Less than 12 months ago, we started Belvo with the vision of becoming the go-to financial infrastructure API platform in Latin America and the key pillar of the Open Banking revolution in the region set to create more efficient, empowering and inclusive financial services. Fast forward to today and it’s really amazing what we have been able to achieve as a team.

Today, we’re happy to announce that we have raised a $10m round to continue supporting the next generation of financial innovators across Latin America and double down on our vision.

This is undoubtedly a great milestone for Belvo and for fintech in Latin America. We’re extremely proud of the team’s relentless work and passion to get to this point. Raising this round is a testament to the quality of the work everyone has put in these last 12 months. We absolutely love working with each and every person in the team and it’s really amazing seeing all the great things that can be achieved with a small, agile, passionate, talented and driven team.

And we’re thrilled to be bringing along the best possible partners on this adventure. The round was led by Founders Fund (and early backer of Facebook, SpaceX, Stripe, Spotify and Twilio) and Kaszek Ventures (an early backer of Nubank, Konfio, QuintoAndar, Creditas, Kavak and NotCo).

Shared vision

We are delighted to be partnering with such high-caliber investors. Their proven track-record in Fintech, SaaS and infrastructure as well as their deep knowledge of the Latin American market will be invaluable in helping us grow Belvo for the years to come. In addition, they very much share our vision that creating more efficient, empowering and inclusive financial products in Latin America should come from a radically new and developer-first infrastructure layer innovators can build on.

Prior to this round and since founding 12 months ago, we had raised $3m in pre-seed funding and were a part of YCombinator’s Winter 2020 batch. Earlier backers include MAYA Capital, Venture Friends, Latinia, David Vélez (Founder and CEO of Nubank), Unpopular VC and STARTegy. We are thankful for their continued support and for believing in us since inception when Belvo was nothing more than an idea. The goal for our pre-seed funding had been to hire the core team, ship our first versions of the product and launch in our first market, Mexico. Our focus for these past 12 months has been to build product and to be very close to our early customers – helping them to integrate with our APIs as fast and successfully as possible.

Next steps

With this new funding, we will primarily invest in the following:

- Continue our product efforts to expand coverage of our core Data API to include more sources and countries. We’re now live in Mexico and Colombia but we are planning on being live in as many as 6 countries very soon.

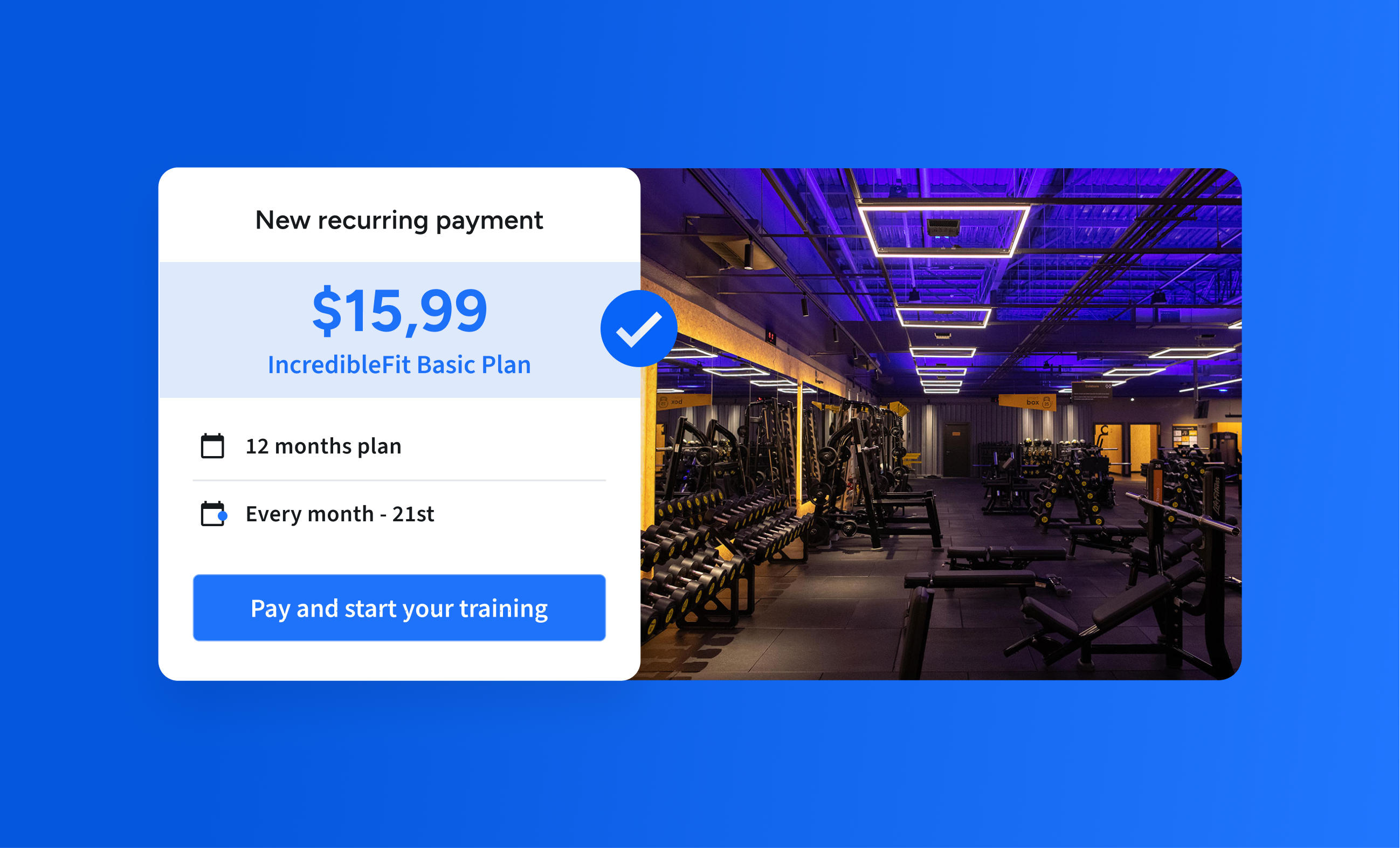

- Develop new API verticals and developer tools. Belvo has always been about making it easier for developers to plug into legacy banking infrastructure and access data in a simple, elegant and lightning-fast way. More API verticals (e.g. Intelligence API) to come very soon.

- Triple the size of our team. Belvo’s team is close to 30 people at the moment, spread across our HQs in Mexico City and Barcelona. We will hire across technology, product and business development as well as select other areas. We are also planning to start hiring in São Paulo soon as well as remotely, as we have done since day 1. All current and future openings will be posted here.

In spite of the negative impact the Covid-19 pandemic has had on many companies and people across the globe, it’s still a great time for tech and an amazing time to build. We believe that the best response any team or startup can have in these tough times and for the months and years to come is to talk to clients, focus on building best-in-class products and think long-term. And we will remain committed to this as we embark on this new chapter. Always driven by the same north star, to help financial innovators create more efficient, empowering and inclusive financial services across Latin America.

Stay tuned!