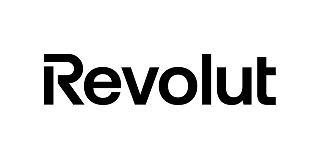

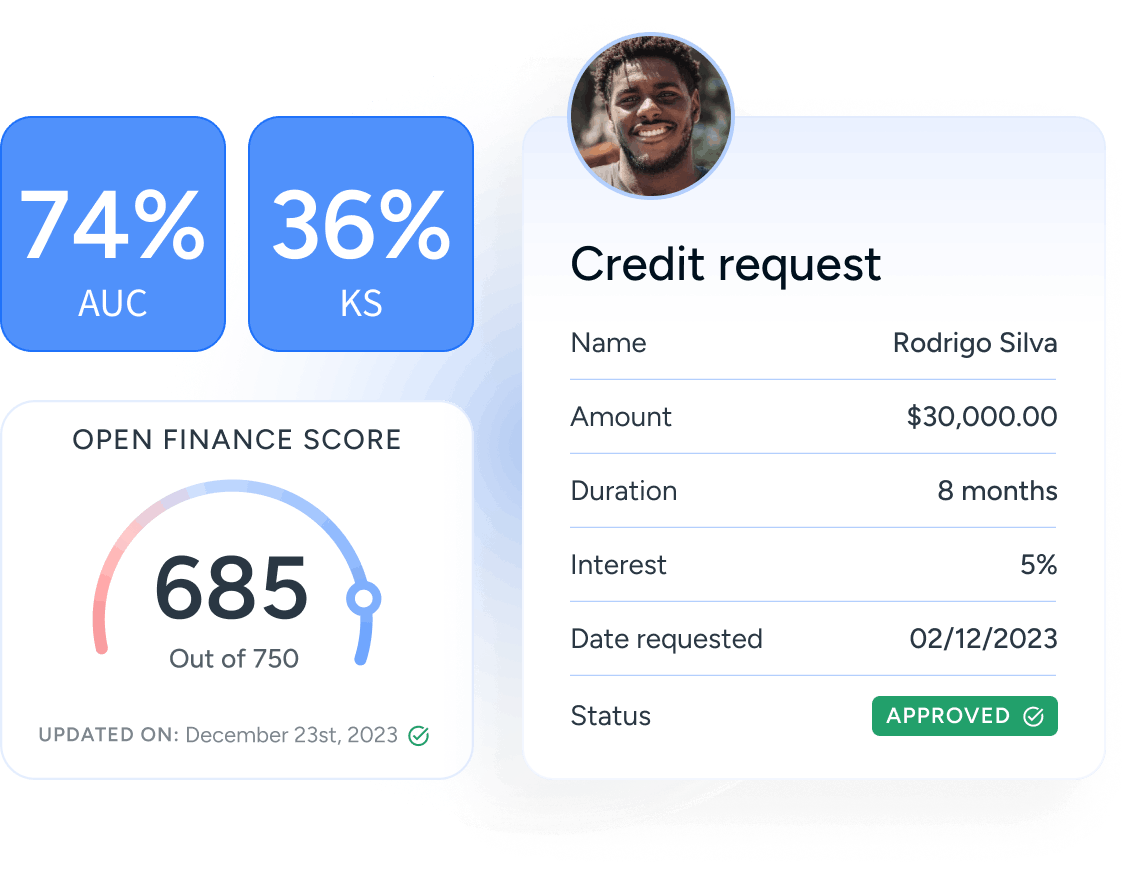

Open Finance Score

Unlock real-time and smart credit decisions with FICO® technology and open finance

Access a real-time score based on transactional data across multiple financial accounts to get a more comprehensive view of your customer thanks to FICO® AI technology.

Trusted by the leading financial innovators

Capture the predictive power of transactional data

Real-time analysis

Get a vivid picture of your customer’s financial situation with a score based on transactional data that gets updated with real-time information and goes beyond credit history.

Increase credit applicants’ pool

Gain additional insights into consumer populations that previously could not be scored due to lack of credit history and enable portfolio growth.

Increased accuracy in risk assessment

Benefit from the predictive power of artificial intelligence to obtain a more nuanced understanding of your customers’ credit capacity.

Leading and responsible AI

FICO is a global trailblazer in the development of machine learning models for scoring and building responsible, ethical and explainable AI.

When AI technology meets open finance data

The score combines the breadth of information that can be extracted through open finance with the predictive capabilities of AI. Developed by FICO®, the model uses neural networks to analyze thousands of transactions across multiple consented accounts (debit, savings, credit card, etc.) and calculates a score that encapsulates customers’ credit capacity.

Harness the predictive power of AI

By integrating open finance data, the AI-driven credit risk score is a powerful analytical tool for financial institutions, enhancing their use of existing credit bureau scores and internal models. The model demonstrates notable performance metrics, boasting an AUC of 74% and a KS of 36%, offering a clear guide to improve decision-making.

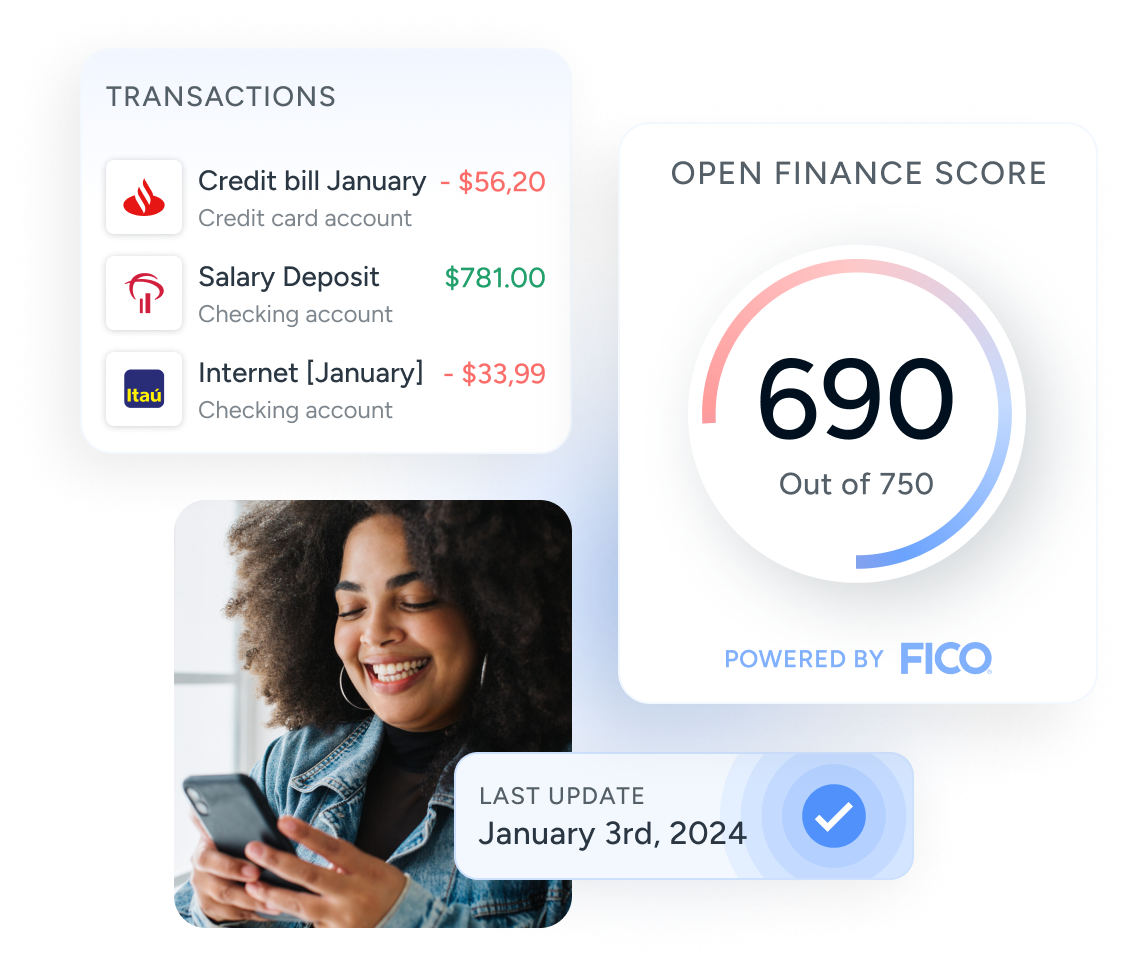

How it works?

Aggregation

Belvo aggregates and harmonizes transactional data from multiple accounts with the customer's consent.

FICO model

The information is fed into the FICO® model, which uses neural networks to analyze thousands of transactions.

Open Finance Score

The model returns a number, a score, and reason codes to interpret a customer's credit capacity.

Informed credit decisions

With this information, lenders can make more informed and accurate credit decisions.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits