The round’s investors included new investors Quona Capital and existing ones Kaszek, Kibo Ventures, Future Positive, Citi Ventures, and Y Combinator. Funds will accelerate product development across data and payments as well as fuel Belvo’s AI strategy to continue powering the next generation of financial services in Latin America.

We are thrilled to announce that we have raised $15 million in new funding! This round sees Quona Capital, a VC fund focused on emerging markets fintech, join our mission as a new investor. We’re also incredibly grateful for the continued support from our existing partners: Kaszek, Kibo Ventures, Future Positive, Citi Ventures, and Y Combinator.

These new funds will be instrumental in accelerating the expansion of our Open Finance product suite across data and payments, and significantly advancing our AI capabilities. Our mission remains clear: to democratize access to financial services in Latin America by powering more inclusive and personalized offerings for millions of individuals and businesses.

Open Finance: from vision to tangible reality 🚀

The momentum behind Open Finance in Latin America is undeniable. What was once a vision when Belvo got started in 2019 is now a structural shift and a tangible reality transforming the financial landscape. This new investment underscores the role Belvo plays in this transformation and our pivotal role in the future growth of the sector in the years to come.

We’re proud to be the leading Open Finance platform in the region, a position built on trust and tangible results:

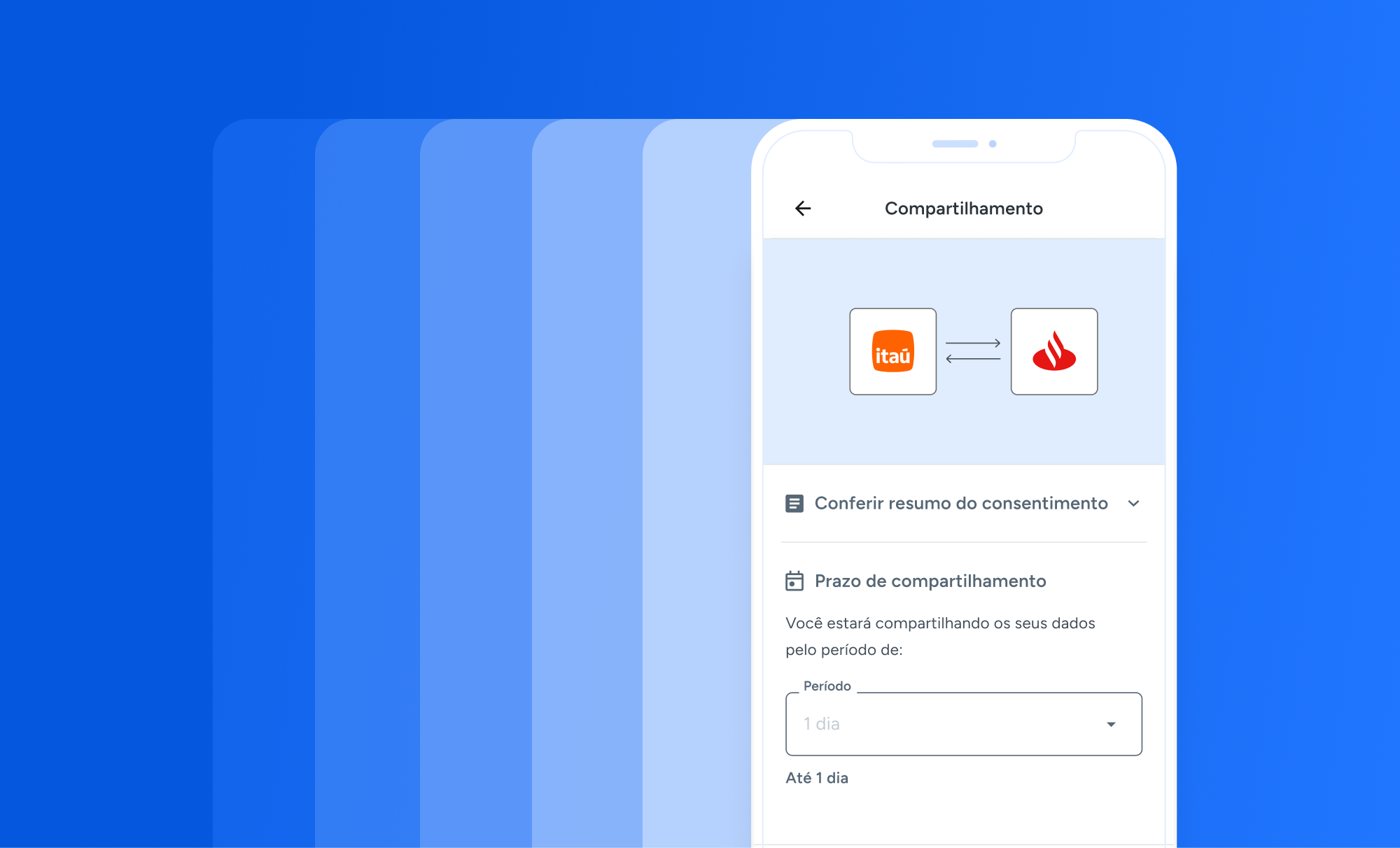

- Massive reach: Over 50 million individuals and businesses have connected their accounts via Belvo-powered apps, sharing financial data (banking, fiscal, employment) securely.

- Significant payment volume: We now process close to 2 million account-to-account payment transactions monthly, translating into an annualized Total Payment Volume (TPV) of over $500 million.

- Trusted by leaders: We serve over 150 customers, including industry giants like BBVA, Banamex, Bradesco, Santander, Mercado Libre, and Creditas, alongside the most innovative financial institutions and fintechs in Mexico and Brazil.

Our platform empowers financial innovators to create better credit underwriting models, seamless payment experiences, and optimized onboarding flows.

Lenders are offering fairer credit by analyzing real-time transactional data to assess risk more accurately and serve previously excluded populations. For example, Mercado Libre uses Belvo’s employment data to increase credit lines by 20% in Mexico.

Onboarding and credit decisions are becoming faster and safer. In Brazil, Facio streamlined user onboarding and cut credit risk by 50% using Belvo’s bank data aggregation to verify identity and income.

And on the payments front, Open Finance is enabling faster, cheaper, and safer account-to-account payments. Rayo, a lending platform, boosted collection rates by 20% in Mexico thanks to our Direct Debit product.

These and other use cases, combined with regulatory advancements like Pix in Brazil, have demonstrably boosted financial inclusion. Since 2019, the number of digitally banked individuals has more than doubled in Brazil and Mexico – a change we’re proud to have substantially contributed to.

Fueling innovation: what’s next? 💡

This new capital injection allows us to double down on scale and innovation :

- Expanding connectivity: We’ll expand our connections across all relevant financial data sources, both regulated and unregulated to help our customers continue to better understand their end-users through better financial data and powerful insights.

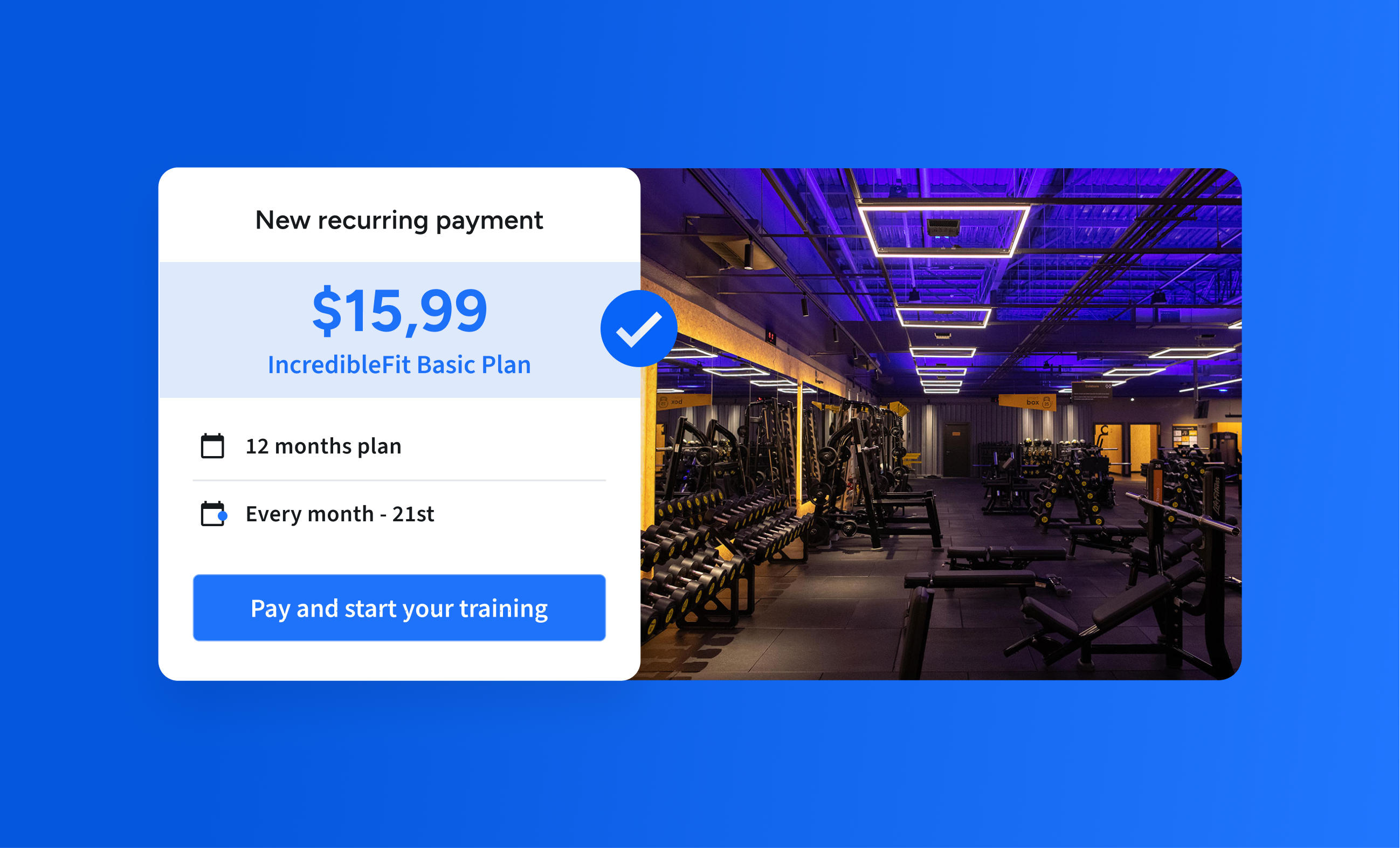

- Next-Gen payments: We’ll roll out highly-anticipated pay-by-bank products, like Pix Automático, our variable recurring payments solution in Brazil, We’ll also further enhance our existing products, such as Biometric Pix in Brazil and Direct Debit in Mexico, with the goal of offering cost-effective account-to-account payment experiences with better conversion and faster settlement times

- Deepening AI capabilities: We will continue to invest heavily in AI. By applying sophisticated models to the billions of financial data points on our platform, we transform fragmented information into powerful, structured insights for critical applications like underwriting, user segmentation, anti-fraud, payment acceptance, and more.

As our Co-Founders and Co-CEOs, Pablo Viguera and Oriol Tintoré, put it: “At Belvo, we’re building the most advanced platform to help financial institutions and innovators make the most out of Open Finance to power their businesses in unprecedented ways. This new investment will enable us to continue to innovate, develop cutting-edge infrastructure, scale our AI capabilities, and work on our mission to democratize access to financial services to millions of people and businesses in Latin America.”

Driving the next wave of financial innovation 💪

Our investors share our excitement for the road ahead:

Rafa de la Guia, Partner at Quona Capital, commented: “From our experience across global markets, the most transformative Open Finance platforms will bring together data and payments in a single, seamless offering. Belvo is uniquely positioned to drive the next wave of financial innovation in Latin America—combining best-in-class data capabilities with powerful payment solutions to help institutions better serve millions across the region.”

Nicolás Szekasy, Co-Founder and Managing Partner at Kaszek, added: “Since our initial investment, we’ve believed Belvo is building the backbone of Open Finance in Latin America. This is not just a technological shift—it’s redefining how millions of people access, experience, and benefit from financial services. Belvo’s expansion from initially serving fintechs to also becoming the go-to platform for leading banks underscores the strength of its infrastructure and strategic vision. With regulatory momentum and digital adoption surging. Belvo is well-positioned to lead the next phase of growth.”

We are incredibly excited about this next chapter and deeply thankful for the trust placed in us by our customers, investors, and the entire Belvo team. Together, we’ll continue designing and crafting the infrastructure for a more open and inclusive financial future in Latin America.

Let’s keep building!