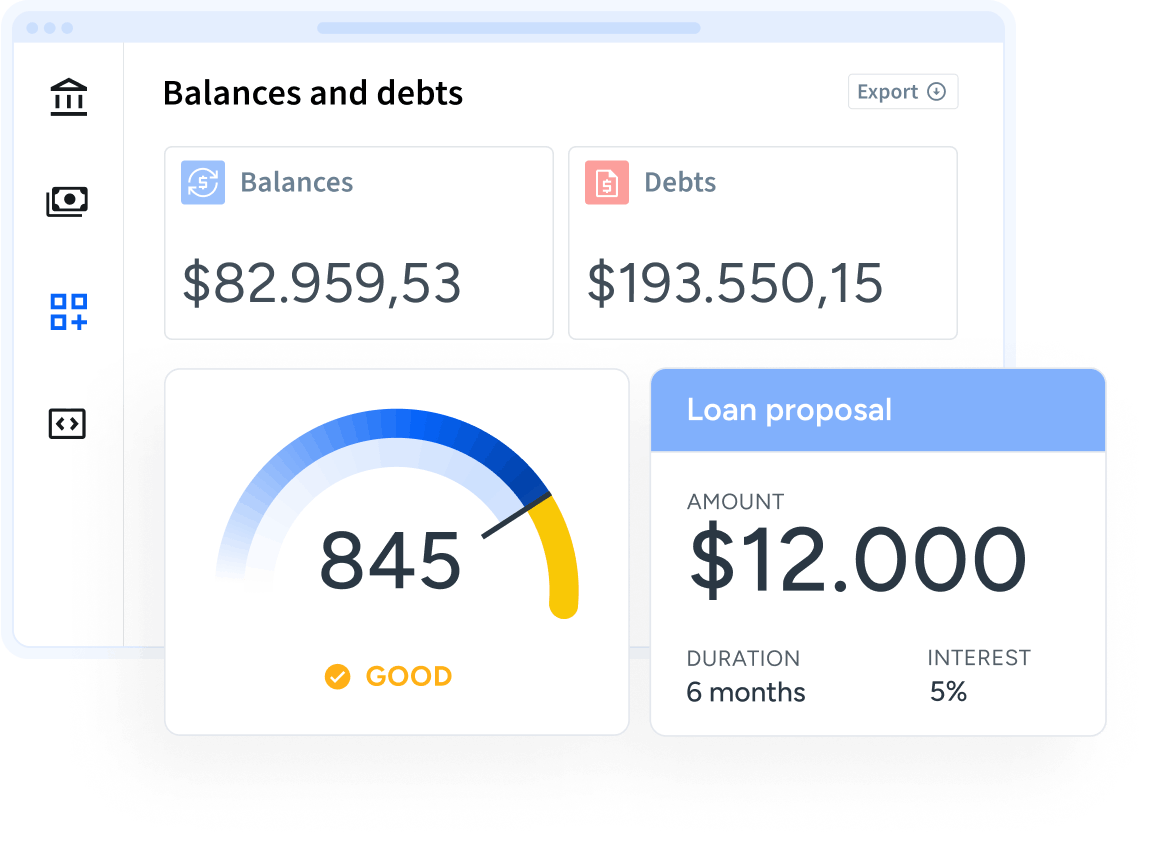

3. Data download and analysis

Safely access, visualize, and analyze customers’ financial data by retrieving transactional data and their total debt and assets. Download the .xlsx file in which you’ll be able to recover raw banking, fiscal or employment data, regarding what is your use case.

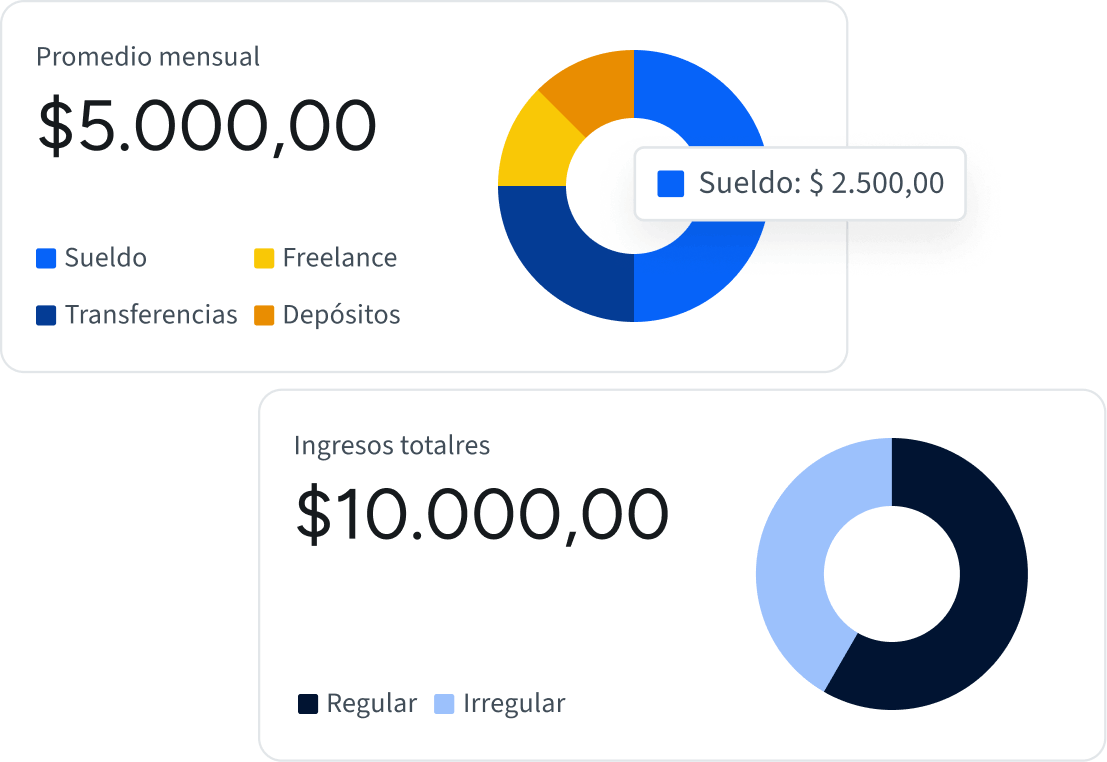

4. Verify income

Automatically verify your user’s income directly from the dashboard. We currently support 10 income categories such as freelance, salary or retirement, and additional metrics like income regularity and stability. Get an annual or monthly overview of the income and optimize credit analysts’ work.

5. Deep dive into the data

Integrate the data and these new insights in your current credit models to reinforce credit decisions. Enrich your credit scoring with income and transaction data to improve the predictive power of your models and increase your loan acceptance rate.

Using analytics has made our work process so much easier! Instead of dealing with those complicated excel spreadsheets, we now have a much simpler and user-friendly interface. With this, we can run thorough and efficient analyses, which helps us make informed and effective decisions.

Michael Gomez

Credit Analyst at Creditea

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits