Employment

Verify workers’ income and employment history

Track users’ income and working stability by leveraging official employment data. Speed up your credit application process and make more informed lending decisions.

Trusted by the leading financial innovators

Verify income and accelerate credit decisions

with employment data

6-10%

Uplift on GINI coefficient

+ 10%

Approval rates increased

98%

Successful data connections

+30M

CURPs successfully processed this year in Mexico

Validate income with employment data and

speed up lending processes

Reach new audiences without a credit history

Between 20% and 30% of credit applications are rejected due to lack of credit history in credit bureaus. Reduce the number of rejected applications due to ‘no-hit’ or the need for physical document submission and contribute to improving financial inclusion.

Through Belvo, you can also analyze the income of your current clients via employment data. This way, you can reevaluate previously rejected applications from clients for whom you had not been able to estimate income.

Streamline credit decisions

Incorporate official employment data as a new source to verify income 100% digitally. Eliminate manual processes and simplify the credit application process with an automatic consultation of work history.

To check work-related data, customers only need to go through a highly secure flow that does not require sharing banking credentials.

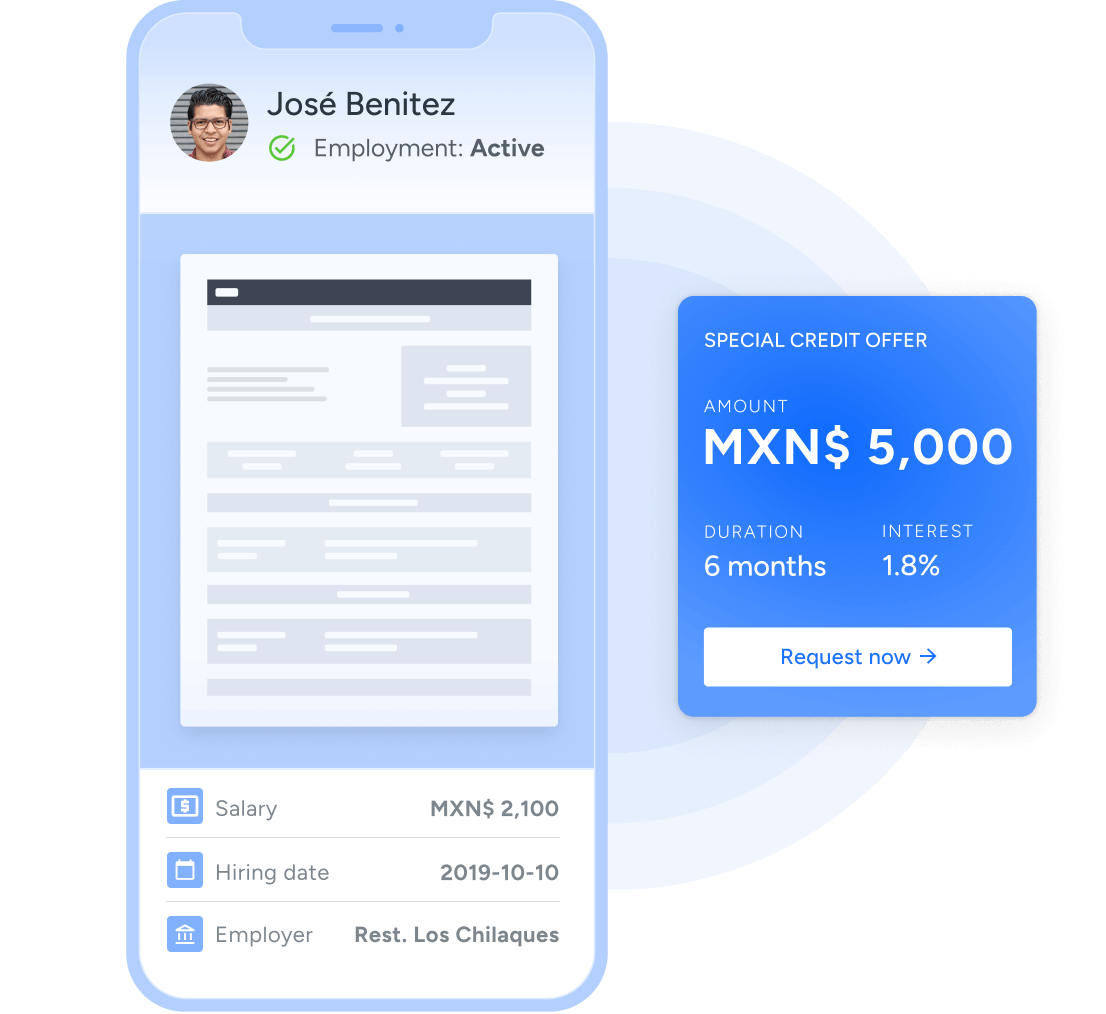

Enhance your risk models

Unlike credit bureau data or information provided by users, employment data accurately represents users’ incomes. This includes precise details about past, current, and exact salaries of employees, as well as enriched data on the evolution of their job status.

Thanks to this, you can improve the accuracy of your models and offer credit proposals and payment terms tailored to the user’s needs. And since your evaluation of the user will always be up-to-date, you can adjust your credit lines if their job situation changes.

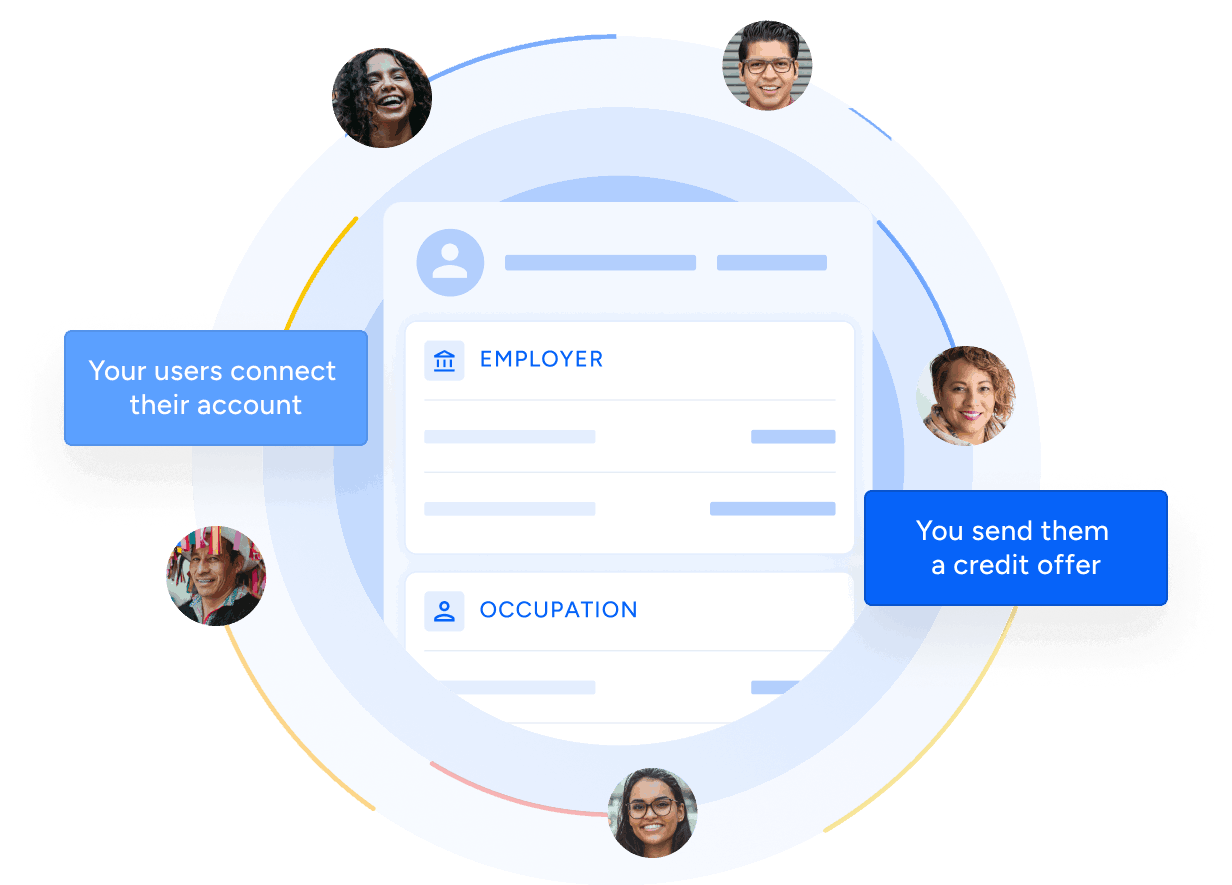

How it works?

Invite users to connect their account

Explain to your users the benefits of connecting their employment data.

Users connect to their account

They only need their CURP (Mexico) or credentials (Brazil) to authenticate.

Safely access users' information

Retrieve social security and working history data.

Make a credit offer after verifying income

Determine users’ working situation and offer them a tailor-made loan proposal.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits