Through open finance, both companies aim to provide more people with access to financial products and services in Mexico

Citibanamex, in partnership with Belvo , seeks to promote greater financial inclusion, allowing individuals currently outside the banking system to access credit.

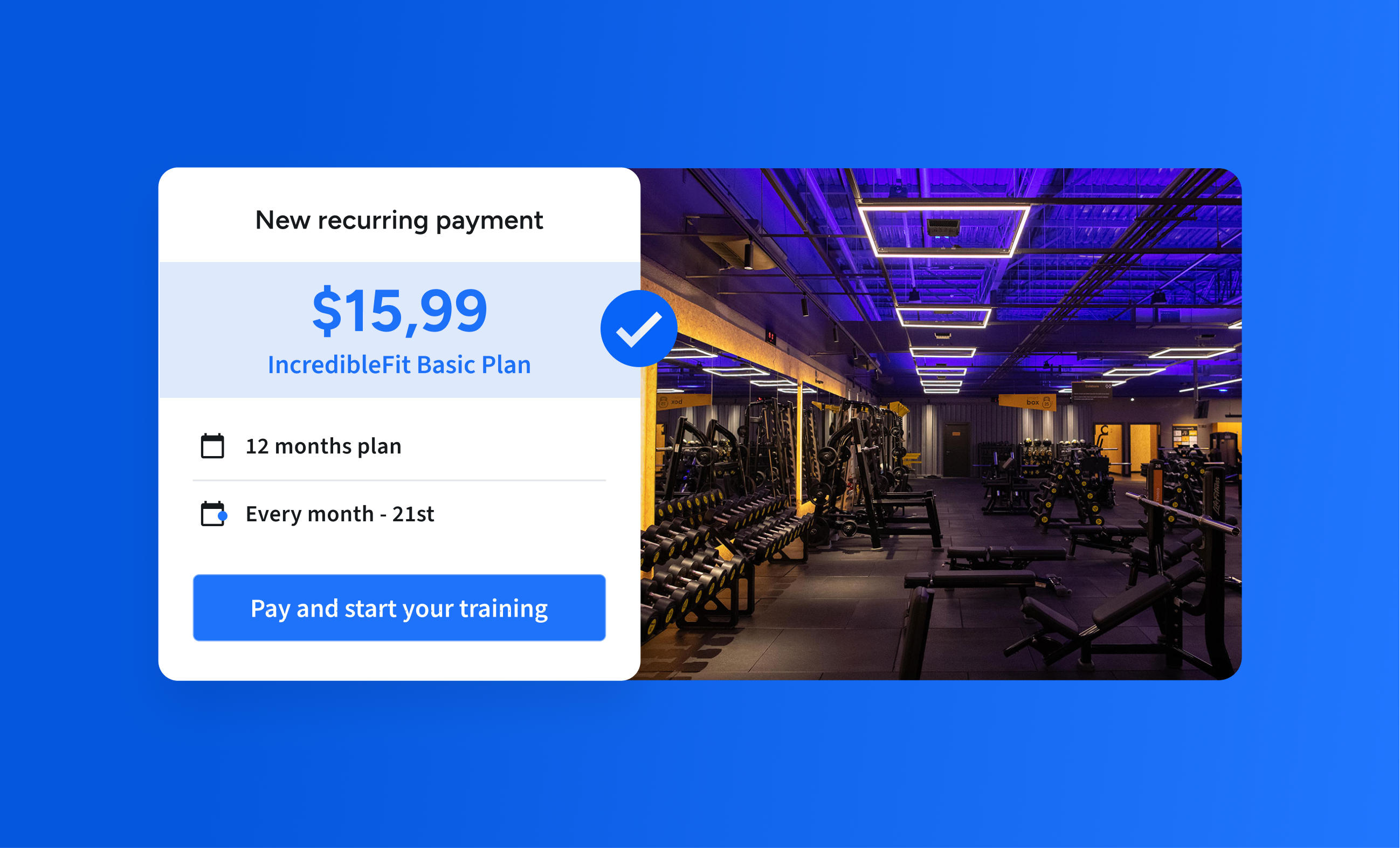

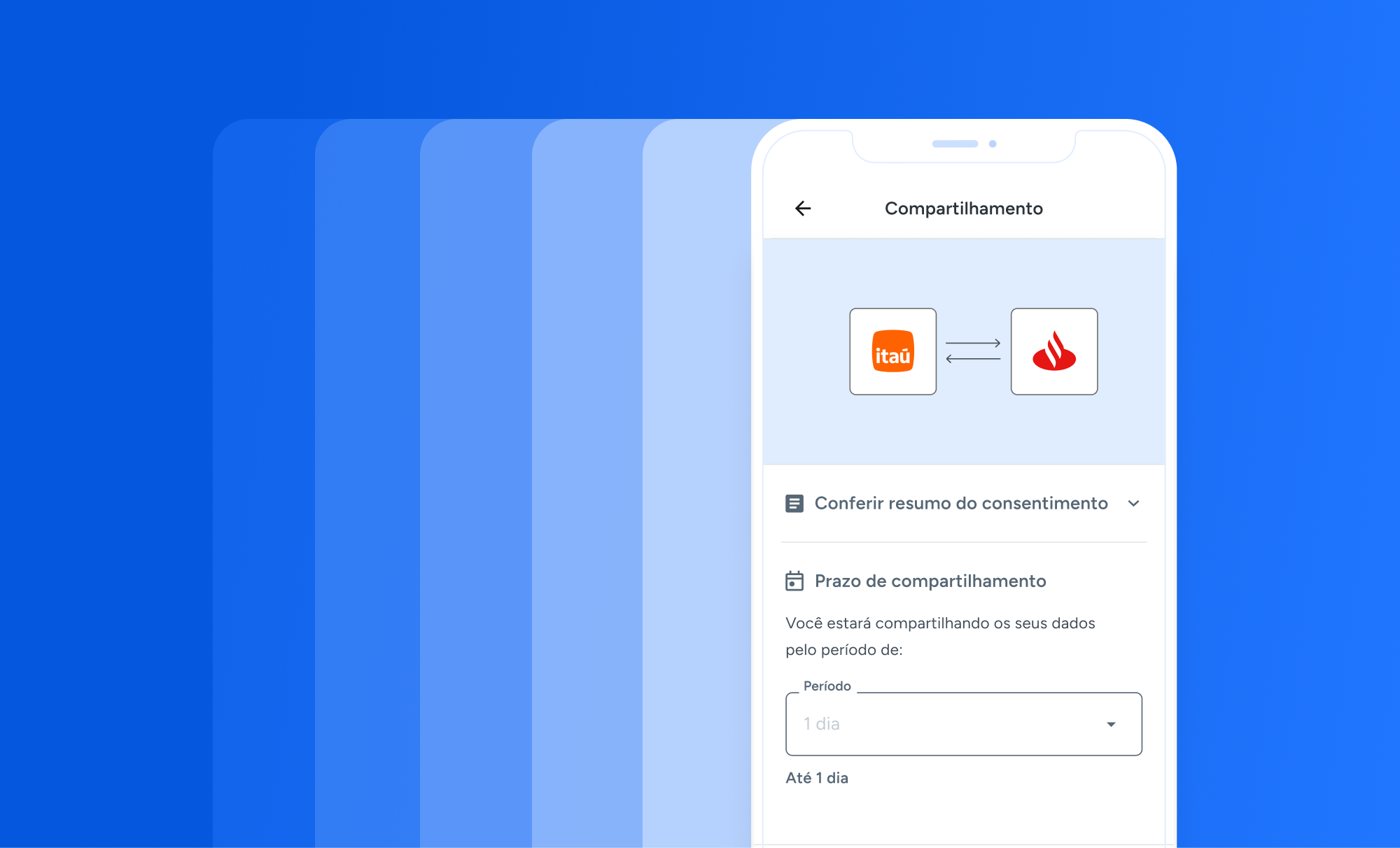

Belvo, the leading open finance data and payments platform in Latin America, verifies labor data histories, as reported by their employers, to the Mexican Social Security Institute (IMSS). Through its platform, it allows fintechs and innovative financial institutions to access and process financial data, as well as initiate payments from their users’ accounts, with the goal of promoting more efficient, secure, and inclusive products.

With Belvo’s help, Citibanamex will be able to offer credit and credit card options to users without a credit history—taking into account factors such as the number of credits requested, outstanding debts, and the applicant’s economic activity, among others—or to those for whom income verification has been a challenge by other means. Additionally, it will improve the operational efficiency of processes that still depend on users presenting physical documents at bank branches.

This is a prime example of how open finance can foster greater financial inclusion for mexicans, removing barriers in the credit application and acquisition process. “At Citibanamex, we are continuously seeking financial inclusion solutions to facilitate access to banking products for individuals who have not been able to benefit from current solutions. With this new functionality, it will be easier for our customers to verify their income, making credit opening processes more agile,” said Miguel Lavalle, Director of Digital Business Development.

“This is pioneering and exciting work, aligned with our mission to help financial innovators create new, more efficient, and inclusive experiences for their users. We are excited to see how financial entities in Mexico are betting on open finance models due to their positive impact on reducing the gap in access to financial services”.

Federica Gregorini, Directora General de Belvo en México,

According to the 2021 National Survey of Financial Inclusion (ENIF), access to credit can have positive impacts on the quality of life of the population, as it allows people to access goods and services that they probably could not obtain due to income limitations, and it can make a difference in facing an emergency.

However, the ENIF also revealed that only 33% of the population has formal credit, and among those who have never had it, one of the main reasons mentioned is not meeting the requirements. On the other hand, those who applied and were rejected cited lack of credit history, issues with the credit bureau, insufficient income, or lack of physical documents proving their income as reasons.