It’s been about 15 months since we published our first post in this blog to introduce Belvo and to share the mission we were embarking on with Open Finance.

Fast forward to today and to say that a lot of things have happened would be an understatement. Back then, we set out on a mission to power the next generation of financial services in Latin America through a bank and financial data API platform. We were driven by our own frustrations when building innovative financial products in the region. Latam is also a very exciting and dynamic place to be in right now and a great place to build infrastructure for the next generation of financial products for a huge market.

We wanted to do a quick recap of how things have evolved since we got started, of where things stand today and to make the case of why now is the best time to be a part of the Open Finance revolution in Latam.

As you might know, Belvo is the Open Finance API platform for Latam. We allow financial innovators and developers to access and interpret their end-users’ bank and financial data. Our API and solutions are also the easiest way to connect bank accounts and financial data to fintech apps. We do the dirty work in the infrastructure trenches so that our clients can build delightful experiences for their end-users easier, faster and better by harnessing the power of banking and financial data.

What have we been up to?

Since getting started we have scaled and grown tremendously. We have gone from writing our first line of code in July 2019, to launching in our first market, Mexico, in February of this year, to currently working across Mexico, Brazil and Colombia with dozens of clients. In February 2020 the first production call was made to our API. Since then, hundreds of developers have used Belvo in Sandbox or in Production to build, test and launch their products. Our client onboarding speed is ramping up very (very!) rapidly and we are seeing interest from other countries like Argentina, Peru, Chile and others where we will look to expand soon. This expansion and pace keeps us on our toes, makes us iterate and grow and is a massive source of excitement across the organisation day in and day out. This growth, in part, has been made possible by the support our investors have provided since we got started and that has resulted in us raising $13m to build a best-in-class suite of Open Banking solutions and scale really fast.

Best-in-class Product and Tech

On the product front we have come a long way since we shipped the first version of our product in February this year. We have shipped many features our clients requested and added substantial coverage to our API platform.

1. Platform – our product is loved by developers

Since launching our bare-bones v1 a few months ago we have shaped our product into a delightful developer experience. Time and time again, our clients and developer partners compliment us on the quality and breadth of our documentation, the implementation ease and the plug-and-play resources we create (SDKs, quickstart apps, frontend authentication modules) for a quick and seamless integration. Our Developer Portal really is a one-stop-shop for all our developer partner needs and an open, transparent and easy set of resources that developers of all walks of life can follow and use.

2. Coverage – our API will be connected to 40 institutions by EOY

An inherent part of our product and our platform is the breadth of coverage we provide. We have developed nearly 30 integrations to date and as we get better and faster we are investing in adding 10-15 new institutions every quarter. This would not be possible without the incredibly talented tech and product team here at Belvo. Developing integrations on top of bank and financial data sources in Latam is hard, each institution is unique and poses its own set of challenges. But we are getting better and faster and use the power of that scale to continuously iterate and improve the platform.

3. Product breadth – beyond just banking

One of the benefits of building a product for developers from the ground up is that we have no legacy and are able to create the product suite our clients need. Open Banking in Latam, where up to 50% of the population is unbanked and underbanked, only goes so far as to explain someone’s finances. Hence Open Finance That is why our product includes additional data sources which, at the asymptote, could gather financial data about virtually anyone picked at random out of the 650 million people in Latam. This is hard as it implies creating a unique and normalised set of standards in our API for all data to be consumed equally on the client side even if it comes from very different sources. This takes time, research and a lot of work.

4. Technology and security – best-in-class security infrastructure

Belvo was designed from the ground up to extract, store and encrypt data with bank-grade standards and enterprise-level security. This is hard to develop, maintain and evolve but is ultimately made possible by our best-in-breed technology in data extraction and data handling. As we grow we also invest in maintaining the highest level of product and corporate security as it is a crucial part of our developer experience.

All this makes us the go-to platform for the most demanding and ambitious financial innovators in Latam when looking to create category-defining products and experiences for their end-users. This is only the beginning.

Our product team currently consists of 3 (soon 4) squads working on shipping the best solutions for financial innovators. Some other exciting things that we are working on or will be working on soon:

- Enrichment solution → in addition to providing raw data on financial information, we are also working on a suite of endpoints that should help our clients understand their end-users better and faster. We currently have an Income endpoint in beta and will soon be releasing more exciting ones suchs as Assets, Liabilities, Employment, Credit Score, and much more.

- Payments solution → initiating bank-to-bank payments is something that we’ve already mapped out and have done some work on. We will double down on our efforts to execute on this to allow both Pay Ins and Pay Outs across the markets where we operate. All with the same simplicity of a few lines of code via the Belvo API and seamless UI/UX interfaces that developers can drag and drop into their products.

- Making sense of additional data sources → Latam is unique when it comes to Open Banking in the sense that up to 50% of the population is unbanked or underbanked. This has pushed us to find tailored solutions that could turn unclassified/uncharacterised data into information, insights and bank-like data.

Global and diverse team with proven track record of success

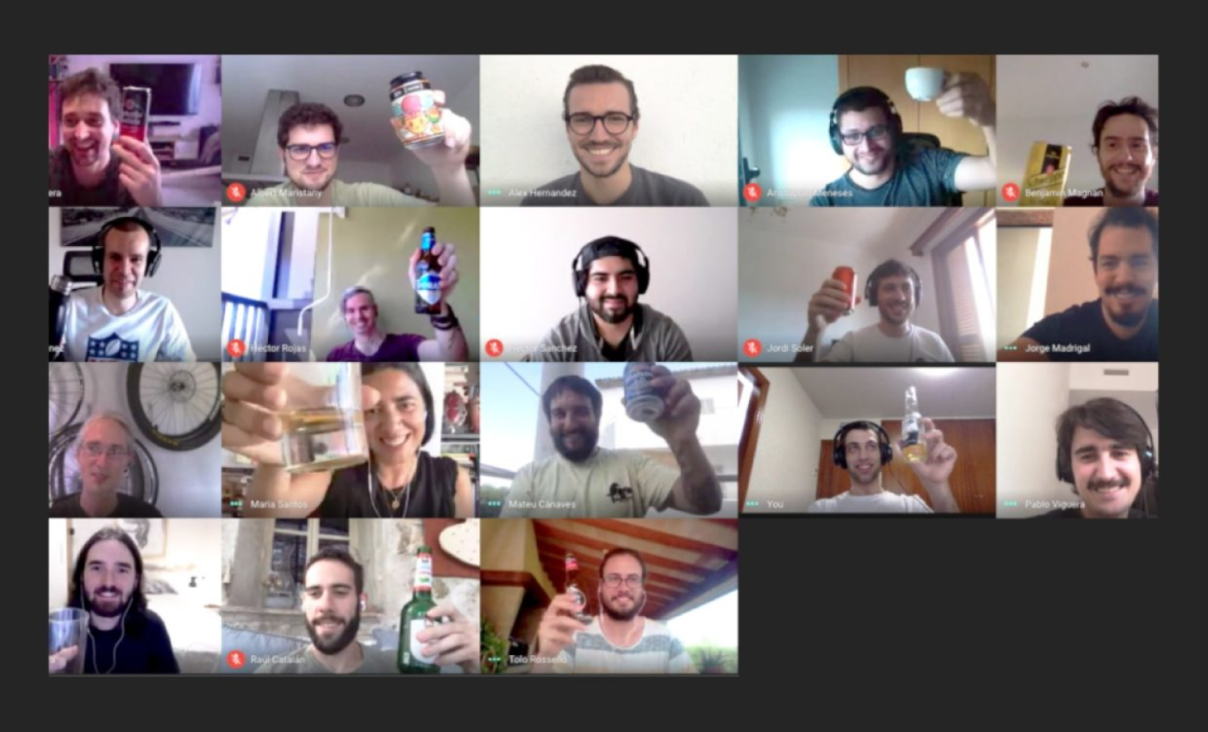

Our team has substantially changed since Uri and I got started 15 months ago. Our team is now 42 people strong and we have 12 nationalities represented: 🇲🇽 🇧🇷 🇺🇾 🇦🇷 🇻🇪 🇪🇸 🇵🇹 🇮🇹 🇫🇷 🇳🇴 🇬🇷 🇦🇱. Something we’re also very proud of is the extremely high-caliber of the team. Our team has gained years of experience building and scaling some of the most successful tech (and specifically fintech) business globally. Some companies our team members have worked at include: Revolut, N26, MercadoLibre/MercadoPago, Eventbrite, TravelPerk, eDreams, EBANX and Kantox.

We are a highly-technical, passionate and driven team based in Mexico City, São Paulo, Barcelona and remotely that is tackling a very challenging problem: connecting fintech innovators with legacy financial infrastructure. We strive to go beyond the limits of what is possible today and to do so in an elegant and developer-first way.

Here are some things we believe:

- Community driven focus → We build tech infrastructure for developers that drives and grows communities across our clients and their users. We also aspire to foster transparency across the board with our software and tools.

- We get things done → We are pragmatic decision-makers, we are a KISStartup and we focus on building things with accountability.

- Fun-loving → We enjoy working on hard challenges that are bigger than ourselves and have a lot of fun doing it.

- Diversity wins → We are a diverse team that cares about our impact. We deeply care about our clients, our partners, our team and all the work that we do for them.

We are looking to continue to grow our team in the months to come. In spite of Covid-19 we have tripled our team since March 2020 and are looking to grow to 100 people in the next 9 months.

Growing to the moon

Over the last few months, we have started to accelerate our growth efforts. We have built our Marketing team from scratch (currently 3 people) and have started executing on our growth playbook. In the last couple of months we have started creating high-quality content and launched reports and webinar campaigns to share our knowledge of Open Finance with the broader community. We have also been covered across Latam by some of the leading media outlets:

- TechCrunch: Belvo scores $10m from Founders Fund and Kaszek to scale its API for financial services

- Cinco Días: Belvo capta 9 millones para impulsar su plataforma de APIs financieras

- Expansión México: Belvo quiere que desarrolles fintechs que la gente sí use

- El Economista: Belvo busca cimentar la infraestructura de open banking en México

- Exame: Com aporte de US$ 13 mi em 1 ano, fintech Belvo chega ao Brasil

Looking to the future

It’s been an intense yet exhilarating first 15 months but it still very much is day 1 for us here at Belvo and for Open Finance as a whole in Latam. It is thus the perfect moment to join if you want to have a high impact, be an owner and build out a category-defining company for the years to come. If you want to solve complex problems with amazing people, Belvo is the right place for you. We will be doubling the size of our team in the next 9 months and are looking for curious, driven, pragmatic people to join the team across all our HQs (Mexico City, São Paulo and Barcelona) as well as remotely.

All our openings can be found here but feel free to also get in touch directly. We’d love to hear from you.