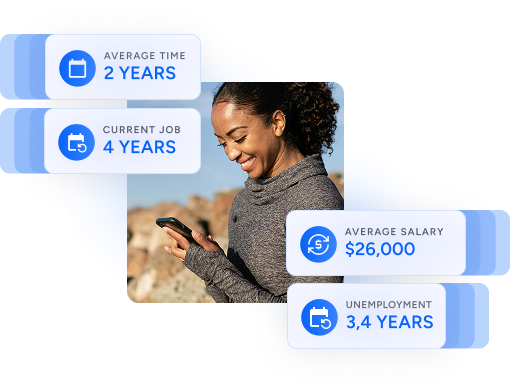

Employment metrics

Employment data ready for your risk models

Turn uncertainty into confident credit decisions.

Access key information about your customers’ employment history and income to confidently offer credit.

Trusted by the leading financial innovators

BENEFITS

Minimize credit risk

Our metrics provide a clear view of your customers’ employment stability and career trajectory, helping you assess their real repayment capacity.

Grant credit with confidence

Get a transparent understanding of your customers’ employment history and stability to evaluate their true ability to repay.

Save time and resources

Metrics are pre-calculated and ready to be easily integrated into your processes. Simplify working with IMSS data by receiving actionable and useful insights.

Save time and resources

Enhance credit bureau data with more robust and inclusive variables to assess applicants with no credit history and give them a fair opportunity.

Proven results to boost your decision-making

20%

Increase in credit lines

By integrating employment data into origination models, companies have achieved up to a 20% increase in the amount of credit granted.

65%

Of verified users receive an offer

Financial companies see that up to 65% of users who verify their income through Belvo receive a credit offer.

73%

AUC reach for risk models

When included in risk models, our employment metrics reach an Area Under the Curve (AUC) of up to 73%, improving repayment prediction.

How it works

Connect to data or run a backtest

Access real-time IMSS employment data through our API or send us a database with your users’ CURPs for analysis.

Access ready-to-use metrics

Get over 30 pre-calculated metrics like work history, salary progression, and unemployment periods.

Integrate variables into your processes

Use the metrics to feed your models and make better decisions—via API integration or a no-code solution.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits