In this white paper, we find out which are the main Open Finance use cases that financial institutions are exploring in Latin America and shed light on their benefits.

Hyper-personalization, speeding up underwriting processes, creating new and better risk models. These are some examples of the use cases that the most innovative financial institutions are looking at in Latin America while building their Open Finance roadmaps.

While the regulation around these new data-sharing models evolves in the region –with Brazil at the forefront–, experts agree that anticipation and preparation are key to being able to benefit from this new wave of innovation in the banking sector.

But where can they start? Experts from BBVA, Citibanamex, Experian, Fintech Colombia, and TruePay share in this white paper their insights about the improvements that the use of open APIs makes possible in the financial industry and how to build a roadmap to start extracting value from them.

“The most disruptive banks in Latin America are facing this new era of transformation open to alliances and building better products for their customers with technological partners. As well as taking advantage of the bi-directional nature of these models and discovering new ways to reach customers they did not previously have access to through third-party channels,” says Pablo Viguera, co-CEO and co-founder of Belvo.

A race against the clock

“The arrival of Open Banking and Open Finance regulations kicks off the race for most banks, but from then on, it becomes a race against the clock”, warns Carmela Gómez, Head of Global Open Banking at BBVA.

In 2022, the implementation of these new models is not an option; it is a must. Not only because it opens up new monetization possibilities for organizations, but also because of its impact.

The first thing the experts recommend is to anticipate the situation, prepare the bank internally and start identifying as soon as possible the use cases that will benefit the different business areas.

These range from aggregating accounts, building new risk models, or embedding services in third-party channels to reach untapped customer segments. According to Esteban Domínguez, Head of Digital Business at Citibanamex, tangible examples will become more sophisticated and will integrate different players in the financial sector as, on the one hand, the industry identifies these use cases and, on the other hand, regulation facilitates their extension to more players.

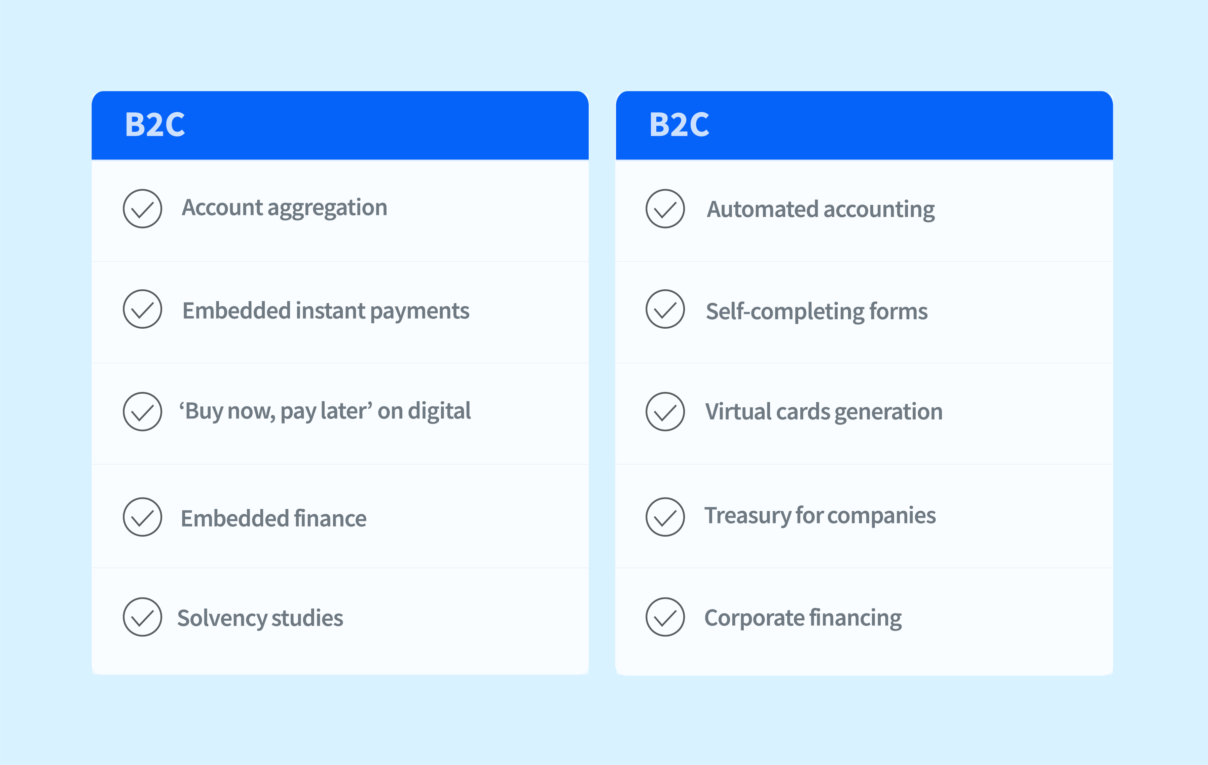

These are some of the use cases:

B2C

- Account aggregation. View all current accounts in one place to understand the financial situation with value-added services such as PFM.

- Embedded instant payments. The ability to easily initiate payments from banking applications or other platforms.

- ‘Buy now, pay later’ on digital marketplaces. Credit offers at checkout on other digital platforms such as e-commerce.

- Embedded finance. Vertical financial service offerings, such as insurance or cards, are integrated into the digital journeys of other platforms.

- Solvency studies. Open Banking helps to streamline this type of risk analysis for faster decision-making.

B2B

- Automated accounting. Software providers use Open Banking for real-time access to companies’ current accounts.

- Self-completing forms. Complete applicant information automatically to save time.

- Generation of virtual cards. Open Banking can streamline the issuance of corporate cards for companies.

- Treasury for companies. Integration of balances and movements in treasury systems, notifications of collections, and payments.

- Corporate financing. Order financing or working capital.

Open Finance in Brazil, an example to follow

Brazil has opted for a model focused on Open Finance where the role of alternative financial data beyond banks plays a very relevant role.

In this white paper, we also explore how the rapid regulatory implementation is leading to the proliferation of new solutions.

In Brazil, two approaches are merging to see what the next steps of Open Finance will be. On the one hand, “large institutions have an obligation to participate in official Open Finance with the development of technology and certifications to implement it. And, on the other hand, they are looking at ‘unregulated’ models as an opportunity to anticipate possible benefits for their customers”, explains Gabriel Pereira, Open Banking specialist at TruePay.

In short, Open Finance is already on the move in Latin America to break old paradigms and take financial institutions to a new level. A new era in finance is already preparing to take off and taking this flight to find new territories where growth and expansion are within reach.

To get a more detailed view of these use cases, their potential benefits, and the steps that banks are following in Latin America to implement them, download our white paper, where you’ll read about:

- The current state of Open Finance in Latin America

- Identifying use cases beyond regulation

- How to gain greater risk analysis capabilities through Open Finance data

- How do regulated and unregulated models coexist

- Developing an action plan for Open Finance