I have been working on fintech and product for the last 11 years. Including areas like FX trading to personal finance management (PFM) solutions, collaborating with top tier banks worldwide. And I can confirm that I discovered a country that is now on the top of my list when I think about opportunity + financial innovation: Brazil. But what’s different about it than other places in the world?

- Young population with high levels of technological adoption and internet penetration.

- Solid banking system, well structured technologically, but focused on a few players.

So halfway through I found Pablo Viguera and Oriol Tintore, two dreamers just like me with whom I share this same vision: Brazilians and Latin Americans need innovators working at fintechs to change the rules of the game and take advantage of society’s propensity to do things in a different, simpler and fairer digital way.

But how could a group of (currently) over 50 dreamers impact this change? The answer was clear: let’s open the doors of today’s financial services, so that more visionaries like us can participate in this revolution. And the Open Finance movement came at the right time, in the right place.

The place to be

And why is Brazil the right place, if Open Banking arrived earlier in Europe? Europe has been taking more and more advantage of the financial competition with the introduction of the single market and the famous “European Regulatory Passport” working since 2011. A London fintech can offer its services in Spain and thanks to this great players like Revolut came into play. They started changing the financial market in a way that favored reductions in interest and other financial rates and created products that are more adapted to the needs of the population. In short, a population already banked and whose needs are already covered at a somewhat fairer cost.

But in Brazil, financial rates remain high and the banking sector remains concentrated. We need to promote the creation of new banking competitors with new products and services adapted to the current needs of the population. For this reason, Open Finance is a fundamental part of this change, and Belvo arrived with it.

In the last six months since Belvo arrived in Brazil, we have been working as we like, surrounded by the best Brazilian fintechs and startups, such as Mobills, a leading personal finance management application with over 8 million downloads. We understand well the needs of end users and created a unique value proposition in the market. Today I am pleased to announce the go-live of our V1.0. And this is a first of many because we have a roadmap full of news.

Next steps

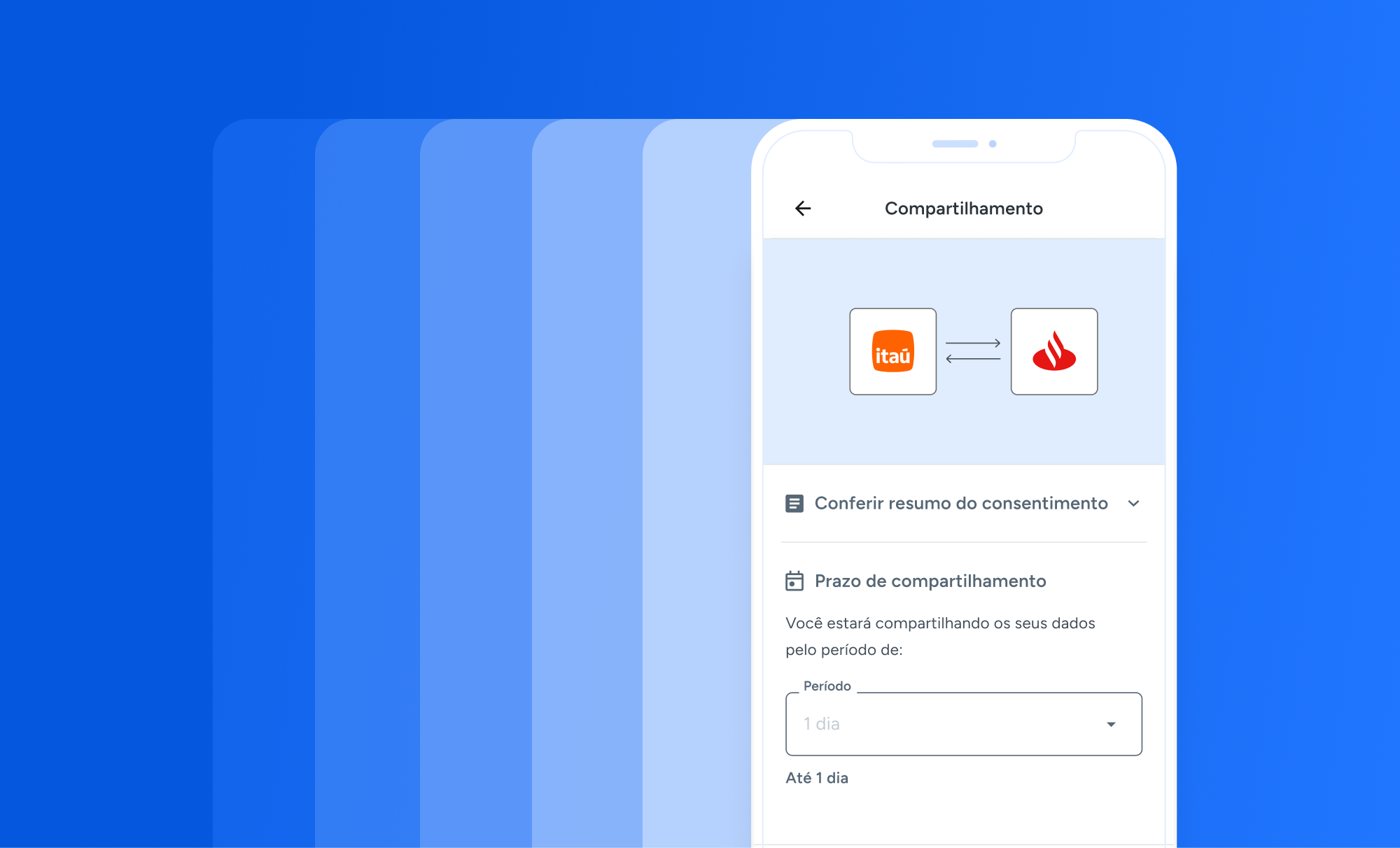

What news do we bring with this first release? The best coverage of personal banking data including the main entities in the country: Itaú, Bradesco, Banco do Brasil, Caixa and Santander. Based 100% on Belvo’s proprietary technology that is already being used by dozens of fintechs in Mexico and Colombia. And we don’t stop there. We’ll continue adding new banks and we are currently enabling our beta for access to banking data (legal entity), and fiscal (via SEFAZ).

We are also working on our latest technological advance with a new data enrichment solution. This includes categorization (improving the quality of data accessed) and income verification, to facilitate that many Brazilians can obtain better credit and better rates. All this supported by the experience of our team of experts in integration, data security, infrastructure, machine learning and UX. And our investors who share the same independent and pro-innovation spirit. Providing the best and most secure Open Finance platform in Brazil, all in a single API.

This is the first chapter of many so stay tuned for more news soon.