Brazil’s financial ecosystem has evolved rapidly in recent years. Pix and Open Finance are transforming how people and businesses move money and access credit.

At the heart of this transformation lies a powerful combination: smart data and smart payments.

When integrated, they enable not only faster and more secure transactions but also more strategic decisions about how, when, and in what way to collect or pay. This is where Belvo plays a key role — using Open Finance data to make payments more efficient.

Open Finance has democratized financial services by putting users at the center and giving them control over their own data. But the true transformation happens when companies can interpret that information intelligently.

Connecting with data goes far beyond access: it allows businesses to deeply understand each customer’s financial life — from spending habits to recurring expenses, even the exact day their salary is credited.

This knowledge paves the way for truly smart payments, aligned with users’ cash flow and business needs. That’s how Open Finance evolves from infrastructure to a true engine of efficiency and innovation in the payments market.

Calculating the Best Collection Date

The day an invoice is due isn’t always the same day a customer has funds available.

With Open Finance data, companies can analyze each consumer’s financial behavior and identify the optimal moment to charge — reducing defaults and increasing payment success rates.

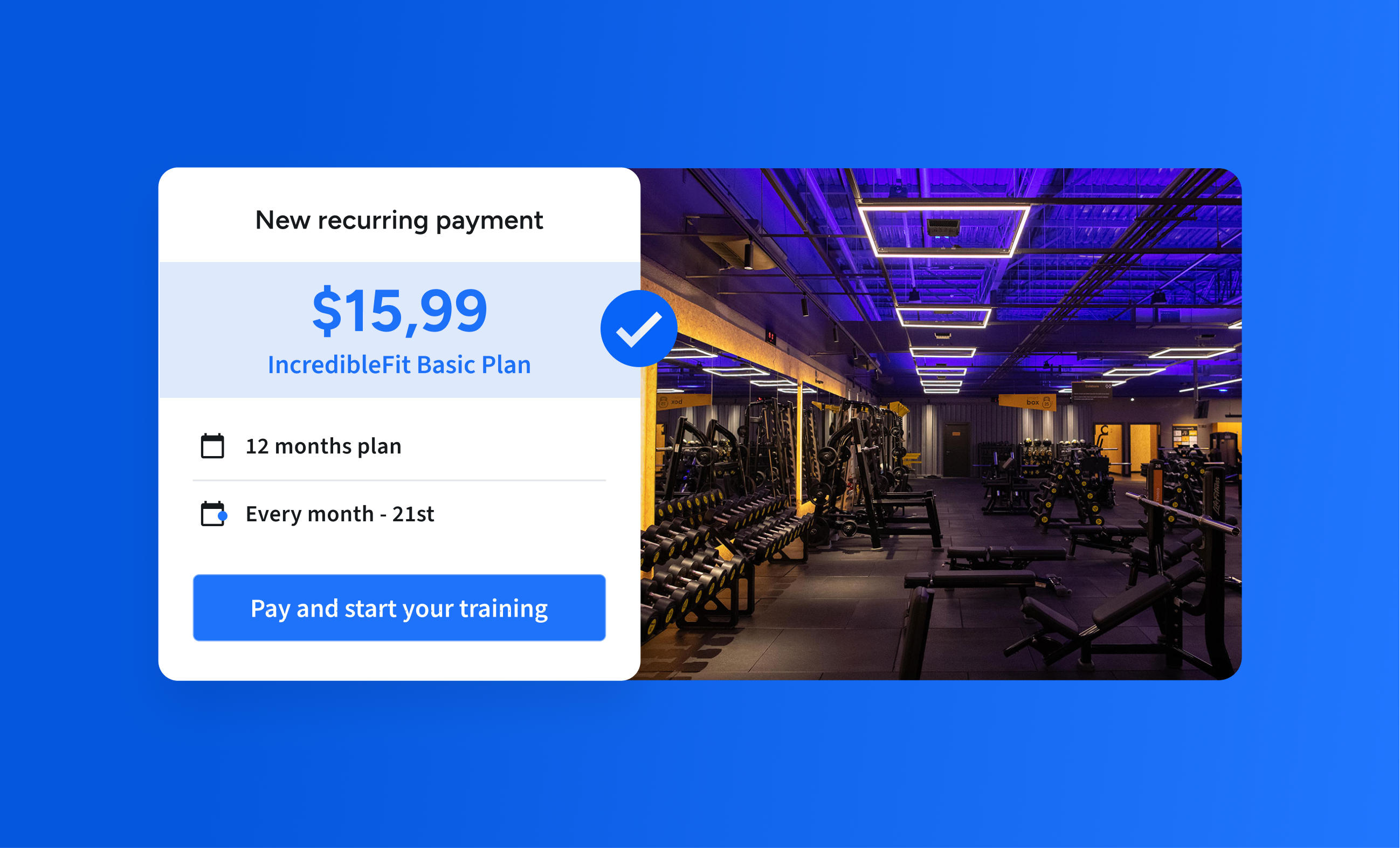

This is especially relevant with the growth of recurring payment systems such as Pix Automático, which enables simple, transparent recurring payments without the need for invoices, credit cards, or manual actions from users.

When combined with data intelligence, Pix Automático becomes even more powerful: by calculating the best charge date, businesses can optimize revenue, improve cash flow predictability, and deliver a smoother user experience.

See how optimizing charge dates can reduce delinquency.

Smart Retries with Open Finance Data

Using Open Finance data, Belvo enables businesses to identify the most likely times for successful charges — for example, right after salary deposits.

Pix Automático was designed to simplify recurring payments but has a key limitation: a restricted number of retry attempts in case of failure. Attempting payments at times when the customer doesn’t have funds wastes those opportunities and affects revenue predictability.

That’s where Open Finance data makes all the difference. By understanding each consumer’s financial behavior, companies can schedule retries within Pix Automático strategically. This helps avoid ineffective attempts, reduce customer friction, and increase successful charge rates.

Account Ownership Validation: Security and Trust in Every Transaction

Another way data makes payments more efficient is by improving bank account verification.

One of the biggest challenges in digital payments is ensuring that the account used in a transaction actually belongs to the payer. Without that confirmation, the risk of fraud, chargebacks, and operational errors rises — issues that increase costs and harm user experience.

- Fraud: use of third-party or “mule” accounts.

- Chargebacks: customers disputing payments.

- Operational errors: transfers to incorrect accounts, causing costs and rework.

At Belvo, we use Open Finance to provide account verification solutions that address these pain points. Verification can be performed in two ways:

1. Data Cross-Check Validation

Belvo currently maintains a database with more than 60 million records, allowing fast and reliable account ownership verification. Our platform not only confirms whether banking details match the reported account holder but also detects possible typos or inconsistencies in customer data.

2. Account Connection Validation

When a mismatch or potential error occurs, our platform enables users to connect their bank account directly and validate their identity through the banking system in real time.

These solutions are especially valuable for high-value payments, credit origination, digital onboarding, and B2B transactions, where security and trust are essential.

Smarter Payments Start with Data

At Belvo, we believe the future of financial services isn’t just about moving money faster — it’s about using data to make every transaction smarter.

Whether it’s choosing the best charge date, applying smart retries with Pix Automático, or validating accounts in real time, we bring together payment infrastructure and data intelligence to help businesses reduce risk, increase conversion, and deliver more reliable experiences for their customers.