Customer stories

How Mercado Pago adjust credit lines using Belvo's employment data solution

CountryMexico

Case of useLending

ProductEmployment data

GoalAccessible credit

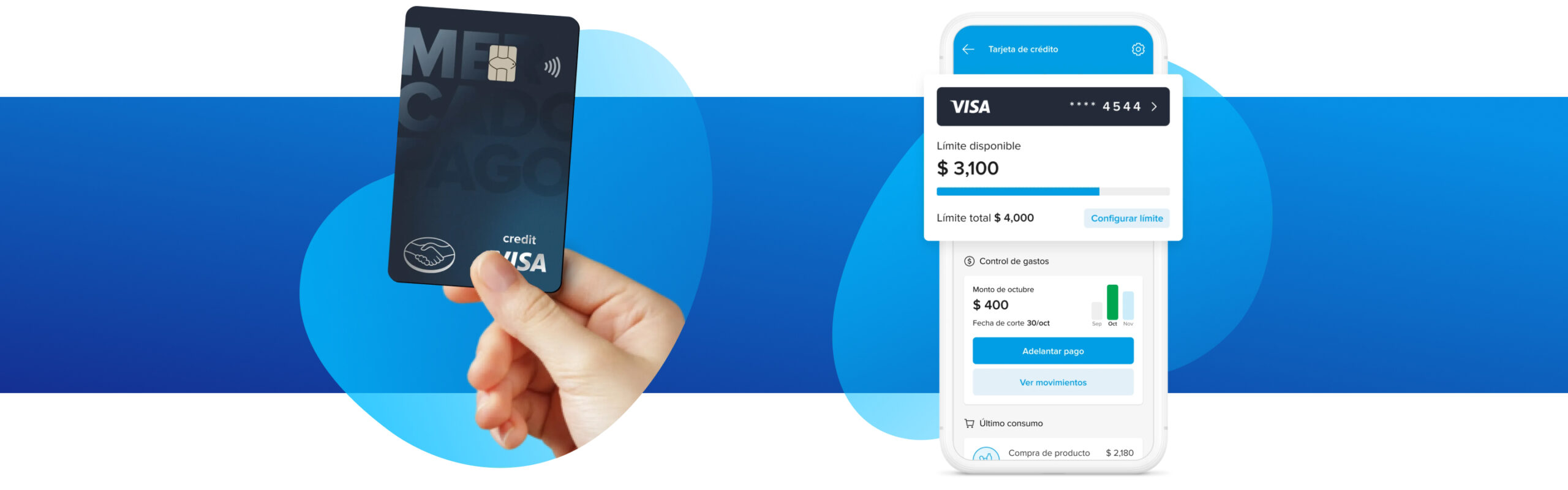

ABOUT MERCADO PAGO

Revolutionizing the financial experience in Mexico

Mercado Pago is an electronic payment and financial services platform that allows users to conduct online purchase and sale transactions securely and conveniently.

Developed by Mercado Libre, one of Latin America's leading e-commerce companies, Mercado Pago has expanded to offer a wide range of financial services and products, including credit card offers, money transfers, balance top-ups, bill payments, and more.

Mercado Pago has established itself as the second most popular financial app in Mexico, only behind BBVA, offering a range of services comparable to those of traditional banking (according to a Latinometrics analysis).

In the region, Mercado Pago processes 371 transactions per second, making it a key player in the country’s digital payments and financial ecosystem.

THE CHALLENGE

In Mexico’s competitive financial market, Mercado Pago faces the critical challenge of personalizing its financial products to meet the individual needs of its customers. This challenge is particularly evident in its customer acquisition and credit line management processes.

To achieve effective personalization, it was necessary to categorize users based on their transactional activity and income level, using this data to offer credit lines that were precisely adjusted to each customer’s financial capacity. This approach not only improves the customer experience but also maximizes the effectiveness of credit decisions, driving Mercado Pago’s growth and profitability in the market.

THE SOLUTION

Mercado Pago integrates Belvo’s employment data solution as part of its acquisition processes.

To assign credit lines, Mercado Pago builds its models based on each user’s payment capacity and income, calculated using internal data and employment data provided by Belvo. Mercado Pago leverages employment data access for its credit line adjustment product.

Thanks to Belvo, they can categorize users based on their transactional activity within the e-commerce ecosystem and their income level. This enables them to offer highly personalized offers and increase the adoption rates of their products.

By integrating employment data into their models, they have seen an approximately 20% increase in the assigned credit line amount.

HOW IT WORKS

The customer provides their CURP to verify their identity, personal details, and employment information.

The system evaluates their current credit offer limit against their payment capacity (income), and if the evaluation is positive, an improved offer is generated for the customer.

Done! The customer receives their credit line upgrade.

THE RESULTS

Thanks to these new data insights, Mercado Pago has observed a significant 20% increase in the assigned credit line amount.

WHAT THE CUSTOMER SAYS

"Belvo’s employment data plays a fundamental role in our acquisition funnel. We implemented this data in our credit line adjustment product, adapted to reflect the user’s actual income. Thanks to employment data, we have observed a significant 20% increase in the assigned credit line amount."