Employment updates

Improve credit offerings based on employment changes

Your customers’ employment status is constantly changing.

Receive automatic alerts about relevant employment changes to design smarter credit offers.

Trusted by the leading financial innovators

Half of formal workers in Mexico switch jobs within 6 months. Make smarter credit decisions with updates.

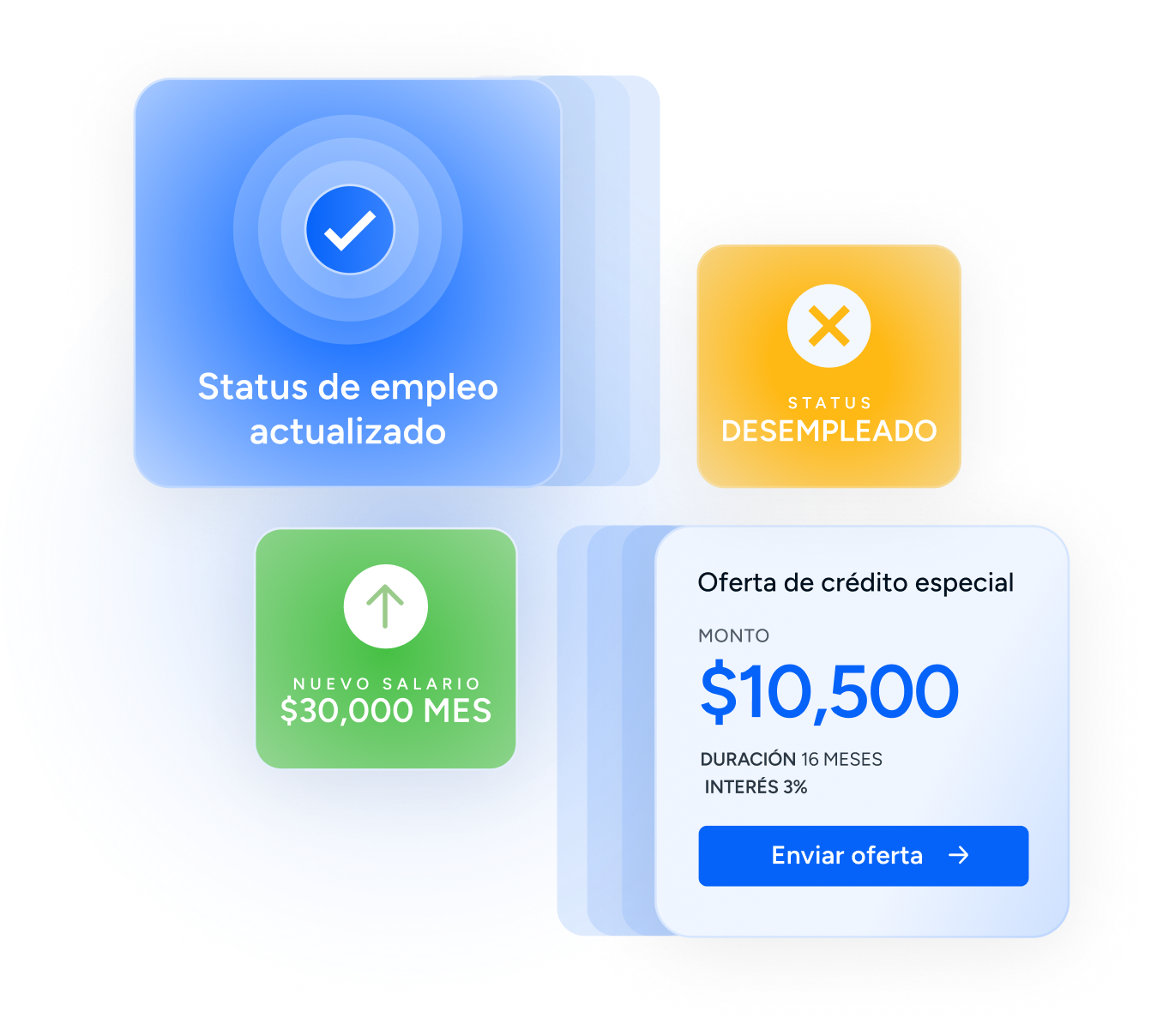

Detect new credit opportunities

Identify job improvements in your customers to launch new offers and increase approvals.

Recover rejected applications

Detect salary increases or job promotions and re-engage customers who previously didn’t qualify for credit.

Act before risk increases

Anticipate salary reductions or unemployment and adjust payment terms to prevent defaults.

Evaluate thousands of applicants in seconds

Process your databases to monitor changes and receive key alerts—no manual work needed.

Employment updates

Track only the employment changes that matter

Your credit team’s co-pilot

Stop guessing and start anticipating. Our platform automatically monitors your portfolio and instantly notifies you via webhook only when a job change truly impacts your customers’ repayment capacity.

Cost-efficient model:

Forget fixed fees – pay only for the notifications you receive.

Key events: Get alerts for new jobs, unemployment, or salary changes greater than 10%.

Custom frequency:

Choose how often we analyze your portfolio: every 2, 3, or 6 months.

How it works

Belvo receives the CURPs

Use our secure flow for users to connect their data or perform a bulk import of the CURPs you'd like to keep track of.

You set the update frequency

You choose how often you want to receive updates: every 2, 3, or 6 months, depending on your strategy.

Relevant notifications are sent automatically

Get alerts if any key changes in your applicants' salary or employment status are detected.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits