Belvo is turning six this week, and we couldn’t be more excited to celebrate this incredible milestone! It’s amazing to look back on how far we’ve come, and even more so, to imagine the possibilities as we continue to drive financial innovation forward in Latin America.

A bold vision that took flight

Our story began with a simple yet daring idea — to revolutionize financial services in Latin America, a region historically underserved by traditional banking, which has flourished into a vibrant and essential infrastructure backbone for many of the leading financial platforms in the region. Today, we proudly operate our Open Finance platform in Mexico and Brazil, delivering powerful financial data aggregation, enrichment, and payments solutions. From well-established financial institutions to leading fintechs and financial innovators, we empower over 200 businesses to create safer, smarter, and more inclusive financial experiences for their customers.

Shaping the Open Finance movement

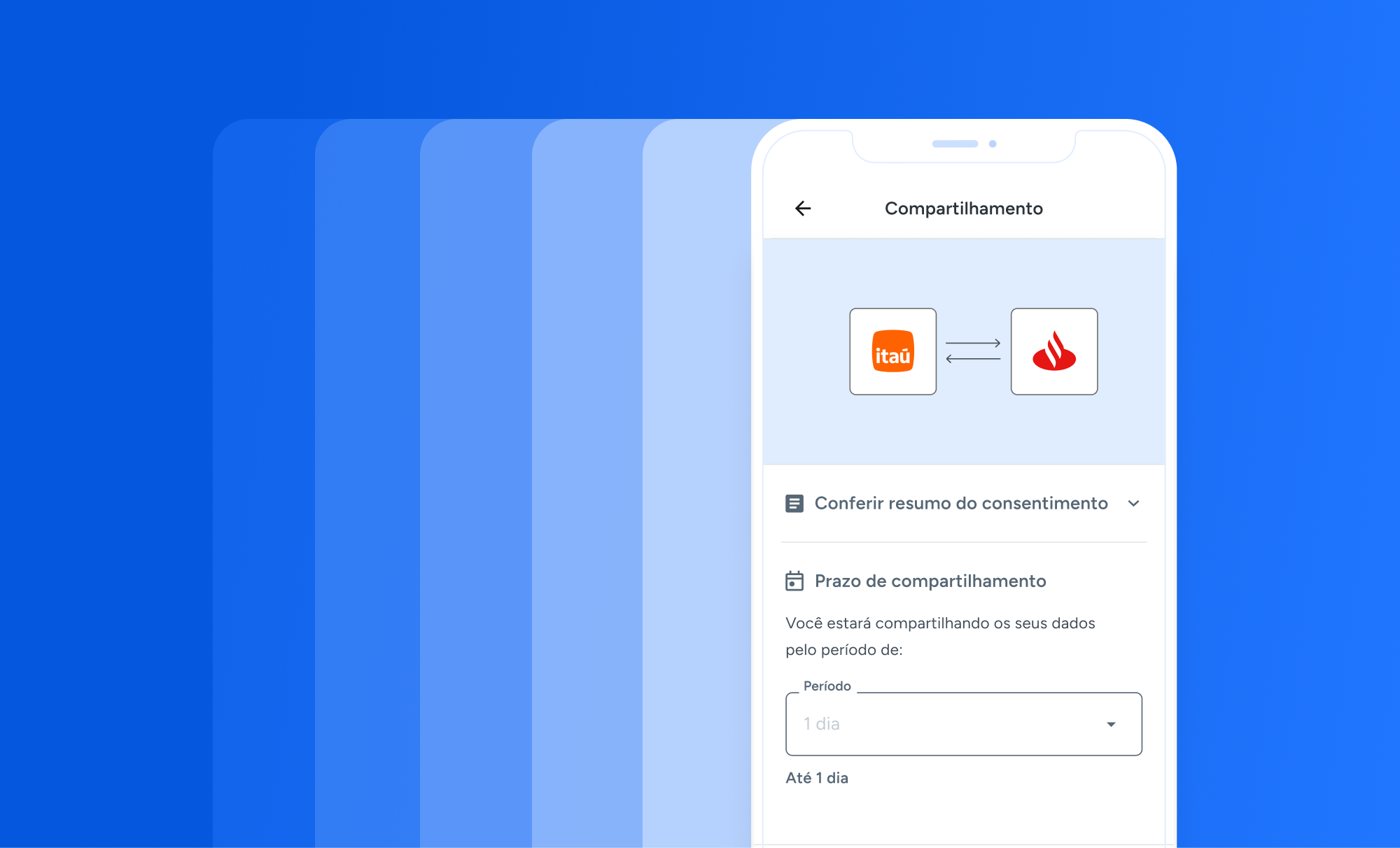

These past six years have demonstrated how critical Open Finance is for building a more accessible and inclusive financial system. From accelerating user onboarding processes to fostering fairer credit decisions and optimizing payment flows, we’ve empowered our partners to achieve remarkable results, revolutionizing how they connect with their customers.

What began as a small fintech movement has grown into a region-wide transformation – one that has allowed us to partner with Latin America’s top financial innovators, including BBVA, Banamex, Bradesco, Santander, and Creditas. Over the past year alone, these institutions have reached great milestones using our data aggregation and payment solutions.

For instance, in Mexico, Mercado Pago leveraged Belvo to dynamically adjust credit lines, achieving up to a 20% increase in credit amounts. Our direct debit solution has empowered lenders like Alvos, R2, and Rayo to simplify payment collection and lower default rates. In Brazil, our Open Finance payment solution is driving innovation with leaders such as Alipay, OneKey, Totalpass, and ABC Evo. Beyond payments, companies like Unico are using our regulated Open Finance connections to establish novel identity verification standards.

The numbers show the impact we’ve made together. More than 50 million individuals and businesses have securely shared financial data with apps powered by Belvo. In Brazil, we are the top-of-mind Open Finance third-party provider, with over 6 million active consents (people who are sharing their data through an app through Belvo). Not to mention that we now process nearly 2 million account-to-account payment transactions every month. That’s over $500 million in annualized transaction value!

And this is just the beginning. Open Finance adoption is gaining incredible traction across Latin America, and we’re more committed than ever to helping our partners unlock this wave of opportunity. Together, we’re shaping a future where financial innovation knows no bounds. 🚀

Fueling innovation and growth with fresh funding

Over the past year, we’ve achieved incredible milestones, refining our solutions and launching innovative products that reinforce our leadership in the Open Finance ecosystem. In Brazil, we’ve solidified our position at the forefront of Open Finance payments by pioneering initiatives spearheaded by the Central Bank, such as Biometric Pix and Pix Automático. Meanwhile, in Mexico, we’ve strengthened our role as the leading partner for direct debit solutions. This included the launch of a mass payments product, enabling businesses to begin receiving payments in minutes, while empowering their operations with more efficiency and flexibility.

To further support our clients in combating fraud, we rolled out advanced account verification solutions like Penny Validation in Mexico and data-checks powered by our Open Finance database. These innovations have transformed customer onboarding processes, making them not only safer but also more reliable. Additionally, we expanded our data-centric product offerings. Brazil saw the introduction of employment data solutions integrated directly with the INSS system, helping lenders refine credit evaluations by utilizing verified income data. Over in Mexico, we launched the Employment Score and Employment Updates, a real-time system that empowers businesses with timely notifications about changes in workers’ job status.

These groundbreaking advancements have driven us forward and garnered significant recognition. This year, we closed a $15 million funding round, welcoming Quona Capital while reaffirming the trust and support of leading investors such as Kaszek, Kibo Ventures, Future Positive, Citi Ventures, and Y Combinator.

With this exciting new phase of growth, here’s what’s next for us and how we plan to put this investment to work:

- Expanding connectivity: we’re broadening access to both regulated and unregulated financial data sources to deliver even greater connectivity for our clients.

- Enhancing payments: we’re doubling down on innovating payment solutions, advancing Pix Automático in Brazil, and improving Direct Debit capabilities in Mexico.

- Leveraging AI: we’ll continue investing in AI technology to unlock the power of billions of financial transactions and payments on our platform, driving advancements in underwriting, fraud prevention, personalized services, and payment optimization.

This investment is a powerful endorsement of our mission to transform Latin America’s financial ecosystem into one that’s more accessible and inclusive.

Growth backed by a world-class team

Everything we’ve achieved has been driven by our highly technical, diverse, and passionate team. Spanning São Paulo, Mexico City, Barcelona, and countless remote locations and nationalities, Team Belvo is all about getting things done, constant growth, relentless curiosity, and a shared determination to make a difference. Whether it’s in the daily grind or during vibrant offsite events, our team’s energy and ideas unite us across borders and time zones.

A future full of potential

Looking ahead, our vision is bold and clear. We want to become the go-to partner for pay-by-bank solutions in Brazil and Mexico. And we’re committed to doubling down on the intersection of data and payments, helping businesses optimize their acceptance rates, cut fraud, and uncover actionable insights from payment behaviors.

AI sits at the heart of this roadmap. By leveraging our robust connectivity, we’re building models that drive smarter credit decisions, improve fraud detection, enable personalized marketing, and much more.

To our team, customers, partners, and everyone who has supported Belvo’s mission so far, thank you. Your trust and belief in our vision have helped us get here, and we’re just getting started.

Here’s to the next chapter in the Open Finance revolution. Together, we’re building a brighter, more inclusive financial future for Latin America.

The best is yet to come!