In recent years, Brazil has undergone a revolution in its payment methods system. While Pix has consolidated itself as an instant means for transfers and one-time payments, a new phase is beginning: the era of recurring payments, driven by Pix Automático.

In this article, we will explore how recurring billing methods have evolved in Brazil, from bank slips (boletos bancários) to Pix Automático, a solution that has brought efficiency, automation, and inclusion.

Recurring payments with bank slips and direct debit

For decades, boletos bancários dominated recurring payments in Brazil. They were (and still are) common for school tuition, health plans, internet services, and education. Despite their widespread acceptance, boletos require manual action from the payer, do not guarantee predictable revenue, and have a high delinquency rate.

Direct debit emerged as a more efficient alternative. By automating payment directly from the consumer’s account, it reduced delinquency and gave companies more control. However, its technical complexity and the need for agreements with multiple banks made implementation costly and restricted to major players in the market.

The rise of Pix

Since its launch in 2020 by the Central Bank, Pix has completely transformed the payment habits of Brazilians. In just a few years, it surpassed TED/DOC transfers and debit cards, becoming the payment method used by 76.4% of the population.

However, until recently, Pix was primarily geared toward one-off payments. This limited its use for recurring charges, a crucial model for SaaS platforms, streaming services, credit fintechs, telecom providers, and others.

The arrival of Pix Automático for recurring payments

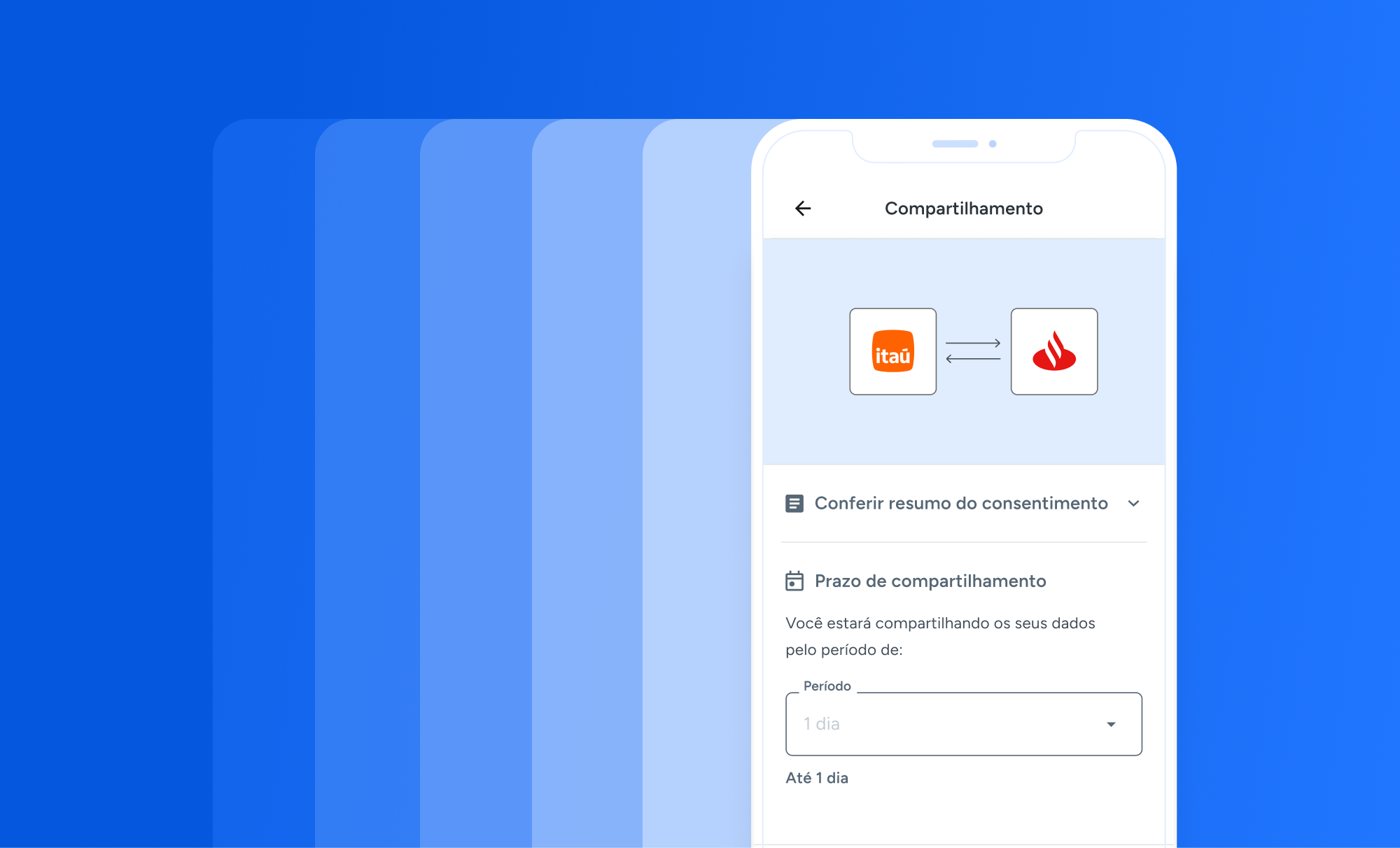

Announced by the Central Bank as one of the main evolutions of the Pix ecosystem, Pix Automático was designed to address precisely this gap: automating recurring payments with the speed and reach of Pix.

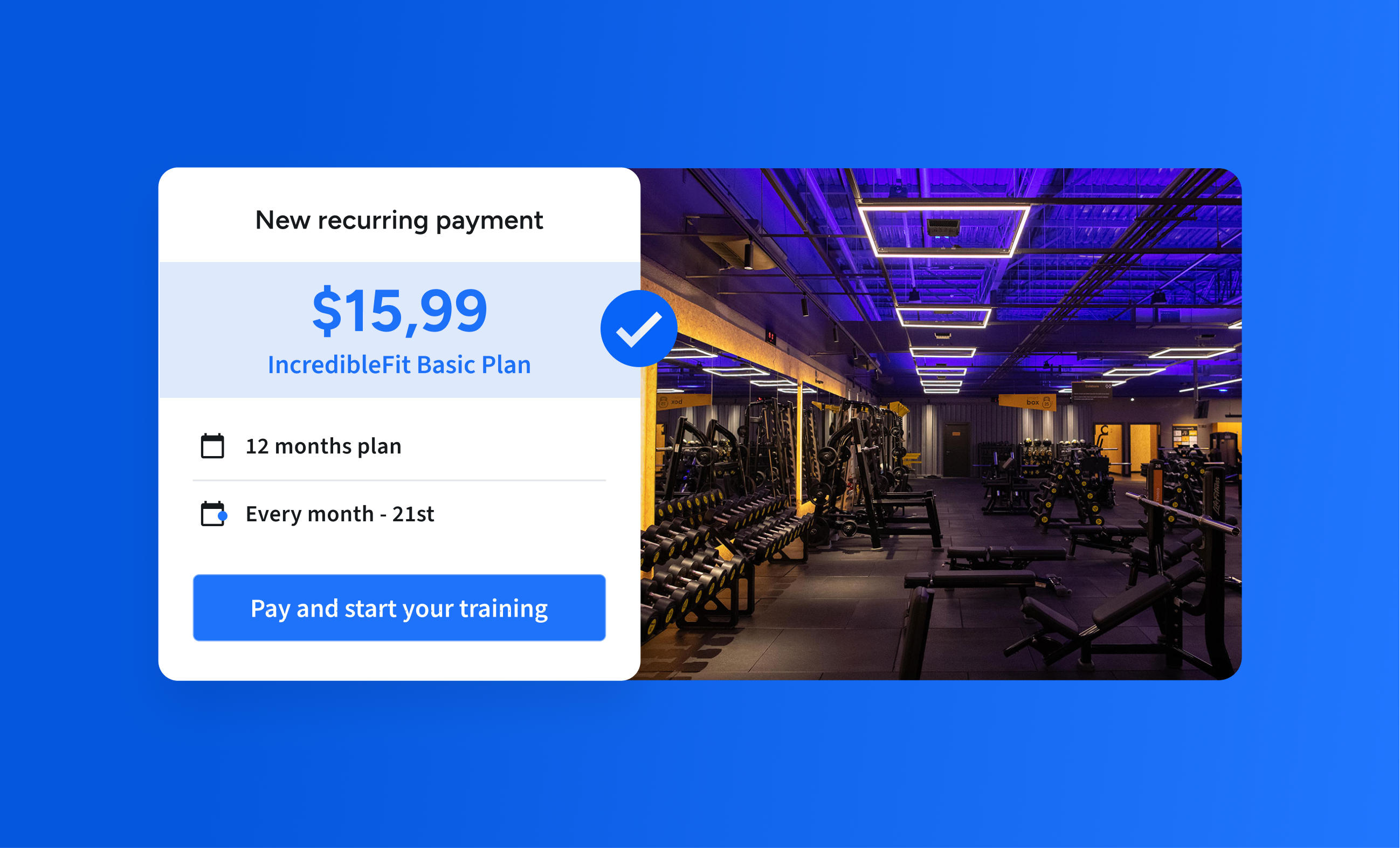

A survey by Opinion Box shows that, for the public, the main use cases for Pix Automático are paying household bills such as water, electricity, and internet (55%), streaming services (34%), and gym memberships (24%). Respondents also pointed out the main benefits: the convenience of not having to remember to make the payment (55%) and avoiding delays or late fees (46%).

With Pix Automático, customers pre-authorize certain payments to be made automatically, similar to direct debit, but with less friction, greater reach, and interoperability between institutions.

The major advantage lies in the standardized user experience and the customer’s autonomy to manage authorizations directly through their bank or fintech app. For businesses, this means greater operational efficiency, more predictable revenue, and a significant reduction in delinquency.

Conclusion

The evolution from bank slips and direct debit to Pix Automático marks a new chapter in recurring payments in Brazil. With the Central Bank’s solid infrastructure, growing adoption of Pix, and the advancement of the Open Finance agenda, the conditions are ideal for companies of all sizes to embrace this model.

By democratizing access to recurring billing, previously restricted to large institutions, Pix Automático aligns with the movement toward financial inclusion and the country’s digital transformation. More than just a technological upgrade, this shift represents a paradigm change: companies that adopt it will not only optimize operations but also deliver a smoother, more practical, and inclusive experience to their customers.

The future of recurring payments in Brazil has already begun, and it’s automatic, instant, and smart.