ERP

Automate your accounting and reconciliation processes

Reduce manual errors and costs using open finance to connect your solution with your customers’ financial data thanks to automated accounting, simplified expense management, and smoother invoicing.

Trusted by the leading financial innovators

Real-time data feeds to simplify your accounting

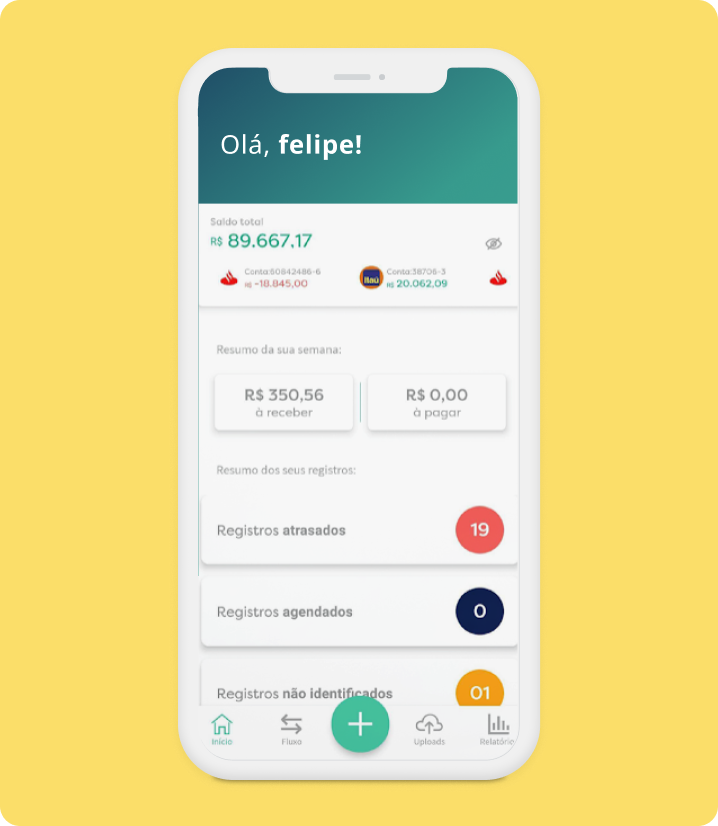

Connect all accounts in one place

Get an overview of your business customers’ financial accounts, cash flow situation and treasury wealth through a single platform.

Reduce fraud risk

Reduce the risk of document forgery and errors by replacing manual data recollection with digital processes.

Monitor customers’ economy activity

Assess the economic activity of your business customers through different data sources and evaluate their financial performance.

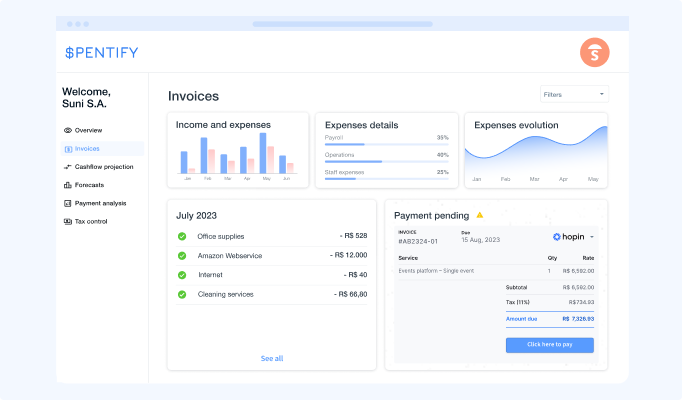

Get powerful insights for businesses with open finance data

Connect and aggregate multiple sources of data

Connect to your business customers’ accounts data to provide an overview of their financial situation along with their real-time balance. Analyze the transactions your customers have made to better understand their financial health and get actionable insights. Incorporate this knowledge into your solution to build budgeting, forecasting and cash-flow analysis features.

Faster onboarding process and account verification

Handling accounting activities for several businesses can be a challenge, specially at the onboarding phase where a lot of information is transferred. With open finance, KYC processes are much more easy and efficient: in a matter of seconds you can retrieve accounts and company information with the data being extracted directly from banks and fiscal institutions. By doing so, you also reduce the risk of frauds and accelerate the integration of new business flows.

Automate data aggregation and boost efficiency

Get access to your business customers’ data from all the institutions which hold financial products or have activities in an easy and compliant way. Thanks to open finance, you can automate the process to retrieve financial data in an already ready-to-use format. Reduce the risk of human error up to 99%, save time and money by improving the efficiency of your operations.

Related guides & Docs

APIs to automate accounting processes

ERPs can rely on open finance data to speed their processes and provide more competitive products.

Get an in depth view of your business customer

Learn how to easily get key information about your business customers using open finance data.

Paying invoices with Pix via Open Financen

Discover how ERPs can integrate our payment widget to process Pix via Open Finance payments.

We can’t wait to hear what you’re going to build

Belvo does not grant loans or ask for deposits